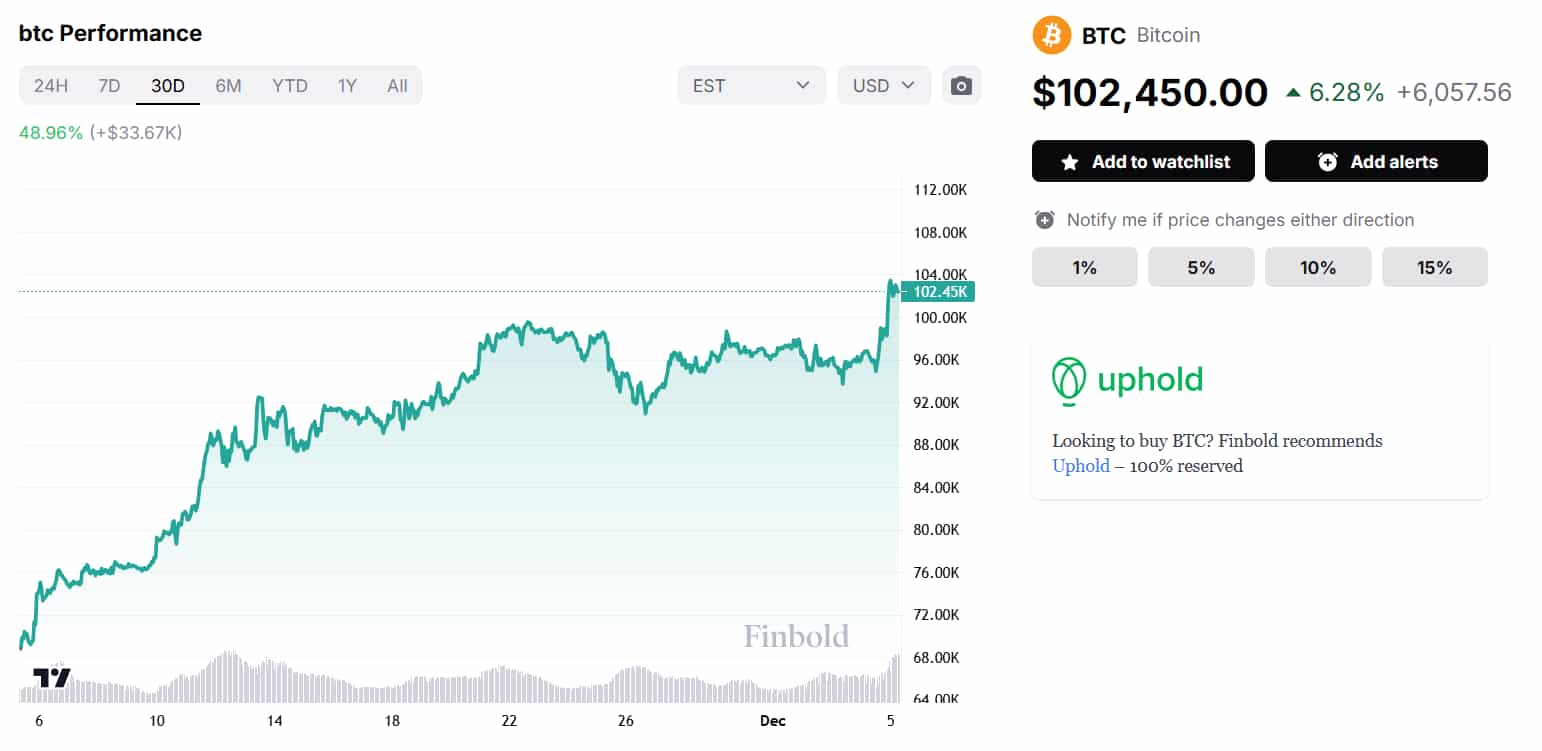

After a relatively protracted stagnation between approximately $94,000 and about $99,000, Bitcoin (BTC) finally broke above $100,000 late on Wednesday, December 4, and even almost climbed to $104,000 during the upswing.

