Bitcoin is currently having its worst time in many months. Selling pressure have pushed the bulls off completely. Technical indicators point to a market under the control of bears.

However, the derivatives market suggests that the bulls might not be dead after all.

The bulls are still here

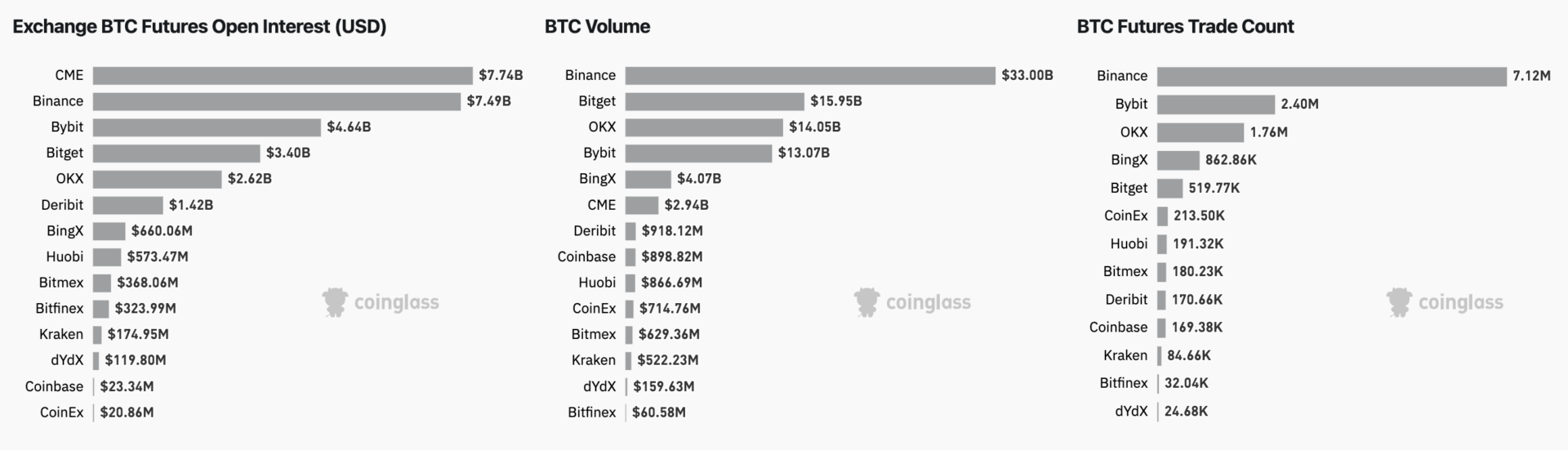

