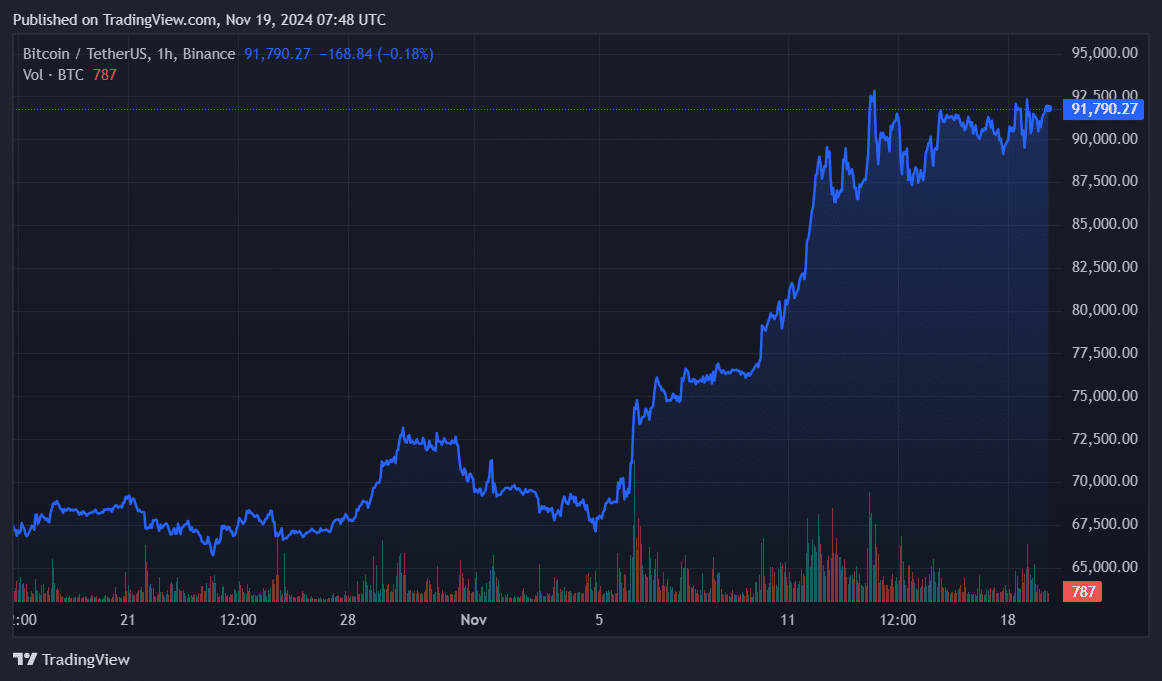

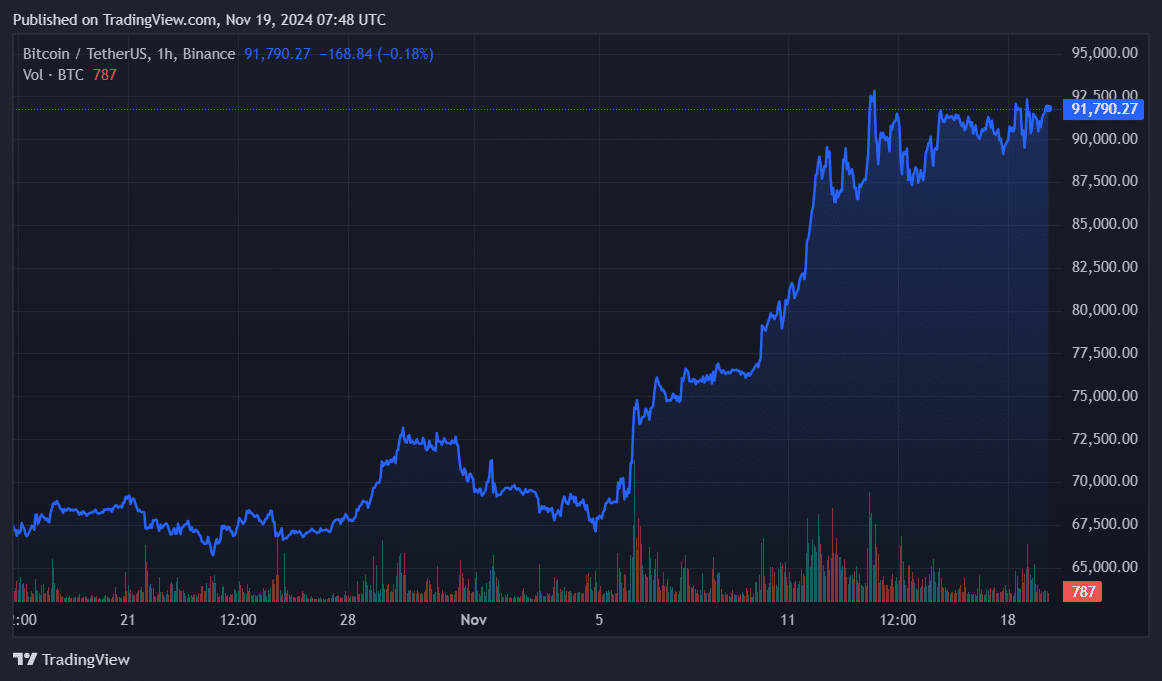

The latest wave of whale accumulation helped Bitcoin get close to its all-time high, surpassing $92,000.

Large Bitcoin (BTC) addresses recorded a net inflow of 21,470 BTC on Monday, Nov. 18, according to data from IntoTheBlock.

The amount of whale transactions, worth at least $100,000 in BTC, also doubled to $78.37 billion in almost 23,000 unique transactions on the same day, ITB data shows. Bitcoin registered a total of over $228 billion in whale transactions over the last seven days.

One of the largest Bitcoin holders purchased the asset on Binance and transferred it to a custodial wallet with $2.2 billion in BTC, per data from Arkham Intelligence.

The increasing whale activity usually develops the fear of missing out among market participants, bringing high volatility to the cryptocurrency sector. This could send mixed signals throughout the market as investors eye the $100,000 mark.

Bernstein Research has raised their expectation of the Bitcoin price rally from $150,000 to $200,000 by 2025. The investment research company said that the expectations of regulatory changes and increased institutional demand are the main factors behind the asset’s price rally.

Bitcoin is trading at $91,800 at the time of writing. Its market cap is sitting at $1.82 trillion.

Moreover, the number of Bitcoin daily active addresses also increased by 13%, reaching 818,910 wallets, according to ITB.

This momentum suggests that retail investors have already started making moves on the blockchain as its daily trading volume increased by 63% to $75.2 billion.

MicroStrategy, one of the leading business intelligence firms in the U.S., added 51,780 BTC, worth $4.6 billion, to its reserves yesterday. The company now holds over 331,200 BTC.

Soon after the massive accumulation, MicroStrategy announced plans to raise $1.75 billion — through the private offering of convertible senior notes — to buy more Bitcoin.

Another wave of institutional adoption could trigger FOMO among retail investors to potentially help Bitcoin break the $100,000 barrier.

However, it should be noted that the Federal Reserve’s hawkish stance — potentially raising the interest rates — could change the market direction and impact the Bitcoin price.

