Coinbase, the leading crypto exchange in the US, recently announced that it will include Stader (SD) in its asset listings roadmap.

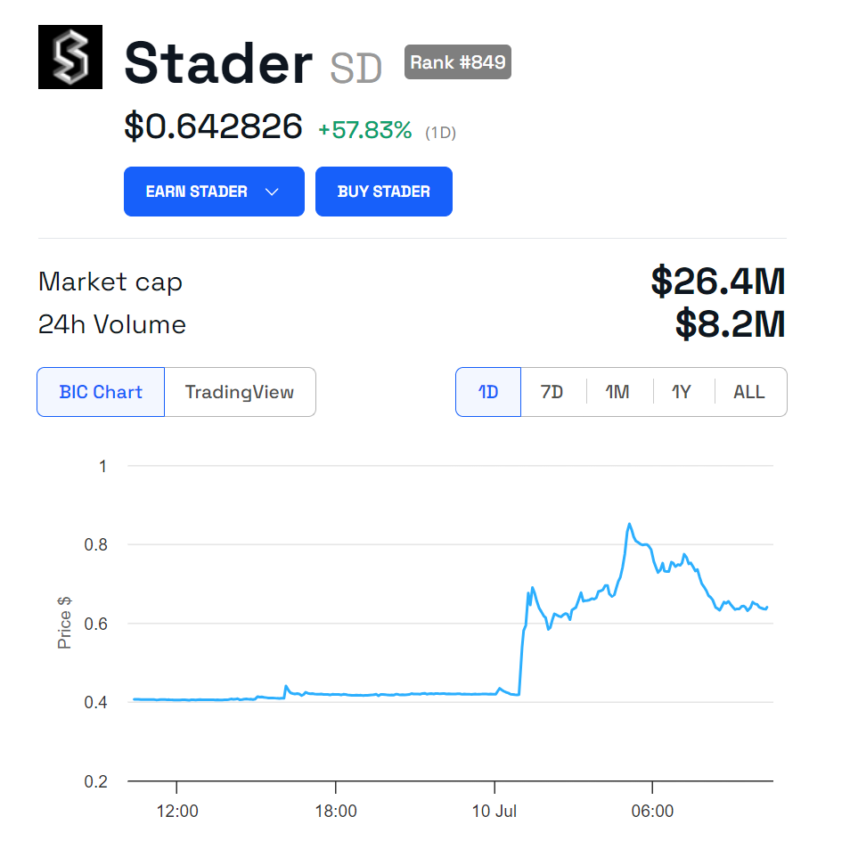

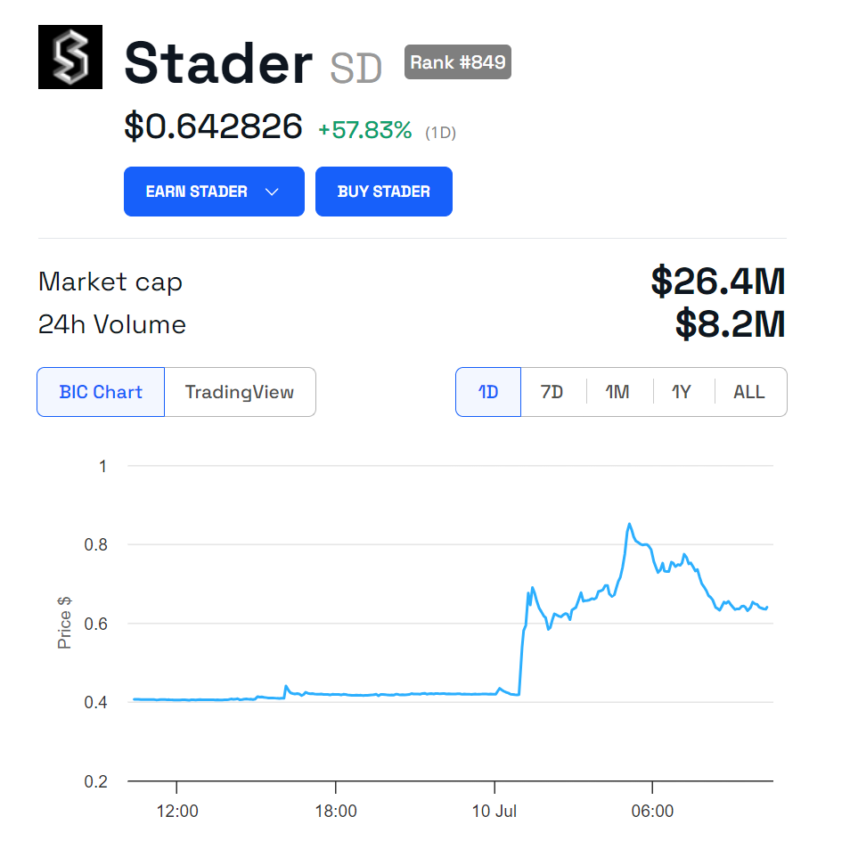

This announcement spurred a dramatic surge in SD’s price.

