Although the price of bitcoin stole the show during Donald Trump’s re-election, its rally also lifted a number of other key metrics. Coinciding with an all-time high in price were bitcoin’s resurgence to all-time high futures transactions, spot ETF inflows, options volume, exchange trade volume, total circulating bitcoin, total value locked, and total hash rate.

These are the eight metrics that took the Bitcoin network to an all-time high beyond its USD price.

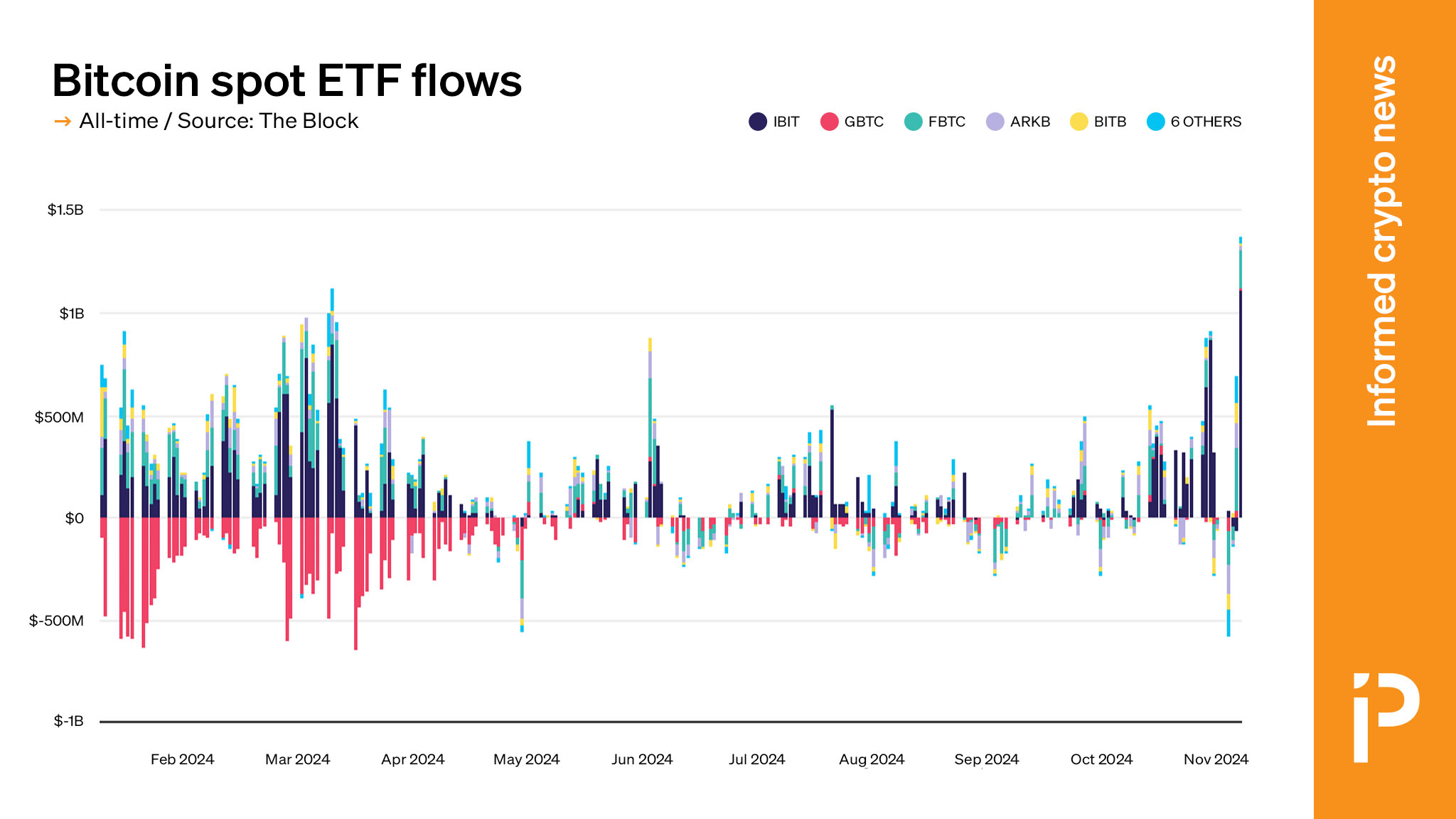

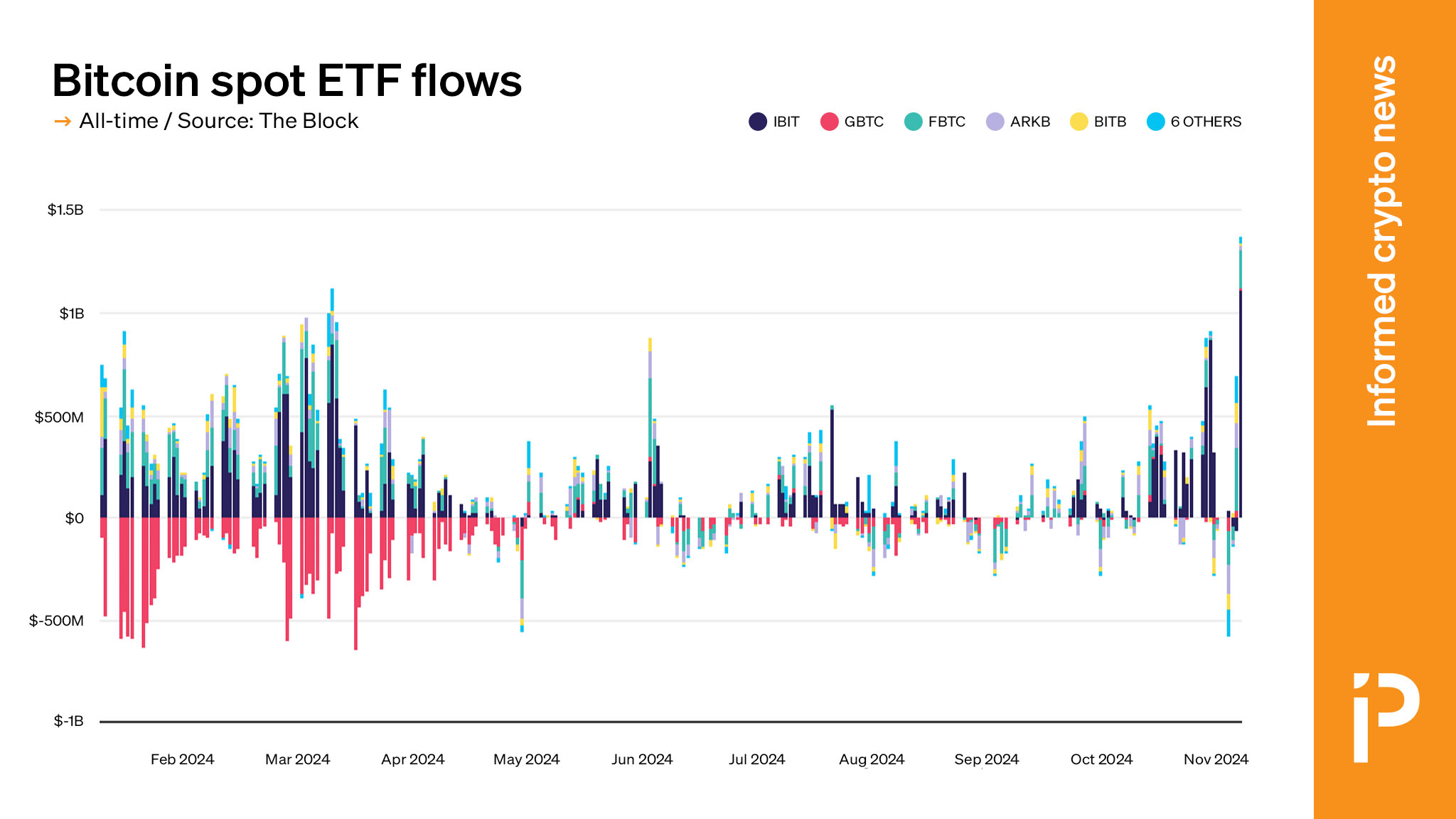

All-time high bitcoin daily spot ETF inflows

As bitcoin rallied on enthusiasm for Donald Trump’s incoming presidency, traditional investors who prefer exchange-listed products also placed plenty of buy orders.

After adjusting for a one-day anomaly of Grayscale trust-to-ETF asset rotation during the debut of spot bitcoin ETFs, US-listed spot bitcoin ETFs enjoyed their highest-ever day of capital inflows as bitcoin itself rallied past $74,000.

