Bitcoin (BTC) Price has reached a historic milestone, crossing $100,000 for the first time and achieving a market cap of $2 trillion. This makes BTC more valuable than Saudi Aramco and positions it close to Alphabet in market cap.

With its EMA lines showing strong bullish momentum and key metrics indicating room for further growth, BTC’s current uptrend appears poised to continue.

Bitcoin’s Current Trend Could Get Stronger

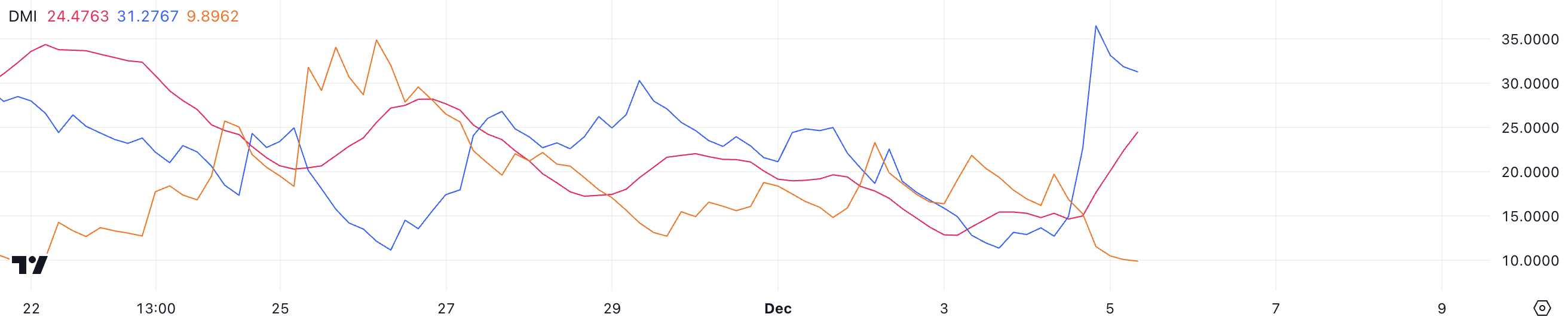

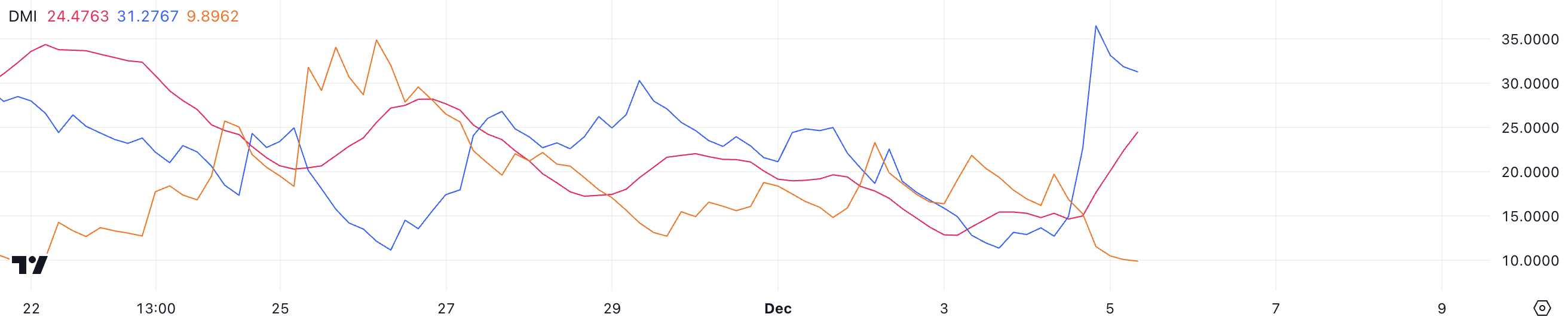

Bitcoin DMI chart shows its ADX rising to 24.4 from 15 in just one day, signaling a strengthening trend. This increase suggests that BTC is transitioning from a weaker market condition to a more defined trend.

