Market veteran Peter Brandt suggests a likely Bitcoin price rebound to the six-figure region amid the recent correction.

After an eight-day streak of big green candles, Bitcoin is showing signs of cooling off, briefly retracing from Tuesday’s $89,950 all-time high.

For context, Bitcoin has dipped by 5.34% to $85,155 since reaching the $89K peak. Now, market participants are pondering whether the lead asset is due for a major retracement or if this explosive price action still has further upside potential.

Legendary market analyst Peter Brandt sparked a conversation earlier today, asking the community to weigh in on whether the market is overbought or merely in its early stages.

Brandt accompanied the post with a historical chart of Bitcoin, featuring various technical indicators to highlight the current market position. One of the major points of interest is that Bitcoin’s chart is showing an inverse head-and-shoulders pattern, a bullish indicator.

Brandt Still Targeting $327K for Bitcoin

Remarkably, the chart suggests that Bitcoin is only about halfway through the expected 518-day post-halving bull run, with further upside potential. On the conservative side, Brandt’s chart is predicting a continuation toward $134,052.

A more optimistic scenario suggests a potential explosive rally to as high as $327,060 over the remaining months of the post-halving price surge.

Although Brandt didn’t take a definitive position in his post, his chart only highlights bullish price targets for Bitcoin without offering any bearish scenarios.

Commenters Agree: Bitcoin Is Just Getting Started

Commenters on Brandt’s post overwhelmingly expressed a bullish outlook, with many stating that Bitcoin’s rally is just beginning.

Leeor Shimron, head of growth at StackingDao, described Brandt’s chart as “probably one of the most bullish and cleanest charts” he has ever seen.

Another commenter noted that Bitcoin had seven months to cool off after initially peaking in March at $73,750, followed by a drop to $49,000. The commenter argued that considering Bitcoin “overbought” at this stage, after just two weeks of consistent gains, misses the bigger picture. “This is the beginning of a breakout, not the end,” he said.

Likewise, X user Ehraz Ahmed emphasized that Bitcoin tends to rally hardest when overbought on the monthly charts, suggesting that the current surge is just starting.

Meanwhile, analyst Kale Abe pointed out that Bitcoin is only up 35% from Election Day, which triggered the current bull run. He noted that a minor pullback wouldn’t be surprising.