On a net basis, investors added $1.373 billion of capital to US spot bitcoin ETFs on November 7.

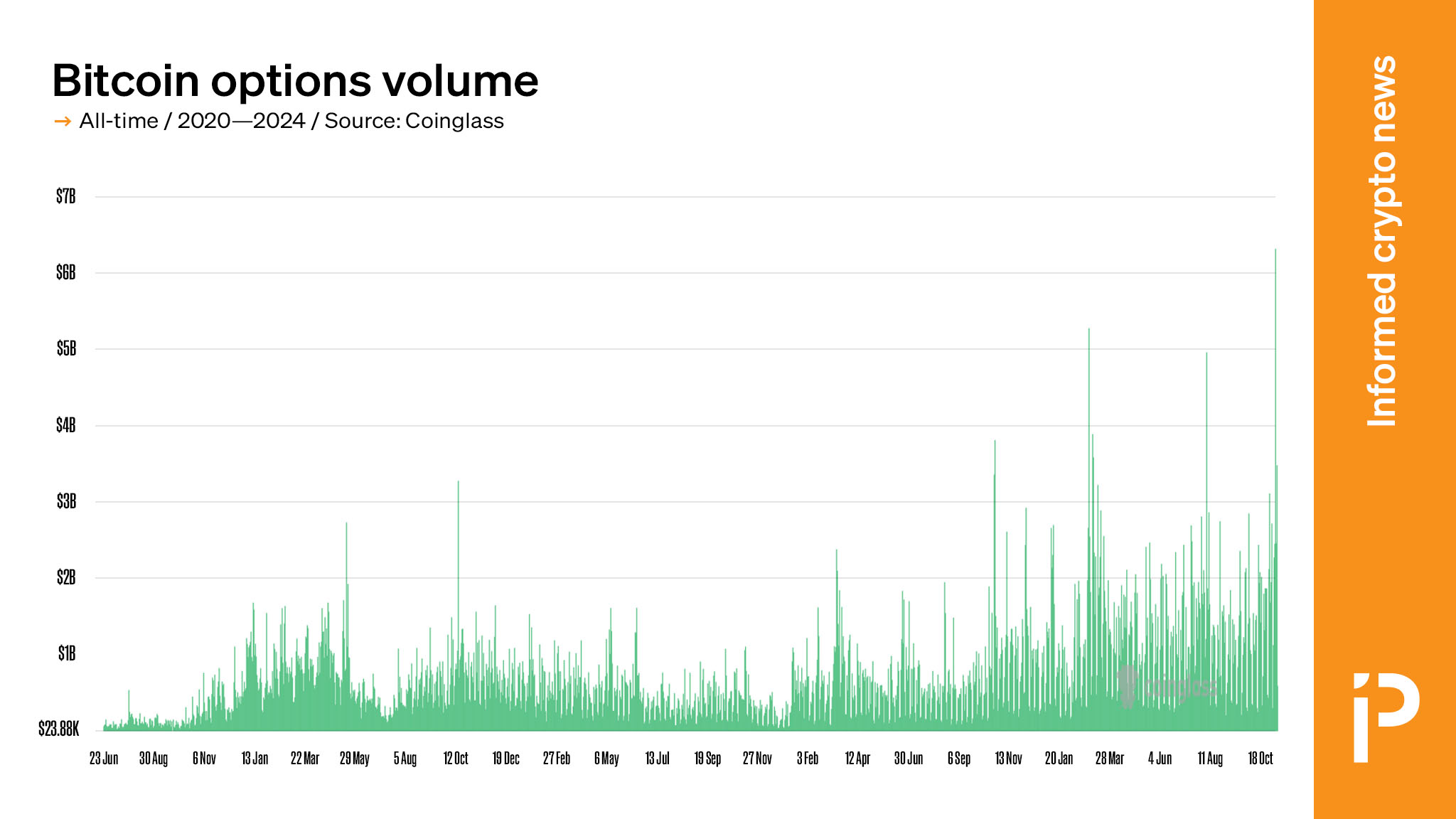

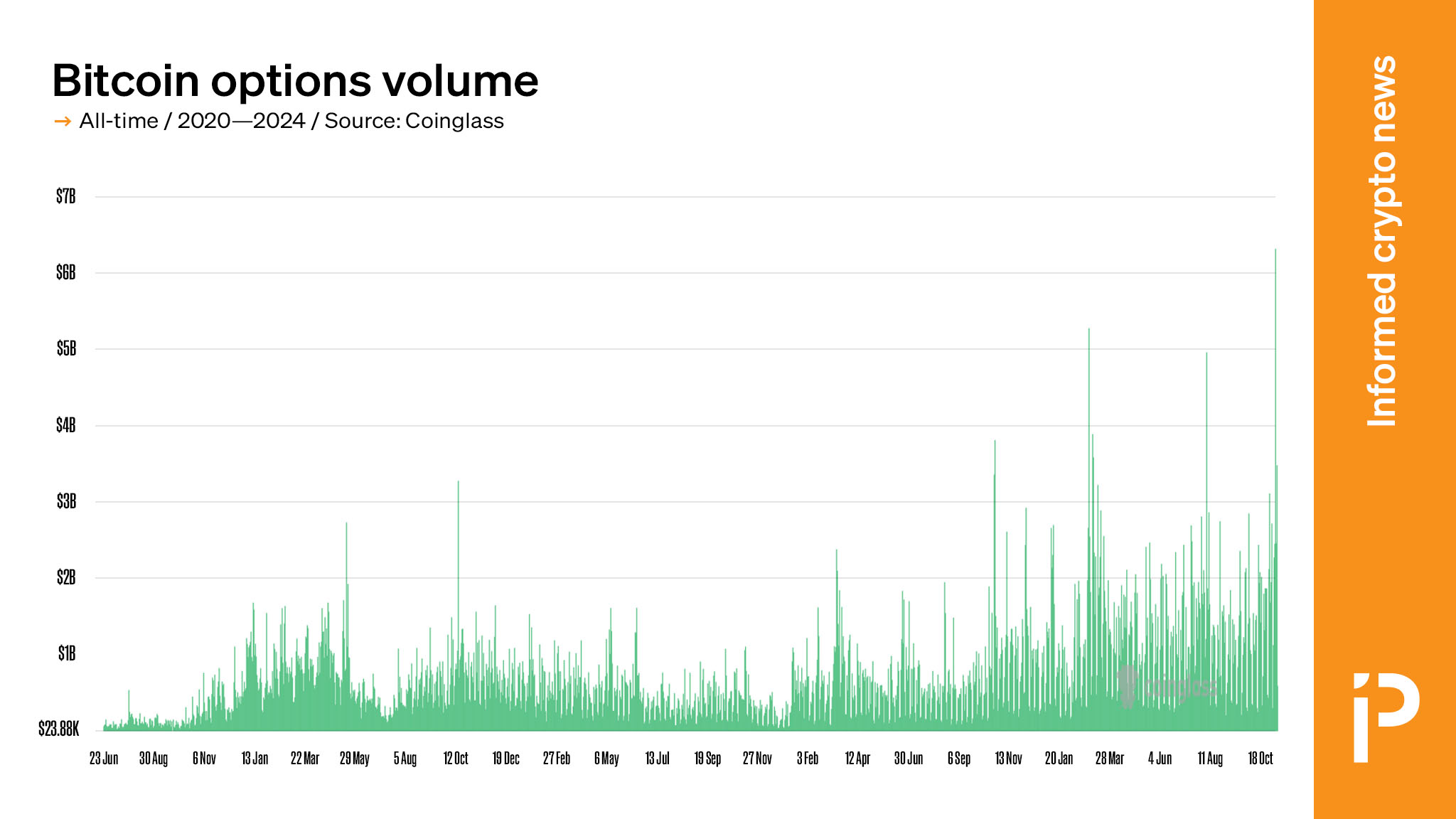

All-time high bitcoin options volume

Bitcoin options volume also hit a new record this week. According to data aggregated at Coinglass, $2.47 billion worth of bitcoin options traded on the currency’s largest options exchange on November 7.

CME, Bitcoin’s second-largest options exchange, posted record-high volumes just prior to the election: $528 million on November 2.

