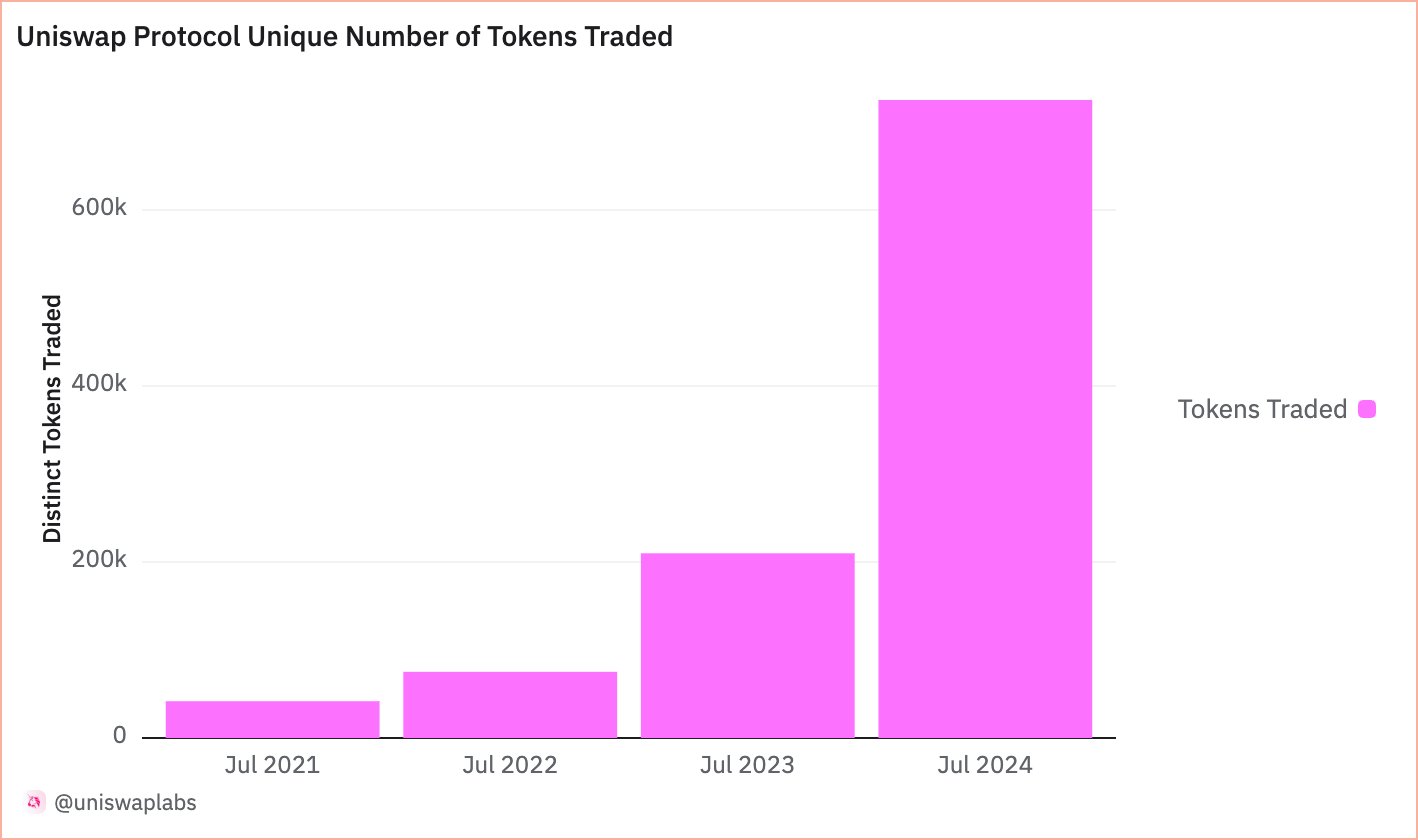

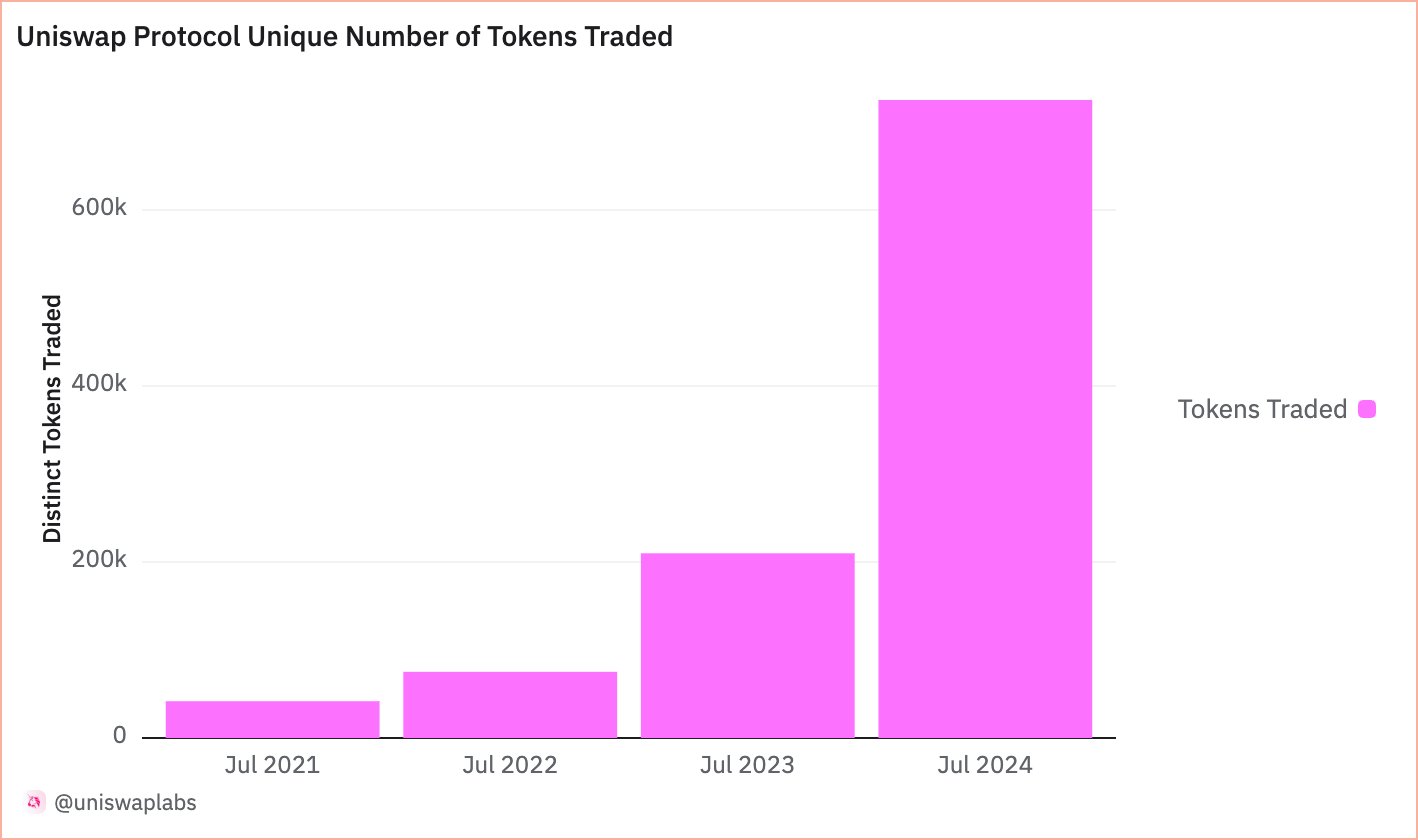

- According to Dune Analytics data, Uniswap records its highest-ever number of unique tokens swapped in a year with 725k in 2024.

- Uniswap recorded 209k unique tokens swapped in 2023, 75k in 2022, and 41k in 2021.

The biggest decentralized exchange (DEX) by trading volume Uniswap (UNI) has reached a historic milestone with 725,000 unique tokens swapped so far in 2024. According to the data compiled by Dune Analytics, this figure more than triples the 209k unique tokens swapped in 2023 and represents about 10 times the 75k recorded in 2022.

Our review of other metrics such as the total number of wallets generated also showed an incredible growth from 3 million in May 2023 to 7.2 million in May 2024. This represents a 140% increase from the year under comparison.

In terms of cumulative trading volume, Uniswap surpassed $2 trillion as of April 5 and also emerged as the largest DEX by Total Value Locked (TVL) with $5.31 billion. This more than doubled the almost $2 billion recorded by PancakeSwap to secure the second position. Surprisingly, this comes amid the fee hike by Uniswap Labs from 0.15% to 0.25%. Following the implementation of the new trading fee, $661,000 was netted as of the latter part of May.