Caution for Short-Term Traders

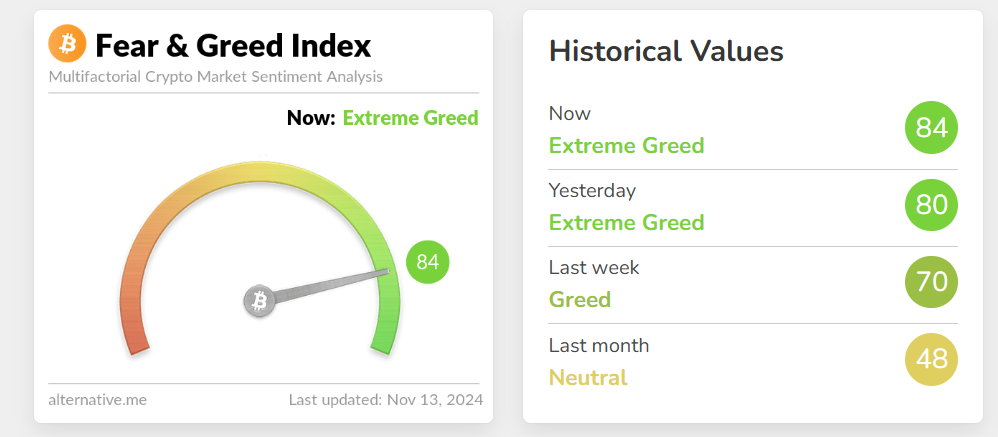

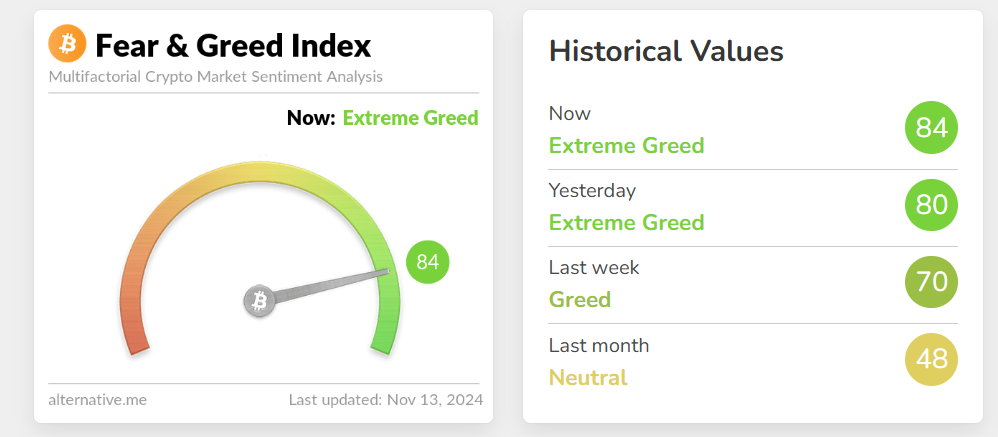

It’s important to note that the overall crypto market sentiment has entered the “extreme greed” phase. This comes as several altcoins are also experiencing historic rallies alongside Bitcoin. While bears await a major retracement, bulls are charged up and expect the rally to continue.

However, as Bitcoin continues to break into uncharted territory, it faces the risk of increased volatility due to “thin” order books and a lack of established support and resistance levels. According to Ki Young Ju, founder of CryptoQuant, this dynamic makes Bitcoin vulnerable to rapid price swings, creating what he calls an “easy up, easy down” phase.

Market veteran Peter Brandt suggests a likely Bitcoin price rebound to the six-figure region amid the recent correction.

After an eight-day streak of big green candles, Bitcoin is showing signs of cooling off, briefly retracing from Tuesday’s $89,950 all-time high.

For context, Bitcoin has dipped by 5.34% to $85,155 since reaching the $89K peak. Now, market participants are pondering whether the lead asset is due for a major retracement or if this explosive price action still has further upside potential.

Legendary market analyst Peter Brandt sparked a conversation earlier today, asking the community to weigh in on whether the market is overbought or merely in its early stages.

Brandt accompanied the post with a historical chart of Bitcoin, featuring various technical indicators to highlight the current market position. One of the major points of interest is that Bitcoin’s chart is showing an inverse head-and-shoulders pattern, a bullish indicator.

Brandt Still Targeting $327K for Bitcoin

Remarkably, the chart suggests that Bitcoin is only about halfway through the expected 518-day post-halving bull run, with further upside potential. On the conservative side, Brandt’s chart is predicting a continuation toward $134,052.

A more optimistic scenario suggests a potential explosive rally to as high as $327,060 over the remaining months of the post-halving price surge.

Although Brandt didn’t take a definitive position in his post, his chart only highlights bullish price targets for Bitcoin without offering any bearish scenarios.

Commenters Agree: Bitcoin Is Just Getting Started

Commenters on Brandt’s post overwhelmingly expressed a bullish outlook, with many stating that Bitcoin’s rally is just beginning.

Leeor Shimron, head of growth at StackingDao, described Brandt’s chart as “probably one of the most bullish and cleanest charts” he has ever seen.

Another commenter noted that Bitcoin had seven months to cool off after initially peaking in March at $73,750, followed by a drop to $49,000. The commenter argued that considering Bitcoin “overbought” at this stage, after just two weeks of consistent gains, misses the bigger picture. “This is the beginning of a breakout, not the end,” he said.

Likewise, X user Ehraz Ahmed emphasized that Bitcoin tends to rally hardest when overbought on the monthly charts, suggesting that the current surge is just starting.

Meanwhile, analyst Kale Abe pointed out that Bitcoin is only up 35% from Election Day, which triggered the current bull run. He noted that a minor pullback wouldn’t be surprising.

Caution for Short-Term Traders

It’s important to note that the overall crypto market sentiment has entered the “extreme greed” phase. This comes as several altcoins are also experiencing historic rallies alongside Bitcoin. While bears await a major retracement, bulls are charged up and expect the rally to continue.

However, as Bitcoin continues to break into uncharted territory, it faces the risk of increased volatility due to “thin” order books and a lack of established support and resistance levels. According to Ki Young Ju, founder of CryptoQuant, this dynamic makes Bitcoin vulnerable to rapid price swings, creating what he calls an “easy up, easy down” phase.