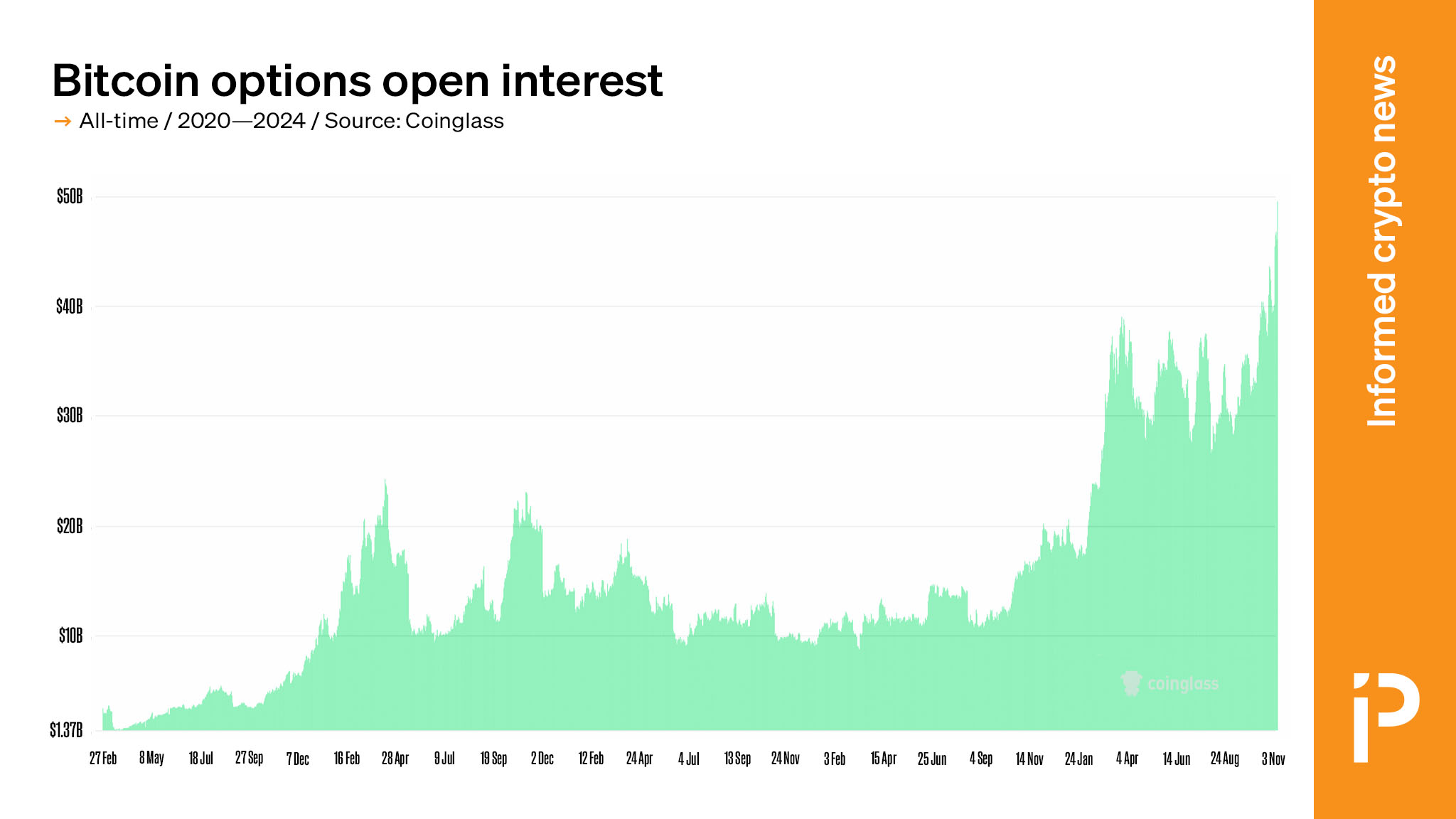

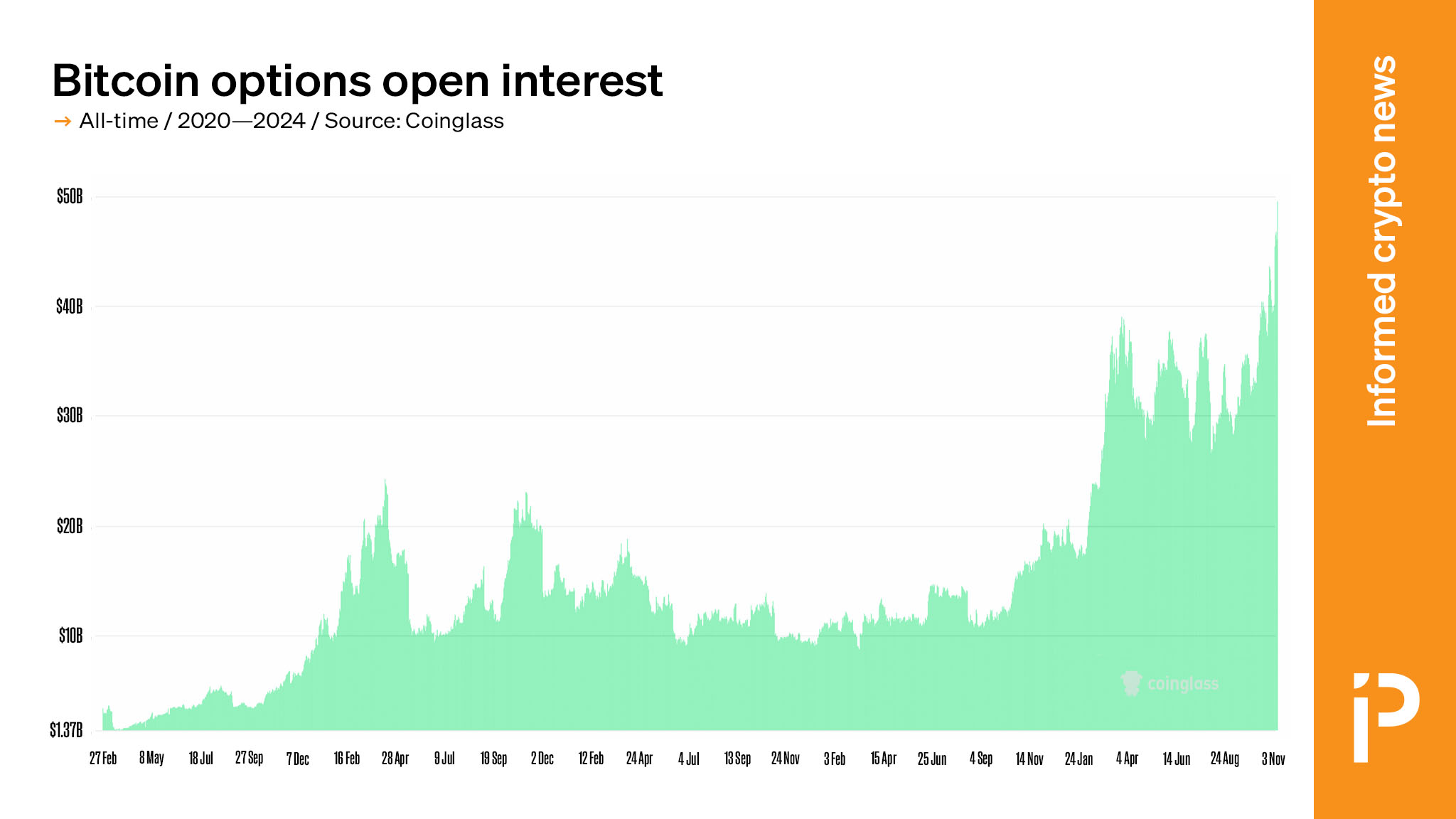

All-time high bitcoin open interest

Bitcoin open interest on options contracts also hit an all-time high alongside their underlying asset. On November 7, bitcoin open interest aggregated at Coinglass totaled a staggering $32.57 billion.