SD Token Price Surges Amid New Listings

According to BeInCrypto’s data, SD has risen nearly 104% from $0.417695 to $0.850730 within just four hours. Despite the initial surge, SD’s price has stabilized. It is trading at $0.642826 at the time of writing.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch in 2024

Stader is a non-custodial, multi-chain liquid staking platform. It offers users access to some of the most rewarding decentralized finance (DeFi) opportunities across Proof-of-Stake (PoS) networks. These include Ethereum, Polygon, BNB, and Hedera.

SD, Stader’s native token, is an ERC-20 token with a maximum supply of 120 million. This token boasts multiple utilities, including a unique SD Utility Pool, liquidity mining incentives, and a governance role within the Stader protocol.

Stader distinguishes itself from native Ethereum staking by lowering the capital commitment for node operators. Instead of the 32 ETH required for native staking, Stader allows node operators to maintain the network with just 4 ETH.

This reduced bond is supplemented by liquid stakers, enabling the issuance of the ETHx token and representing the entire stake. Furthermore, Stader offers users a 50% reward boost, resulting in a reward rate exceeding 6%, while node operators can earn up to 35% more yields with 8x leverage on their staked ETH.

ETHx Restaking Launch and Chainlink Integration Elevate Stader’s DeFi Game

In December 2023, Stader’s ETHx became an accepted liquid staking token (LST) for restaking on EigenLayer. Starting December 18, 2023, users can restake their ETHx.

They can participate either directly on EigenLayer or through the Early Queue on Kelp DAO. These options aim to maximize the rewards for ETHx holders and enhance the staking experience.

Stader also integrated Chainlink CCIP across the Ethereum and Arbitrum mainnets in June. By leveraging CCIP’s Simplified Token Transfer capabilities, Stader facilitates secure cross-chain transfers of ETHx. Stader is sponsoring the ETHx/ETH Chainlink Price Feed on Ethereum to boost ETHx adoption across DeFi.

“We’re excited to integrate the industry-standard Chainlink CCIP to help secure cross-chain transfers of ETHx. By leveraging CCIP’s level-5 security and advanced risk management infrastructure, we can help increase the adoption of ETHx across DeFi,” Amitej Gajjala, Co-Founder of Stader Labs, said.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

According to Token Terminal data, Stader’s current total value locked (TVL) is $474.74 million. Although this represents a decrease from its year-high of $706.84 million on March 13, the recent inclusion of Stader on Coinbase’s roadmap signals a vote of confidence in its potential, promising further growth and adoption within the crypto community.

Coinbase, the leading crypto exchange in the US, recently announced that it will include Stader (SD) in its asset listings roadmap.

This announcement spurred a dramatic surge in SD’s price.

SD Token Price Surges Amid New Listings

According to BeInCrypto’s data, SD has risen nearly 104% from $0.417695 to $0.850730 within just four hours. Despite the initial surge, SD’s price has stabilized. It is trading at $0.642826 at the time of writing.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch in 2024

Stader is a non-custodial, multi-chain liquid staking platform. It offers users access to some of the most rewarding decentralized finance (DeFi) opportunities across Proof-of-Stake (PoS) networks. These include Ethereum, Polygon, BNB, and Hedera.

SD, Stader’s native token, is an ERC-20 token with a maximum supply of 120 million. This token boasts multiple utilities, including a unique SD Utility Pool, liquidity mining incentives, and a governance role within the Stader protocol.

Stader distinguishes itself from native Ethereum staking by lowering the capital commitment for node operators. Instead of the 32 ETH required for native staking, Stader allows node operators to maintain the network with just 4 ETH.

This reduced bond is supplemented by liquid stakers, enabling the issuance of the ETHx token and representing the entire stake. Furthermore, Stader offers users a 50% reward boost, resulting in a reward rate exceeding 6%, while node operators can earn up to 35% more yields with 8x leverage on their staked ETH.

ETHx Restaking Launch and Chainlink Integration Elevate Stader’s DeFi Game

In December 2023, Stader’s ETHx became an accepted liquid staking token (LST) for restaking on EigenLayer. Starting December 18, 2023, users can restake their ETHx.

They can participate either directly on EigenLayer or through the Early Queue on Kelp DAO. These options aim to maximize the rewards for ETHx holders and enhance the staking experience.

Stader also integrated Chainlink CCIP across the Ethereum and Arbitrum mainnets in June. By leveraging CCIP’s Simplified Token Transfer capabilities, Stader facilitates secure cross-chain transfers of ETHx. Stader is sponsoring the ETHx/ETH Chainlink Price Feed on Ethereum to boost ETHx adoption across DeFi.

“We’re excited to integrate the industry-standard Chainlink CCIP to help secure cross-chain transfers of ETHx. By leveraging CCIP’s level-5 security and advanced risk management infrastructure, we can help increase the adoption of ETHx across DeFi,” Amitej Gajjala, Co-Founder of Stader Labs, said.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

According to Token Terminal data, Stader’s current total value locked (TVL) is $474.74 million. Although this represents a decrease from its year-high of $706.84 million on March 13, the recent inclusion of Stader on Coinbase’s roadmap signals a vote of confidence in its potential, promising further growth and adoption within the crypto community.