Bitcoin showed resilience as the escalating tension between Ukraine and Russia signaled a shift in how investors perceive the digital gold.

Ukraine attacked Russian territory with U.S. ATACMS missiles, fired at a military facility, after the Biden administration granted permission to do so on Nov. 19 — the 1,000th day of the ongoing conflict between the two countries.

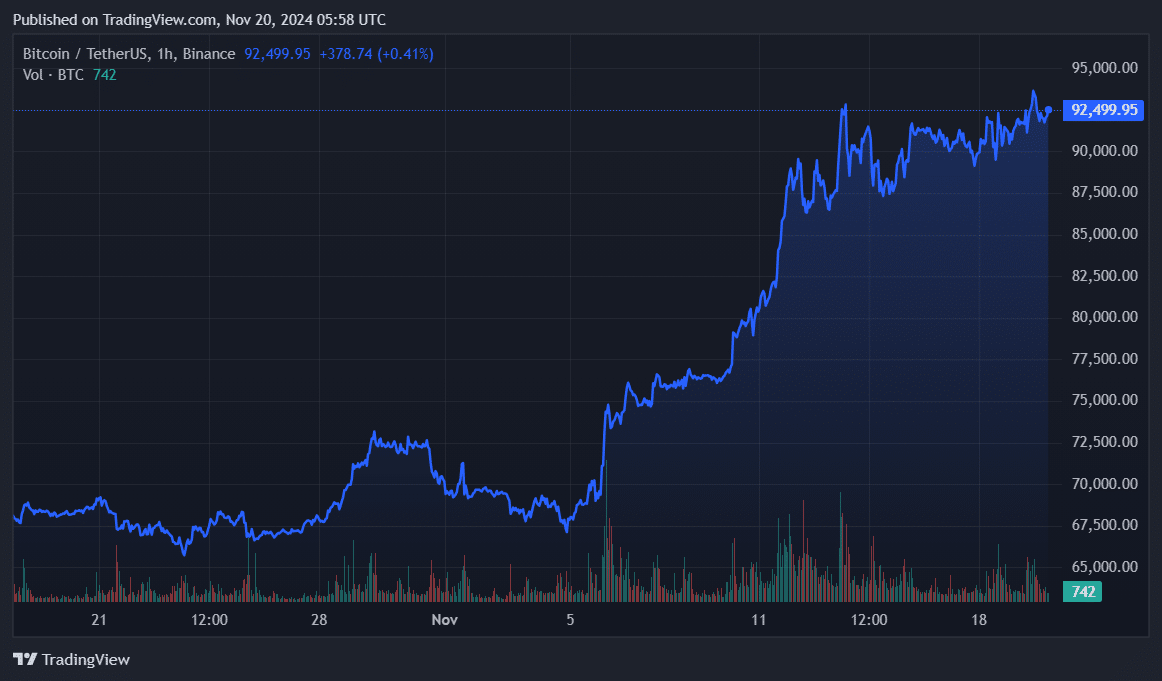

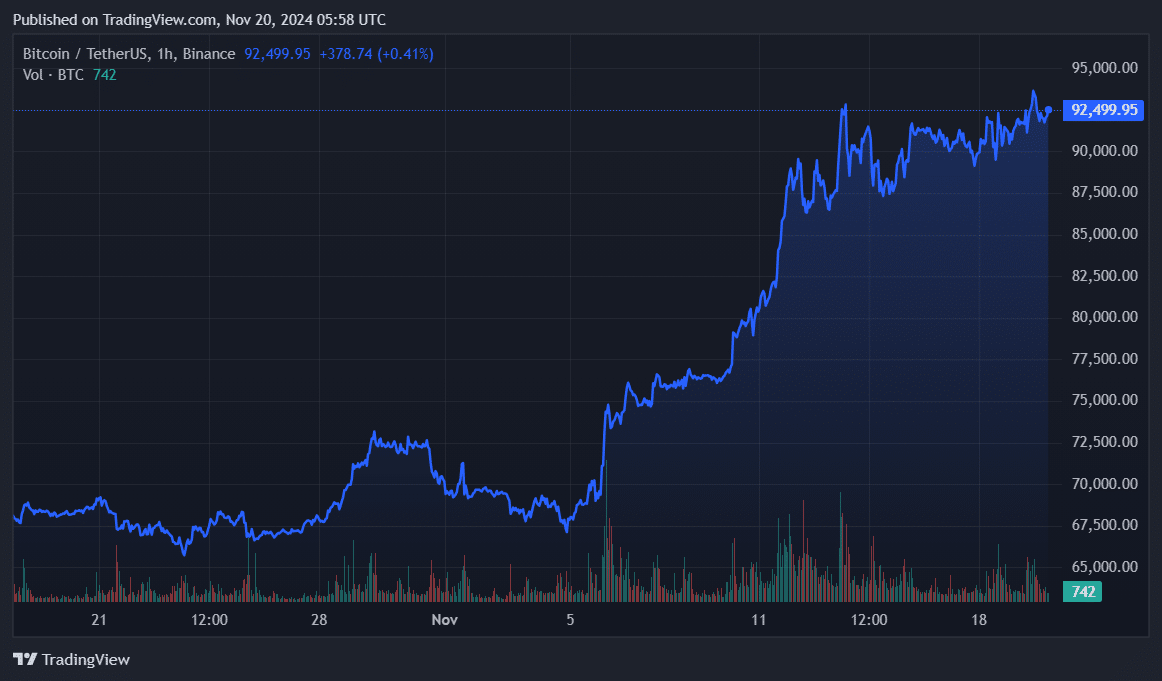

Bitcoin (BTC) did not witness a bearish blow, unlike the previous macro tensions. Instead, the flagship cryptocurrency rose to an all-time high of $94,000 with a market cap of $1.86 trillion.

Cory Klippsten, the CEO of Swan Bitcoin, told crypto.news that this behavior could reflect a maturing Bitcoin’s store-of-value narrative.

“Traditionally, geopolitical instability sends investors flocking to safe-haven assets like gold or the dollar. But Bitcoin’s recent all-time highs indicate it’s entering a new role as a hedge against both money printing and geopolitical risk.”

Klippsten said.

The major shift

In February 2022, the Ukraine crisis brought an 8% decline in the Bitcoin price to $34,000 as the crypto market witnessed a $150 billion wipeout.

Quite similarly, the leading crypto asset fell by 4% to $61,000 just hours after the Israel-Iran conflict escalated in October this year.

“While traditional markets may continue reacting to geopolitical volatility, Bitcoin stands as a counterpoint, a lifeboat asset for those seeking uncorrelated security,” Klippsten added.

Despite a slight correction from its latest ATH, Bitcoin is still up 1% in the past 24 hours and is trading at $92,500. The global crypto market cap decreased by 1.7%, reaching $3.203 trillion, CoinGecko data shows.

