Base Blockchain, the layer-2 network launched by Coinbase in 2023, is doing well as the ‘crypto winter’ continues.

Nansen data shows that the network’s number of users is growing and beating many blockchains like Avalanche (AVAX), Polygon (POL), and Cronos (CRO).

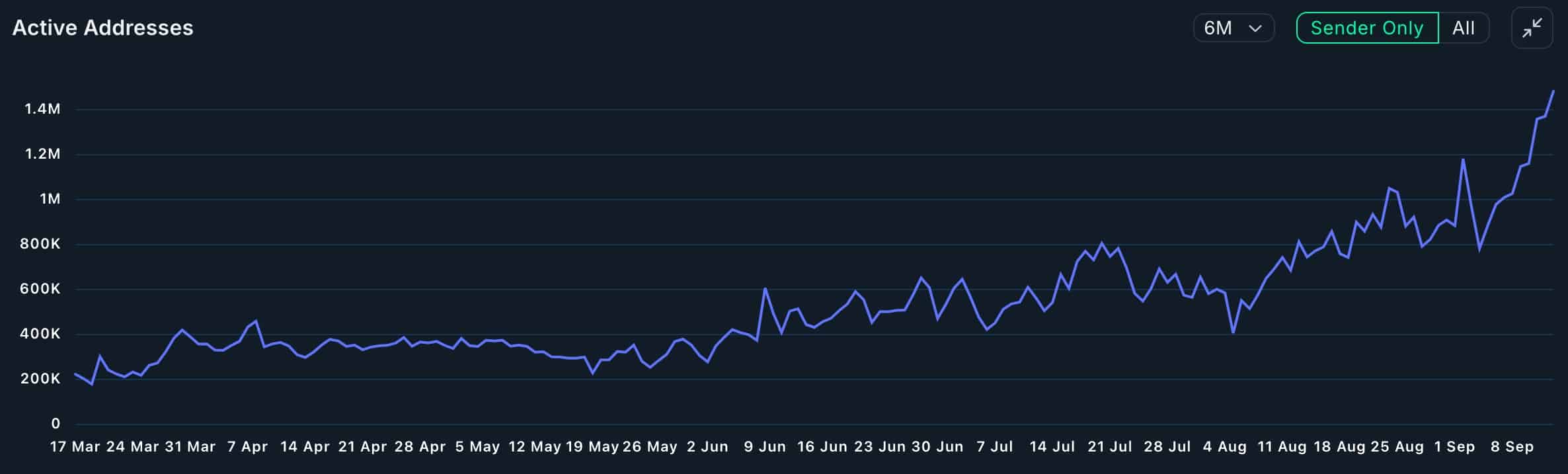

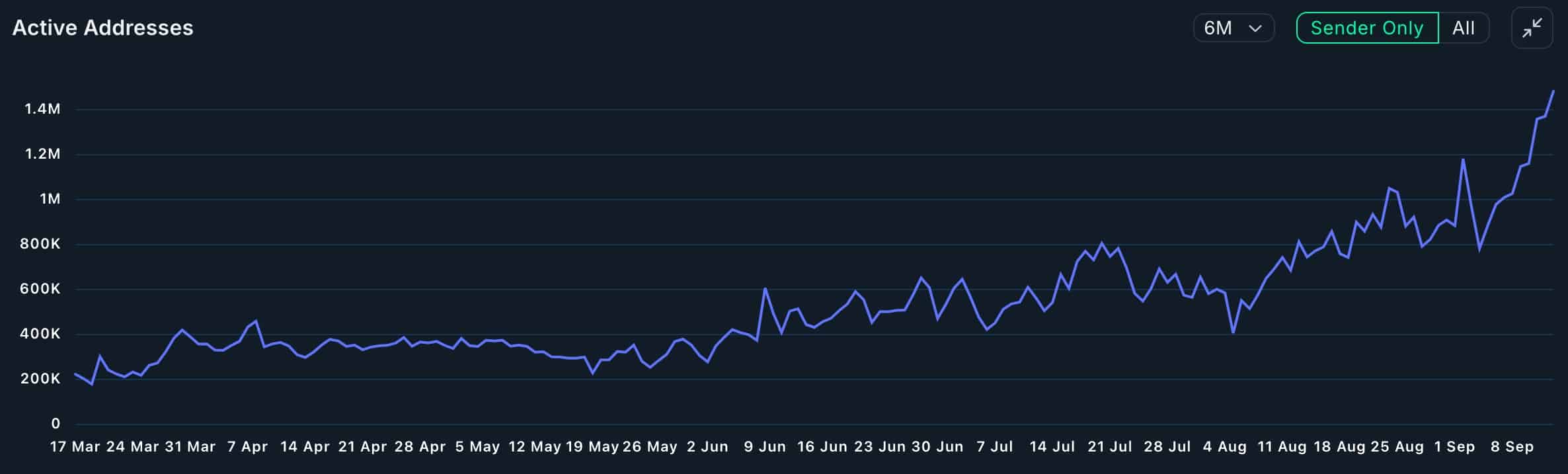

The number of active addresses jumped to a record high of over 1.964 million, up from the year-to-date low of 196,000.

Another number reveals that the number of transactions handled by Base Blockchain has jumped to 4.8 million, up from January’s low of less than 300,000.

Meanwhile, the number of daily deployments in the network rose to an all-time high of near 18,000 earlier this month.

In contrast, as we wrote this week, Avalanche’snumber of active addresses and transactions have dropped by over 50% from the highest level this year.

This growth happened as more developers embraced the network because of its strong speeds and low transaction costs.

According to DeFi Llama, Base has 348 dApps in the decentralized finance industry and a total value locked of $1.57 billion, making it the sixth-biggest chain. The biggest DeFi dApps in its ecosystem are Aerodrome, Uniswap, Extra Finance, AAVE, and Morpho Blue.

It is also the sixth-biggest in terms of stablecoins in the ecosystem, with over $1.57 billion. It will likely have more stablecoins when it is included in Tether’s network.

Most importantly, Base Blockchain has also become the third-biggest chain in the decentralized exchange industry, where its dApps handled a volume of $3 billion in the last seven days. This made it bigger than Arbitrum, which processed $2.77 billion.

Developers and users love Base because of its low gas fees. According to Nansen, while its transactions have jumped, the amount of gas fees fell to $50,425, down from over $2.3 million in March. Base has made just $57 million in fees this year while Ethereum and Tron have made over $1 billion.

The performance of Base is a good thing for Coinbase, which is losing market share to companies like Crypto.com, Huobi, and Bybit.

Coinbase handled crypto volume worth $66 billion while the others had volume of over $70 billion.

