- US spot Bitcoin ETFs registered slight inflows on Monday.

- On-chain data shows that BTC’s daily active addresses increased, signaling greater blockchain usage.

- German Government transferred 1,500 BTC, valued at $94.7 million, out of its wallet on Monday.

Bitcoin (BTC) is encountering resistance near the $64,000 level, with on-chain data indicating a rise in daily active addresses, slight inflows into US spot Bitcoin ETFs, and the German Government’s transfer of 1,500 BTC valued at $94.7 million potentially triggering a minor correction in BTC price before an anticipated upward rally in the coming days.

Daily digest market movers: Bitcoin spot ETFs saw a mild inflow

- According to data from Lookonchain, 9 ETFs added 526 BTC worth $33 million on July 1, continuing a net inflow for five consecutive days.

- Blackrock has added 1,366 BTC worth $85.9 million and currently holds 306,979 BTC, valued at $19.3 billion. Grayscale, Invesco, and Fidelity decreased by 198, 201, and 437 BTC, respectively. Collectively, the nine spot BTC ETFs hold reserves amounting to $54.3 billion in Bitcoin.

July 1 Update:

9 ETFs added 526 $BTC(+$33M).#Blackrock added 1,366 $BTC(+$85.9M) and currently holds 306,979 $BTC($19.3B).#Grayscale decreased 198 $BTC(-$12.4M) and currently holds 275,758 $BTC($17.34B).https://t.co/xXLHLZXSyV pic.twitter.com/b5uF2c7ioH

— Lookonchain (@lookonchain) July 1, 2024

- In the last hours, the German Government transferred 1,500 BTC, valued at $94.7 million, from its wallet. Out of this, 400 BTC worth $25.3 million were transferred to Coinbase, Bitstamp and Kraken exchanges, data from Lookonchain shows. Over the past week, German authorities have moved 1,700 BTC worth $110.88 million to Coinbase, Bitstamp, and Kraken. This significant transfer activity may have fueled FUD (Fear, Uncertainty, Doubt) among traders.

The German Government transferred 1,500 $BTC($94.7M) out again in the past 20 minutes, of which 400 $BTC($25.3M) was transferred to #Bitstamp, #Coinbase and #Kraken.

German Government currently holds 44,692 $BTC($2.82B).https://t.co/6V5KFoyQa7 pic.twitter.com/35yMQIcMA8

— Lookonchain (@lookonchain) July 1, 2024

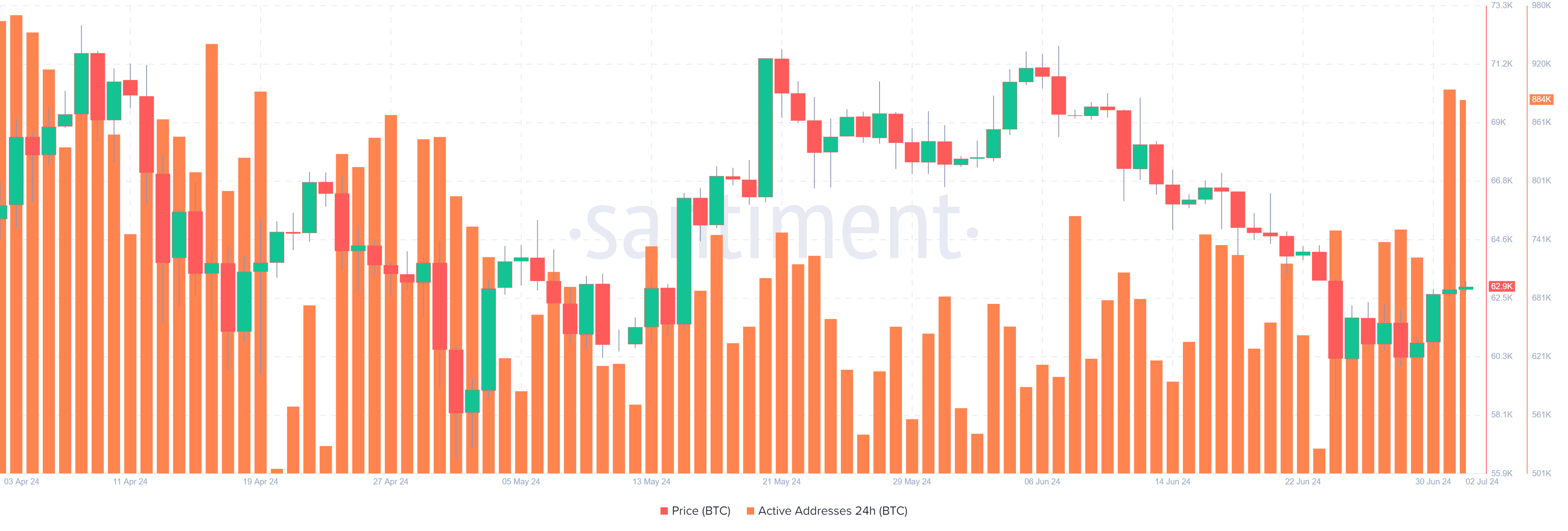

- Santiment’s Daily Active Addresses index helps track network activity over time. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

- In BTC’s case, Daily Active Addresses have risen from 666,020 on June 30 to 894,980 on July 1. This 34.3% rise is the highest since mid-April and indicates that demand for BTC’s blockchain usage is increasing, which could eventually propel a rise in Bitcoin’s price.

Bitcoin Daily Active Addresses chart

- On Monday, Whalefin revealed that its parent company, Amber Japan, would rebrand as S.BLOX after its Sony unit Quetta Web acquisition in August 2023. The announcement emphasized plans to leverage collaboration across Sony Group businesses to innovate crypto asset trading services, alongside Sony’s intent to relaunch the crypto exchange with a new app, as stated in a PR Times release.

Sony plans to restart Whalefin with a new app and user interface. @Sony bought the crypto exchange from Amber Group last year.https://t.co/FrAA7Y8045

— CoinDesk (@CoinDesk) July 1, 2024

Technical analysis: BTC faces resistance around the $64,000 level

Bitcoin’s price broke above the falling wedge pattern on Monday, but it was rejected by the daily resistance level at $63,956 and trades below it at $62,916 on Tuesday.

If BTC’s price closes above the $63,956 daily resistance level, it could rise 5% to retest its next weekly resistance at $67,147.

The Relative Strength Index (RSI) and the Awesome Oscillator in the daily chart are below their neutral levels of 50 and zero. If bulls are indeed returning, then both momentum indicators must regain their positions above their respective neutral levels.

If the bulls are aggressive and the overall crypto market outlook is positive, BTC could extend an additional rally of 6% to revisit its weekly resistance at $71,280.

BTC/USDT daily chart

However, if BTC closes below the $58,375 level and forms a lower low in the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 3% decline in Bitcoin’s price, to revisit its low of $56,522 from May 1.