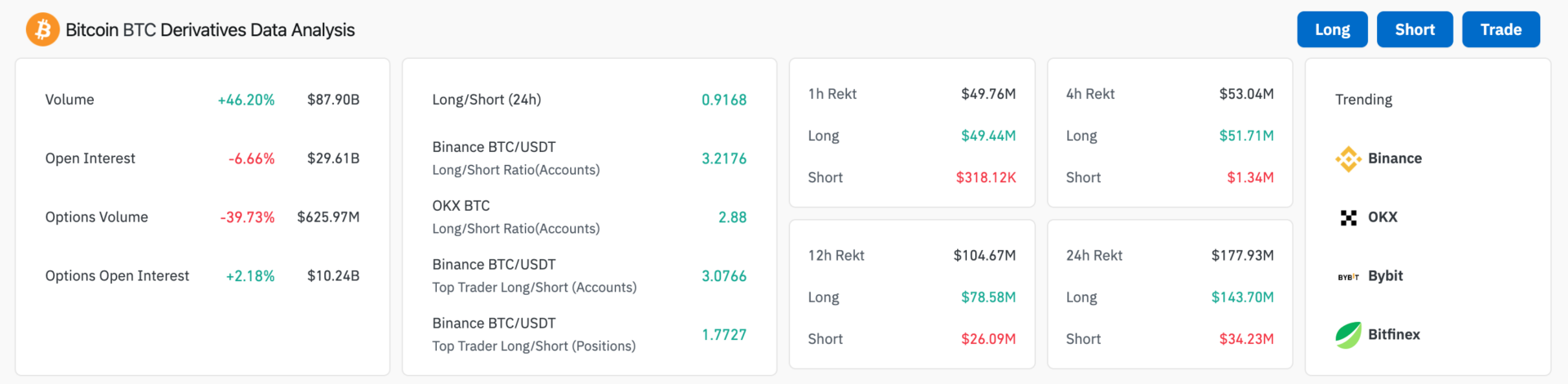

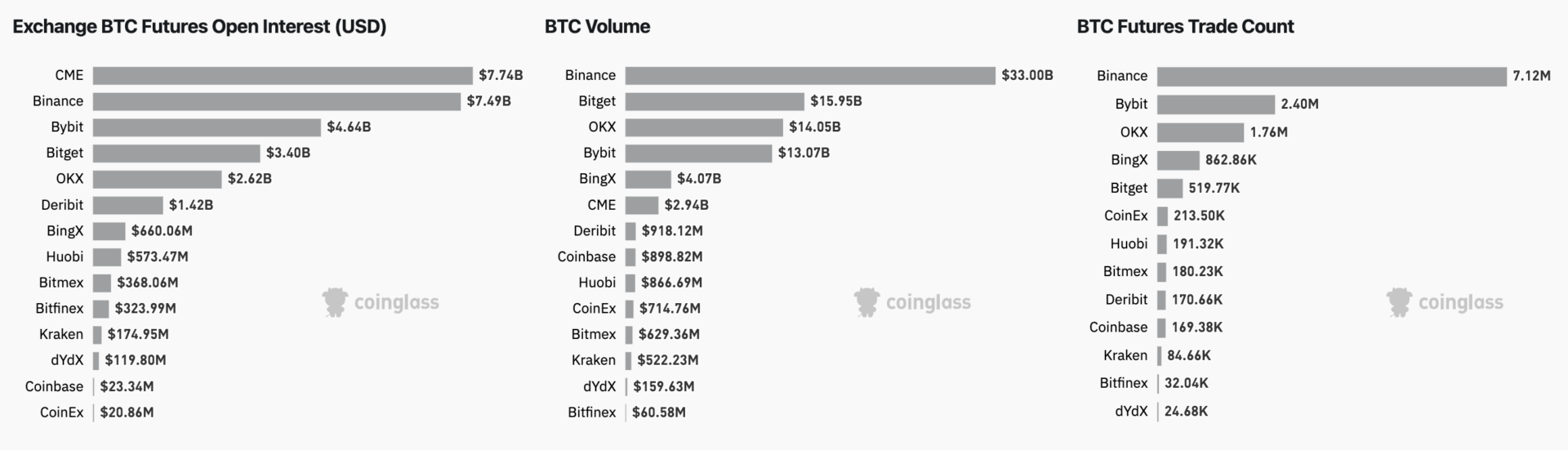

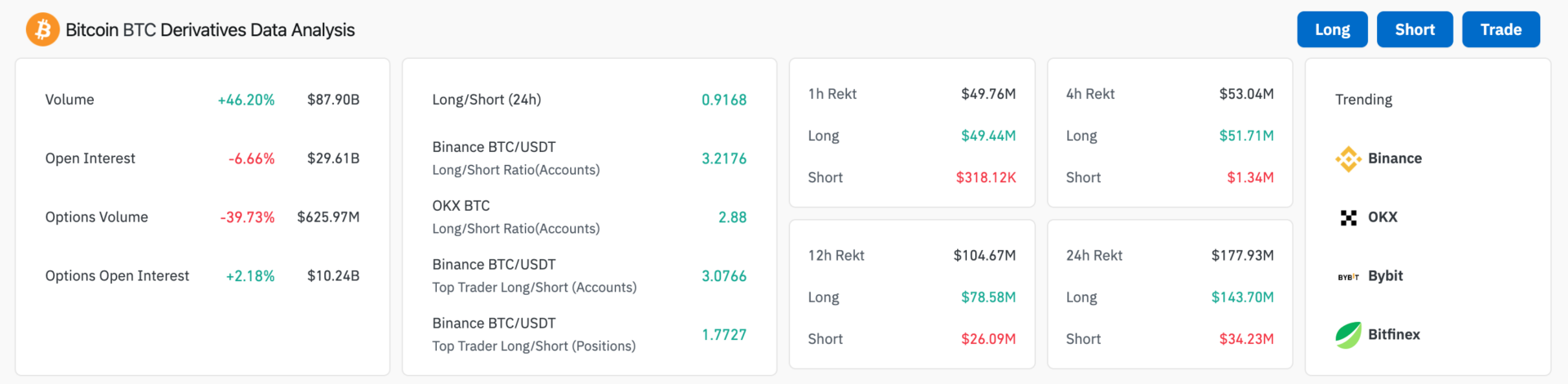

Derivatives data from Coinglass shows bullishness in market sentiment and activity. Over the past 24 hours, trading volume has surged by 46.20%, reaching $87.90 billion. Clearly, traders have heightened their activity.