Base Blockchain, the layer-2 network launched by Coinbase in 2023, is doing well as the ‘crypto winter’ continues.

Nansen data shows that the network’s number of users is growing and beating many blockchains like Avalanche (AVAX), Polygon (POL), and Cronos (CRO).

The number of active addresses jumped to a record high of over 1.964 million, up from the year-to-date low of 196,000.

Another number reveals that the number of transactions handled by Base Blockchain has jumped to 4.8 million, up from January’s low of less than 300,000.

Meanwhile, the number of daily deployments in the network rose to an all-time high of near 18,000 earlier this month.

In contrast, as we wrote this week, Avalanche’snumber of active addresses and transactions have dropped by over 50% from the highest level this year.

This growth happened as more developers embraced the network because of its strong speeds and low transaction costs.

According to DeFi Llama, Base has 348 dApps in the decentralized finance industry and a total value locked of $1.57 billion, making it the sixth-biggest chain. The biggest DeFi dApps in its ecosystem are Aerodrome, Uniswap, Extra Finance, AAVE, and Morpho Blue.

It is also the sixth-biggest in terms of stablecoins in the ecosystem, with over $1.57 billion. It will likely have more stablecoins when it is included in Tether’s network.

Most importantly, Base Blockchain has also become the third-biggest chain in the decentralized exchange industry, where its dApps handled a volume of $3 billion in the last seven days. This made it bigger than Arbitrum, which processed $2.77 billion.

Developers and users love Base because of its low gas fees. According to Nansen, while its transactions have jumped, the amount of gas fees fell to $50,425, down from over $2.3 million in March. Base has made just $57 million in fees this year while Ethereum and Tron have made over $1 billion.

The performance of Base is a good thing for Coinbase, which is losing market share to companies like Crypto.com, Huobi, and Bybit.

Coinbase handled crypto volume worth $66 billion while the others had volume of over $70 billion.