Combined with an uptrend indicated by other metrics, the growing ADX reflects a build-up in momentum that could drive further price movement.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and below 25 signaling a weaker or consolidating market. BTC current ADX at 24.4, alongside a D+ of 31.2 and a D- of 9.8, shows buyers maintaining significant control.

While the trend strength hasn’t reached the levels seen during its $90,000 rally — when ADX exceeded 40 — the current upward trajectory suggests the potential for further price gains if momentum continues to build.

Bitcoin NUPL Shows More Space For Growth

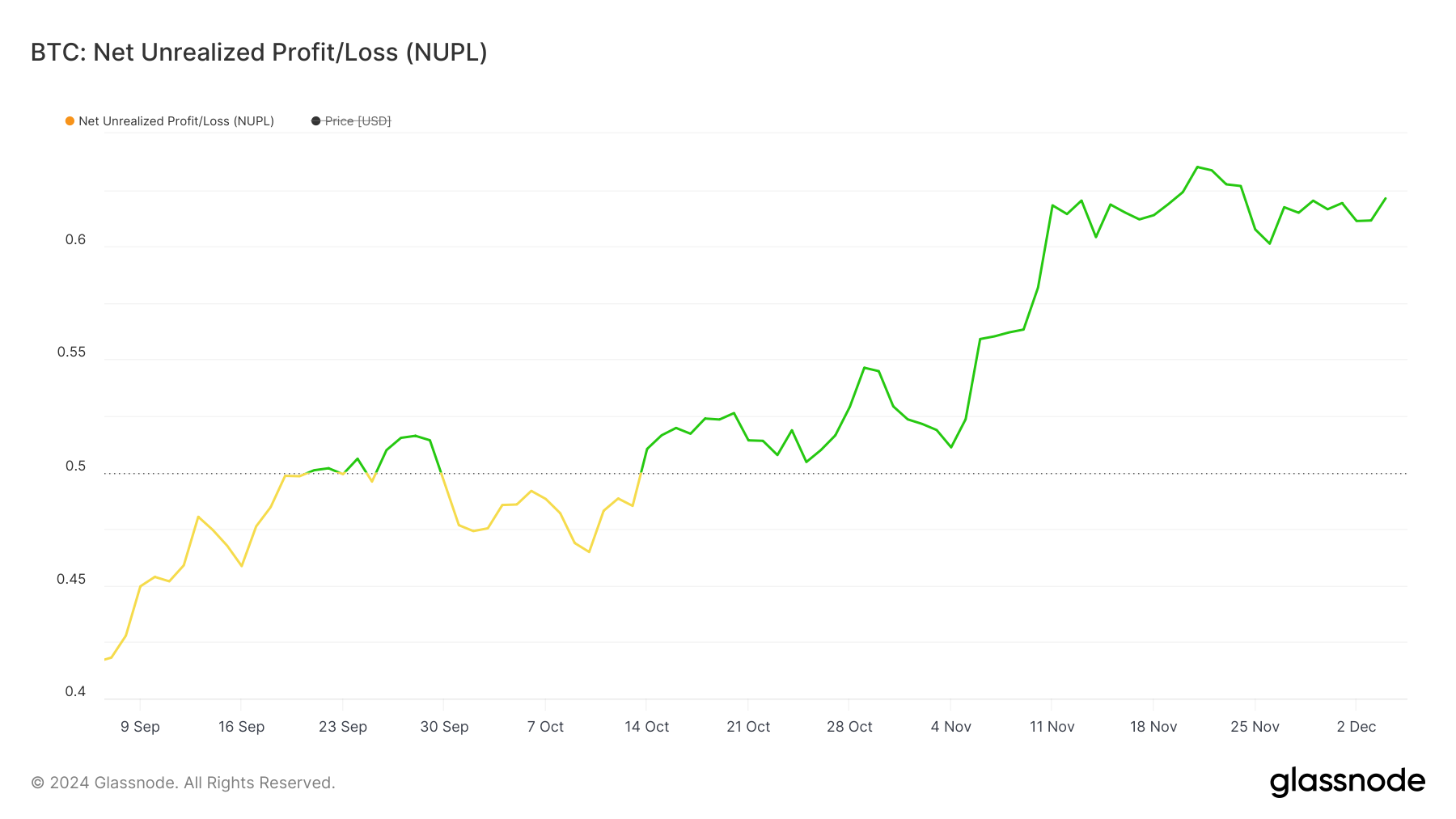

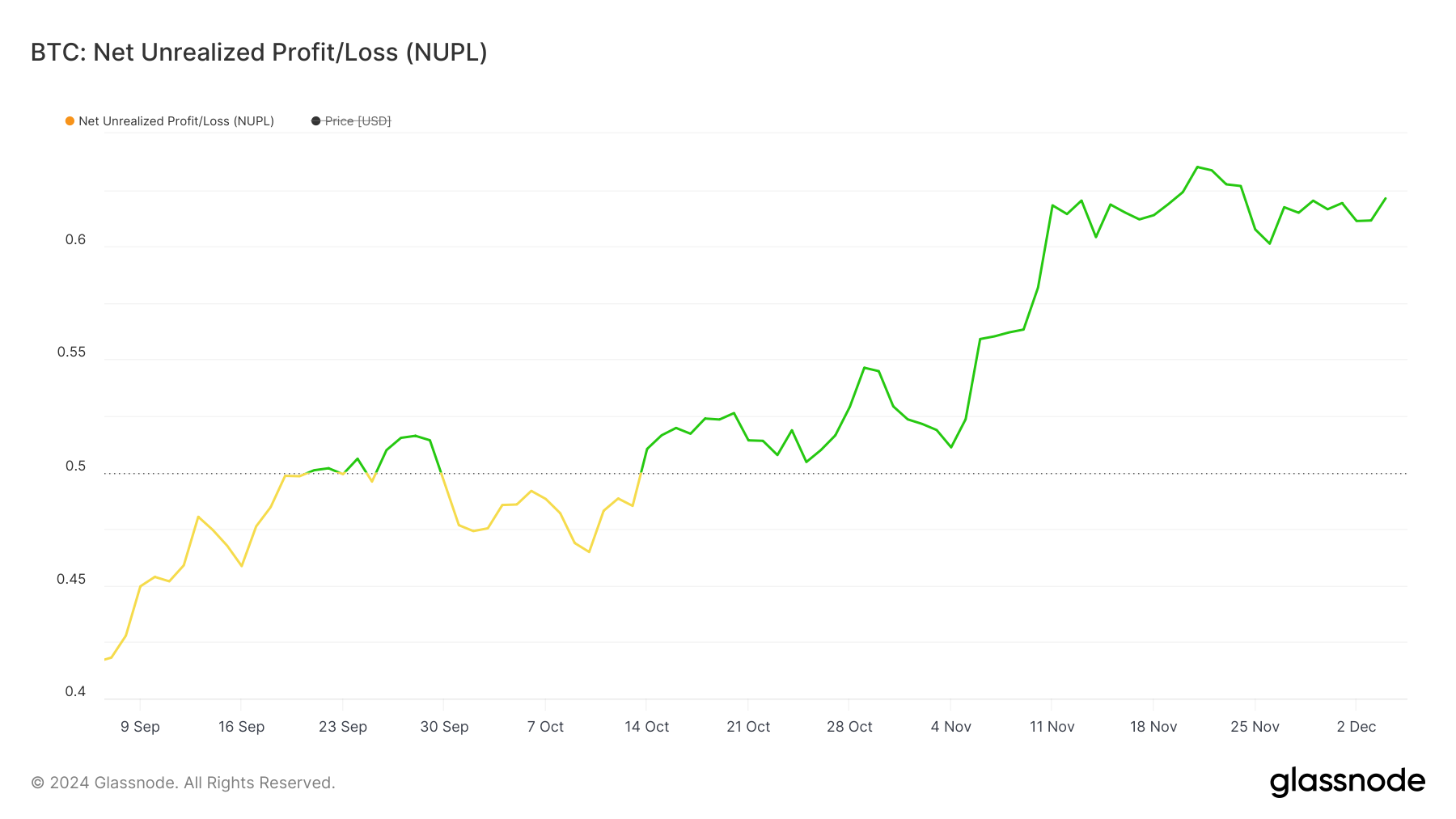

Bitcoin NUPL chart shows its current NUPL at 0.62, slightly down from 0.63 a few days ago. NUPL (Net Unrealized Profit/Loss) measures the proportion of market participants in profit relative to those at a loss, offering insight into market sentiment.

