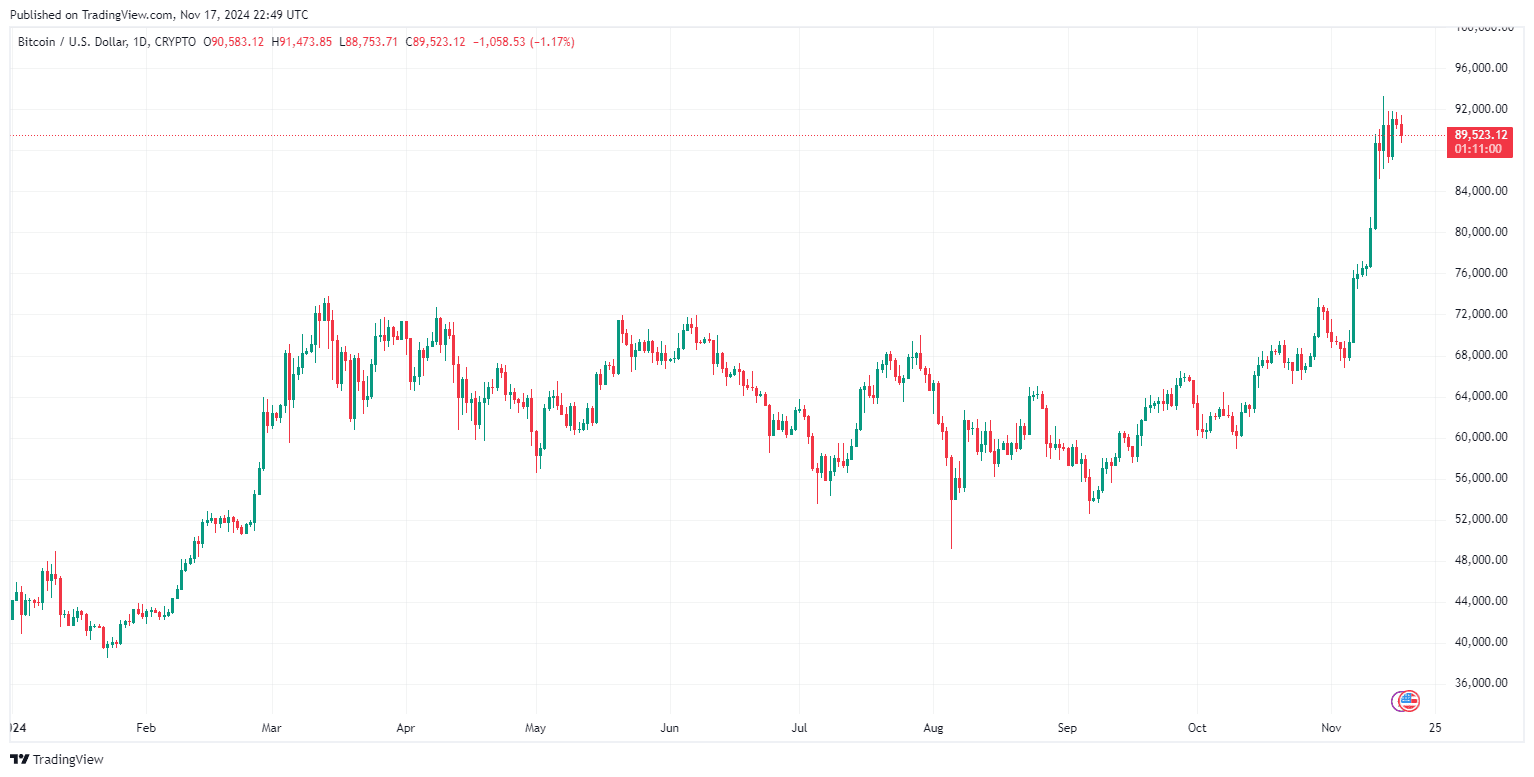

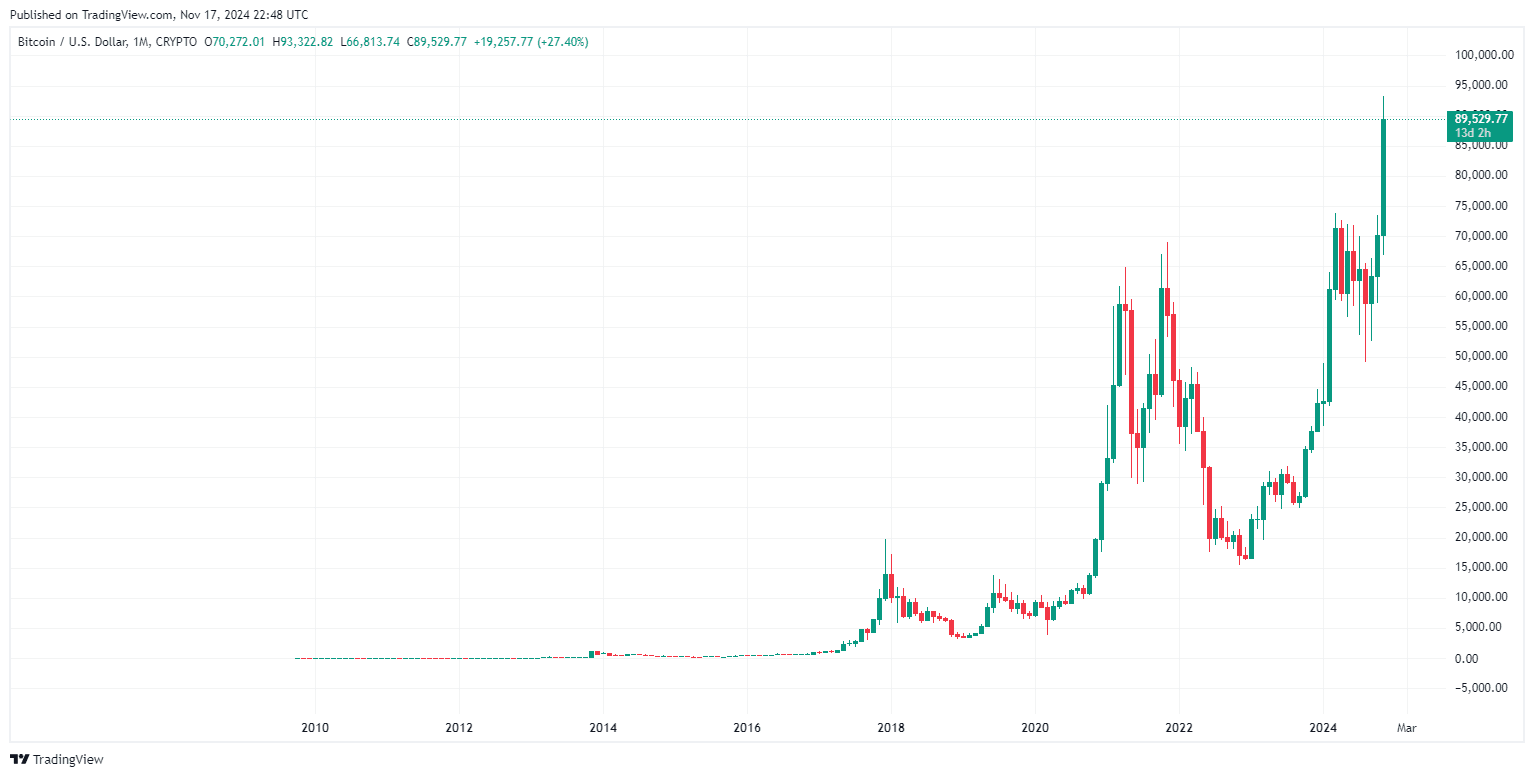

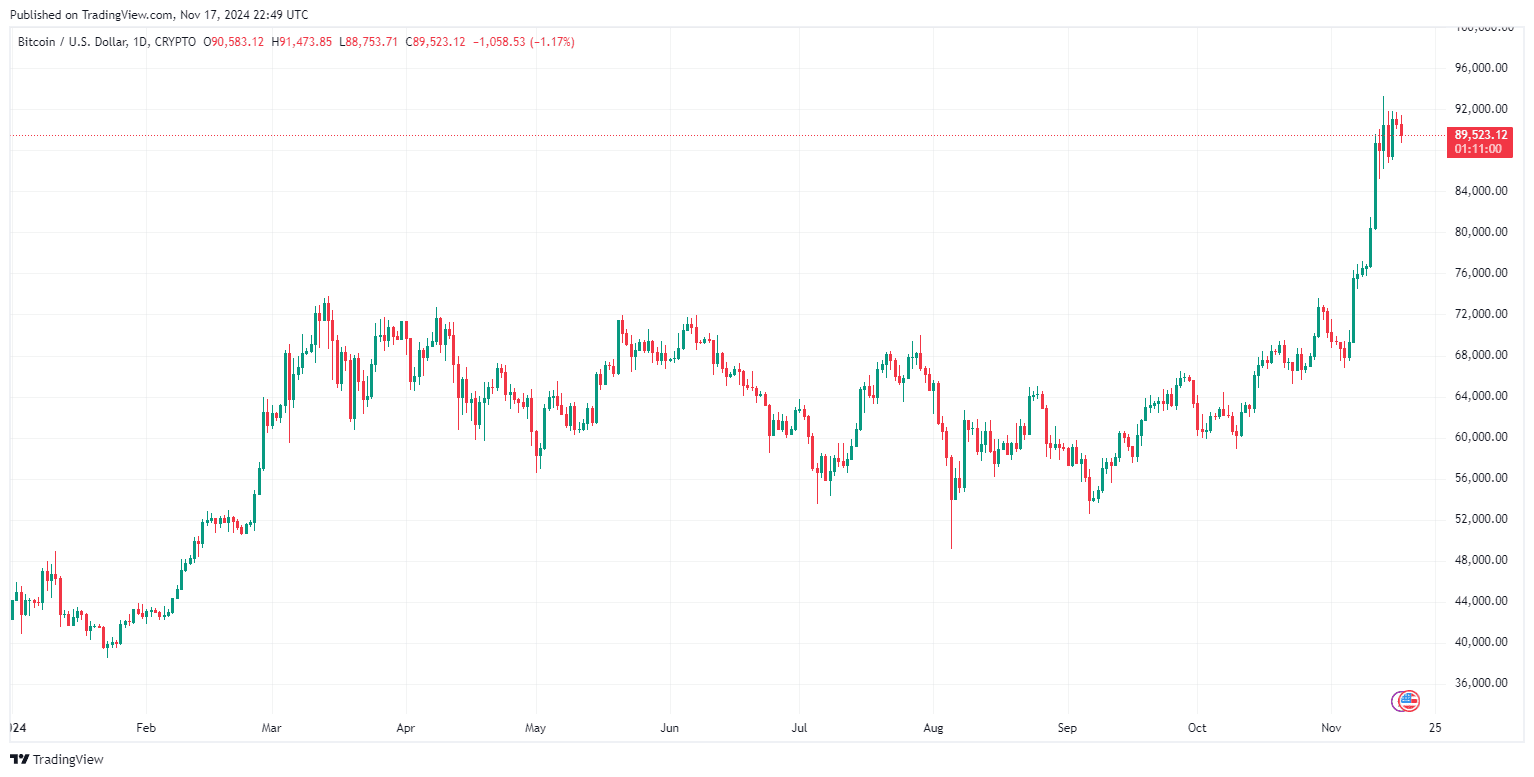

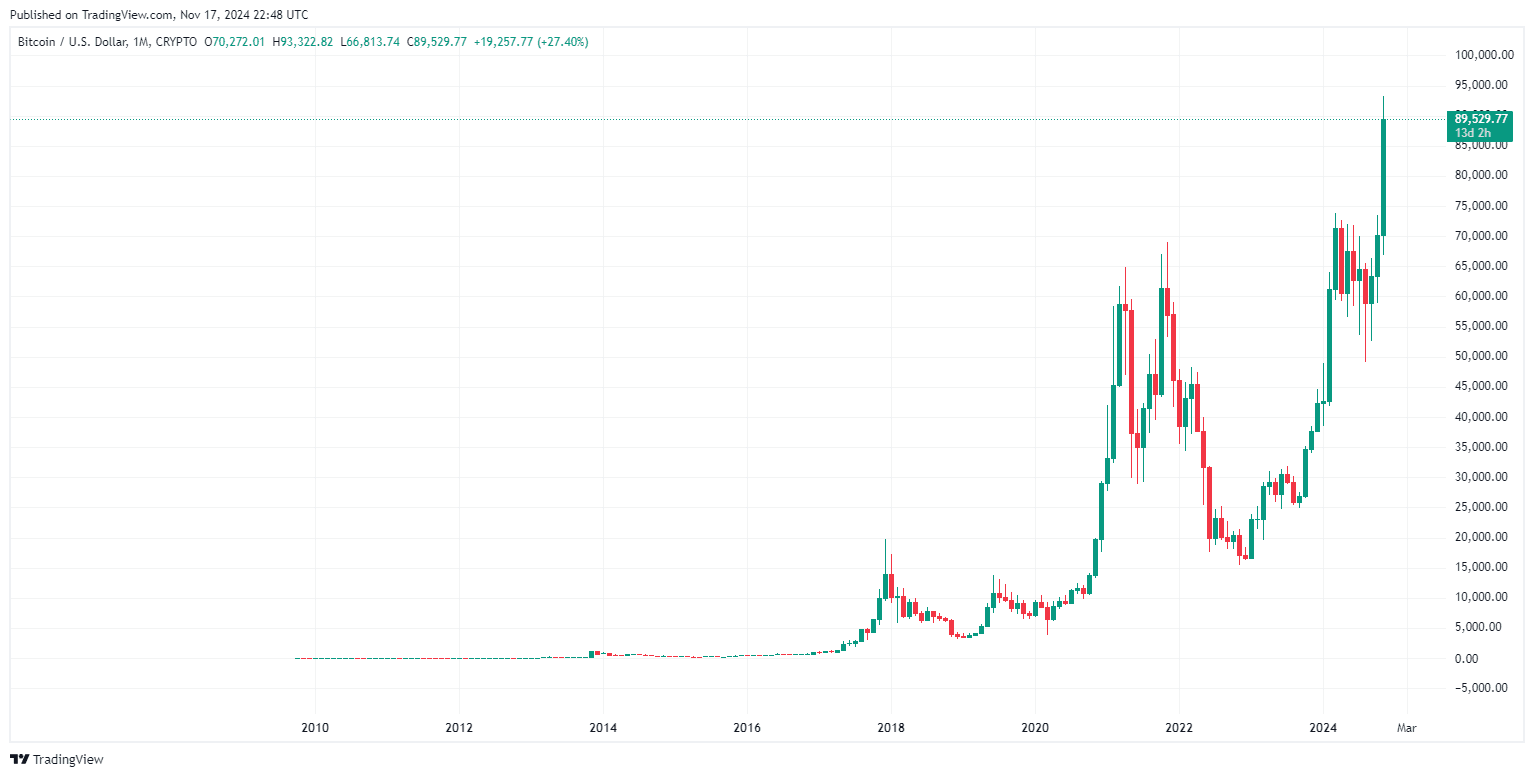

With BTC price approaching the elusive $100,000 mark, Bitcoin is once again making waves in the cryptocurrency market. This highlightly anticipated surge has ignited optimism among investors and analysts alike. However, as history shows, the path to new all-time highs (ATHs) is rarely straightforward. And with the recent downturn of BTC price, could the journey to $100k be over? This article explores Bitcoin price’s recent performance, market signals, and corporate adoption, shedding light on whether the cryptocurrency can sustain its bullish momentum.

