Bitcoin has recently seen a remarkable uptrend, with the cryptocurrency reaching new all-time highs almost daily this week. Unlike previous peaks, this rally appears more sustainable, driven by robust market fundamentals.

Bitcoin’s consistent growth has drawn significant attention, positioning the asset for even more potential upside.

Bitcoin Gains Strength

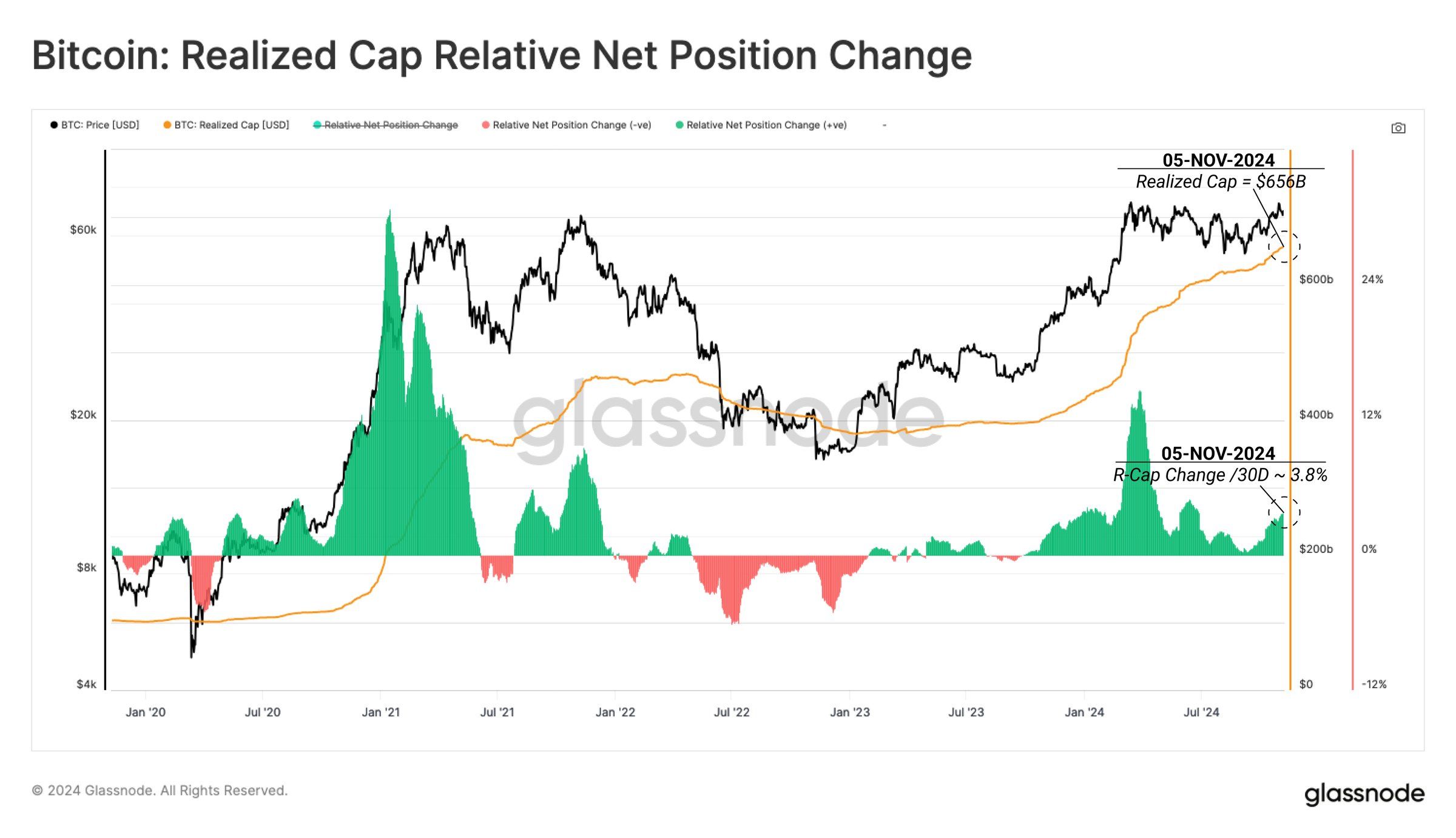

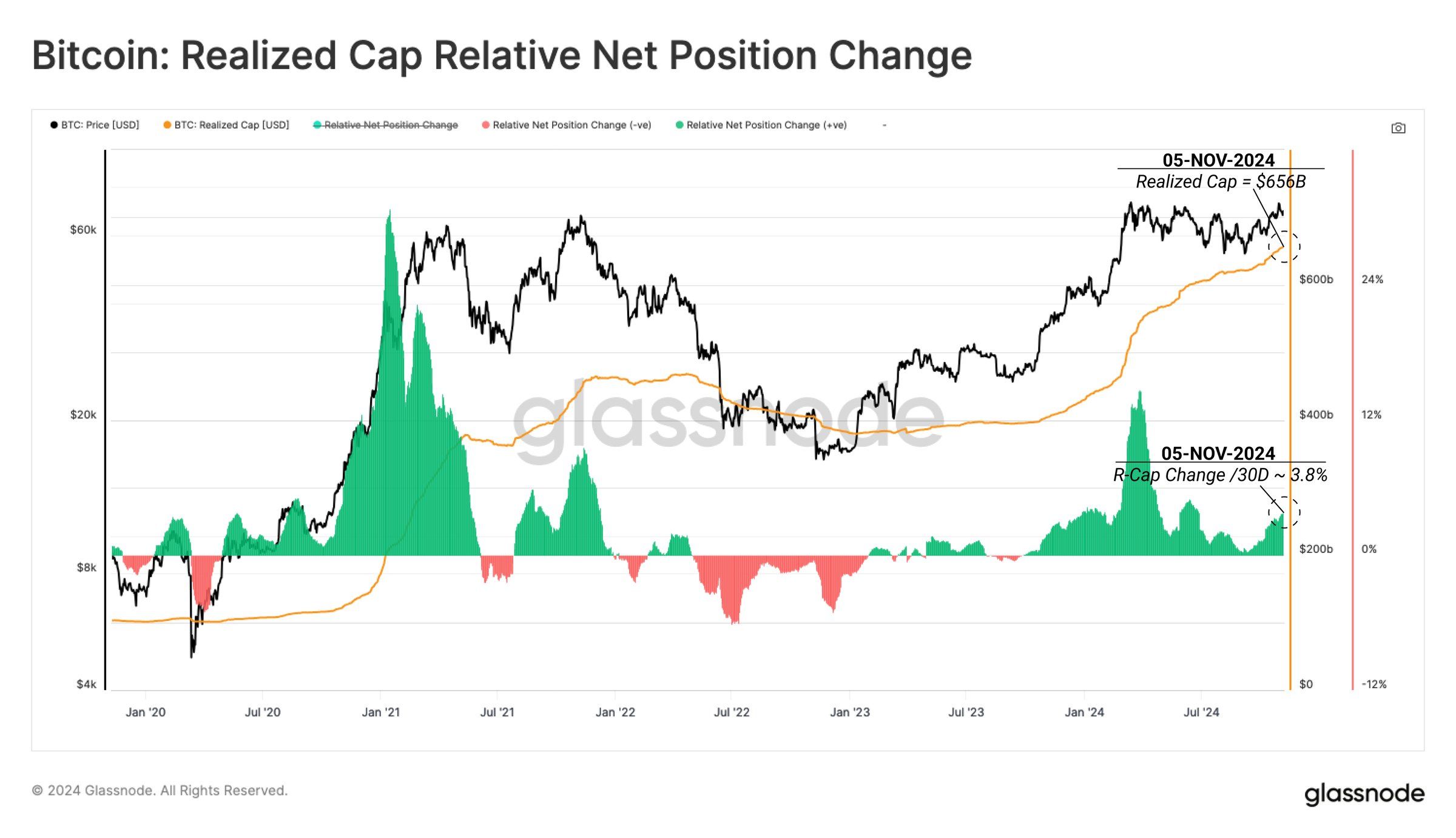

As per Glassnode’s analysis Bitcoin’s Realized Cap has risen by 3.8% over the past 30 days, marking one of the most substantial inflow levels seen since January 2023. This increase reflects heightened investment activity and growing confidence in the cryptocurrency’s value stability.

“The Realized Cap is currently trading at an ATH value of $656 billion, supported by a net 30-day capital inflow of $2.5 billion,” Glassnode noted.

