Bitcoin price fell to a new 40-day bottom of $62,667 on Monday June 24, as institutional investors switch focus towards Ethereum and the roaring stock markets, here’s how BTC price could react in the week ahead.

Bitcoin price tumbles below $63k First Time in 40-Days

After a negative performance last week, BTC shed more than 150 billion from its market capitalization, accounting for over 12% in losses between June 15 and June 21. Over the weekend, bears further tightened their on the Bitcoin markets, with the pioneer cryptocurrency shaping up for a false start to the coming week.

In the news, positive movements around Ethereum ETFs as well as bullish upswings in the US stocks markets, led by AI-chips manufacturing behemoth NVIDIA, have further pulled investors’ attention away from BTC in the recent days.

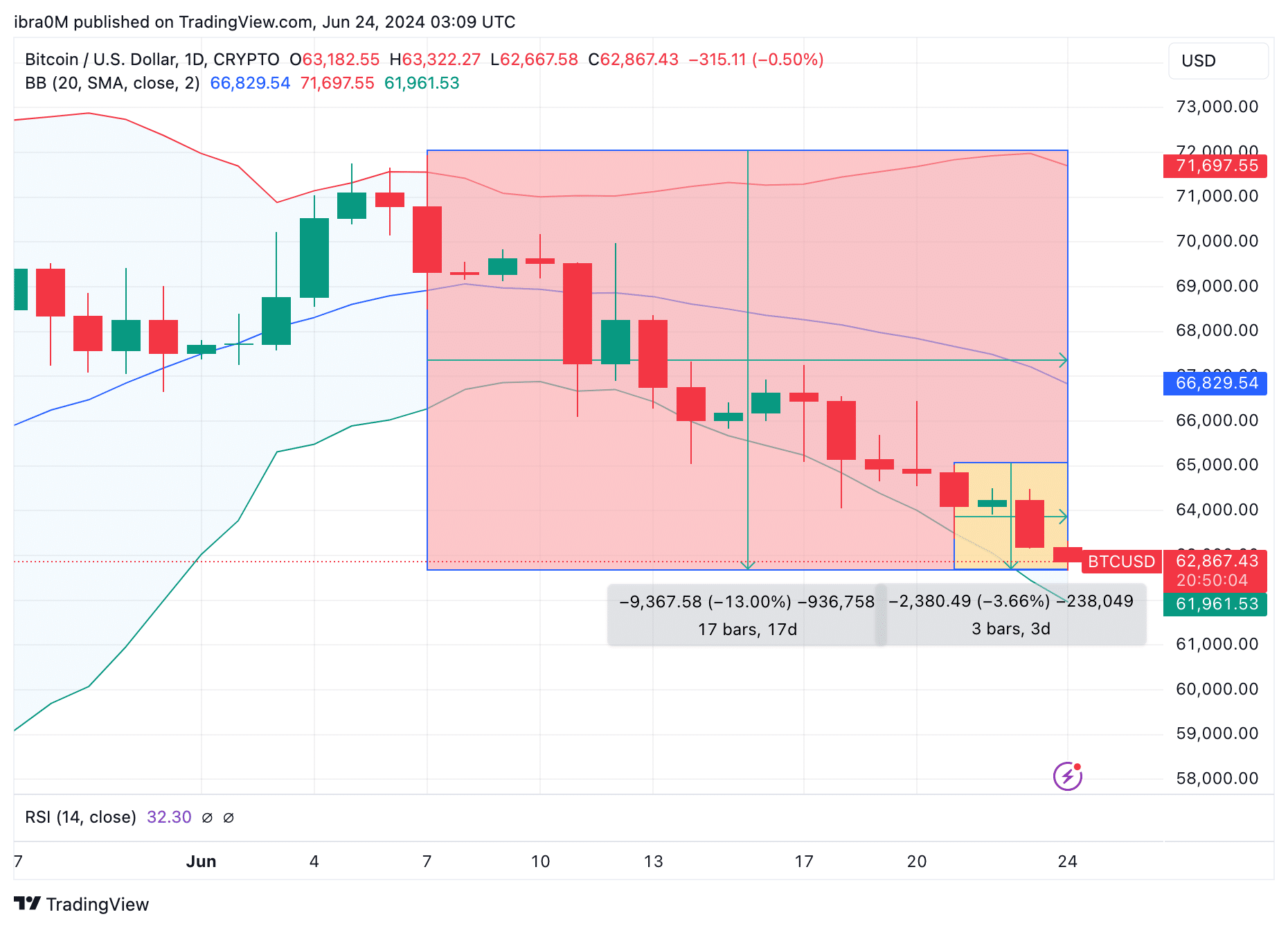

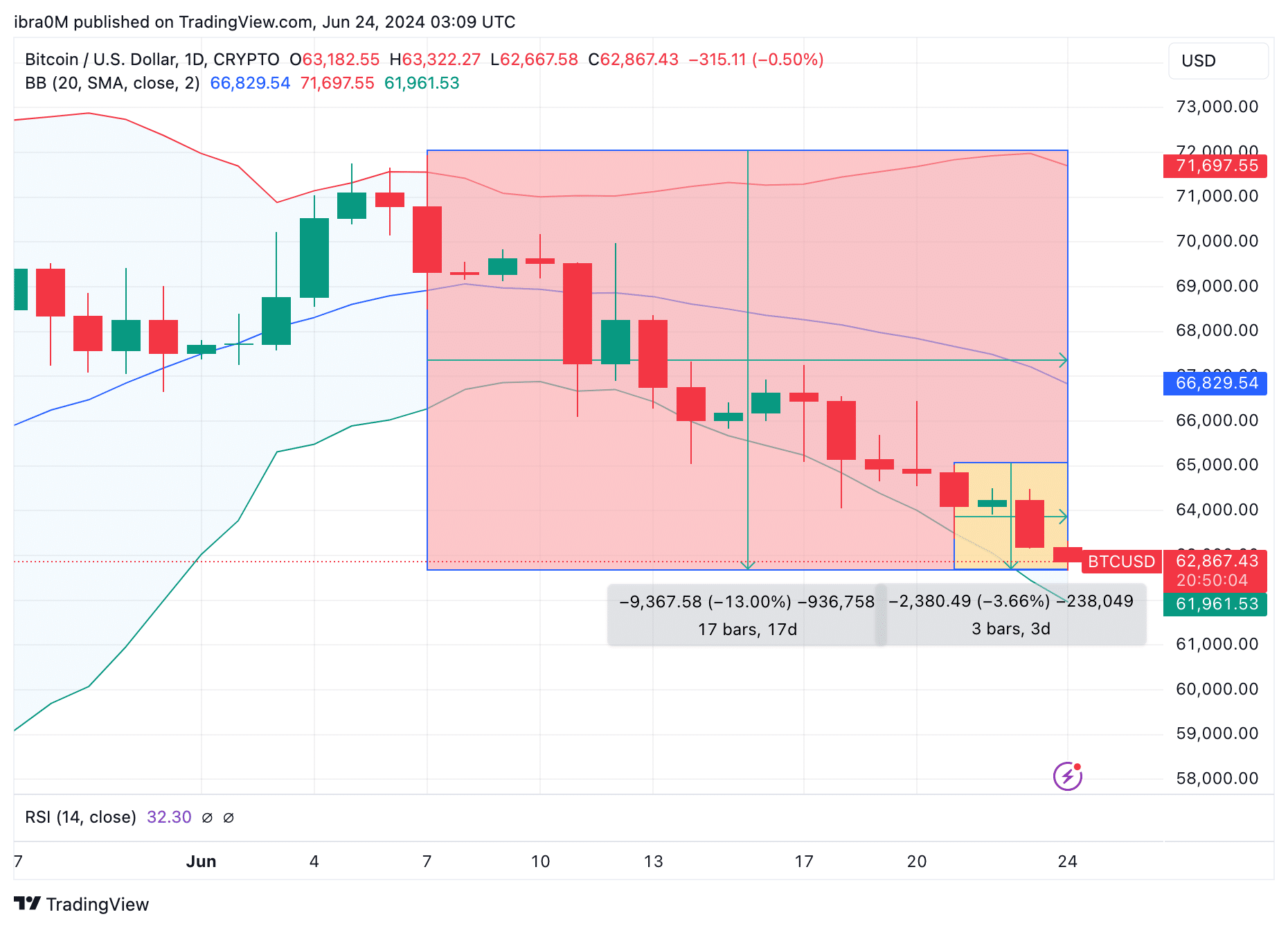

The chart above shows that Bitcoin price peaked at $65,026 on Friday, June 21, as bulls attempted to reclaim the $65,000 resistance level. But since then, the bears have flipped the tide and forced another 3.66% downtrend over the weekend.

Zooming out, Bitcoin price falling to a 40-day low of $62,667 on Monday, June 24, means it has now plunged 13% since the current correction phase began around June 7.

Whale Investors Cut Bitcoin Transactions to 8-Month Low

As hinted by the major news headlines in the past few days, Bitcoin price stagnation below $65,000 has been largely attributed ETH ETFs‘ imminent launch and risking stock prices dominating investors mind-share.