Read more: CHART: Bitcoin could have turned your $1,200 stimulus check into $14,000

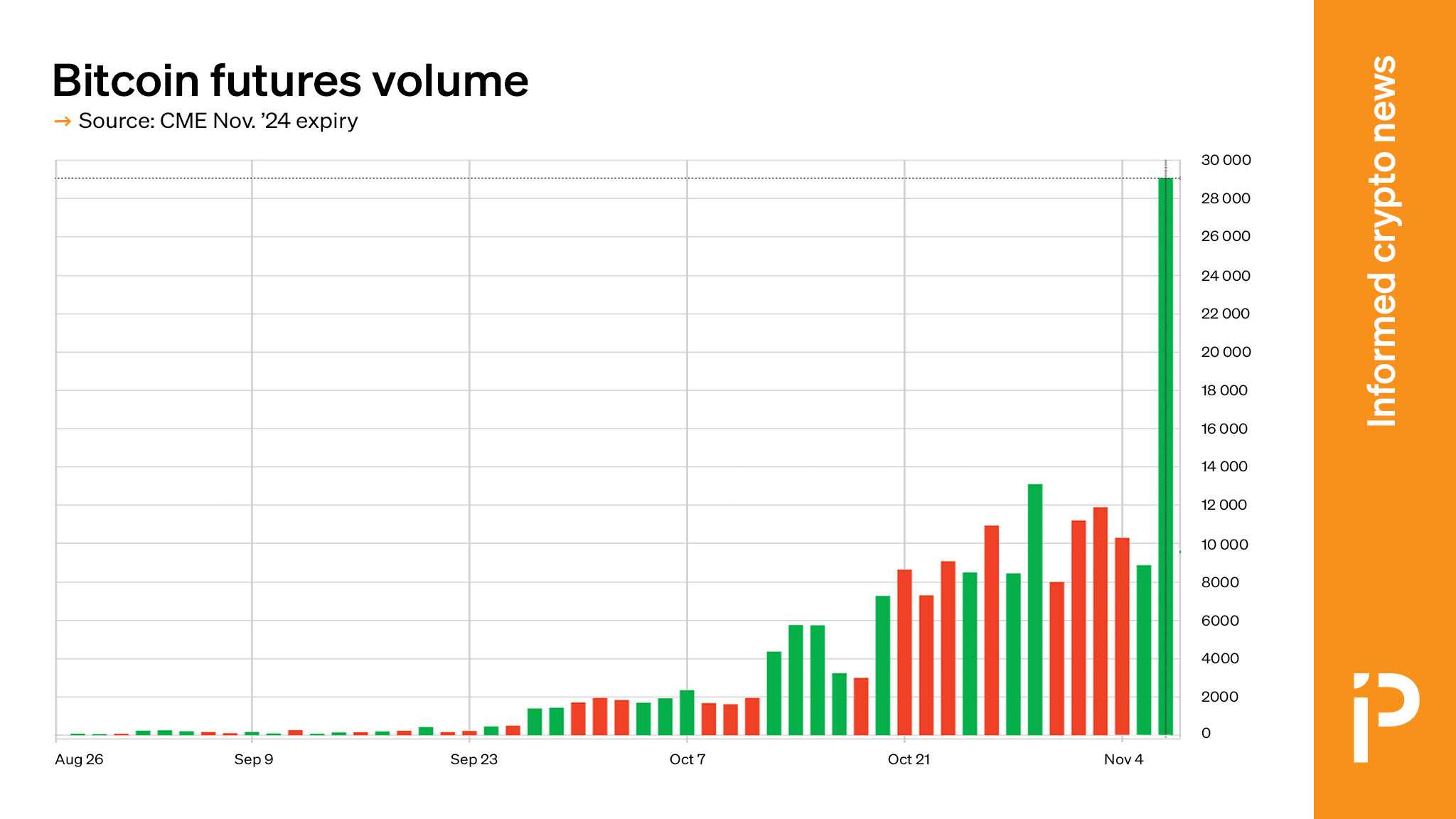

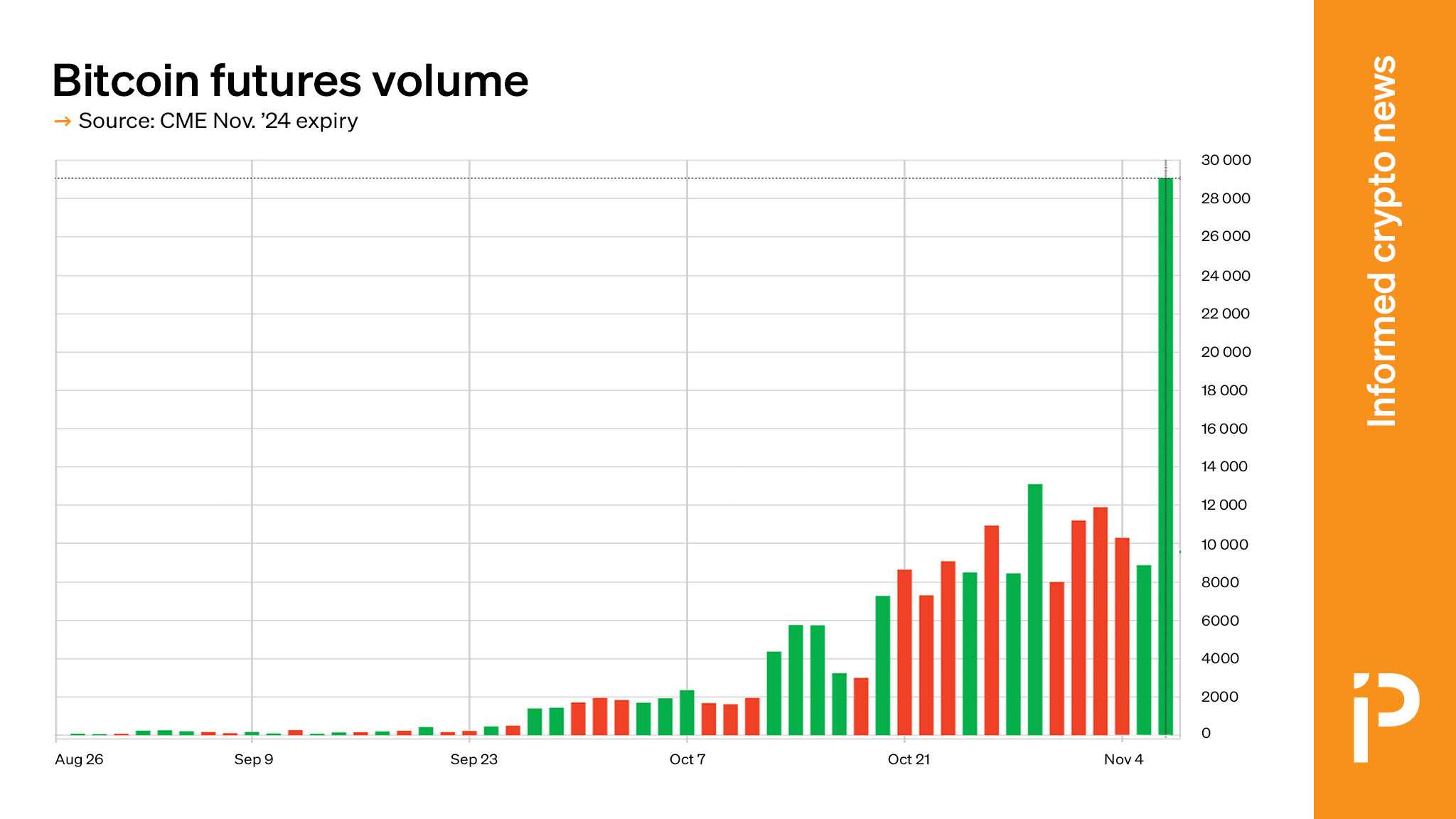

All-time high bitcoin futures transactions

Transaction volume for another bitcoin derivative also hit a record this week. On November 6, 29,081 futures contracts traded hands ahead of bitcoin’s front-month, November 2024 expiry on the CME.

