A recent note from 10X Research on Sunday highlighted the trend, underscored by a sharp drop in the amount of Bitcoin available to buy.

It contrasts sharply with trends observed in late summer when a sudden inflow temporarily replenished exchange reserves, according to the report.

This time, however, no such inventory boost has occurred, exacerbating the supply crunch.

Bitcoin and the broader crypto market have been bolstered by favorable catalysts that point to continual growth in the coming year, analysts say.

President-elect Donald Trump has vowed to establish a Bitcoin reserve in the U.S. while protecting crypto mining interests and crafting favorable industry policy.

That has helped drive Bitcoin’s price to record highs just below $100,000 and has revamped the asset’s image as a store of value in the eyes of investors.

On-chain analytics suggest that long-term holders—often viewed as a stabilizing force in the market—are firmly holding their positions, limiting the flow of Bitcoin into exchanges and reducing liquidity.

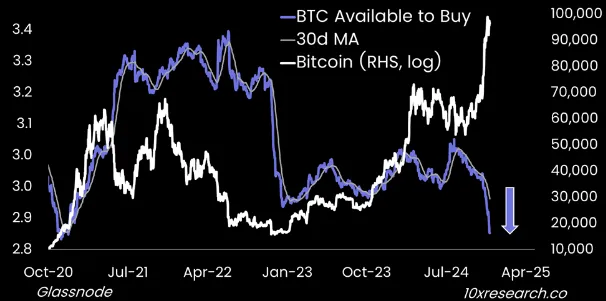

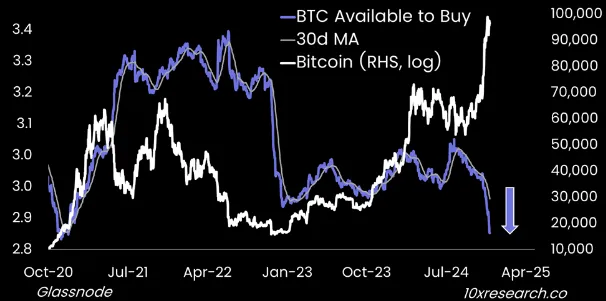

The attached chart from 10X Research, leveraging Glassnode data, reveals a clear divergence between Bitcoin’s available supply on exchanges and its price.

The blue line, representing the 30-day moving average of Bitcoin available to buy, has plummeted.

Meanwhile, Bitcoin’s price, plotted on a logarithmic scale, surged sharply in the latter half of 2024, recently nearing the $100,000 threshold.

Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—report sufficient Bitcoin reserves to meet buyer demand, 10X notes.

Smaller exchanges face increasing challenges in maintaining liquidity, which could lead to heightened price volatility.

A tightening supply coincides with broader macroeconomic trends, including institutional interest in Bitcoin-driven financial products such as spot ETFs.

Shrinking exchange inventory may further drive upward price pressure as demand from both retail and institutional players grows, Decrypt was previously told.

A recent note from 10X Research on Sunday highlighted the trend, underscored by a sharp drop in the amount of Bitcoin available to buy.

It contrasts sharply with trends observed in late summer when a sudden inflow temporarily replenished exchange reserves, according to the report.

This time, however, no such inventory boost has occurred, exacerbating the supply crunch.

Bitcoin and the broader crypto market have been bolstered by favorable catalysts that point to continual growth in the coming year, analysts say.

President-elect Donald Trump has vowed to establish a Bitcoin reserve in the U.S. while protecting crypto mining interests and crafting favorable industry policy.

That has helped drive Bitcoin’s price to record highs just below $100,000 and has revamped the asset’s image as a store of value in the eyes of investors.

On-chain analytics suggest that long-term holders—often viewed as a stabilizing force in the market—are firmly holding their positions, limiting the flow of Bitcoin into exchanges and reducing liquidity.

The attached chart from 10X Research, leveraging Glassnode data, reveals a clear divergence between Bitcoin’s available supply on exchanges and its price.

The blue line, representing the 30-day moving average of Bitcoin available to buy, has plummeted.

Meanwhile, Bitcoin’s price, plotted on a logarithmic scale, surged sharply in the latter half of 2024, recently nearing the $100,000 threshold.

Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—report sufficient Bitcoin reserves to meet buyer demand, 10X notes.

Smaller exchanges face increasing challenges in maintaining liquidity, which could lead to heightened price volatility.

A tightening supply coincides with broader macroeconomic trends, including institutional interest in Bitcoin-driven financial products such as spot ETFs.

Shrinking exchange inventory may further drive upward price pressure as demand from both retail and institutional players grows, Decrypt was previously told.