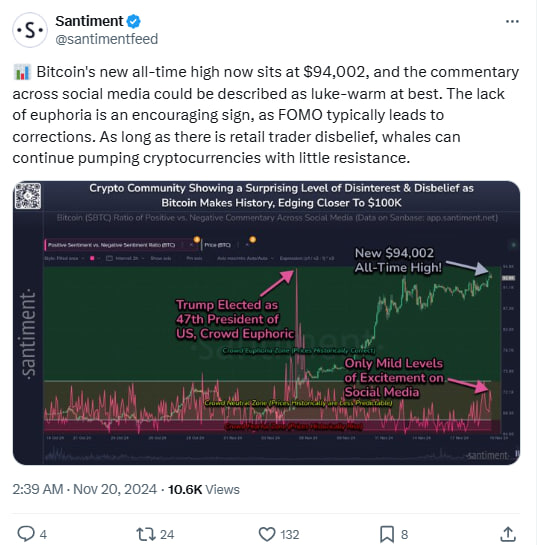

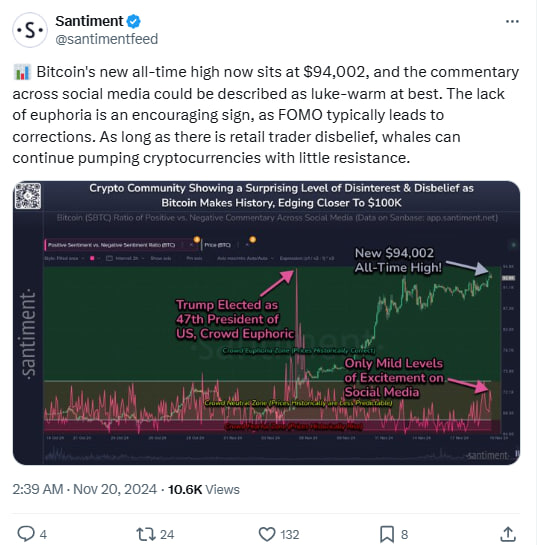

Bitcoin hit a new all-time high of $94,002. But despite this milestone, reactions from social media and the crypto community remained surprisingly mute.

According to Santiment’s data, Bitcoin’s rise to new heights has not sparked the usual waves of euphoria often seen during price surges. The graph reveals that even with Bitcoin approaching $100,000, sentiment on social platforms stayed relatively neutral, with only occasional spikes in positivity.

Additionally, Bitcoin’s move into the “Neutral Zone” in sentiment analysis could mean lower volatility and steadier progress. Historically, neutral sentiment has often coincided with less accurate price predictions, making the market’s short-term outlook unpredictable.

“Crowd Fearful Zone” May Signal Positive Price Movement

Another interesting takeaway from the sentiment analysis is Bitcoin’s price behavior during “Crowd Fearful Zone” periods. The data shows that Bitcoin’s price rose when social sentiment was fearful or negative.

This trend suggests that the market may resist traditional sentiment indicators and that Bitcoin’s price movements can often challenge the broader social mood.

Bitcoin’s Current Market Status: A Snapshot

As of the latest update from CoinMarketCap, Bitcoin is trading at $91,679.08, recording an increase of 0.46% over the past day, the market capitalization stands at $1.81 trillion, with a trading volume of $74.93 billion, representing a slight increase in volume by 0.83%.

Read also: Bitcoin Targets $100K by Year-End, Analyst Links Surge to Trump’s Crypto Push

Despite the declines within this period, Bitcoin remained within a tight price range, retaining stability below the $92K mark.

Technical indicators also point out Bitcoin’s market strength. The MACD shows a strong bullish signal, with the MACD line above the signal line, supported by rising histogram bars. This signals strong buying pressure supporting Bitcoin’s price movement.

However, the RSI stands at 75.43, signaling that Bitcoin is in overbought territory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Bitcoin hit a new all-time high of $94,002. But despite this milestone, reactions from social media and the crypto community remained surprisingly mute.

According to Santiment’s data, Bitcoin’s rise to new heights has not sparked the usual waves of euphoria often seen during price surges. The graph reveals that even with Bitcoin approaching $100,000, sentiment on social platforms stayed relatively neutral, with only occasional spikes in positivity.

Additionally, Bitcoin’s move into the “Neutral Zone” in sentiment analysis could mean lower volatility and steadier progress. Historically, neutral sentiment has often coincided with less accurate price predictions, making the market’s short-term outlook unpredictable.

“Crowd Fearful Zone” May Signal Positive Price Movement

Another interesting takeaway from the sentiment analysis is Bitcoin’s price behavior during “Crowd Fearful Zone” periods. The data shows that Bitcoin’s price rose when social sentiment was fearful or negative.

This trend suggests that the market may resist traditional sentiment indicators and that Bitcoin’s price movements can often challenge the broader social mood.

Bitcoin’s Current Market Status: A Snapshot

As of the latest update from CoinMarketCap, Bitcoin is trading at $91,679.08, recording an increase of 0.46% over the past day, the market capitalization stands at $1.81 trillion, with a trading volume of $74.93 billion, representing a slight increase in volume by 0.83%.

Read also: Bitcoin Targets $100K by Year-End, Analyst Links Surge to Trump’s Crypto Push

Despite the declines within this period, Bitcoin remained within a tight price range, retaining stability below the $92K mark.

Technical indicators also point out Bitcoin’s market strength. The MACD shows a strong bullish signal, with the MACD line above the signal line, supported by rising histogram bars. This signals strong buying pressure supporting Bitcoin’s price movement.

However, the RSI stands at 75.43, signaling that Bitcoin is in overbought territory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.