As the asset redemption process continues, FTX has unstaked over 178K Solana (SOL) tokens. These tokens are worth more than $128 million.

The decision comes after the U.S. Bankruptcy Court approved FTX’s reorganization plan, as the exchange seeks to compensate its creditors following the company’s bankruptcy.

This latest unstacking continues a trend in recent months. FTX redeems a similar number of SOL tokens between the 12th and 15th of each month.

FTX’s Regular Solana Redemptions Raise Concerns

The unstaking of 178,631 SOL on October 15 is part of the ongoing efforts of FTX to liquidate assets and send back the funds to the customers. This comes after a U.S. court gave the nod to its reorganization plan that seeks to give out over $14 billion to creditors.

In the plan, several digital assets are identified for sale, with large volumes of Solana being sold in the process, and such liquidations could be seen to put downward pressure on the value of SOL.

The SOL staking address of FTX/Alameda redeemed 178,631 SOL (US$28 million) today, most of which are expected to flow into Coinbase or Binance. The SOL of this address is redeemed and transferred out about 170k SOL on the 12th to 15th of each month. Currently, there are 7.09…

— Wu Blockchain (@WuBlockchain) October 15, 2024

For the past few months, FTX and its sister company, Alameda Research has be using SOL tokens to redeem them. For instance, in September 2024, the companies unstaked more than 530,000 SOL which is approximately $71 million.

These tokens were sent to various wallets, with approximately 176,700 SOL being claimed every month. Nevertheless, FTX and Alameda still hold about 7.06 million SOL with the worth of approximately $945.7 million in the middle of September.

Potential Market Impact of FTX’s SOL Sales

The constant unstaking and the possibility of selling large amounts of SOL in the open market might cause the price of the token to go down. The 178,631 SOL recently redeemed by FTX is believed to be sent to major exchanges such as Coinbase and Binance and may be sold. If this happens, the increased supply will put downward pressure on the price. As FTX continues to implement its reorganization plan more of such sales may occur, which may put more pressure on SOL prices.

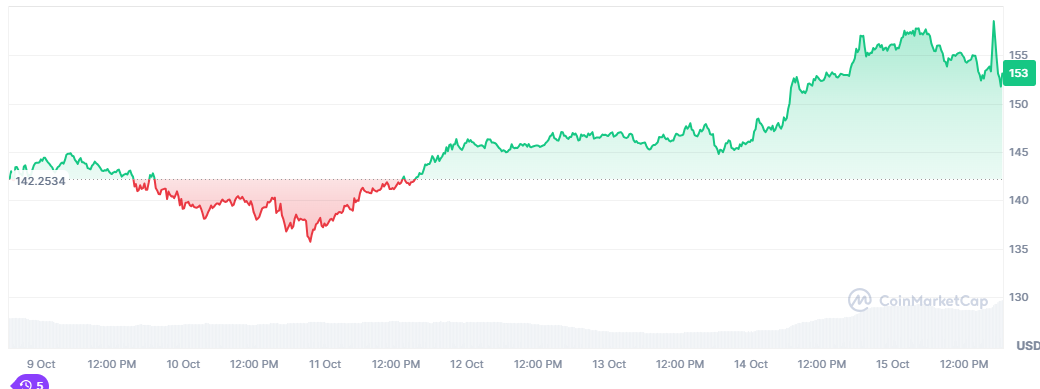

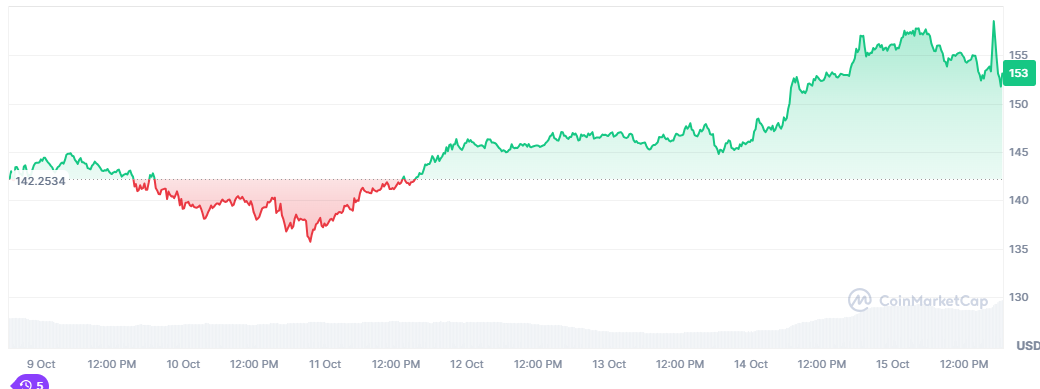

As for FTX’s liquidations, SOL may experience some short-term losses, yet the market sentiment is becoming more positive. In the last 7 days, Solana has been on the rise, with its price rising by more than 8%.

Currently, SOL is trading at around $151, a 3% decline due to increased market fear post the FTX move. However, this upward movement may be temporary if the liquidated tokens pour back into the market.