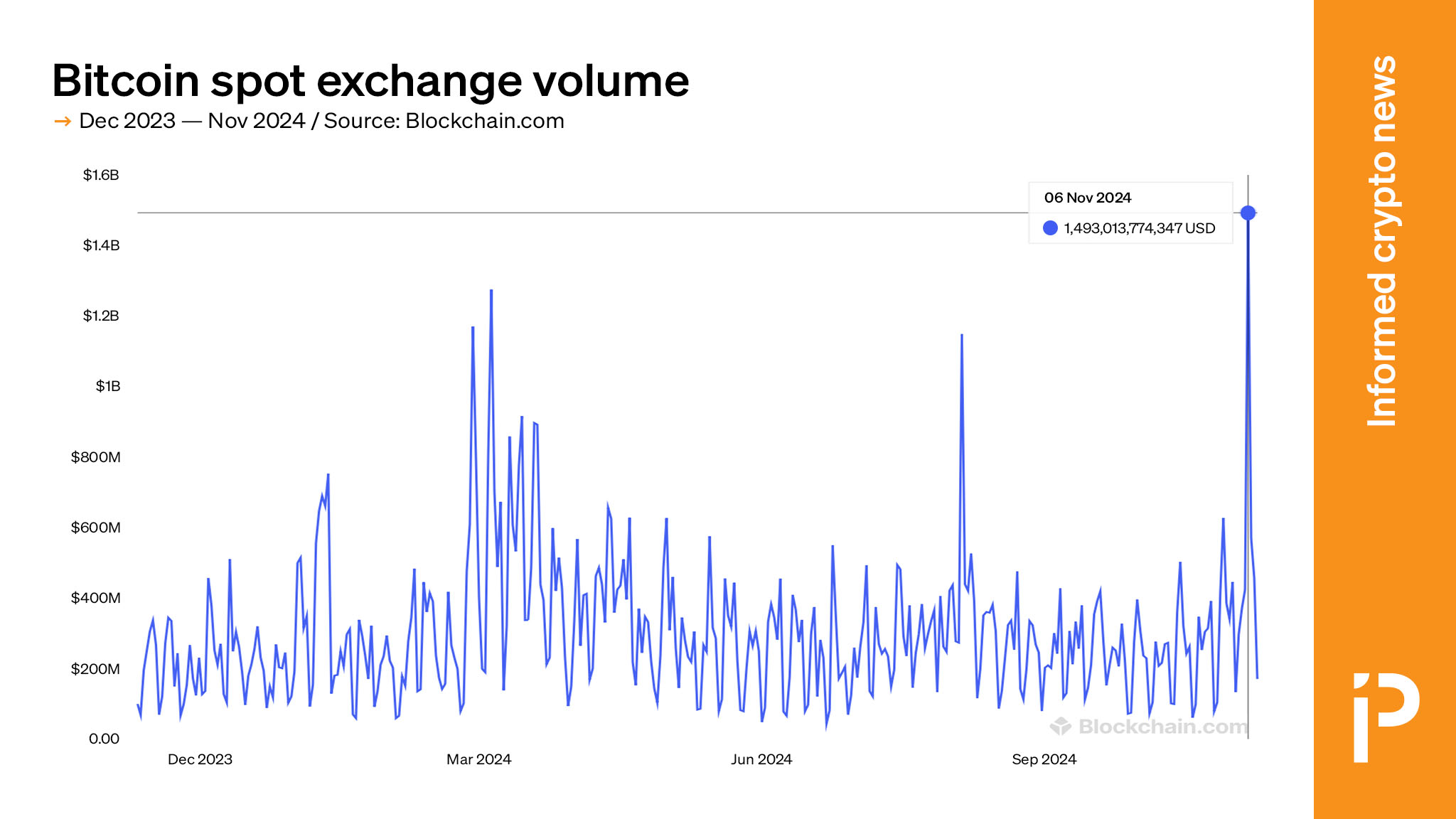

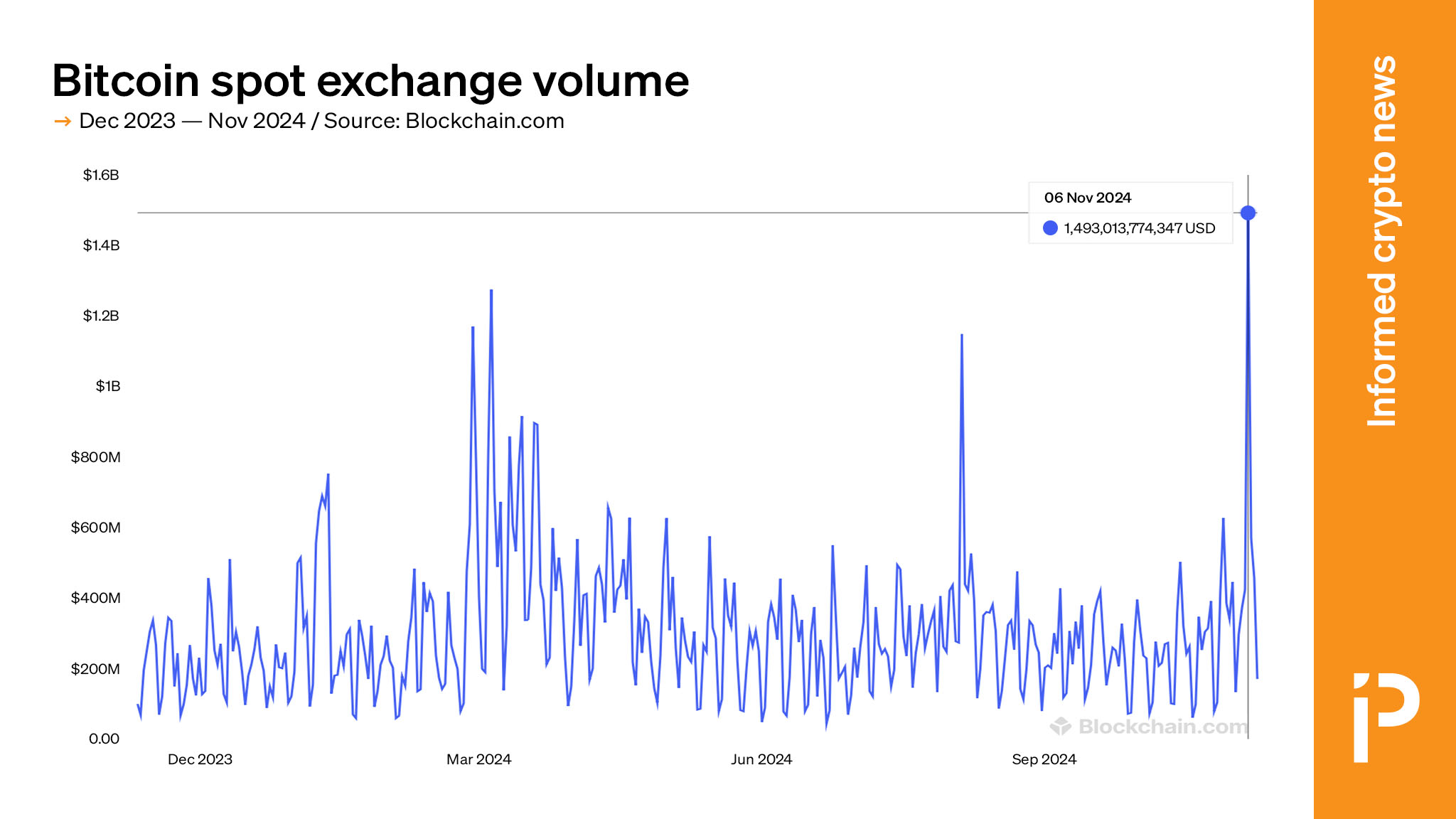

All-time high bitcoin exchange trade volume

Total trading volume of spot bitcoin across major bitcoin exchanges also hit an all-time high this week. On November 6, crypto exchanges reported $1.49 billion worth of spot bitcoin transactions.

