Crypto lending rates have soared up to 30% APR (annual percentage rate) on Bitfinex today, which is nearly three times the exchange’s average interest rate. This indicates that traders are confident in significant price increases.

Greeks.live observed several orders on Bitfinex exceeding 21% and reaching up to 30% APR for short-term loans. This suggests that large spot traders—those who trade actual crypto assets rather than derivatives—are heavily increasing their positions.

Crypto Lending Rates Have Been a Consistent Indicator for Bull Markets

A 30% APR lending rate has been a reliable indicator of a major bull market for the last two years. When borrowing costs spike to this level, it usually coincides with strong market rallies.

Despite a minor pullback in the market today, large spot traders are significantly increasing their holdings. Traders borrowing at high rates believe the potential gains outweigh the borrowing costs, further fueling market optimism.

“With a small pullback in the market, the big spot traders have started to add to their positions in a big way, so to speak. This is a strong bullish signal, and 30% APR lending has been an accurate signal of a major bull market for the last two years,” Greeks.live said.

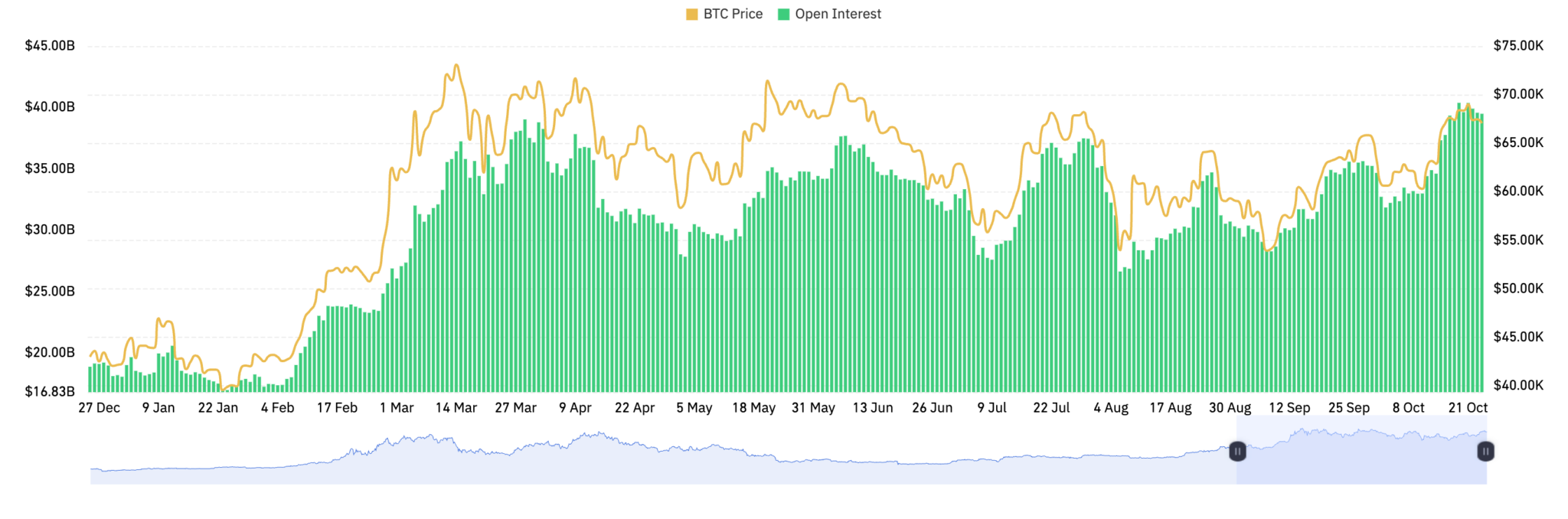

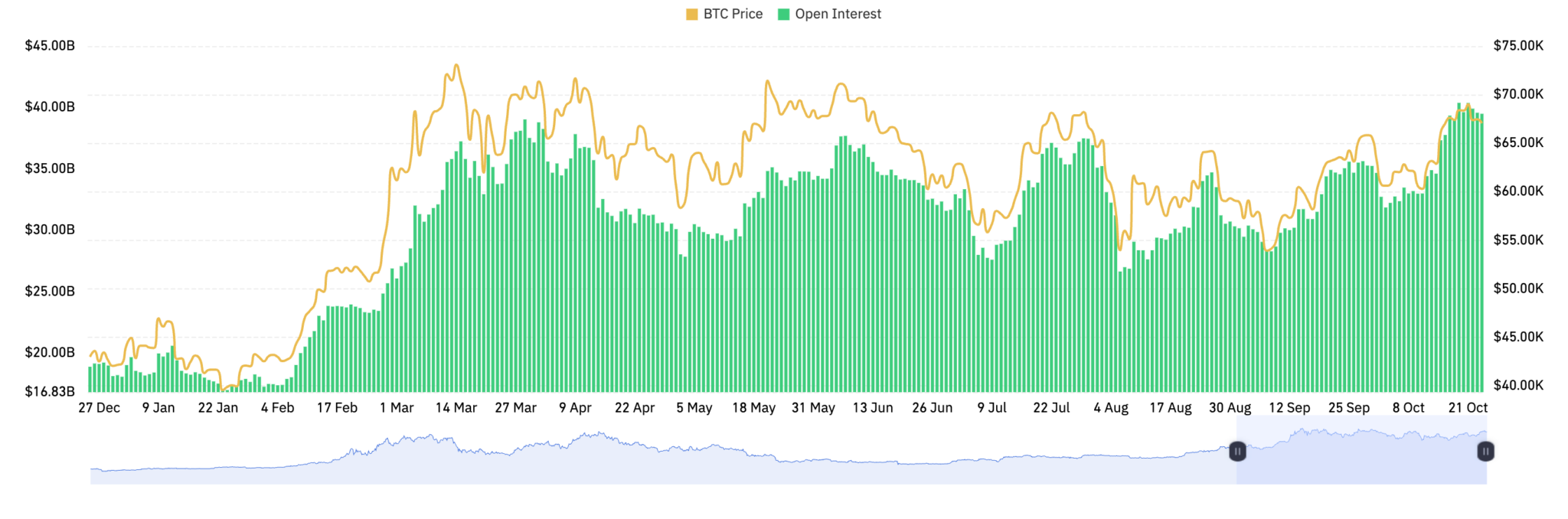

The futures market also indicates a potential bull market is on the horizon. According to Coinglass data, Bitcoin futures open interest surged to $40.5 billion yesterday.

Open interest refers to the total number of outstanding derivative contracts, like futures or options, that haven’t been settled yet. This level of spike in open interest also appeared back in July when Bitcoin hit $70,000.

However, a sharp rise in open interest also suggests increased leverage in the system, which can lead to rapid price drops if the market shifts.

If Bitcoin’s price suddenly declines, it could trigger cascading liquidations, where leveraged positions are forced to sell, potentially causing significant price corrections like the 20% drop in August.

The high crypto lending rates at Bitfinex could also be risky If prices move against heavily leveraged positions. It can result in significant losses for borrowers and systemic price shocks.