However, an in-depth inquest into Bitcoin’s underlying on-chain trends shows that whale investor cutting back on their BTC trading activity may have played a more prominent role in the ongoing price downtrend as well.

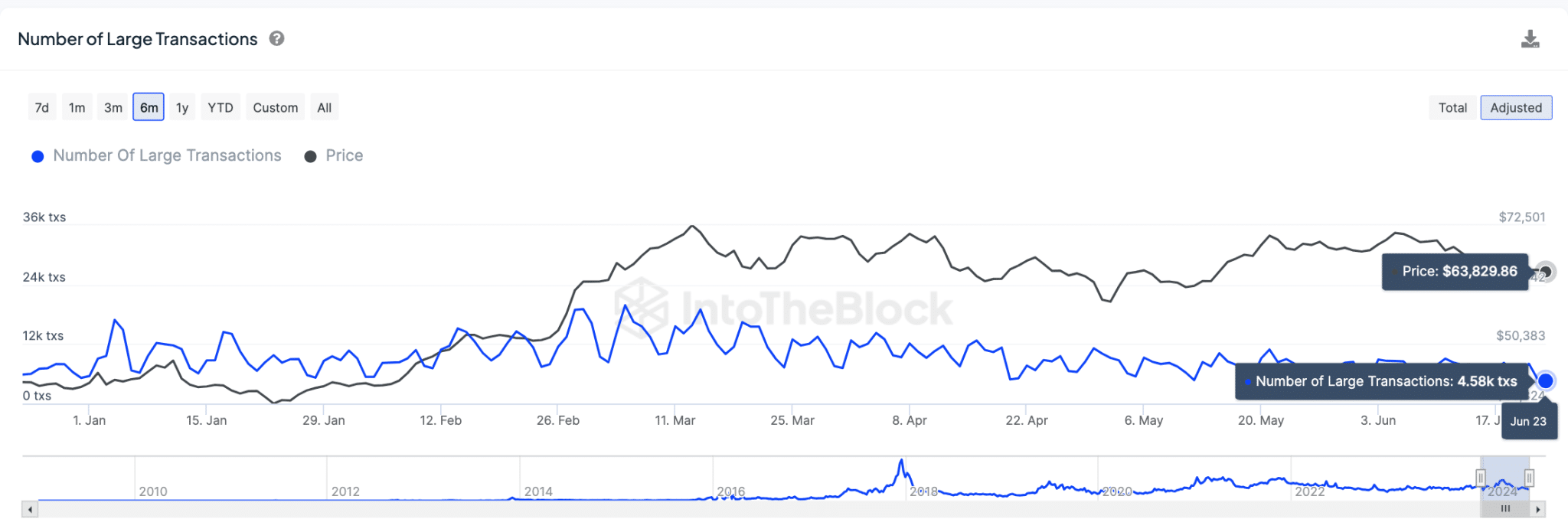

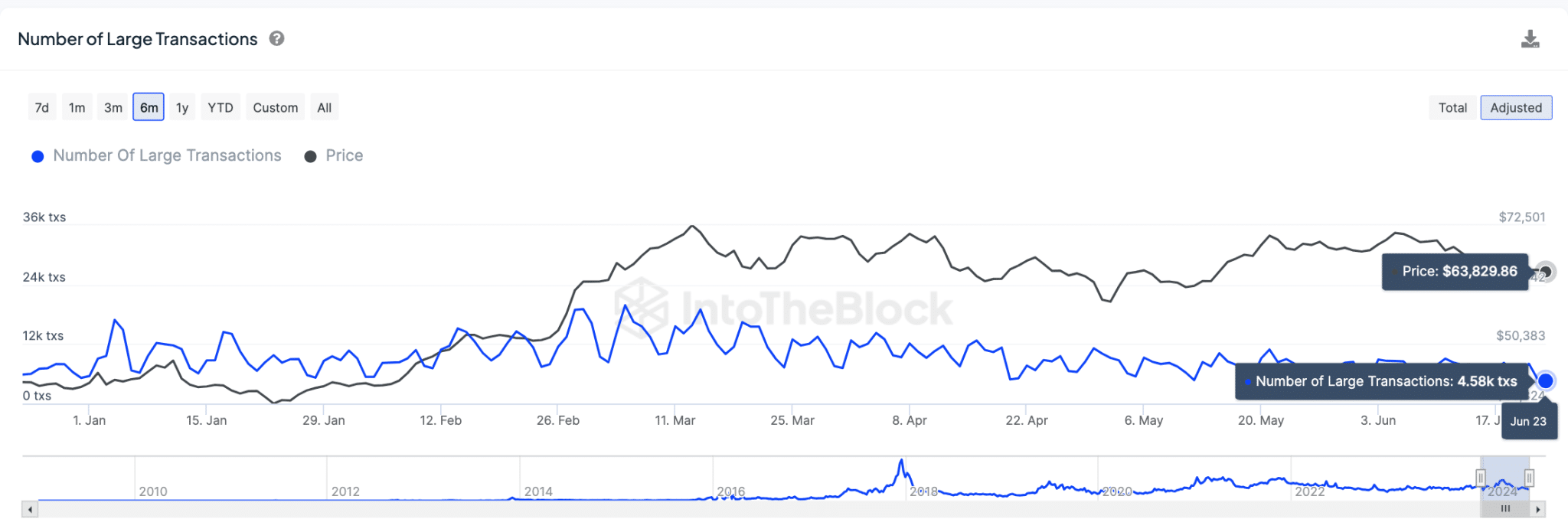

IntoTheBlock’s Large Transactions Count data tracks the total number of individual transactions exceeding $100,000 on any given trading day. This serves as a proxy for measuring the spate of whales’ trading activity within a cryptocurrency network.

As seen above, the Bitcoin network recorded a total of 4,580 unique large transactions exceeding $100,000 in nominal value at close of June 23. Worryingly, the chart shows that the number of the whale transactions has been in a steep decline since March 2024, when BTC price first reached retest all-time highs above $72,000.

In more concrete terms, the last time BTC whale transactions fell lower than the 4,580 large transactions recorded on June 23 was as far back as 8 months ago, on October 9, 2023, when it recorded 4,509 whale BTC transactions.

For a number of, whale investors cutting their trading activity to the lowest levels in over 8-months may have a negative impact of BTC price action in the week ahead.

Firstly, whale transactions provide much-needed liquidity to any cryptocurrency markets. As dramatic drop-off as observed above means that panic sellers now have less-liquidity available to conduct high-volume sell-offs without causing major price dips.

In essence, the whale transactions falling to an 8-month low now puts Bitcoin prices at risk of further downswings towards $60,000 in the days ahead.

Bitcoin price fell to a new 40-day bottom of $62,667 on Monday June 24, as institutional investors switch focus towards Ethereum and the roaring stock markets, here’s how BTC price could react in the week ahead.

Bitcoin price tumbles below $63k First Time in 40-Days

After a negative performance last week, BTC shed more than 150 billion from its market capitalization, accounting for over 12% in losses between June 15 and June 21. Over the weekend, bears further tightened their on the Bitcoin markets, with the pioneer cryptocurrency shaping up for a false start to the coming week.

In the news, positive movements around Ethereum ETFs as well as bullish upswings in the US stocks markets, led by AI-chips manufacturing behemoth NVIDIA, have further pulled investors’ attention away from BTC in the recent days.

