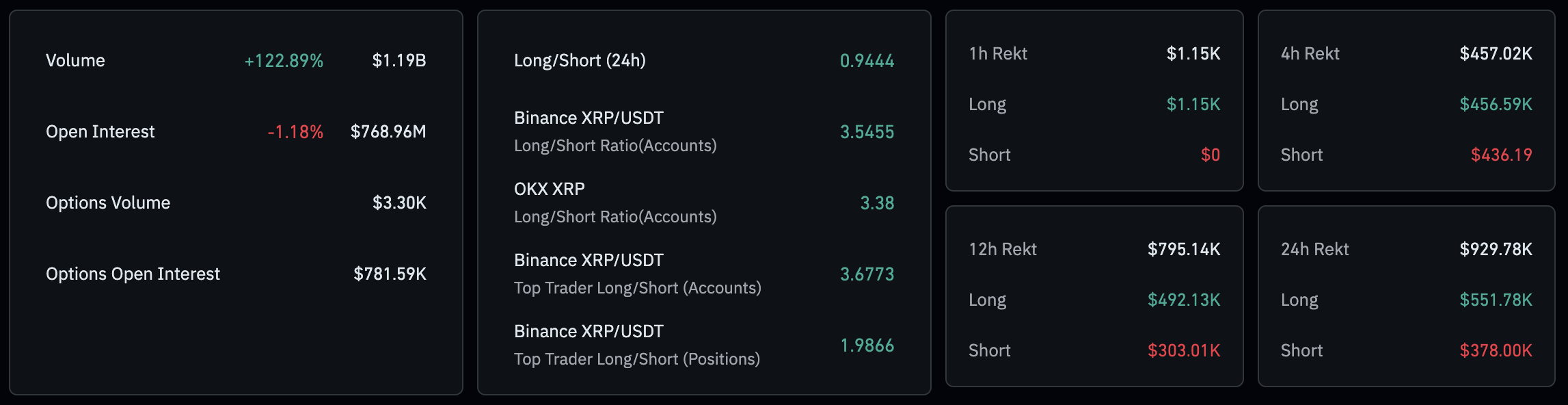

The volume of derivatives on the popular cryptocurrency, XRP, soared by over 130% today, according to data from CoinGlass. As reported, trading activity in mostly perpetual futures on the seventh largest cryptocurrency jumped as high as $1.19 billion, more than double the amount traded the day before.

At the same time, the cryptocurrency’s turnover on the spot market also soared, reaching $1.3 billion, up 108.04% from Sunday, according to CoinMarketCap. To assess whether this is really a big increase in trading activity, let’s look at the ratio of volume to market cap.

With a combined volume of $2.5 billion on both futures and spot markets, and a market cap of around $30.94 billion, the ratio is 8%, which is quite high but not an extraordinary level of trader engagement.

The surge in trading activity comes as the price of XRP faces a crucial test amid a pullback in the broader cryptocurrency market.

XRP: Price outlook

In the last hour, the price of XRP has reached a key support level represented by the 200-day MA, which currently stands at $0.54. The cryptocurrency has managed to touch the band on all major time frames, from one hour to one day.

This is important as the price has managed to hold above it, which means that buyers are here, and they have the power and the will to buy XRP.

On the other hand, the bears also showed their hands as the price of XRP was rejected on the daily time frame right at $0.56, where the 50-day MA is currently stretched.

As it stands, XRP is stuck in a very tight range between $0.54 and $0.56, where both bulls and bears refuse to lose.