Calls for Ondo (ONDO) to reach a new all-time high dominated the market after the price reached $1.48 on June 3. Yet, the token went against those wishes and is now 17.64% down from its peak.

When analyzing a cryptocurrency’s prospective price, on-chain data lets out unseen insights to help investors make informed decisions. For ONDO, there has been a change in previous developments, suggesting that the bullish predictions could become reality.

Cheaper Spend Can Lead to Higher Prices

When ONDO launched, its price was around $0.11. However, its 658% increase over the last 365 days makes it one crypto with many eyes on it. Fueled chiefly by solid fundamentals and a trending Real World Asset (RWA) narrative, here is how the cryptocurrency may fare in weeks to come.

To start with, BeInCrypto assesses the Realized Cap. Simply put, the Realized Cap measures the average value weighted by the price token holders paid for it. Furthermore, increases occur when cryptocurrencies that were last moved are spent at cheaper prices.

Converesly, the value decreases when the last tokens moved are spent at high prices. As a result, the metric acts as on-chain support or resistance.

At press time, ONDO’s Realized Cap stands at $1.15 billion. On average, the metric is a crucial tool for spotting accumulation and distribution regions. However, this happens when compared with the market cap.

If the Realized Cap is above the market cap, it implies a warning sign that the price may decrease. As of this writing, Ondo’s market cap is $1.70 billion. Furthermore, the fact that the Realized Cap is lower paves the way for the price to continue its bullish path.

Read More: How To Invest in Real-World Crypto Assets (RWA)

Tokens Continue to Leave Circulation

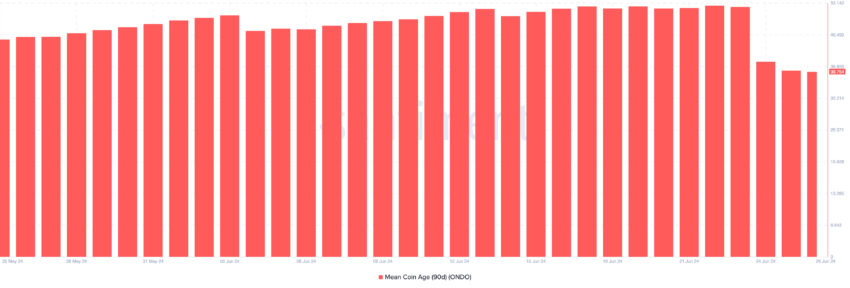

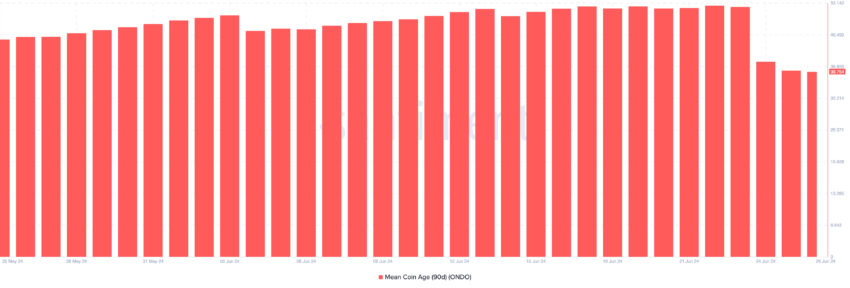

As the metric above increases, the Mean Coin Age takes the opposite direction. Often called by its short form, the MCA tracks the average age of all tokens on the blockchain. With the MCA, one can tell if trading activity around a token increases or if holders are sticking to keep it out of circulation.

According to Santiment, the 90-day MCA has plummeted as of this writing. This means that ONDO holders are refraining from sending tokens into exchanges. Instead, they seem committed to keeping them in self-custody.

If sustained, ONDO’s price can begin to run past its all-time high, and the $2 prediction being talked about in the market may come to pass.

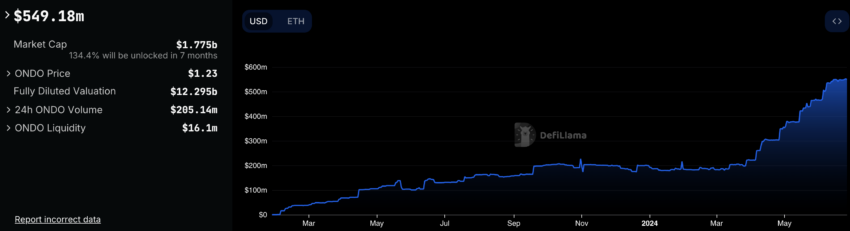

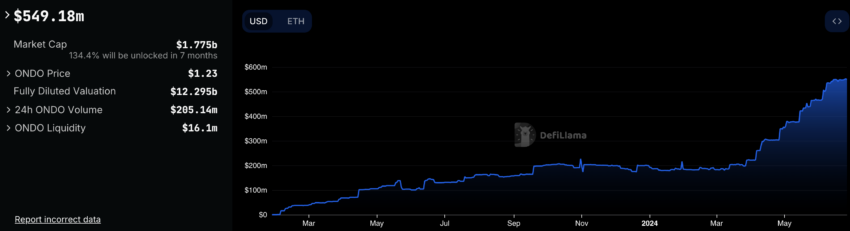

Outside of the price action, the Total Value Locked (TVL) continues to reach new highs. Based on DeFiLlama’s data, Ondo’s TVL is $549.18 million. This is an 18.32% increase within the last 30 days.