The chart above shows that Bitcoin price peaked at $65,026 on Friday, June 21, as bulls attempted to reclaim the $65,000 resistance level. But since then, the bears have flipped the tide and forced another 3.66% downtrend over the weekend.

Zooming out, Bitcoin price falling to a 40-day low of $62,667 on Monday, June 24, means it has now plunged 13% since the current correction phase began around June 7.

Whale Investors Cut Bitcoin Transactions to 8-Month Low

As hinted by the major news headlines in the past few days, Bitcoin price stagnation below $65,000 has been largely attributed ETH ETFs‘ imminent launch and risking stock prices dominating investors mind-share.

However, an in-depth inquest into Bitcoin’s underlying on-chain trends shows that whale investor cutting back on their BTC trading activity may have played a more prominent role in the ongoing price downtrend as well.

IntoTheBlock’s Large Transactions Count data tracks the total number of individual transactions exceeding $100,000 on any given trading day. This serves as a proxy for measuring the spate of whales’ trading activity within a cryptocurrency network.

As seen above, the Bitcoin network recorded a total of 4,580 unique large transactions exceeding $100,000 in nominal value at close of June 23. Worryingly, the chart shows that the number of the whale transactions has been in a steep decline since March 2024, when BTC price first reached retest all-time highs above $72,000.

In more concrete terms, the last time BTC whale transactions fell lower than the 4,580 large transactions recorded on June 23 was as far back as 8 months ago, on October 9, 2023, when it recorded 4,509 whale BTC transactions.

For a number of, whale investors cutting their trading activity to the lowest levels in over 8-months may have a negative impact of BTC price action in the week ahead.

Firstly, whale transactions provide much-needed liquidity to any cryptocurrency markets. As dramatic drop-off as observed above means that panic sellers now have less-liquidity available to conduct high-volume sell-offs without causing major price dips.

In essence, the whale transactions falling to an 8-month low now puts Bitcoin prices at risk of further downswings towards $60,000 in the days ahead.