Values between 0.5 and 0.7 are categorized as the “Belief—Denial” phase, during which optimism grows but hasn’t reached its peak.

Despite BTC’s impressive 49.65% gain over the last 30 days, its NUPL at 0.62 indicates that the market hasn’t yet entered the “Euphoria” zone. That zone is typically achieved when NUPL reaches 0.7.

This suggests that while the sentiment is bullish, Bitcoin price is still far from overextended. Historically, reaching the Euphoria stage has aligned with significant price corrections, indicating room for further growth before BTC reaches that level.

BTC Price Prediction: Can Bitcoin Reach $110,000 In December?

BTC price chart shows its EMA lines in a strongly bullish configuration, with short-term lines above long-term ones and the price trading above all of them.

This alignment indicates strong upward momentum. If the trend strengthens further while NUPL remains below the euphoria zone, BTC could soon test $110,000, a threshold now less than 7% away.

However, before a new surge, BTC price might retest key support at $99,000. If this level fails to hold, the price could drop further to $90,000 before attempting to reach new all-time highs.

Bitcoin (BTC) Price has reached a historic milestone, crossing $100,000 for the first time and achieving a market cap of $2 trillion. This makes BTC more valuable than Saudi Aramco and positions it close to Alphabet in market cap.

With its EMA lines showing strong bullish momentum and key metrics indicating room for further growth, BTC’s current uptrend appears poised to continue.

Bitcoin’s Current Trend Could Get Stronger

Bitcoin DMI chart shows its ADX rising to 24.4 from 15 in just one day, signaling a strengthening trend. This increase suggests that BTC is transitioning from a weaker market condition to a more defined trend.

Combined with an uptrend indicated by other metrics, the growing ADX reflects a build-up in momentum that could drive further price movement.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and below 25 signaling a weaker or consolidating market. BTC current ADX at 24.4, alongside a D+ of 31.2 and a D- of 9.8, shows buyers maintaining significant control.

While the trend strength hasn’t reached the levels seen during its $90,000 rally — when ADX exceeded 40 — the current upward trajectory suggests the potential for further price gains if momentum continues to build.

Bitcoin NUPL Shows More Space For Growth

Bitcoin NUPL chart shows its current NUPL at 0.62, slightly down from 0.63 a few days ago. NUPL (Net Unrealized Profit/Loss) measures the proportion of market participants in profit relative to those at a loss, offering insight into market sentiment.

Values between 0.5 and 0.7 are categorized as the “Belief—Denial” phase, during which optimism grows but hasn’t reached its peak.

Despite BTC’s impressive 49.65% gain over the last 30 days, its NUPL at 0.62 indicates that the market hasn’t yet entered the “Euphoria” zone. That zone is typically achieved when NUPL reaches 0.7.

This suggests that while the sentiment is bullish, Bitcoin price is still far from overextended. Historically, reaching the Euphoria stage has aligned with significant price corrections, indicating room for further growth before BTC reaches that level.

BTC Price Prediction: Can Bitcoin Reach $110,000 In December?

BTC price chart shows its EMA lines in a strongly bullish configuration, with short-term lines above long-term ones and the price trading above all of them.

This alignment indicates strong upward momentum. If the trend strengthens further while NUPL remains below the euphoria zone, BTC could soon test $110,000, a threshold now less than 7% away.

However, before a new surge, BTC price might retest key support at $99,000. If this level fails to hold, the price could drop further to $90,000 before attempting to reach new all-time highs.