Though such a move is undoubtedly good for BTC bulls and ensures the majority of long positions are in the green, it bodes ill for those investors who wagered the world’s premier cryptocurrency could not sustain the positive momentum.

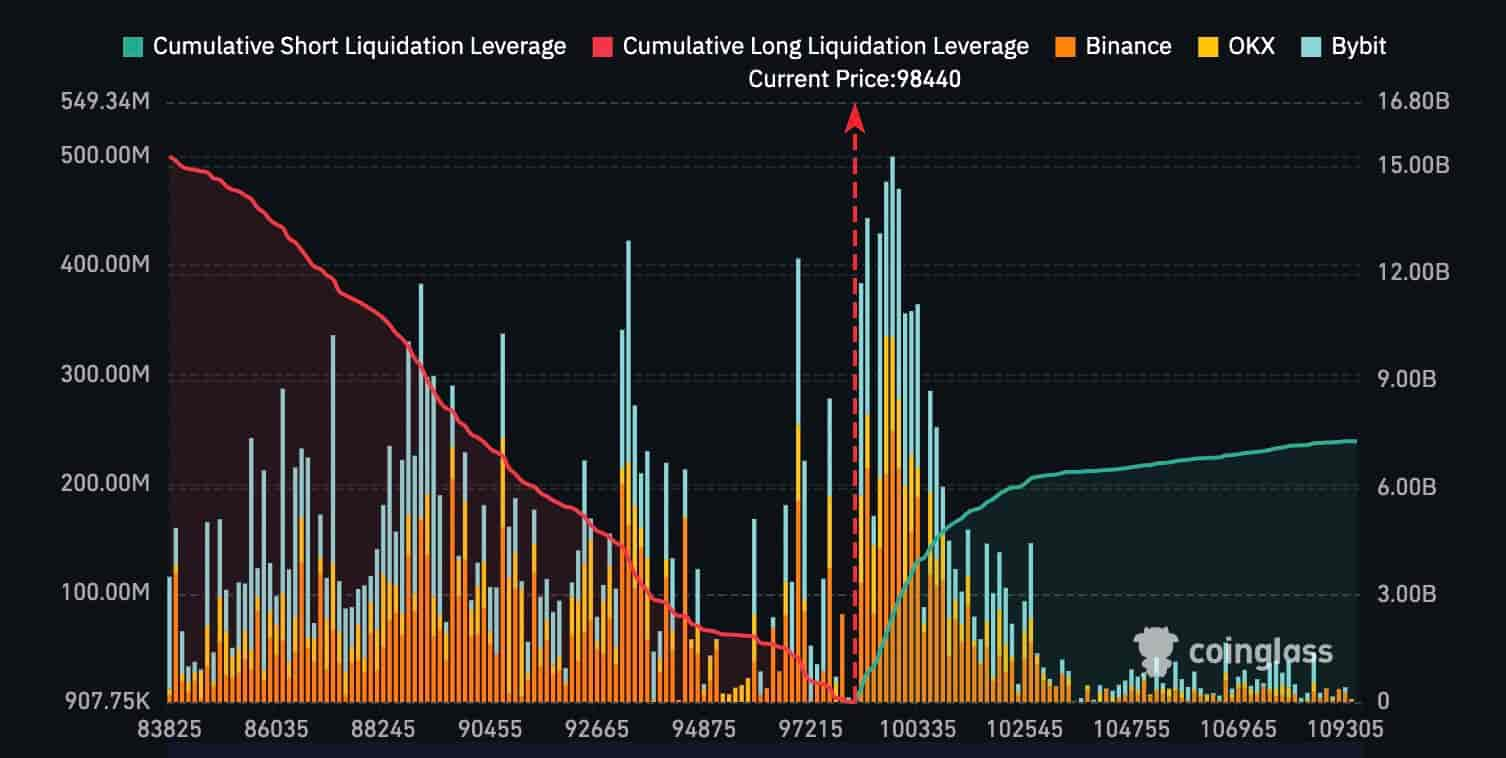

Specifically, at press time on December 5, $110,000 is shaping up to be a highly painful level for those who bet Bitcoin’s price will drop. Approximately $8 billion worth of shorts will be liquidated once it is reached, according to data retrieved by Finbold from CoinGlass on Thursday.