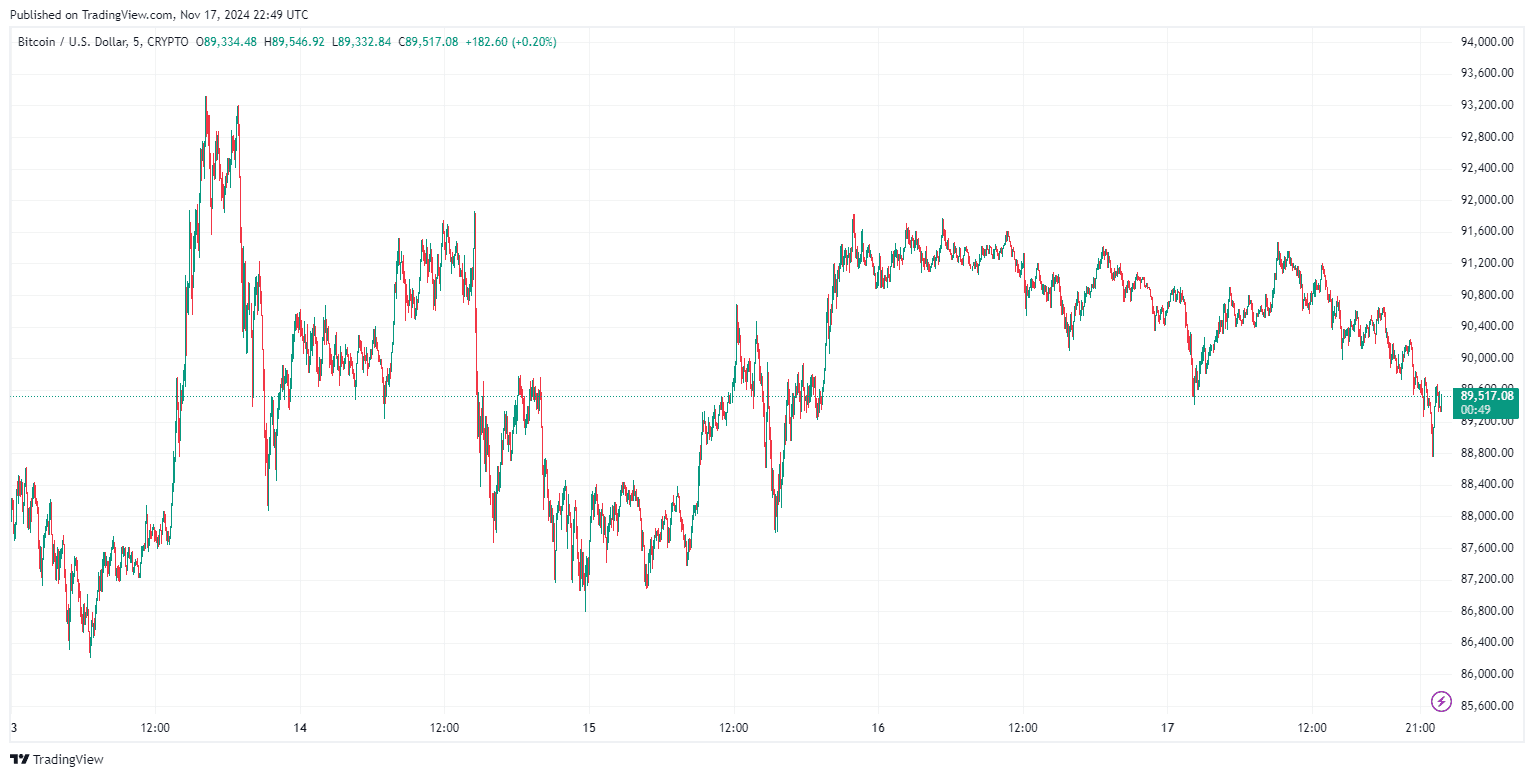

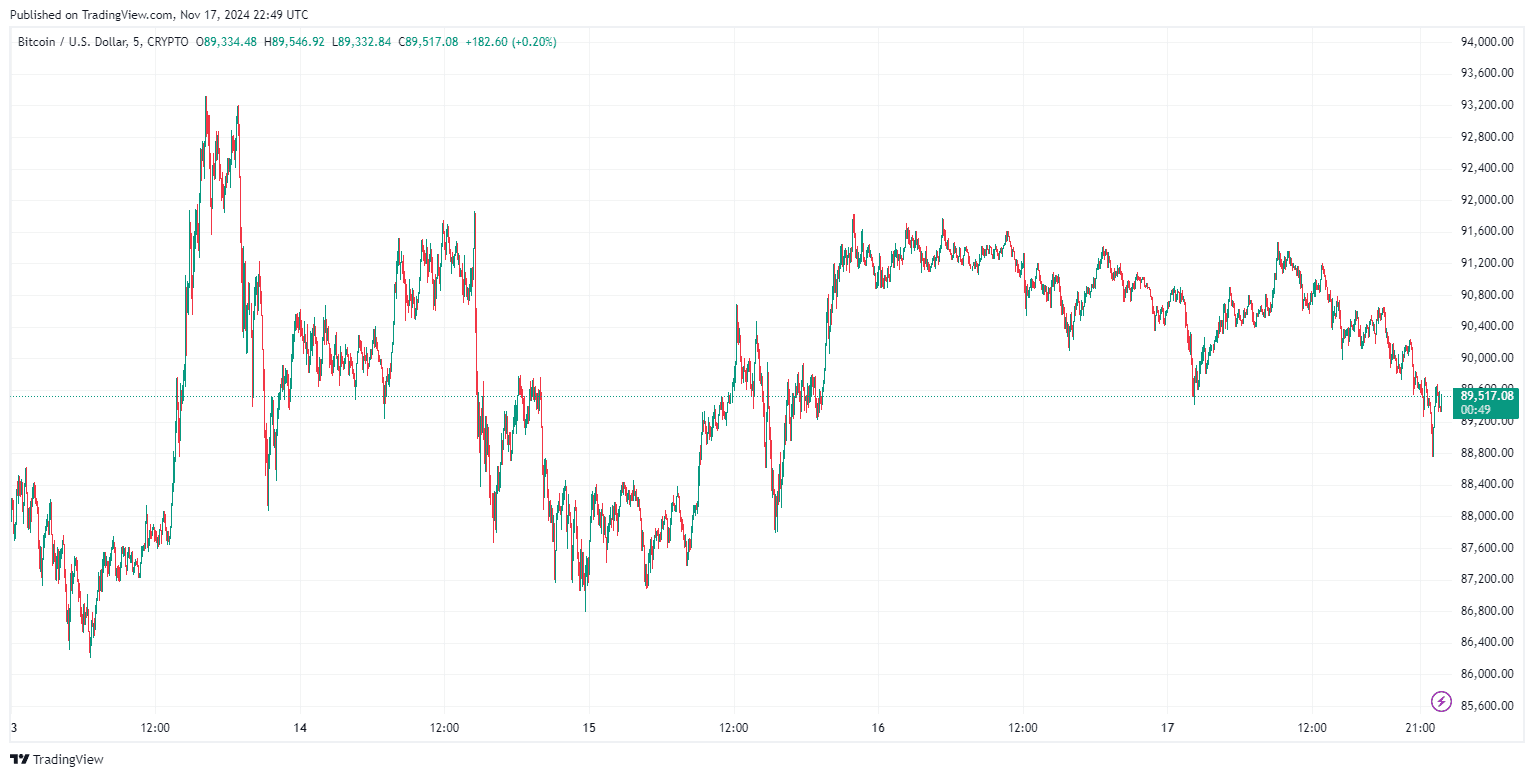

1- Consolidation and Market Cooling

Bitcoin’s rapid ascent has led to discussions about the need for market consolidation. On-chain analytics indicate a potential “healthy cooling” phase, with downside targets around $70,000-$77,000 before resuming upward momentum. Such consolidation phases are essential for sustaining long-term growth, as they allow the market to establish stronger support levels. Despite these short-term challenges, whale accumulation remains strong, reflecting confidence in Bitcoin’s long-term potential.