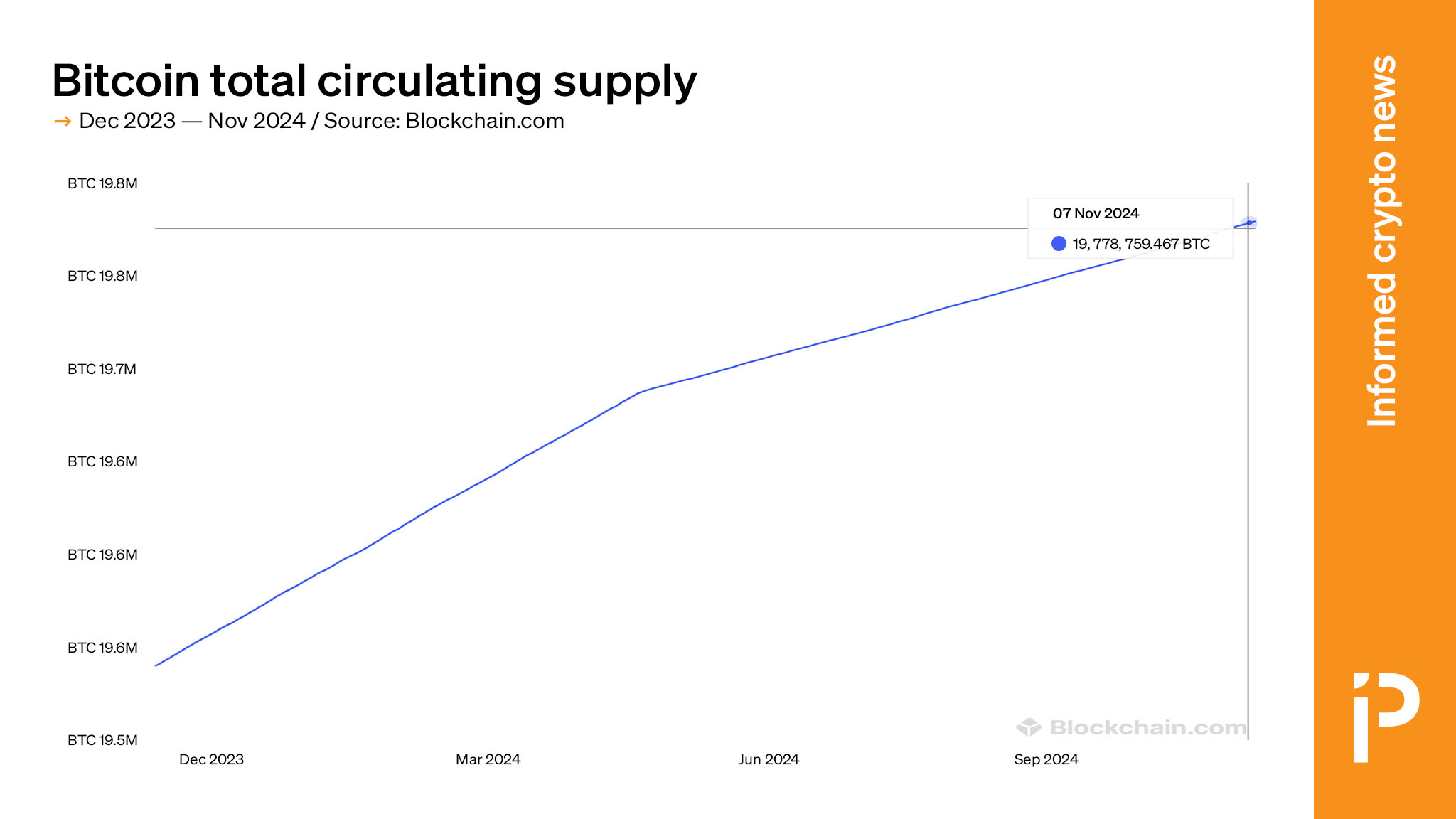

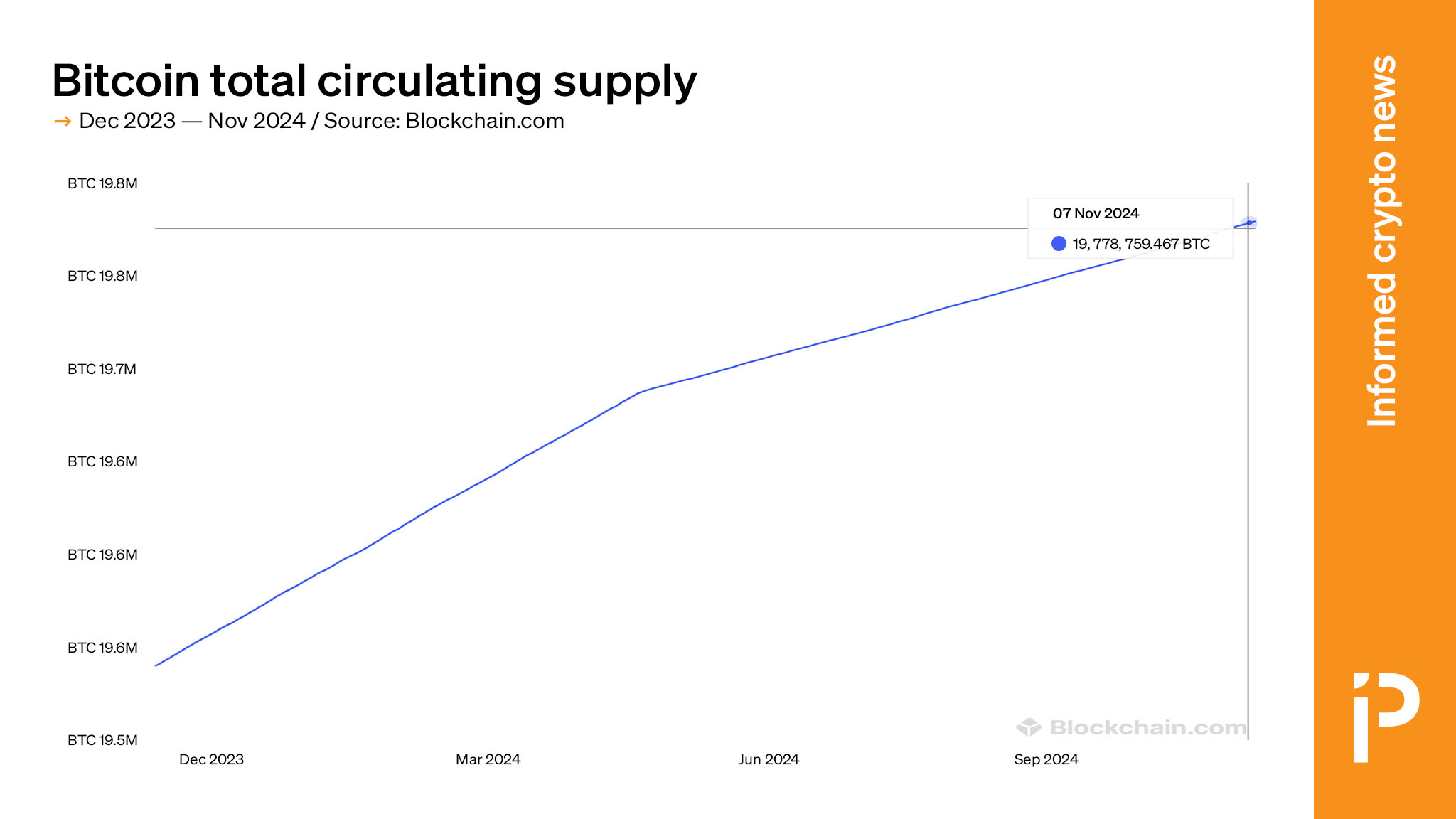

All-time high total circulating bitcoin

Although easy to forecast given bitcoin’s predictable supply and issuance schedule, the total number of mined bitcoins that are circulating in the market reached an all-time high alongside the USD price of each coin. On November 7, total circulating BTC hit 19,778,915 — 94.1% of its supply cap.