Strong Fundamentals Could Support SOL Despite Sell-Off

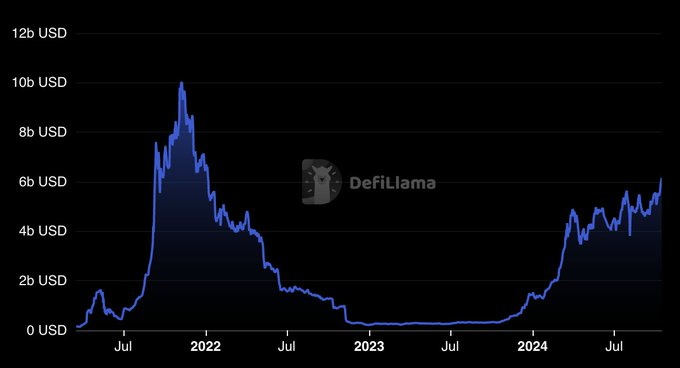

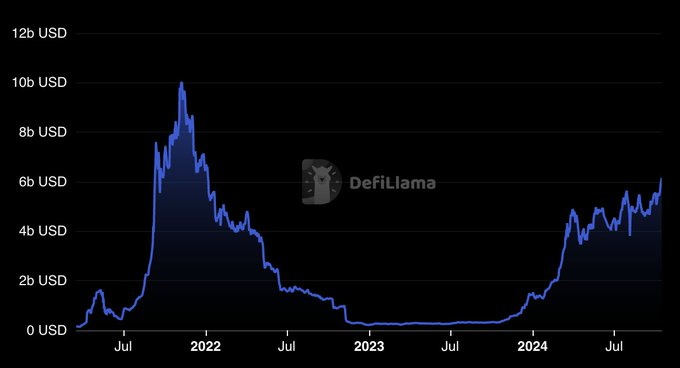

However, as Solana’s network continues to experience growth, there are indicators that can support its price even amidst the current redemptions at FTX. The Total Value Locked (TVL) in Solana DeFi applications has surpassed $6.1 billion in October, the highest level since January 2022.

This growth shows that users are gaining more confidence and participation on the platform, which would benefit SOL’s price despite the rising selling pressure.

In addition, the daily active addresses have increased tremendously with over 4 million new addresses being created daily on the Solana network. This increase in user activity and fresh capital inflows means that there is a steady need for Solana’s services which may overshadow the negative price impact from the liquidation of assets at FTX.

From a technical point of view, analysts say that Solana is encountering a major barrier at the $159 mark. If the token’s price manages to overcome this resistance level it may head towards $186 a price last seen in July 2024.

Nonetheless, if FTX starts to liquidate unstaked SOL tokens without adequate market demand, SOL may drop by 15% with the help of support at $131. If this support level collapses, Solana’s price may decline, and may fall to as low as $109.

As the asset redemption process continues, FTX has unstaked over 178K Solana (SOL) tokens. These tokens are worth more than $128 million.

The decision comes after the U.S. Bankruptcy Court approved FTX’s reorganization plan, as the exchange seeks to compensate its creditors following the company’s bankruptcy.

This latest unstacking continues a trend in recent months. FTX redeems a similar number of SOL tokens between the 12th and 15th of each month.

FTX’s Regular Solana Redemptions Raise Concerns

The unstaking of 178,631 SOL on October 15 is part of the ongoing efforts of FTX to liquidate assets and send back the funds to the customers. This comes after a U.S. court gave the nod to its reorganization plan that seeks to give out over $14 billion to creditors.

In the plan, several digital assets are identified for sale, with large volumes of Solana being sold in the process, and such liquidations could be seen to put downward pressure on the value of SOL.

The SOL staking address of FTX/Alameda redeemed 178,631 SOL (US$28 million) today, most of which are expected to flow into Coinbase or Binance. The SOL of this address is redeemed and transferred out about 170k SOL on the 12th to 15th of each month. Currently, there are 7.09…

— Wu Blockchain (@WuBlockchain) October 15, 2024

For the past few months, FTX and its sister company, Alameda Research has be using SOL tokens to redeem them. For instance, in September 2024, the companies unstaked more than 530,000 SOL which is approximately $71 million.

These tokens were sent to various wallets, with approximately 176,700 SOL being claimed every month. Nevertheless, FTX and Alameda still hold about 7.06 million SOL with the worth of approximately $945.7 million in the middle of September.

Potential Market Impact of FTX’s SOL Sales

The constant unstaking and the possibility of selling large amounts of SOL in the open market might cause the price of the token to go down. The 178,631 SOL recently redeemed by FTX is believed to be sent to major exchanges such as Coinbase and Binance and may be sold. If this happens, the increased supply will put downward pressure on the price. As FTX continues to implement its reorganization plan more of such sales may occur, which may put more pressure on SOL prices.

As for FTX’s liquidations, SOL may experience some short-term losses, yet the market sentiment is becoming more positive. In the last 7 days, Solana has been on the rise, with its price rising by more than 8%.

Currently, SOL is trading at around $151, a 3% decline due to increased market fear post the FTX move. However, this upward movement may be temporary if the liquidated tokens pour back into the market.

Strong Fundamentals Could Support SOL Despite Sell-Off

However, as Solana’s network continues to experience growth, there are indicators that can support its price even amidst the current redemptions at FTX. The Total Value Locked (TVL) in Solana DeFi applications has surpassed $6.1 billion in October, the highest level since January 2022.

This growth shows that users are gaining more confidence and participation on the platform, which would benefit SOL’s price despite the rising selling pressure.

In addition, the daily active addresses have increased tremendously with over 4 million new addresses being created daily on the Solana network. This increase in user activity and fresh capital inflows means that there is a steady need for Solana’s services which may overshadow the negative price impact from the liquidation of assets at FTX.

From a technical point of view, analysts say that Solana is encountering a major barrier at the $159 mark. If the token’s price manages to overcome this resistance level it may head towards $186 a price last seen in July 2024.

Nonetheless, if FTX starts to liquidate unstaked SOL tokens without adequate market demand, SOL may drop by 15% with the help of support at $131. If this support level collapses, Solana’s price may decline, and may fall to as low as $109.