Amid cryptocurrencies like Bitcoin (BTC) becoming more present and relevant in the mainstream, BlackRock (NYSE: BLK), a $10 trillion asset manager and creator of the largest Bitcoin exchange-traded fund (ETF) in the world, has shared its views regarding the maiden crypto asset’s future.

Indeed, BlackRock outlined the dynamics of Bitcoin “as it pertains to risk, return, and portfolio interactions, (…) in recognition of the early stage Bitcoin is at in its journey, and the rapidity with which its adoption and understanding by the global investor community is evolving,” in a report called Bitcoin: A Unique Diversifier.

How Bitcoin surpassed $1 trillion

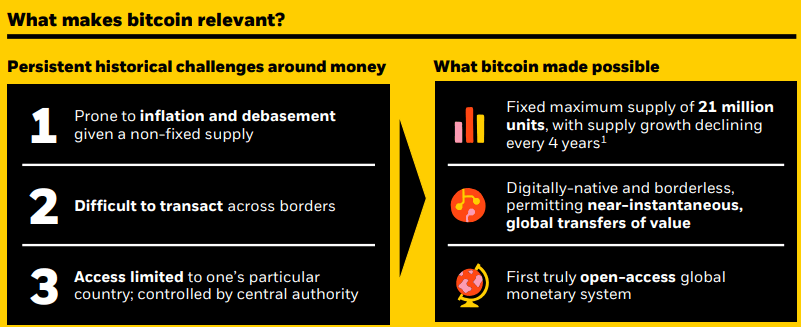

Specifically, in the section referring to BTC’s $1 trillion in market capitalization, the report highlighted its “remarkable rise and significant global adoption to date” but also that its “evolving market value reflects (…) uncertainty” regarding the potential to be a “widespread store of value and/or global payment asset.”

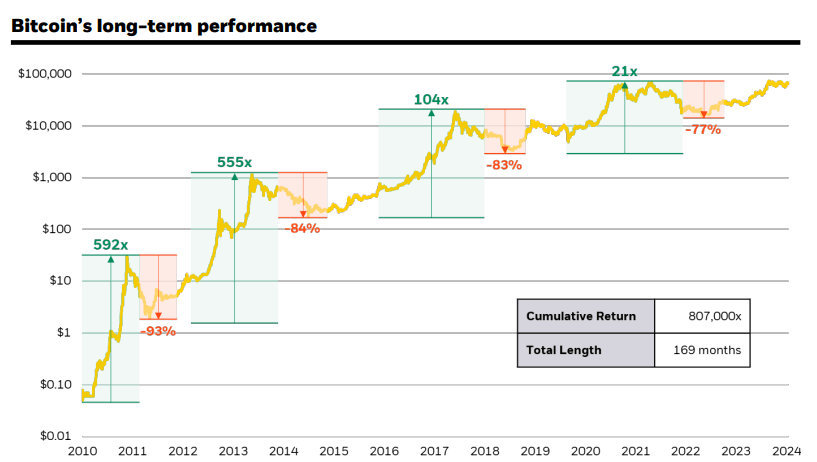

On the other hand, the asset manager observed that Bitcoin had outperformed all major asset classes in 7 out of the last 10 years, leading it to an extraordinary return in excess of 100% annualized over the last decade,” and stressed its ability to recover from bearish periods:

“This performance was achieved despite Bitcoin also being the worst-performing asset in the other three of those 10 years, with four drawdowns in excess of 50%. Through these historical cycles, it has shown an ability to recover from such drawdowns and reach new highs, despite these extended bear market periods.”

As BlackRock’s team deduced, such movements in the price of the flagship decentralized finance (DeFi) asset illustrate, to a certain degree, its “evolving prospects through time of becoming adopted on a widespread basis as a global monetary alternative.”

At the same time, the report referred to Bitcoin’s risk, arguing that, while its volatility does make it “a ‘risky’ asset on a standalone basis, (…) most of the risk and potential return drivers Bitcoin faces are fundamentally different from traditional ‘risky’ assets, making it unfitting for most traditional finance frameworks – including the ‘risk on’ vs. ‘risk off’ framework employed by some macro commentators.”

Finally, BlackRock concluded that Bitcoin’s adoption trajectory will likely develop under the influence of concerns over global monetary stability, geopolitical issues, the fiscal stability of the United States, as well as the country’s political stability, describing this as the “inverse of the relationship (…) generally attributed to traditional ‘risk assets’ with respect to such forces.”

Bitcoin price analysis

Meanwhile, Bitcoin was at press time changing hands at the price of $60,080, reflecting a 1.91% increase in the last 24 hours, gaining 6.22% across the previous seven days, and accumulating an advance of 3.73% in the past month, according to the most recent data retrieved on September 18.

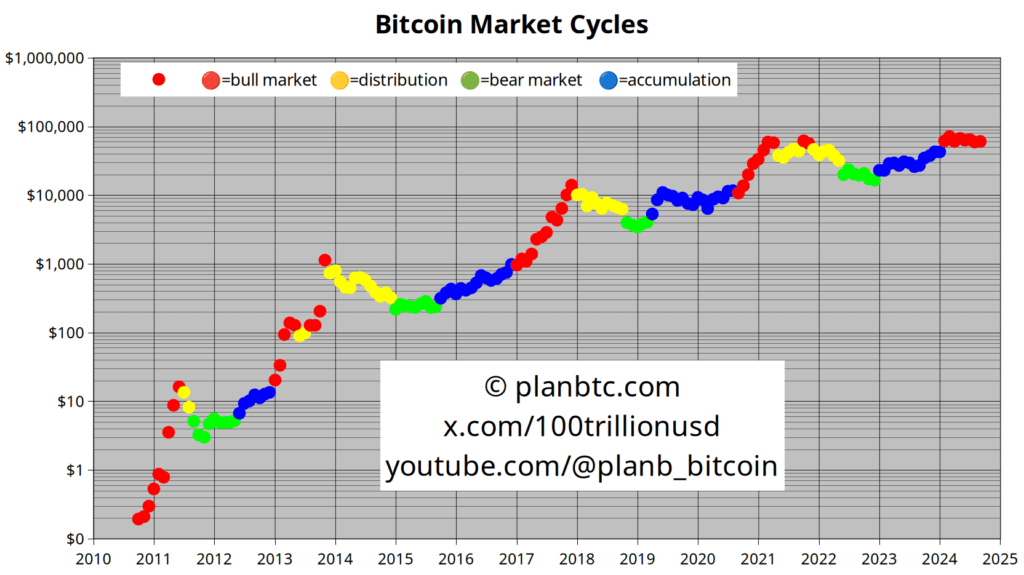

It is also worth noting that renowned crypto expert PlanB recently observed that Bitcoin seems to be in the early phases of a bull market but is still waiting for a “trigger to explode upwards,” opining that the victory of the former U.S. President Donald Trump in the upcoming presidential election could provide this trigger.

All things considered, Bitcoin might, indeed, continue to follow along the same bullish path as described by the company with $10 trillion in assets under its management. However, it is important to remember that trends in the crypto market can change without warning, so doing one’s own due diligence is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.