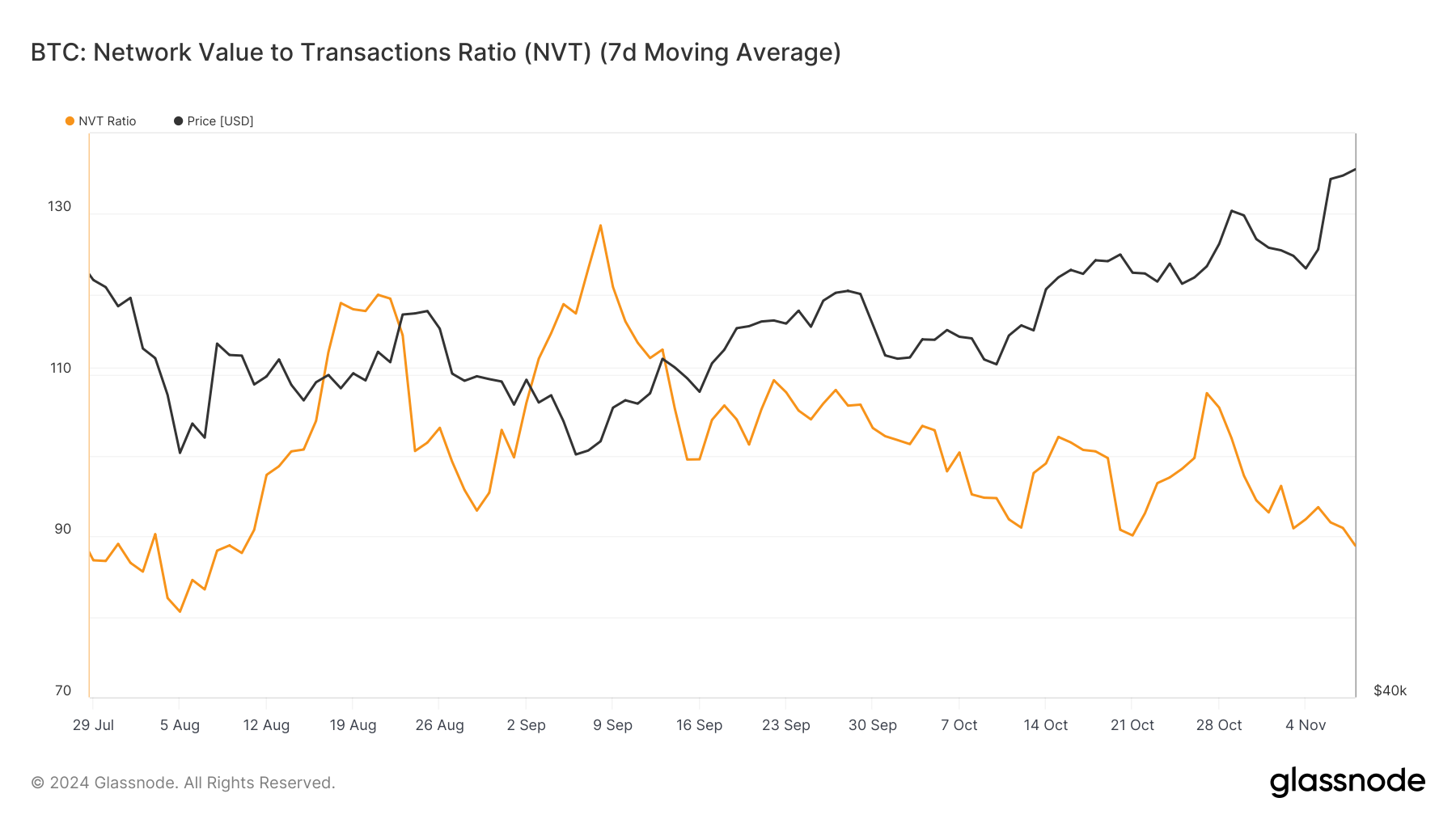

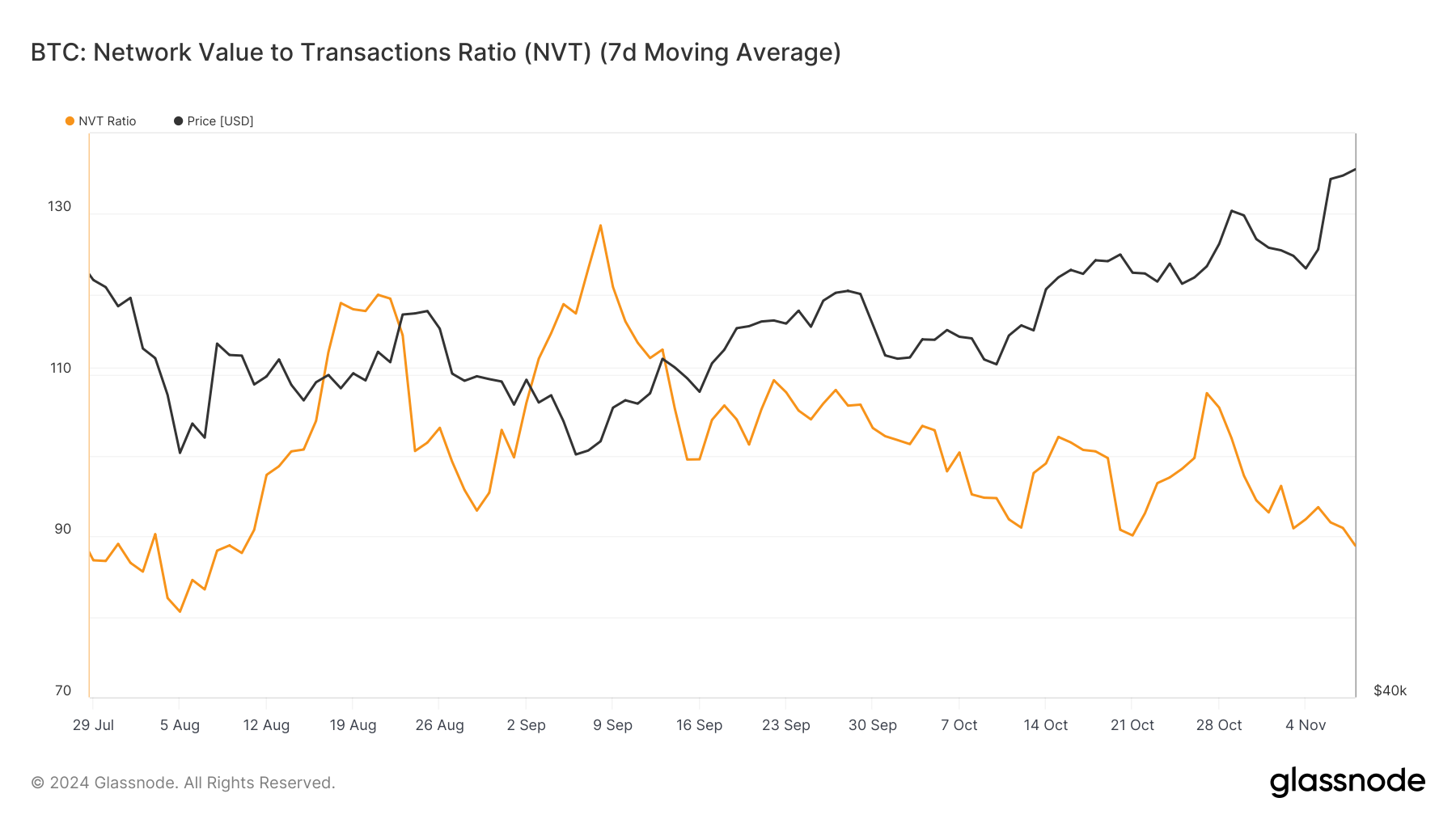

The macro momentum for Bitcoin is strong, supported by the NVT (Network Value to Transactions) Ratio, which currently stands at a three-month low. A lower NVT Ratio indicates that Bitcoin is not overvalued, reducing the likelihood of an immediate correction.

This undervaluation, as shown by the NVT, suggests that Bitcoin’s growth is not driven by speculative excess, as in previous rallies. With its value rooted in transactional strength, Bitcoin appears well-positioned to maintain its upward trajectory, drawing confidence from investors who view this as a more stable phase of growth.

ETH Price Prediction: ATHs Continue

At the time of writing, Bitcoin is trading at $76,443 after achieving a new all-time high of $77,175 during intra-day trading on Friday. This continued rise reflects Bitcoin’s strength in the face of broader economic shifts and confirms strong buyer interest.

While Bitcoin is on the verge of crossing $80,000, it may see a slight dip to test support around $73,773. This pullback would allow BTC to consolidate before resuming its uptrend, maintaining healthy growth without triggering overbought conditions.