2- Meme Coin Volume and Bitcoin Peaks

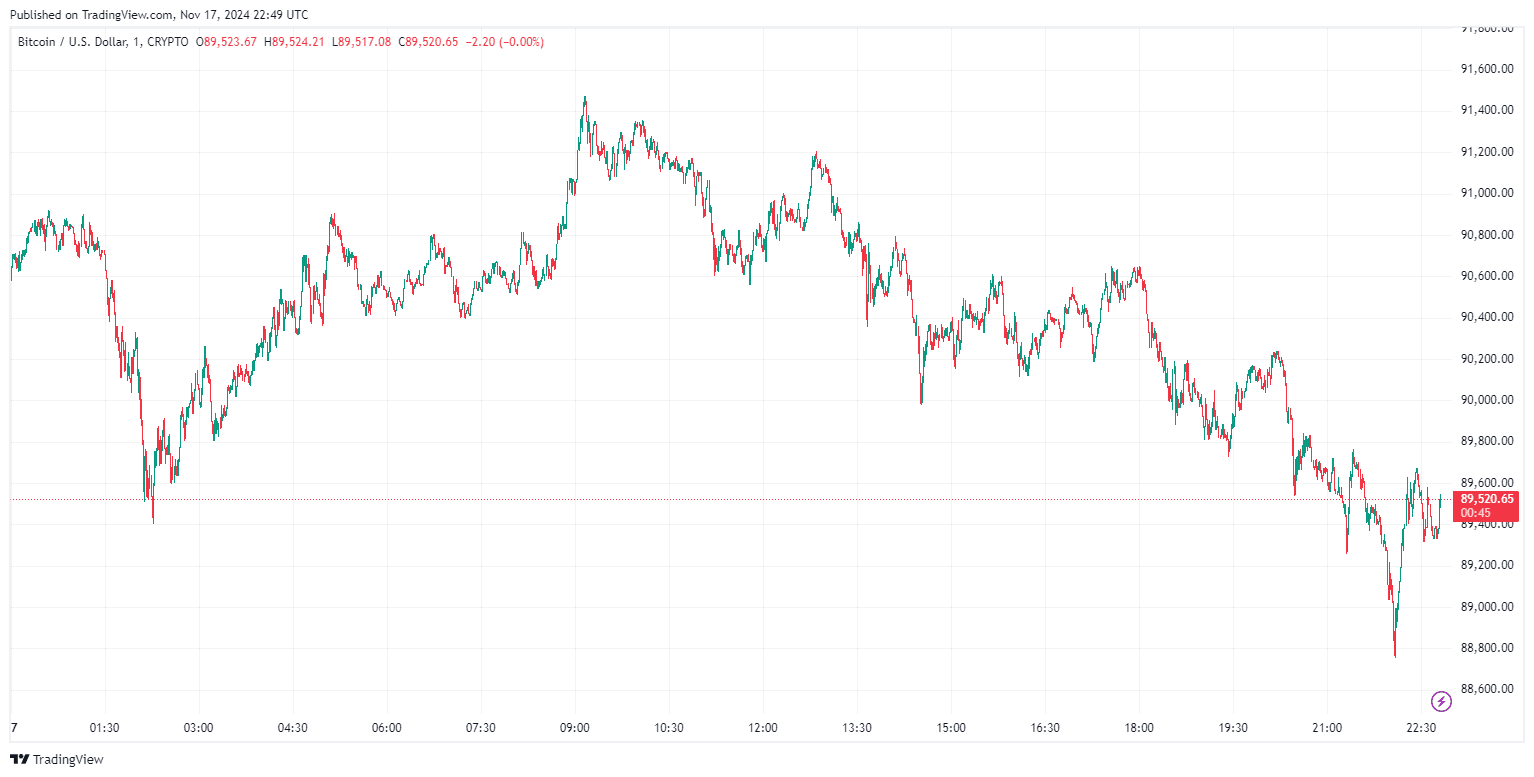

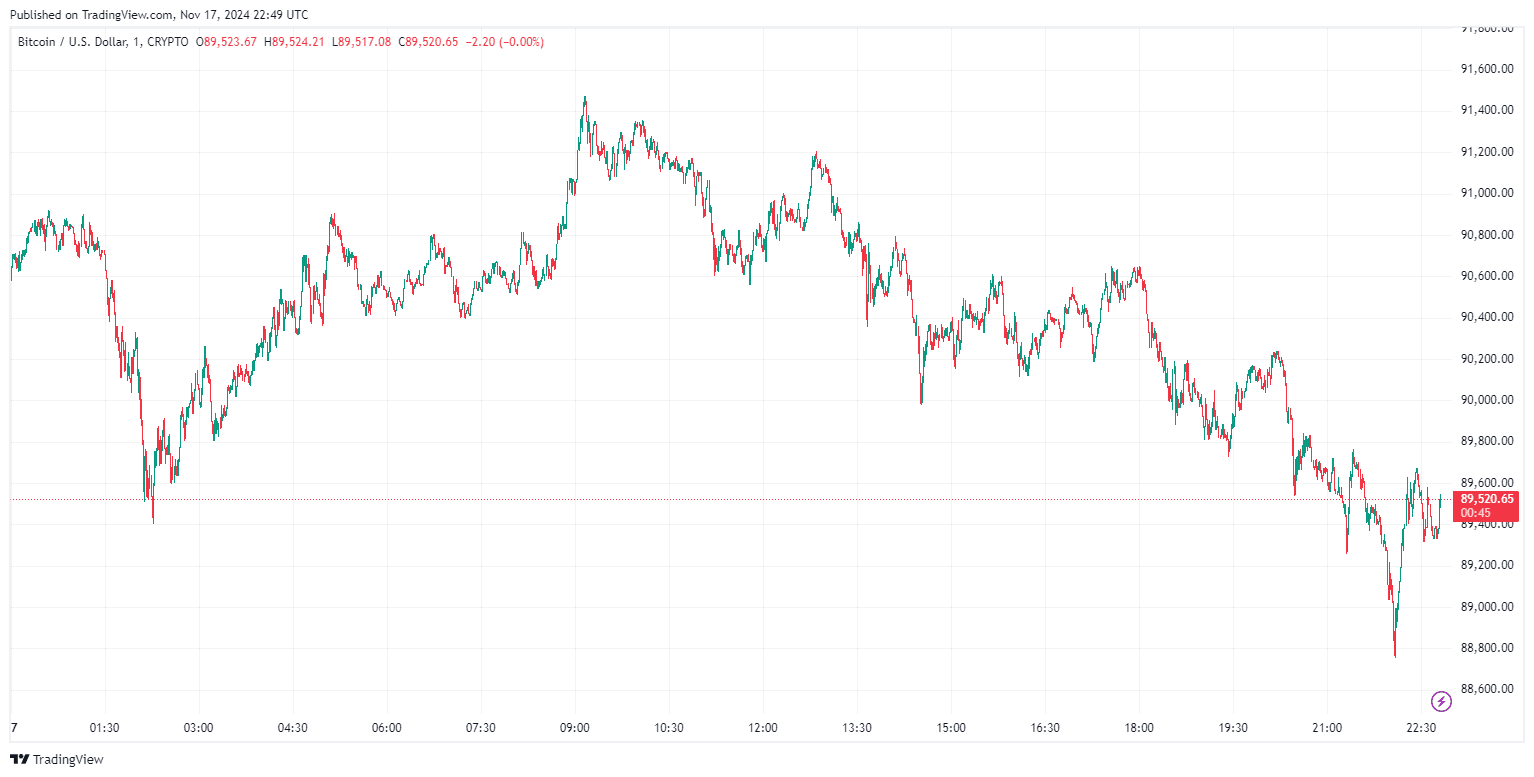

Historical data suggests a correlation between spikes in meme coin trading volume and Bitcoin’s market peaks. Recent trends indicate a surge in meme coin activity, comparable to previous instances in early 2021, mid-2021, and mid-2023, which were followed by significant corrections in Bitcoin’s price. As Bitcoin was trading above $91,000, it is navigating psychological resistance at $100,000. Technical indicators like the Relative Strength Index (RSI) signal overbought conditions, suggesting potential for a cooling-off period. Investors should monitor trading volume dynamics and meme coin activity closely, as these could signal a market reversal or continuation. And with Bitcoin now trading below $90,000, it may be the beginning of a recovery, a fallback, or an anticipation of another bullish trend.

3- Inflation and Institutional Involvement

The U.S. Consumer Price Index (CPI) recently signaled rising inflation, coinciding with Bitcoin’s new ATHs. Institutional players, including BlackRock, have shown increasing interest, with significant investments in Bitcoin ETFs. The correlation between Bitcoin and traditional assets like stocks is strengthening, suggesting that institutional adoption is driving both markets. Analysts project that Bitcoin’s price could reach $150,000 to $200,000 by 2025, highlighting its role as a hedge against inflation and a valuable asset in institutional portfolios.

4- MicroStrategy’s Bitcoin Leadership

MicroStrategy’s strategic pivot to Bitcoin has redefined its corporate identity, with its BTC holdings surpassing $26 billion in value. This places the company ahead of corporate giants like IBM and Nike in treasury assets. Since 2020, MicroStrategy has accumulated 279,240 BTC at an average cost of $42,888, positioning it as the largest publicly traded Bitcoin holder. Despite skepticism, the company’s Bitcoin-focused strategy has paid off, with its stock soaring by over 2,500%. Executive Chairman Michael Saylor’s vision to transform MicroStrategy into a trillion-dollar Bitcoin bank underscores the increasing institutional adoption of the cryptocurrency.