However, the open interest has decreased by 6.66%, now standing at $29.61 billion. This reduction typically means that traders are still closing their positions, likely due to recent market uncertainties or profit-taking following recent price movements.

Additionally, options trading shows a mixed sentiment. While the options volume has dropped by 39.73%, options open interest has slightly increased by 2.18%, hinting that although new trades are fewer, existing positions remain massive.

The overall long/short ratio is 0.9168, suggesting a slight predominance of short positions. However, on major exchanges like Binance and OKX, the long/short ratios are notably higher (3.2176 and 2.88, respectively).

Furthermore, the Binance BTC/USDT top trader long/short (accounts) ratio is 3.0766, and for positions, it is 1.7727.

Liquidation data gives another perspective. Massive liquidations have been observed, with $49.76 million liquidated in the past hour, predominantly from long positions ($49.44 million), and only $318.12K from shorts.

Over the past 12 hours, $104.67 million has been liquidated, with long liquidations at $78.58 million compared to $26.09 million from shorts.

Despite the bullish sentiment in open positions, the price drops have triggered considerable long liquidations, which could pressure the market further downward if it continues.

But the bears remain in charge

Bitcoin is trading below the Ichimoku Cloud, indicating a bearish trend. The conversion line (blue) and baseline (red) are both below the cloud, further supporting the bears.

The OBV oscillator shows a huge negative value of -110.131K, and the CMF is at -0.25, indicating that money is flowing out of Bitcoin. This means that the bears are currently in control.

The ADX is at 35.94, indicating that the current trend is relatively strong. Since the price is declining and the ADX is rising, it means the bears are actually getting stronger by the minute.

A rising ADX in a downtrend suggests that the downward momentum is going to continue. Bitcoin is likely to continue its bearish trend in the short term. Key support levels to watch are around $56,000.

If Bitcoin breaks below this level, the next support could be around $55,000. Resistance levels are near $59,000 and $60,000. A break above these levels could signal a potential reversal.

Reporting by Jai Hamid

Bitcoin is currently having its worst time in many months. Selling pressure have pushed the bulls off completely. Technical indicators point to a market under the control of bears.

However, the derivatives market suggests that the bulls might not be dead after all.

The bulls are still here

Derivatives data from Coinglass shows bullishness in market sentiment and activity. Over the past 24 hours, trading volume has surged by 46.20%, reaching $87.90 billion. Clearly, traders have heightened their activity.

However, the open interest has decreased by 6.66%, now standing at $29.61 billion. This reduction typically means that traders are still closing their positions, likely due to recent market uncertainties or profit-taking following recent price movements.

Additionally, options trading shows a mixed sentiment. While the options volume has dropped by 39.73%, options open interest has slightly increased by 2.18%, hinting that although new trades are fewer, existing positions remain massive.

The overall long/short ratio is 0.9168, suggesting a slight predominance of short positions. However, on major exchanges like Binance and OKX, the long/short ratios are notably higher (3.2176 and 2.88, respectively).

Furthermore, the Binance BTC/USDT top trader long/short (accounts) ratio is 3.0766, and for positions, it is 1.7727.

Liquidation data gives another perspective. Massive liquidations have been observed, with $49.76 million liquidated in the past hour, predominantly from long positions ($49.44 million), and only $318.12K from shorts.

Over the past 12 hours, $104.67 million has been liquidated, with long liquidations at $78.58 million compared to $26.09 million from shorts.

Despite the bullish sentiment in open positions, the price drops have triggered considerable long liquidations, which could pressure the market further downward if it continues.

But the bears remain in charge

Bitcoin is trading below the Ichimoku Cloud, indicating a bearish trend. The conversion line (blue) and baseline (red) are both below the cloud, further supporting the bears.

The OBV oscillator shows a huge negative value of -110.131K, and the CMF is at -0.25, indicating that money is flowing out of Bitcoin. This means that the bears are currently in control.

The ADX is at 35.94, indicating that the current trend is relatively strong. Since the price is declining and the ADX is rising, it means the bears are actually getting stronger by the minute.

A rising ADX in a downtrend suggests that the downward momentum is going to continue. Bitcoin is likely to continue its bearish trend in the short term. Key support levels to watch are around $56,000.

If Bitcoin breaks below this level, the next support could be around $55,000. Resistance levels are near $59,000 and $60,000. A break above these levels could signal a potential reversal.

Reporting by Jai Hamid