If, however, Bitcoin fails to rebound from this level and investors begin profit-taking, the price could dip further. A fall below $73,773 might lead to a decline to $71,367, which would challenge the current bullish outlook and introduce caution for short-term traders.

Bitcoin has recently seen a remarkable uptrend, with the cryptocurrency reaching new all-time highs almost daily this week. Unlike previous peaks, this rally appears more sustainable, driven by robust market fundamentals.

Bitcoin’s consistent growth has drawn significant attention, positioning the asset for even more potential upside.

Bitcoin Gains Strength

As per Glassnode’s analysis Bitcoin’s Realized Cap has risen by 3.8% over the past 30 days, marking one of the most substantial inflow levels seen since January 2023. This increase reflects heightened investment activity and growing confidence in the cryptocurrency’s value stability.

“The Realized Cap is currently trading at an ATH value of $656 billion, supported by a net 30-day capital inflow of $2.5 billion,” Glassnode noted.

The macro momentum for Bitcoin is strong, supported by the NVT (Network Value to Transactions) Ratio, which currently stands at a three-month low. A lower NVT Ratio indicates that Bitcoin is not overvalued, reducing the likelihood of an immediate correction.

This undervaluation, as shown by the NVT, suggests that Bitcoin’s growth is not driven by speculative excess, as in previous rallies. With its value rooted in transactional strength, Bitcoin appears well-positioned to maintain its upward trajectory, drawing confidence from investors who view this as a more stable phase of growth.

ETH Price Prediction: ATHs Continue

At the time of writing, Bitcoin is trading at $76,443 after achieving a new all-time high of $77,175 during intra-day trading on Friday. This continued rise reflects Bitcoin’s strength in the face of broader economic shifts and confirms strong buyer interest.

While Bitcoin is on the verge of crossing $80,000, it may see a slight dip to test support around $73,773. This pullback would allow BTC to consolidate before resuming its uptrend, maintaining healthy growth without triggering overbought conditions.

If, however, Bitcoin fails to rebound from this level and investors begin profit-taking, the price could dip further. A fall below $73,773 might lead to a decline to $71,367, which would challenge the current bullish outlook and introduce caution for short-term traders.