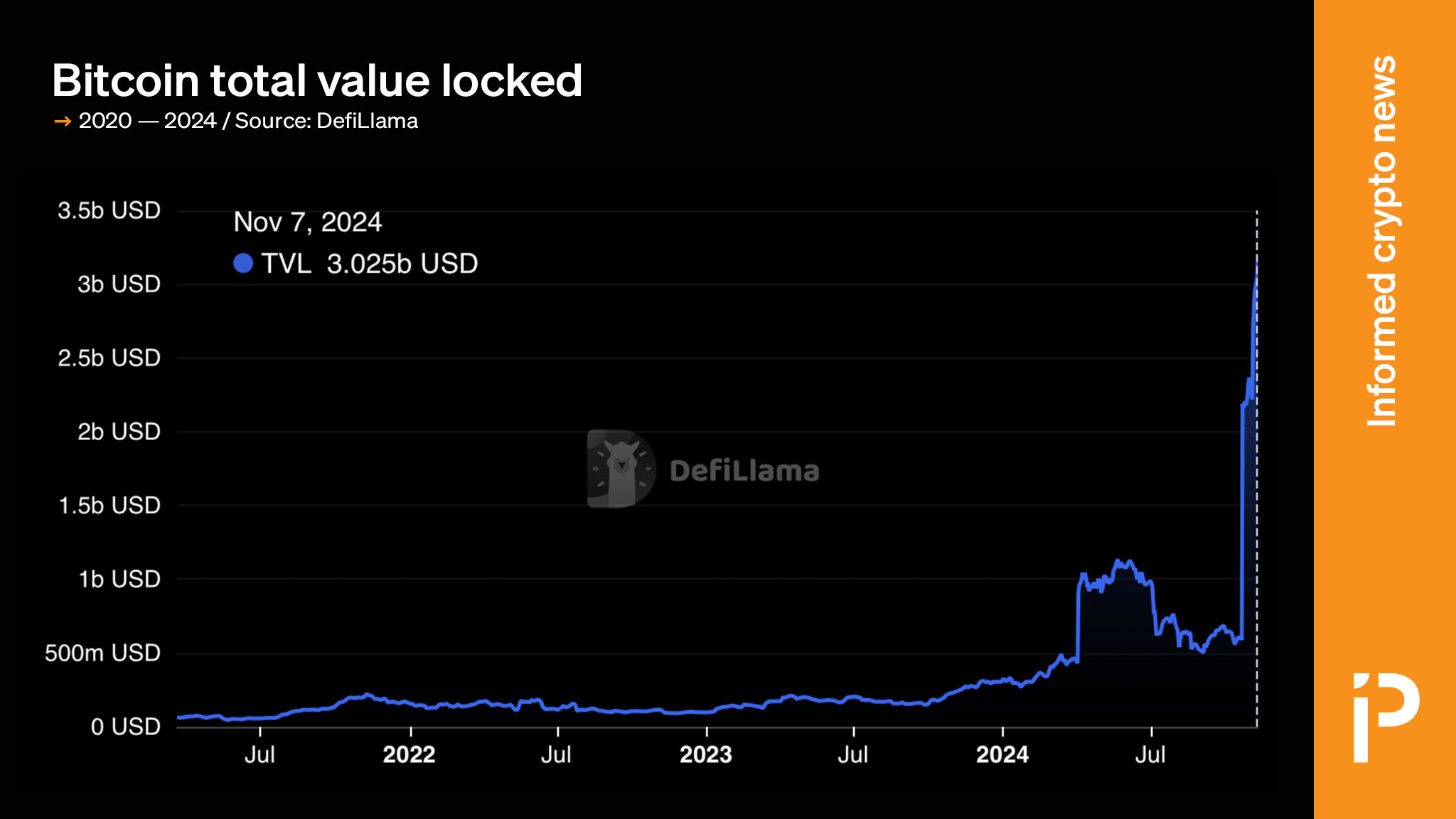

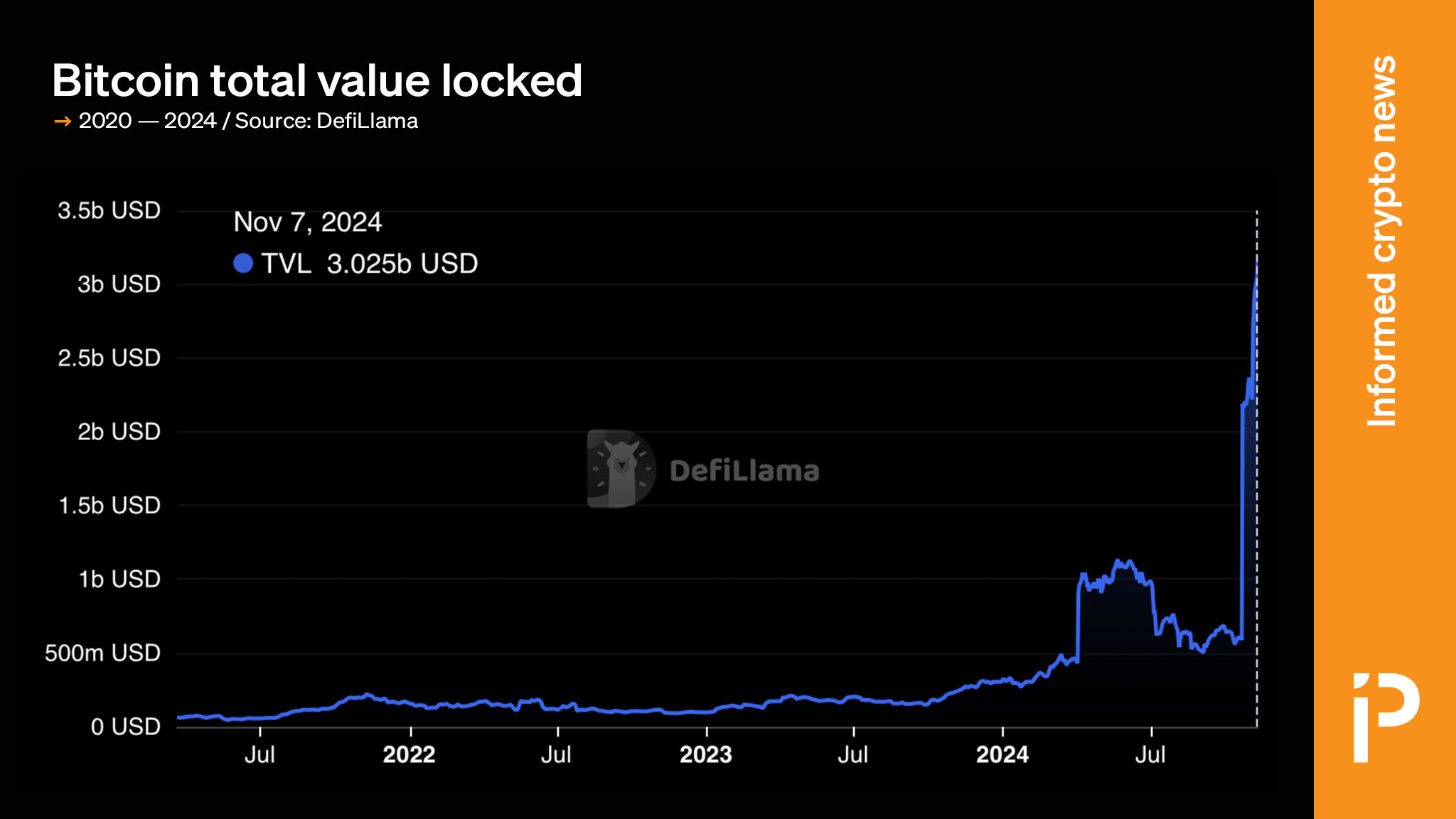

All-time high bitcoin total value locked

Investors locked a record 39,790 bitcoin worth $3 billion in DeFi applications using Bitcoin’s blockchain per data from DefiLlama.