5- Bitcoin Price Prediction: Is The Journey to $100k OVER?

According to CryptoQuant, Bitcoin remains undervalued despite its recent rally to its latest ATH of $93,400. Metrics like the Market Value to Realized Value (MVRV) ratio and rising stablecoin liquidity suggest further upside potential. Analysts predict Bitcoin could breach $100,000 as demand grows, fueled by a surge in U.S. investor interest and positive market sentiment following the recent presidential election. However, minor selling pressure from large miners may lead to short-term corrections, emphasizing the importance of monitoring market liquidity and miner activity.

A mix of market demand, institutional adoption, and macroeconomic factors fuels Bitcoin’s journey to $100,000. While short-term corrections and consolidation phases are expected, the long-term outlook remains bullish. So, while the journey to $100k might seem to be over, it might as well be just starting. Investors should stay informed about trading volume, on-chain activity, and macroeconomic trends to navigate this dynamic market effectively.

With BTC price approaching the elusive $100,000 mark, Bitcoin is once again making waves in the cryptocurrency market. This highlightly anticipated surge has ignited optimism among investors and analysts alike. However, as history shows, the path to new all-time highs (ATHs) is rarely straightforward. And with the recent downturn of BTC price, could the journey to $100k be over? This article explores Bitcoin price’s recent performance, market signals, and corporate adoption, shedding light on whether the cryptocurrency can sustain its bullish momentum.

1- Consolidation and Market Cooling

Bitcoin’s rapid ascent has led to discussions about the need for market consolidation. On-chain analytics indicate a potential “healthy cooling” phase, with downside targets around $70,000-$77,000 before resuming upward momentum. Such consolidation phases are essential for sustaining long-term growth, as they allow the market to establish stronger support levels. Despite these short-term challenges, whale accumulation remains strong, reflecting confidence in Bitcoin’s long-term potential.

2- Meme Coin Volume and Bitcoin Peaks

Historical data suggests a correlation between spikes in meme coin trading volume and Bitcoin’s market peaks. Recent trends indicate a surge in meme coin activity, comparable to previous instances in early 2021, mid-2021, and mid-2023, which were followed by significant corrections in Bitcoin’s price. As Bitcoin was trading above $91,000, it is navigating psychological resistance at $100,000. Technical indicators like the Relative Strength Index (RSI) signal overbought conditions, suggesting potential for a cooling-off period. Investors should monitor trading volume dynamics and meme coin activity closely, as these could signal a market reversal or continuation. And with Bitcoin now trading below $90,000, it may be the beginning of a recovery, a fallback, or an anticipation of another bullish trend.

3- Inflation and Institutional Involvement

The U.S. Consumer Price Index (CPI) recently signaled rising inflation, coinciding with Bitcoin’s new ATHs. Institutional players, including BlackRock, have shown increasing interest, with significant investments in Bitcoin ETFs. The correlation between Bitcoin and traditional assets like stocks is strengthening, suggesting that institutional adoption is driving both markets. Analysts project that Bitcoin’s price could reach $150,000 to $200,000 by 2025, highlighting its role as a hedge against inflation and a valuable asset in institutional portfolios.

4- MicroStrategy’s Bitcoin Leadership

MicroStrategy’s strategic pivot to Bitcoin has redefined its corporate identity, with its BTC holdings surpassing $26 billion in value. This places the company ahead of corporate giants like IBM and Nike in treasury assets. Since 2020, MicroStrategy has accumulated 279,240 BTC at an average cost of $42,888, positioning it as the largest publicly traded Bitcoin holder. Despite skepticism, the company’s Bitcoin-focused strategy has paid off, with its stock soaring by over 2,500%. Executive Chairman Michael Saylor’s vision to transform MicroStrategy into a trillion-dollar Bitcoin bank underscores the increasing institutional adoption of the cryptocurrency.

5- Bitcoin Price Prediction: Is The Journey to $100k OVER?

According to CryptoQuant, Bitcoin remains undervalued despite its recent rally to its latest ATH of $93,400. Metrics like the Market Value to Realized Value (MVRV) ratio and rising stablecoin liquidity suggest further upside potential. Analysts predict Bitcoin could breach $100,000 as demand grows, fueled by a surge in U.S. investor interest and positive market sentiment following the recent presidential election. However, minor selling pressure from large miners may lead to short-term corrections, emphasizing the importance of monitoring market liquidity and miner activity.

A mix of market demand, institutional adoption, and macroeconomic factors fuels Bitcoin’s journey to $100,000. While short-term corrections and consolidation phases are expected, the long-term outlook remains bullish. So, while the journey to $100k might seem to be over, it might as well be just starting. Investors should stay informed about trading volume, on-chain activity, and macroeconomic trends to navigate this dynamic market effectively.