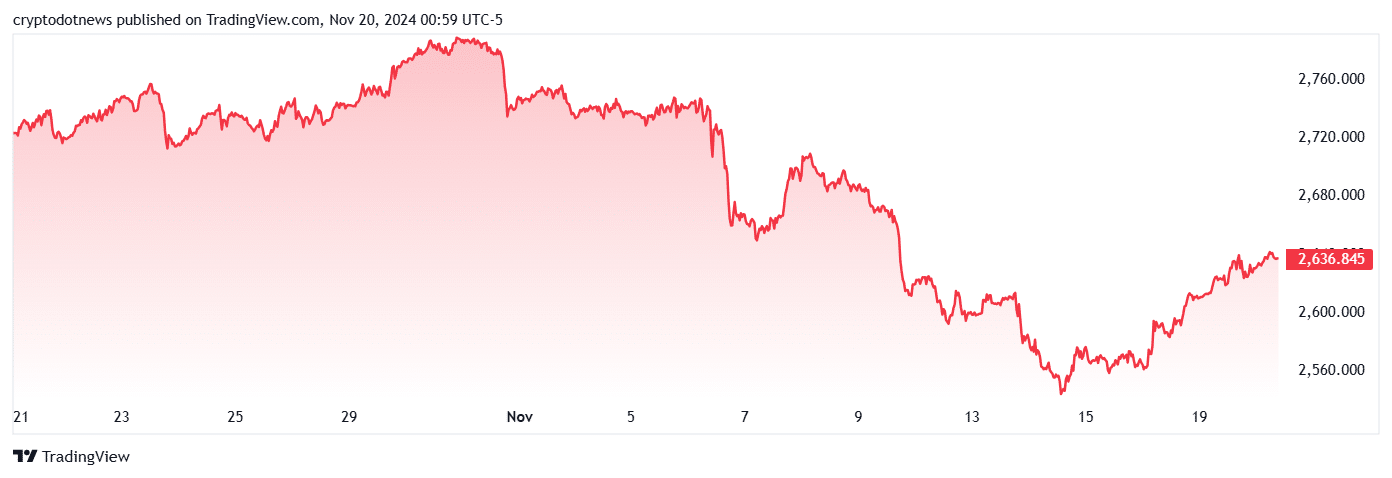

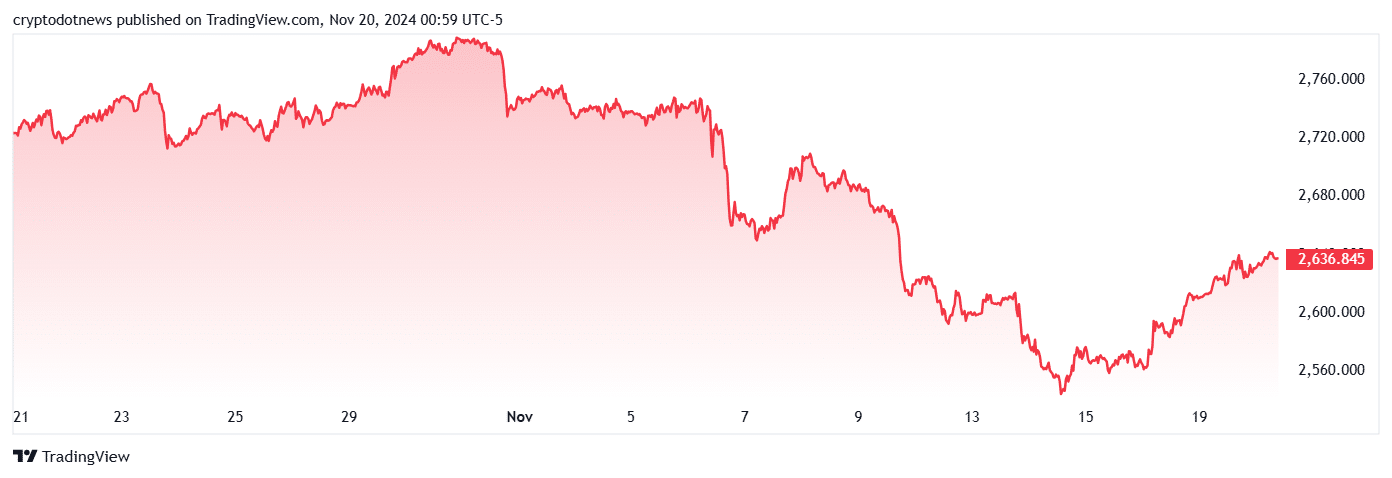

Gold gained 0.1% and is trading at $2,636 — still down by 3.3% over the last 30 days. The crude oil WTI futures, on the other hand, fell 0.09% to $69.17 a barrel.

The Swan Bitcoin CEO believes that Bitcoin’s recent ATH could potentially solidify it as the go-to asset for uncertain times. “We could be witnessing Bitcoin’s transition from a speculative asset to a macroeconomic refuge,” Klippsten concluded.

Bitcoin showed resilience as the escalating tension between Ukraine and Russia signaled a shift in how investors perceive the digital gold.

Ukraine attacked Russian territory with U.S. ATACMS missiles, fired at a military facility, after the Biden administration granted permission to do so on Nov. 19 — the 1,000th day of the ongoing conflict between the two countries.

Bitcoin (BTC) did not witness a bearish blow, unlike the previous macro tensions. Instead, the flagship cryptocurrency rose to an all-time high of $94,000 with a market cap of $1.86 trillion.

Cory Klippsten, the CEO of Swan Bitcoin, told crypto.news that this behavior could reflect a maturing Bitcoin’s store-of-value narrative.