The latest wave of whale accumulation helped Bitcoin get close to its all-time high, surpassing $92,000.

Large Bitcoin (BTC) addresses recorded a net inflow of 21,470 BTC on Monday, Nov. 18, according to data from IntoTheBlock.

The amount of whale transactions, worth at least $100,000 in BTC, also doubled to $78.37 billion in almost 23,000 unique transactions on the same day, ITB data shows. Bitcoin registered a total of over $228 billion in whale transactions over the last seven days.

One of the largest Bitcoin holders purchased the asset on Binance and transferred it to a custodial wallet with $2.2 billion in BTC, per data from Arkham Intelligence.

The increasing whale activity usually develops the fear of missing out among market participants, bringing high volatility to the cryptocurrency sector. This could send mixed signals throughout the market as investors eye the $100,000 mark.

Bernstein Research has raised their expectation of the Bitcoin price rally from $150,000 to $200,000 by 2025. The investment research company said that the expectations of regulatory changes and increased institutional demand are the main factors behind the asset’s price rally.

Bitcoin is trading at $91,800 at the time of writing. Its market cap is sitting at $1.82 trillion.

Moreover, the number of Bitcoin daily active addresses also increased by 13%, reaching 818,910 wallets, according to ITB.

This momentum suggests that retail investors have already started making moves on the blockchain as its daily trading volume increased by 63% to $75.2 billion.

MicroStrategy, one of the leading business intelligence firms in the U.S., added 51,780 BTC, worth $4.6 billion, to its reserves yesterday. The company now holds over 331,200 BTC.

Soon after the massive accumulation, MicroStrategy announced plans to raise $1.75 billion — through the private offering of convertible senior notes — to buy more Bitcoin.

Another wave of institutional adoption could trigger FOMO among retail investors to potentially help Bitcoin break the $100,000 barrier.

However, it should be noted that the Federal Reserve’s hawkish stance — potentially raising the interest rates — could change the market direction and impact the Bitcoin price.