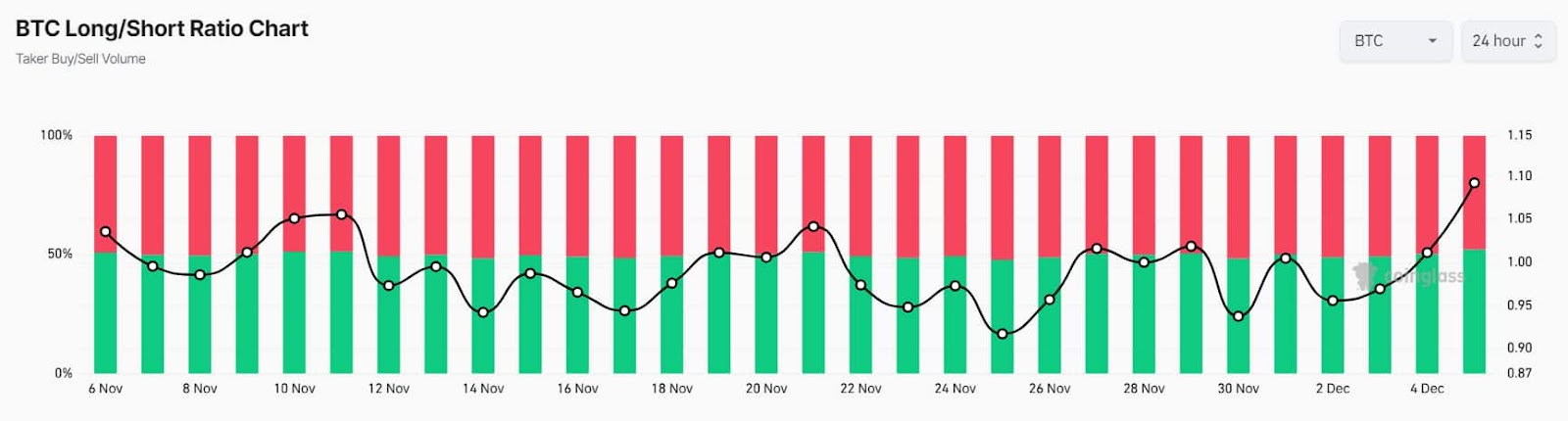

Furthermore, data from the same platform reveals that a significant portion of traders could be adversely affected by a continued Bitcoin rally as the long-short ratio has been roughly even in the last 30 days, indicating investors have been as keen to bet against the coin as they have been interested in betting on BTC.

What is behind Bitcoin’s rally above $100,000?

No matter the next step BTC faces, the December 4 and December 5 rally ensured the coin is up 6.20% in the last 24 hours, 7.83% in the last week, and a staggering 48.96% in the green in the last 30 days.

The most recent move was, by all accounts, driven by two separate events in the political sphere on Wednesday. Federal Reserve Chair Jerome Powell rejected the notion that Bitcoin is a competitor to the American dollar but, in the same motion, lent it credence by likening the digital asset to the world’s biggest commodity: gold.

On the same day, former president and President-Elect Donald Trump unveiled Paul Atkins as his pick for the new Securities and Exchange Commission (SEC) Chair.

As a co-chair of the Token Alliance, a pro-cryptocurrency lobbying group, Atkins starkly contrasts the current SEC Chair, Gary Gensler, who is widely seen as a villain inside the community.

The two latest developments come amidst an overall bullish shift in attitude that emerged from Trump’s re-election. The incoming Republican administration is considered better for business, trading, and digital assets by most investors and is set to bring numerous pro-crypto individuals into power.

Furthermore, some of the departures from the U.S. government have themselves proven powerful tailwinds for various coins and tokens in the cryptocurrency market, with Gensler’s announced January 20 resignation driving a particularly strong rally for XRP.

Featured image via Shutterstock