Crypto lending rates have soared up to 30% APR (annual percentage rate) on Bitfinex today, which is nearly three times the exchange’s average interest rate. This indicates that traders are confident in significant price increases.

Greeks.live observed several orders on Bitfinex exceeding 21% and reaching up to 30% APR for short-term loans. This suggests that large spot traders—those who trade actual crypto assets rather than derivatives—are heavily increasing their positions.

Crypto Lending Rates Have Been a Consistent Indicator for Bull Markets

A 30% APR lending rate has been a reliable indicator of a major bull market for the last two years. When borrowing costs spike to this level, it usually coincides with strong market rallies.

Despite a minor pullback in the market today, large spot traders are significantly increasing their holdings. Traders borrowing at high rates believe the potential gains outweigh the borrowing costs, further fueling market optimism.

“With a small pullback in the market, the big spot traders have started to add to their positions in a big way, so to speak. This is a strong bullish signal, and 30% APR lending has been an accurate signal of a major bull market for the last two years,” Greeks.live said.

The futures market also indicates a potential bull market is on the horizon. According to Coinglass data, Bitcoin futures open interest surged to $40.5 billion yesterday.

Open interest refers to the total number of outstanding derivative contracts, like futures or options, that haven’t been settled yet. This level of spike in open interest also appeared back in July when Bitcoin hit $70,000.

However, a sharp rise in open interest also suggests increased leverage in the system, which can lead to rapid price drops if the market shifts.

If Bitcoin’s price suddenly declines, it could trigger cascading liquidations, where leveraged positions are forced to sell, potentially causing significant price corrections like the 20% drop in August.

The high crypto lending rates at Bitfinex could also be risky If prices move against heavily leveraged positions. It can result in significant losses for borrowers and systemic price shocks.