While Bitcoin has been experiencing consecutive declines recently, these declines are considered to be effective due to BTC sales from the German and US governments and miners.

While BTC is currently above $61,000, data on Personal Consumption Expenditures (PCE), which is closely followed by the FED when making interest rate decisions and is considered a leading inflation indicator, was announced.

Accordingly, all data announced regarding personal consumption expenditures in May were as follows:

Core Personal Consumption Expenditures Price Index (Annual) Announced 2.6% – Expected 2.6% – Previous 2.8%

Core Personal Consumption Expenditures Price List (Monthly) Announced 0.1% – Expected 0.1% – Previous 0.2%

Personal Consumption Expenditures Price Index (Annual) Announced 2.6% – Expected 2.6% – Previous 2.7%

Personal Consumption expenditures Price Index (Monthly) Announced 0.0% – Expected 0.0% – Previous 0.3%

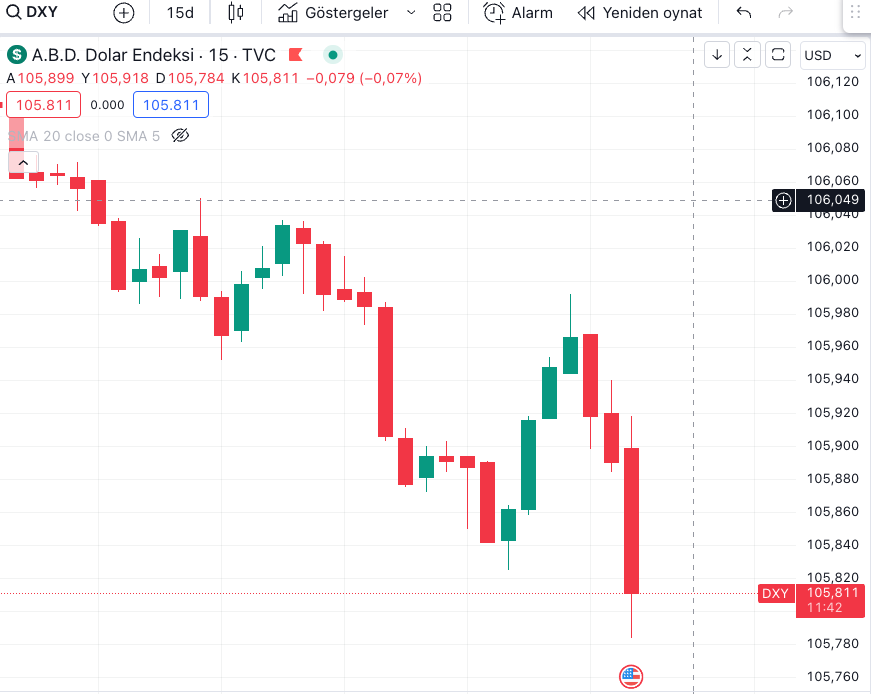

What Was the First Reaction of Bitcoin and the Dollar?

What is Core Personal Consumption Expenditures Price Index? What is the Effect on Price?

Core Personal Consumption expenditures (PCE) determine the rate of inflation experienced by consumers when purchasing goods and services other than Food and Energy.

Currency traders observe the Core PCE Price List as the Reserve Bank’s preferred consumer inflation indicator.

PCE differs slightly from CPI in that it only identifies services and goods that are consumed and targeted separately. The Nutrient and Energy calculation is roughly 25% of the PCE, but these can vary greatly from month to month and can distort the whole picture. Like the CPI, it reflects price changes in consumer goods and services. By excluding the variable components, PCE would be a better indicator under the inflationary slope. (investing.com)

*This is not investment advice.