Ethereum ETFs made a remarkable debut today, marking a significant milestone for digital assets in traditional financial markets. The launch saw nine different spot Ethereum exchange-traded funds (ETFs) from eight issuers begin trading on U.S. exchanges. This event turned the usually calm ETF trading landscape into a bustling marketplace.

Impressive Start for Ethereum ETFs

The excitement began right from the opening bell. Within the first 15 minutes, Ethereum ETFs amassed $112 million in trading volume. By the 90-minute mark, this figure had surged to $361 million. Bloomberg senior ETF analyst Eric Balchunas shared these figures, noting that this initial volume placed the new Ethereum ETFs among the top 1% of all ETFs, on par with well-established funds like TLT and EEM.

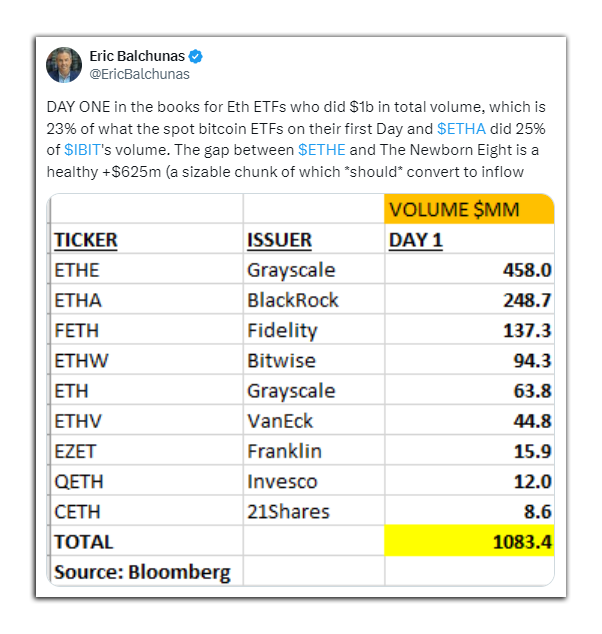

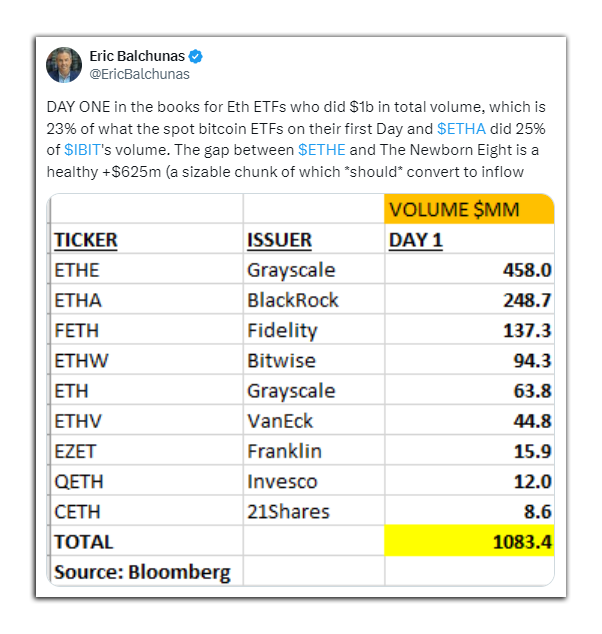

Leading the pack, Grayscale’s ETHE reported the highest volume at $458 million, followed by BlackRock’s ETHA with $248.7 million, and Fidelity’s FETH’s at $137.3 million. Bitwise’s ETHW also saw significant activity, recording $94.3 million in volume. Other contributors included Grayscale’s ETH with $63.8 million, VanEck’s ETHV with $44.3 million, Franklin Templeton’s EZET with $15.9 million, Invesco’s QETH with $12 million, and 21Shares’ CETH with $5.6 million. All of them combined to generate a total of $1083.4 M.

Midday Momentum Builds

By midday, the trading volume continued to climb. At 12:30 p.m. ET, the cumulative volume had reached nearly $600 million. Grayscale’s ETHE remained in the lead with $250 million in shares traded, followed by BlackRock’s ETHA at $130 million. Fidelity’s Advantage Ether ETF recorded $77 million, and Bitwise’s Ethereum ETF had seen $66 million in volume.

Bloomberg Intelligence senior ETF analyst Eric Balchunas pointed out that much of Grayscale’s volume was likely due to outflows. Despite this, the pace of trading suggested that the newly launched ETFs were on track to reach approximately $940 million by the end of the day. Analysts had predicted that the demand for Ethereum ETFs would be about 20% of that seen for Bitcoin ETFs, due to factors such as lower name recognition and the inability to stake Ethereum when buying shares of the funds.

