Yesterday, Dec. 10, BlackRock’s Ethereum ETF (ETHA) made a big splash, landing in the top four ETF launches of 2024, according to Nate Geraci, President of the ETF Store. With a daily net inflow of around $81.6574 million, ETHA has seen consistent growth over the past 12 days, making it a key player in the highly competitive cryptocurrency landscape.

Yesterday’s data showed that total net inflows for spot Ethereum ETFs reached about $305.74 million. Of this, BlackRock’s ETHA accounted for a big chunk of change – $81.65 million – while Fidelity’s ETF (FETH) led the pack with $202 million.

Make that 8 straight days of inflows into iShares Ethereum ETF…

Over $1bil total.

Top 4 ETF launch of 2024 (out of approx 675 ETFs). https://t.co/5LKWrDdfjw

— Nate Geraci (@NateGeraci) December 11, 2024

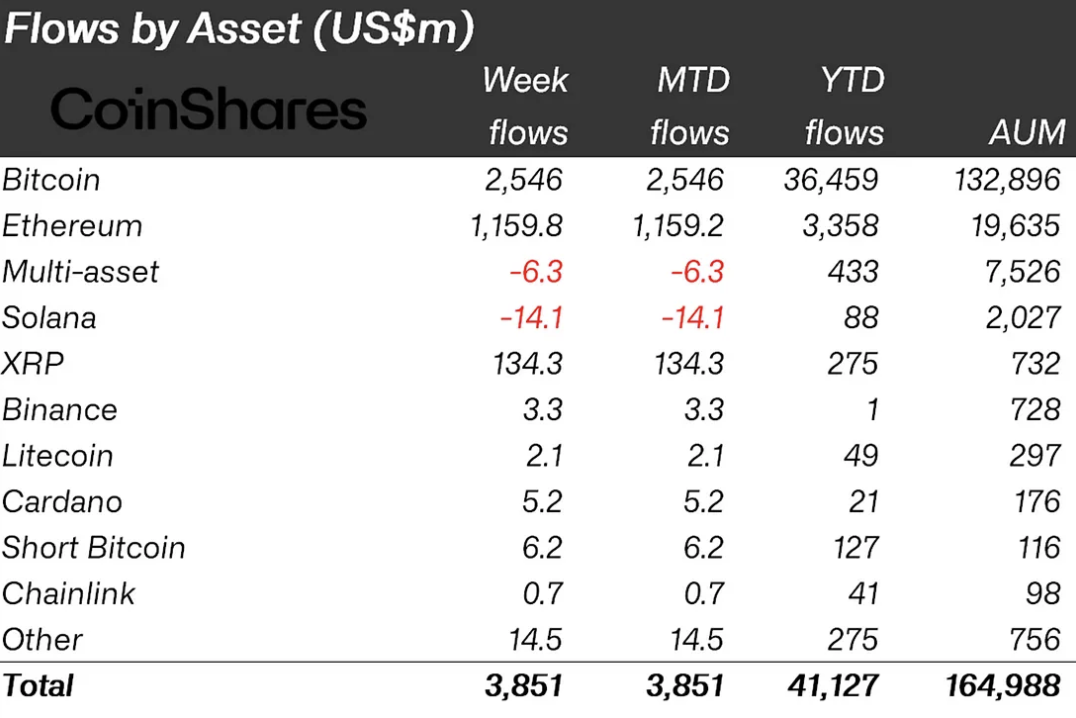

As BlackRock’s ETHA continues to gain ground, its success reflects broader trends in the cryptocurrency investment space. Ethereum-focused investment products saw record-breaking inflows this week, reaching a total of $1.2 billion and exceeding previous highs set in July.

Will BlackRock launch Solana (SOL) ETF, though?

This has led to a drop in Solana, which has seen $14 million in outflows for two weeks running, according to CoinShares analyst James Butterfill.

BlackRock’s overall performance has also been pretty impressive. Its Bitcoin ETF, IBIT, is now equal to the combined size of 50 European-based ETFs, which shows that its influence extends beyond just Ethereum investments.

Meanwhile, ETHA is in the top four for ETF launches, just behind leaders like IBIT and FBTC. It has strong momentum and could close the gap before the end of the year and come in third among all ETFs.

BlackRock’s Ethereum ETF has carved out a distinct space in a competitive market, giving investors a way to gain exposure to Ethereum’s growth. With its steady inflows and increasing visibility, ETHA is shaping up to be a strong contender in the landscape of digital asset investing.