TVL measures a protocol’s health by gauging the value of locked or staked assets. An increase implies that market participants are depositing more liquidity with hopes of a good yield, which is the case with Ondo.

If the TVL falls, it means that participants are withdrawing their assets as perceived trust for the project wanes. However, it is unlikely that the value of locked assets will plummet, especially as interest from traditional institutional investors continues to climb.

ONDO Price Prediction: Is a 15% increase Next?

Alongside the rising TVL, technical analysis shows that ONDO’s price is eyeing further gains. One reason for this forecast is the Exponential Moving Average (EMA), a technical tool designed to track a cryptocurrency’s price trend over a given period.

Some of the most important timeframes include the 20 EMA, 50 EMA, and 200 EMA. The daily ONDO/USD chart shows that the price is $1.20, trading above the 20 EMA (blue). This is a bullish sign for the token and may ensure the ONDO’s price does not fall below $1.19.

The token also trades above the 50 EMA (yellow), indicating that the cryptocurrency’s trend may give in to the upside in the short term. Should this be the case, ONDO’s first target will be a 15% increase to $1.39.

Afterward, it may move to break through the all-time high at $.1.48 if whales decide to buy as they did in the past.

Read More: Real-World Asset (RWA) Backed Tokens Explained

In the event that the price slides below the aforementioned EMAs, the prediction will be invalidated. If this happens, ONDO may drop to $1.07, setting the stage for a 12% decrease.

Calls for Ondo (ONDO) to reach a new all-time high dominated the market after the price reached $1.48 on June 3. Yet, the token went against those wishes and is now 17.64% down from its peak.

When analyzing a cryptocurrency’s prospective price, on-chain data lets out unseen insights to help investors make informed decisions. For ONDO, there has been a change in previous developments, suggesting that the bullish predictions could become reality.

Cheaper Spend Can Lead to Higher Prices

When ONDO launched, its price was around $0.11. However, its 658% increase over the last 365 days makes it one crypto with many eyes on it. Fueled chiefly by solid fundamentals and a trending Real World Asset (RWA) narrative, here is how the cryptocurrency may fare in weeks to come.

To start with, BeInCrypto assesses the Realized Cap. Simply put, the Realized Cap measures the average value weighted by the price token holders paid for it. Furthermore, increases occur when cryptocurrencies that were last moved are spent at cheaper prices.

Converesly, the value decreases when the last tokens moved are spent at high prices. As a result, the metric acts as on-chain support or resistance.

At press time, ONDO’s Realized Cap stands at $1.15 billion. On average, the metric is a crucial tool for spotting accumulation and distribution regions. However, this happens when compared with the market cap.

If the Realized Cap is above the market cap, it implies a warning sign that the price may decrease. As of this writing, Ondo’s market cap is $1.70 billion. Furthermore, the fact that the Realized Cap is lower paves the way for the price to continue its bullish path.

Read More: How To Invest in Real-World Crypto Assets (RWA)

Tokens Continue to Leave Circulation

As the metric above increases, the Mean Coin Age takes the opposite direction. Often called by its short form, the MCA tracks the average age of all tokens on the blockchain. With the MCA, one can tell if trading activity around a token increases or if holders are sticking to keep it out of circulation.

According to Santiment, the 90-day MCA has plummeted as of this writing. This means that ONDO holders are refraining from sending tokens into exchanges. Instead, they seem committed to keeping them in self-custody.

If sustained, ONDO’s price can begin to run past its all-time high, and the $2 prediction being talked about in the market may come to pass.

Outside of the price action, the Total Value Locked (TVL) continues to reach new highs. Based on DeFiLlama’s data, Ondo’s TVL is $549.18 million. This is an 18.32% increase within the last 30 days.

TVL measures a protocol’s health by gauging the value of locked or staked assets. An increase implies that market participants are depositing more liquidity with hopes of a good yield, which is the case with Ondo.

If the TVL falls, it means that participants are withdrawing their assets as perceived trust for the project wanes. However, it is unlikely that the value of locked assets will plummet, especially as interest from traditional institutional investors continues to climb.

ONDO Price Prediction: Is a 15% increase Next?

Alongside the rising TVL, technical analysis shows that ONDO’s price is eyeing further gains. One reason for this forecast is the Exponential Moving Average (EMA), a technical tool designed to track a cryptocurrency’s price trend over a given period.

Some of the most important timeframes include the 20 EMA, 50 EMA, and 200 EMA. The daily ONDO/USD chart shows that the price is $1.20, trading above the 20 EMA (blue). This is a bullish sign for the token and may ensure the ONDO’s price does not fall below $1.19.

The token also trades above the 50 EMA (yellow), indicating that the cryptocurrency’s trend may give in to the upside in the short term. Should this be the case, ONDO’s first target will be a 15% increase to $1.39.

Afterward, it may move to break through the all-time high at $.1.48 if whales decide to buy as they did in the past.

Read More: Real-World Asset (RWA) Backed Tokens Explained

In the event that the price slides below the aforementioned EMAs, the prediction will be invalidated. If this happens, ONDO may drop to $1.07, setting the stage for a 12% decrease.