“Traditionally, geopolitical instability sends investors flocking to safe-haven assets like gold or the dollar. But Bitcoin’s recent all-time highs indicate it’s entering a new role as a hedge against both money printing and geopolitical risk.”

Klippsten said.

The major shift

In February 2022, the Ukraine crisis brought an 8% decline in the Bitcoin price to $34,000 as the crypto market witnessed a $150 billion wipeout.

Quite similarly, the leading crypto asset fell by 4% to $61,000 just hours after the Israel-Iran conflict escalated in October this year.

“While traditional markets may continue reacting to geopolitical volatility, Bitcoin stands as a counterpoint, a lifeboat asset for those seeking uncorrelated security,” Klippsten added.

Despite a slight correction from its latest ATH, Bitcoin is still up 1% in the past 24 hours and is trading at $92,500. The global crypto market cap decreased by 1.7%, reaching $3.203 trillion, CoinGecko data shows.

Gold gained 0.1% and is trading at $2,636 — still down by 3.3% over the last 30 days. The crude oil WTI futures, on the other hand, fell 0.09% to $69.17 a barrel.

The Swan Bitcoin CEO believes that Bitcoin’s recent ATH could potentially solidify it as the go-to asset for uncertain times. “We could be witnessing Bitcoin’s transition from a speculative asset to a macroeconomic refuge,” Klippsten concluded.