The decrease of bitcoin’s supply on exchanges could lead to higher price volatility, market maturity, and increased influence from institutional investors.

Bitcoin Investors Are Not Selling Anytime Soon

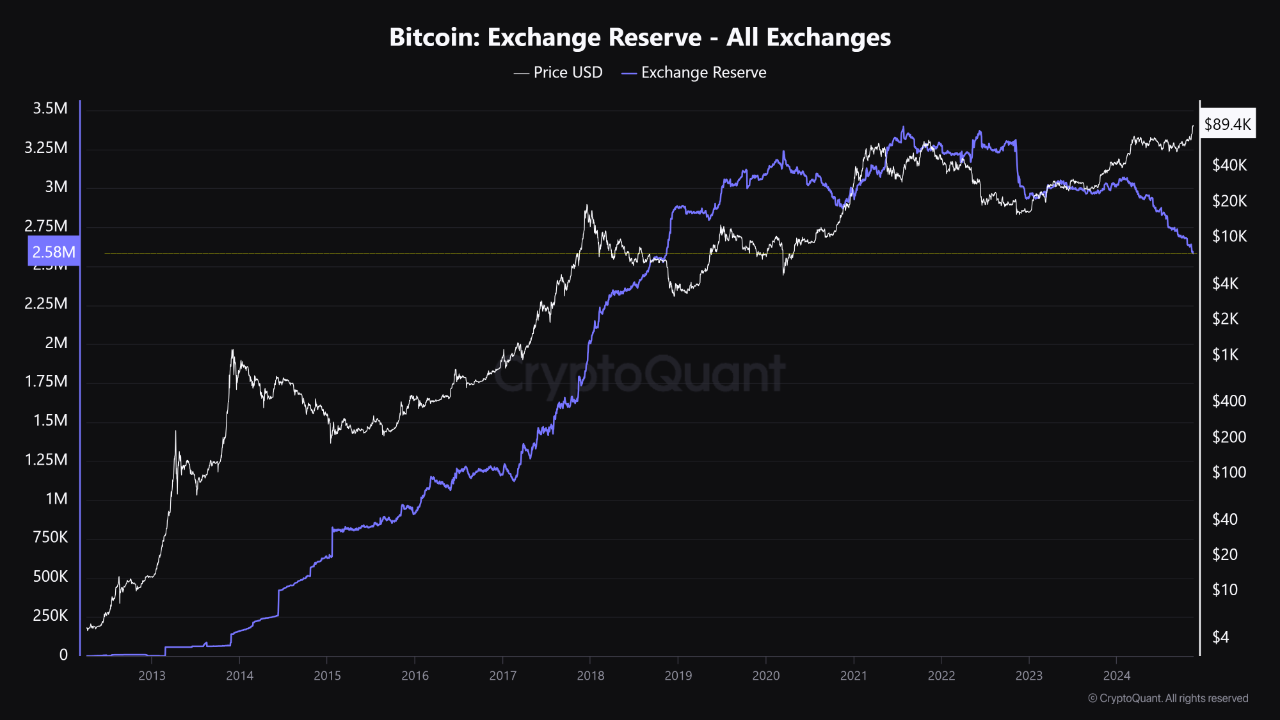

Bitcoin has seen a significant decline in its supply on cryptocurrency exchanges, reaching its lowest level since November 2018. This trend indicates that investors are increasingly opting to hold bitcoin long-term, rather than actively trading it.

According to data from Cryptoquant, the amount of bitcoin held on exchanges has dropped to approximately 2.58 million coins. This represents a substantial decrease from the peak levels observed in 2021 during the previous bull run.

The reduction of bitcoin available on exchanges puts pressure on buyers by lowering the amount of bitcoin that is readily available for sale. As a result, if demand stays the same or increases, bitcoin’s upward trend will be sustained.

This also suggests that investors are putting more faith in bitcoin as a store of value, due to unpredictable global economic policies and rising inflation.

Sharing his thoughts, Gaah, author at Cryptoquant remarked:

This scenario signals a potentially more volatile but more resilient bitcoin market, with less selling pressure and a growing dominance of long-term holders, which could open up space for new price peaks.

One of the factors actively contributing to a decline of bitcoin on exchanges is institutional adoption. Institutional investors, such as Microstrategy, Semler Scientific, and Metaplanet are increasingly allocating a portion of their portfolios to bitcoin. These large-scale investors tend to hold bitcoin in cold storage, further reducing the supply on exchanges.

This shift in approach largely driven by institutional adoption along with potential regulatory clarity on digital assets could see this trend persist, shaping the future of bitcoin and the broader digital assets ecosystem.