Record-Breaking End to the Day

As the trading day progressed, the momentum continued to build. By 3 p.m. EST, the total trading volume had surged to over $1.019 billion. Grayscale’s ETHE led the way with $456 million, accounting for nearly half of the total volume. BlackRock’s ETHA followed with 24% ($240 million), and Fidelity’s FETH captured 13% ($136 million).

James Seyffart from Bloomberg Intelligence highlighted that the volume correlated with $655 million in inflows by that time. This impressive performance reflects the growing interest in Ethereum-based investment vehicles and their potential to attract significant capital.

Industry Reactions

Nate Geraci, president of The ETF Store, expressed optimism about the future of Ethereum ETFs, stating, “I’m not expecting the same frenzy as with Bitcoin ETFs, but if Ethereum ETFs pull in 20-25% of Bitcoin ETFs’ assets, that would be a highly successful result.” His sentiment was echoed by Markus Thielen, founder of 10x Research, who noted that Ethereum’s lower funding rate might impact institutional interest. However, the strong initial volumes indicate a robust demand for these new financial products.

Conclusion

The debut of Ethereum ETFs has set a new benchmark in the crypto market, demonstrating significant investor interest and strong trading volumes. This launch not only boosts Ethereum’s visibility but also signals a growing acceptance of digital assets in mainstream finance. As the market continues to evolve, Ethereum ETFs are poised to play a crucial role in the broader adoption of cryptocurrencies.

Ethereum ETFs made a remarkable debut today, marking a significant milestone for digital assets in traditional financial markets. The launch saw nine different spot Ethereum exchange-traded funds (ETFs) from eight issuers begin trading on U.S. exchanges. This event turned the usually calm ETF trading landscape into a bustling marketplace.

Impressive Start for Ethereum ETFs

The excitement began right from the opening bell. Within the first 15 minutes, Ethereum ETFs amassed $112 million in trading volume. By the 90-minute mark, this figure had surged to $361 million. Bloomberg senior ETF analyst Eric Balchunas shared these figures, noting that this initial volume placed the new Ethereum ETFs among the top 1% of all ETFs, on par with well-established funds like TLT and EEM.

Leading the pack, Grayscale’s ETHE reported the highest volume at $458 million, followed by BlackRock’s ETHA with $248.7 million, and Fidelity’s FETH’s at $137.3 million. Bitwise’s ETHW also saw significant activity, recording $94.3 million in volume. Other contributors included Grayscale’s ETH with $63.8 million, VanEck’s ETHV with $44.3 million, Franklin Templeton’s EZET with $15.9 million, Invesco’s QETH with $12 million, and 21Shares’ CETH with $5.6 million. All of them combined to generate a total of $1083.4 M.

Midday Momentum Builds

By midday, the trading volume continued to climb. At 12:30 p.m. ET, the cumulative volume had reached nearly $600 million. Grayscale’s ETHE remained in the lead with $250 million in shares traded, followed by BlackRock’s ETHA at $130 million. Fidelity’s Advantage Ether ETF recorded $77 million, and Bitwise’s Ethereum ETF had seen $66 million in volume.

Bloomberg Intelligence senior ETF analyst Eric Balchunas pointed out that much of Grayscale’s volume was likely due to outflows. Despite this, the pace of trading suggested that the newly launched ETFs were on track to reach approximately $940 million by the end of the day. Analysts had predicted that the demand for Ethereum ETFs would be about 20% of that seen for Bitcoin ETFs, due to factors such as lower name recognition and the inability to stake Ethereum when buying shares of the funds.

Record-Breaking End to the Day

As the trading day progressed, the momentum continued to build. By 3 p.m. EST, the total trading volume had surged to over $1.019 billion. Grayscale’s ETHE led the way with $456 million, accounting for nearly half of the total volume. BlackRock’s ETHA followed with 24% ($240 million), and Fidelity’s FETH captured 13% ($136 million).

James Seyffart from Bloomberg Intelligence highlighted that the volume correlated with $655 million in inflows by that time. This impressive performance reflects the growing interest in Ethereum-based investment vehicles and their potential to attract significant capital.

Industry Reactions

Nate Geraci, president of The ETF Store, expressed optimism about the future of Ethereum ETFs, stating, “I’m not expecting the same frenzy as with Bitcoin ETFs, but if Ethereum ETFs pull in 20-25% of Bitcoin ETFs’ assets, that would be a highly successful result.” His sentiment was echoed by Markus Thielen, founder of 10x Research, who noted that Ethereum’s lower funding rate might impact institutional interest. However, the strong initial volumes indicate a robust demand for these new financial products.

Conclusion

The debut of Ethereum ETFs has set a new benchmark in the crypto market, demonstrating significant investor interest and strong trading volumes. This launch not only boosts Ethereum’s visibility but also signals a growing acceptance of digital assets in mainstream finance. As the market continues to evolve, Ethereum ETFs are poised to play a crucial role in the broader adoption of cryptocurrencies.