According to experts, these numbers are expected to double or triple after the approval of the spot Ethereum Exchange Traded Funds (ETFs). It can be recalled that the trading volume of the decentralized exchange surged to a whopping $5.5 billion when the Ether ETF hype peaked in late May. At that time, the total volume of DEXes reached $11.2 billion. Our research also showed that the trading volume recorded by Uniswap surpassed that of any blockchain on which Uniswap operates.

Uniswap vs SEC Legal Confrontations

Recently, Uniswap received a Wells Notice from the US Securities and Exchange Commission (SEC) about potential violations of the US Securities laws. As we earlier reported, Uniswap responded with a 43-page filing explaining the reasons why the Commission should not pursue legal charges against them. In a statement issued by Uniswap’s Chief Legal Officer, Marvin Ammori, and presented by CNF, almost all the allegations raised by the SEC lie on false assumptions.

The SEC’s entire case rests on the false assumption that all tokens are securities. Tokens are in fact, simply a file format for value. The SEC has to essentially unilaterally change the definitions of exchange, broker and investment contract to try to capture what we do.

In explaining the details of the notice, Uniswap CEO Hayden Adam disclosed that the SEC outlined three key issues at the center of the dispute. The first has to do with whether Uniswap’s interface constitutes a broker. The second was about the Securities status of UNI while the third stressed the transparency and the absence of a contractual relationship between Uniswap and token holders.

Regardless of this, crypto analyst Ali Martinez predicts that UNI could hit $10 soon. At press time, UNI was trading at $8.3 after surging by 2% in the last 24 hours.

- According to Dune Analytics data, Uniswap records its highest-ever number of unique tokens swapped in a year with 725k in 2024.

- Uniswap recorded 209k unique tokens swapped in 2023, 75k in 2022, and 41k in 2021.

The biggest decentralized exchange (DEX) by trading volume Uniswap (UNI) has reached a historic milestone with 725,000 unique tokens swapped so far in 2024. According to the data compiled by Dune Analytics, this figure more than triples the 209k unique tokens swapped in 2023 and represents about 10 times the 75k recorded in 2022.

Our review of other metrics such as the total number of wallets generated also showed an incredible growth from 3 million in May 2023 to 7.2 million in May 2024. This represents a 140% increase from the year under comparison.

In terms of cumulative trading volume, Uniswap surpassed $2 trillion as of April 5 and also emerged as the largest DEX by Total Value Locked (TVL) with $5.31 billion. This more than doubled the almost $2 billion recorded by PancakeSwap to secure the second position. Surprisingly, this comes amid the fee hike by Uniswap Labs from 0.15% to 0.25%. Following the implementation of the new trading fee, $661,000 was netted as of the latter part of May.

According to experts, these numbers are expected to double or triple after the approval of the spot Ethereum Exchange Traded Funds (ETFs). It can be recalled that the trading volume of the decentralized exchange surged to a whopping $5.5 billion when the Ether ETF hype peaked in late May. At that time, the total volume of DEXes reached $11.2 billion. Our research also showed that the trading volume recorded by Uniswap surpassed that of any blockchain on which Uniswap operates.

Uniswap vs SEC Legal Confrontations

Recently, Uniswap received a Wells Notice from the US Securities and Exchange Commission (SEC) about potential violations of the US Securities laws. As we earlier reported, Uniswap responded with a 43-page filing explaining the reasons why the Commission should not pursue legal charges against them. In a statement issued by Uniswap’s Chief Legal Officer, Marvin Ammori, and presented by CNF, almost all the allegations raised by the SEC lie on false assumptions.

The SEC’s entire case rests on the false assumption that all tokens are securities. Tokens are in fact, simply a file format for value. The SEC has to essentially unilaterally change the definitions of exchange, broker and investment contract to try to capture what we do.

In explaining the details of the notice, Uniswap CEO Hayden Adam disclosed that the SEC outlined three key issues at the center of the dispute. The first has to do with whether Uniswap’s interface constitutes a broker. The second was about the Securities status of UNI while the third stressed the transparency and the absence of a contractual relationship between Uniswap and token holders.

Regardless of this, crypto analyst Ali Martinez predicts that UNI could hit $10 soon. At press time, UNI was trading at $8.3 after surging by 2% in the last 24 hours.