Read more: Jack Dorsey and Block abandon Web5 to mine bitcoin

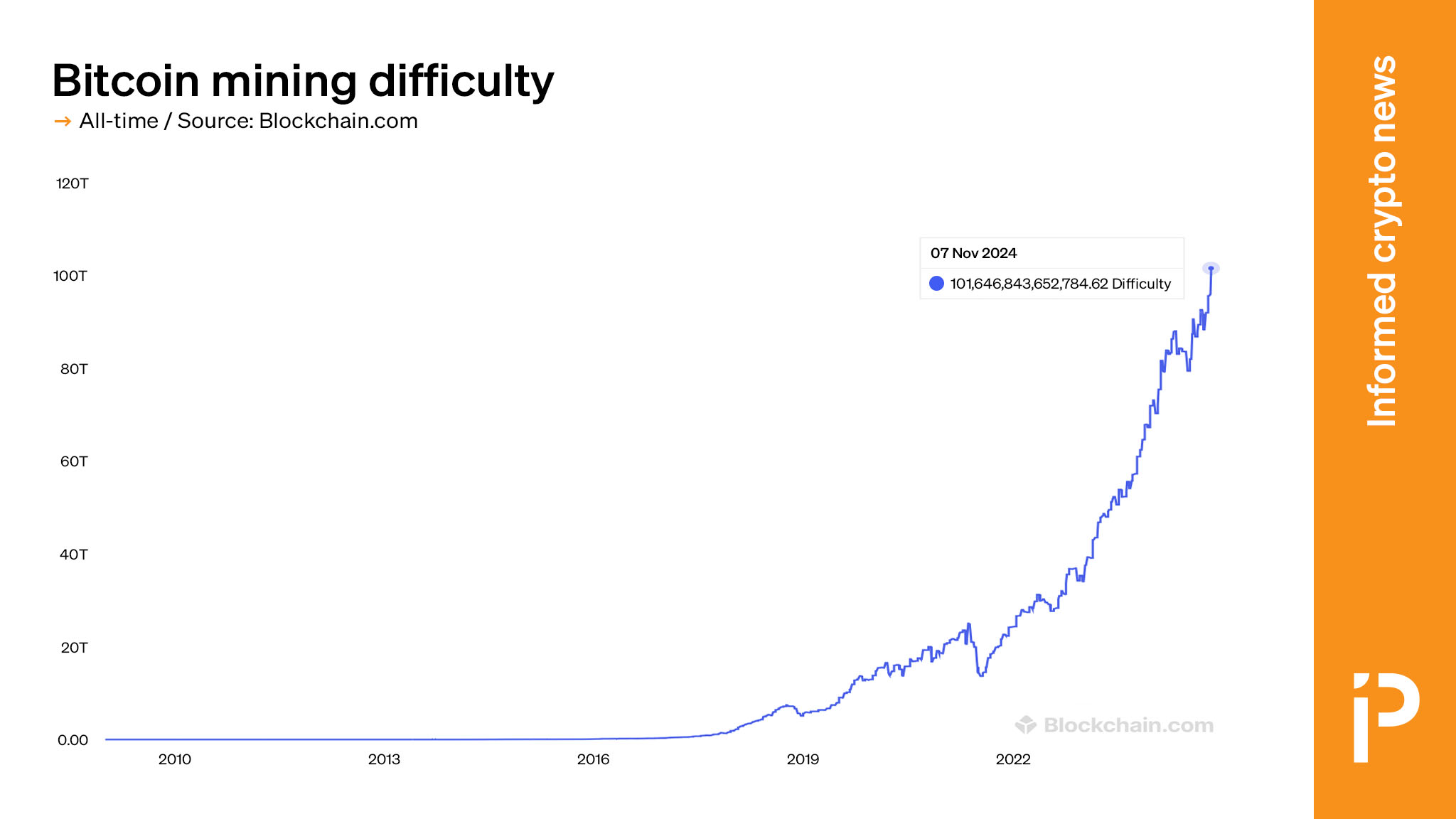

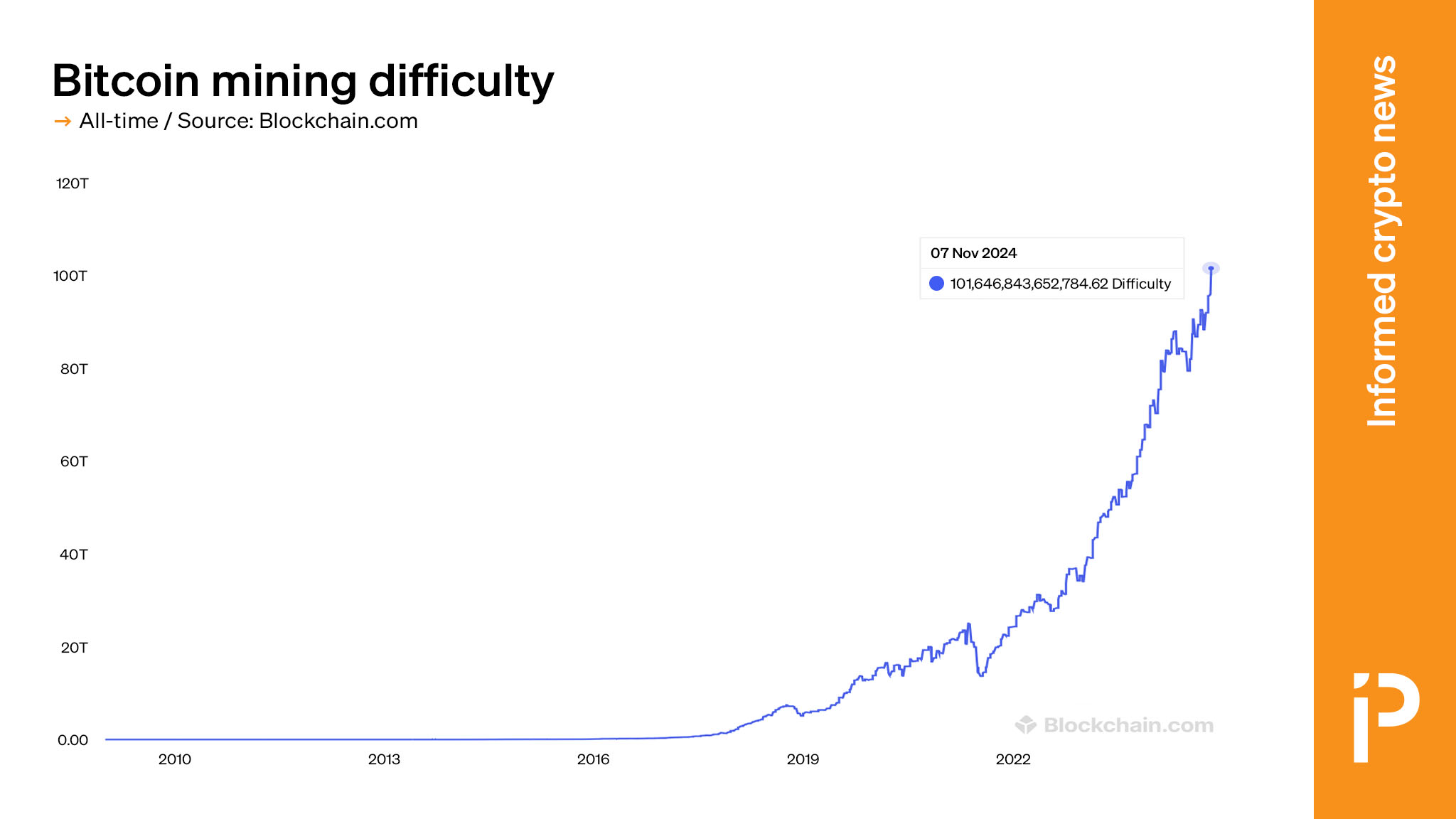

All-time high bitcoin network mining difficulty

As a record bitcoin price incentivized more miners to join the network to earn block rewards, Bitcoin’s protocol has raised the mathematical difficulty of hashing a block of transactions.

As of November 7, the mining difficulty is at an all-time high of 101,646,843,652,790.

Difficulty is expressed as a regular number that simply describes how many times harder it is to mine a block compared to the easiest it can ever be.

Although the price of bitcoin stole the show during Donald Trump’s re-election, its rally also lifted a number of other key metrics. Coinciding with an all-time high in price were bitcoin’s resurgence to all-time high futures transactions, spot ETF inflows, options volume, exchange trade volume, total circulating bitcoin, total value locked, and total hash rate.

These are the eight metrics that took the Bitcoin network to an all-time high beyond its USD price.

All-time high bitcoin daily spot ETF inflows

As bitcoin rallied on enthusiasm for Donald Trump’s incoming presidency, traditional investors who prefer exchange-listed products also placed plenty of buy orders.

After adjusting for a one-day anomaly of Grayscale trust-to-ETF asset rotation during the debut of spot bitcoin ETFs, US-listed spot bitcoin ETFs enjoyed their highest-ever day of capital inflows as bitcoin itself rallied past $74,000.

On a net basis, investors added $1.373 billion of capital to US spot bitcoin ETFs on November 7.

All-time high bitcoin options volume

Bitcoin options volume also hit a new record this week. According to data aggregated at Coinglass, $2.47 billion worth of bitcoin options traded on the currency’s largest options exchange on November 7.

CME, Bitcoin’s second-largest options exchange, posted record-high volumes just prior to the election: $528 million on November 2.

All-time high bitcoin open interest

Bitcoin open interest on options contracts also hit an all-time high alongside their underlying asset. On November 7, bitcoin open interest aggregated at Coinglass totaled a staggering $32.57 billion.

Read more: CHART: Bitcoin could have turned your $1,200 stimulus check into $14,000

All-time high bitcoin futures transactions

Transaction volume for another bitcoin derivative also hit a record this week. On November 6, 29,081 futures contracts traded hands ahead of bitcoin’s front-month, November 2024 expiry on the CME.

All-time high bitcoin exchange trade volume

Total trading volume of spot bitcoin across major bitcoin exchanges also hit an all-time high this week. On November 6, crypto exchanges reported $1.49 billion worth of spot bitcoin transactions.

All-time high total circulating bitcoin

Although easy to forecast given bitcoin’s predictable supply and issuance schedule, the total number of mined bitcoins that are circulating in the market reached an all-time high alongside the USD price of each coin. On November 7, total circulating BTC hit 19,778,915 — 94.1% of its supply cap.

All-time high bitcoin total value locked

Investors locked a record 39,790 bitcoin worth $3 billion in DeFi applications using Bitcoin’s blockchain per data from DefiLlama.

Read more: Jack Dorsey and Block abandon Web5 to mine bitcoin

All-time high bitcoin network mining difficulty

As a record bitcoin price incentivized more miners to join the network to earn block rewards, Bitcoin’s protocol has raised the mathematical difficulty of hashing a block of transactions.

As of November 7, the mining difficulty is at an all-time high of 101,646,843,652,790.

Difficulty is expressed as a regular number that simply describes how many times harder it is to mine a block compared to the easiest it can ever be.