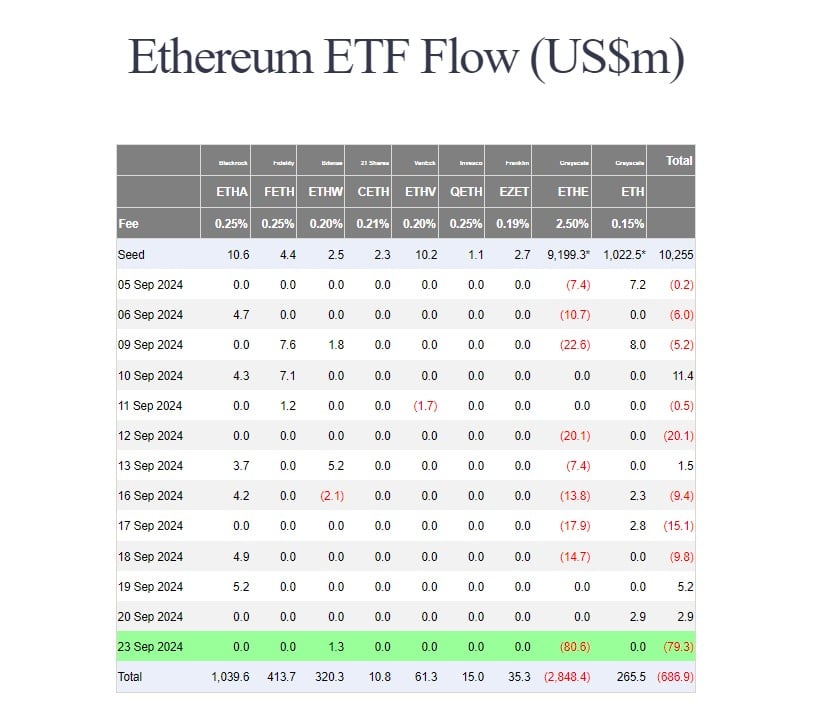

Over $79 million was withdrawn from nine US spot Ethereum ETFs on Monday, the largest single-day outflow since July 29, according todatatracked by Farside Investors. The Grayscale Ethereum Trust, or ETHE, led redemptions, with investors pulling over $80 million from the fund.

Since its ETF conversion, the ETHE fund has seen net outflows of over $2.8 billion. Despite continued bleeding, it is still the largest Ether fund in the world with around $4,6 billion in assets under management.

Monday’s outflows ended a brief two-day gain for these ETFs. In contrast to ETHE, the Bitwise Ethereum ETF (ETHW) was the sole gainer on the day with zero flows reported from most competing funds. Investors bought over $1 million worth of shares in Bitwise’s ETHW offering.

As of September 23, ETHW’s net buying topped $320 million, while itsEther holdingsexceeded 97,700, worth around $261 million at current prices.

Thesluggish demandfor US-listed Ethereum ETFs has continued since theirmarket debuton July 23. BlackRock’s iShares Ethereum Trust (ETHA) currently leads in net inflows and was the first to reach $1 billion in net capital. It is followed by Fidelity’s Ethereum Fund (FETH) and Bitwise’s ETHW.

While Ethereum ETFs faced a downturn, their Bitcoin counterparts enjoyed a third consecutive day of gains, collectively adding $4.5 million, Farside’sdatashows.

Gains from Fidelity’s Bitcoin Fund (FBTC), BlackRock’s iShares Bitcoin Trust (IBIT), and Grayscale’s Bitcoin Mini Trust (BTC) offset substantial outflows from Grayscale’s Ethereum Trust.