MKR, the governance token of the leading stablecoin lender MakerDAO, has experienced a sharp decline in recent weeks. It currently trades at $1,206, noting an 11% price drop over the past week.

The altcoin now trades at its lowest price since September 2023. If the downward trend continues, MKR’s price could fall below $1,000 for the first time since 2023. This analysis explains why.

Maker Holders May Be in Trouble

Since August, MKR has traded below its Ichimoku Cloud. This indicator tracks the momentum of its market trends and identifies potential support/resistance levels.

Read More: What Are Tokenized Real-World Assets (RWA)?

When an asset’s price falls below it, it signals a shift from a bullish to a bearish trend. If the price consistently stays beneath this cloud, it strengthens the downtrend. It suggests that a recovery above the cloud may be challenging unless driven by a significant increase in new demand.

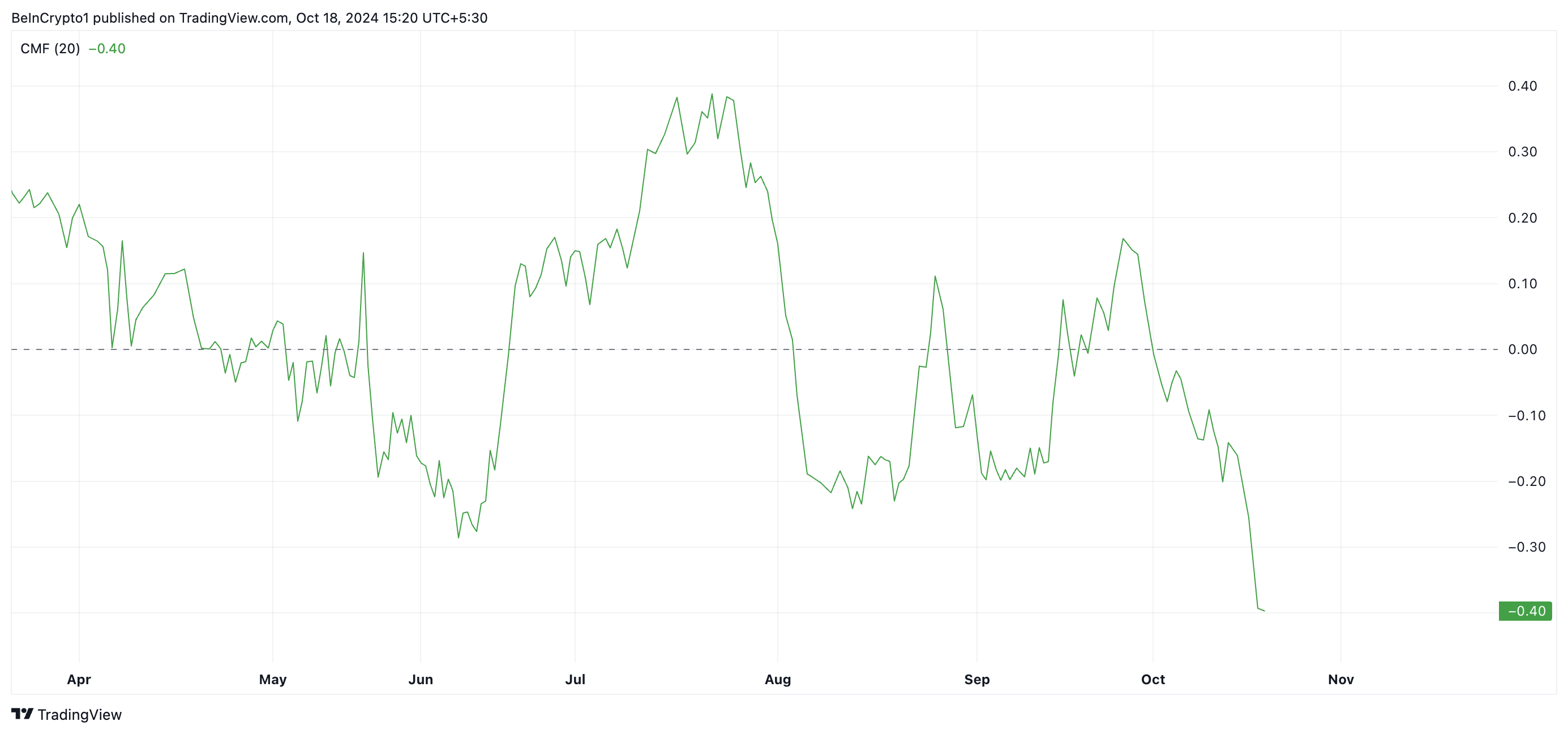

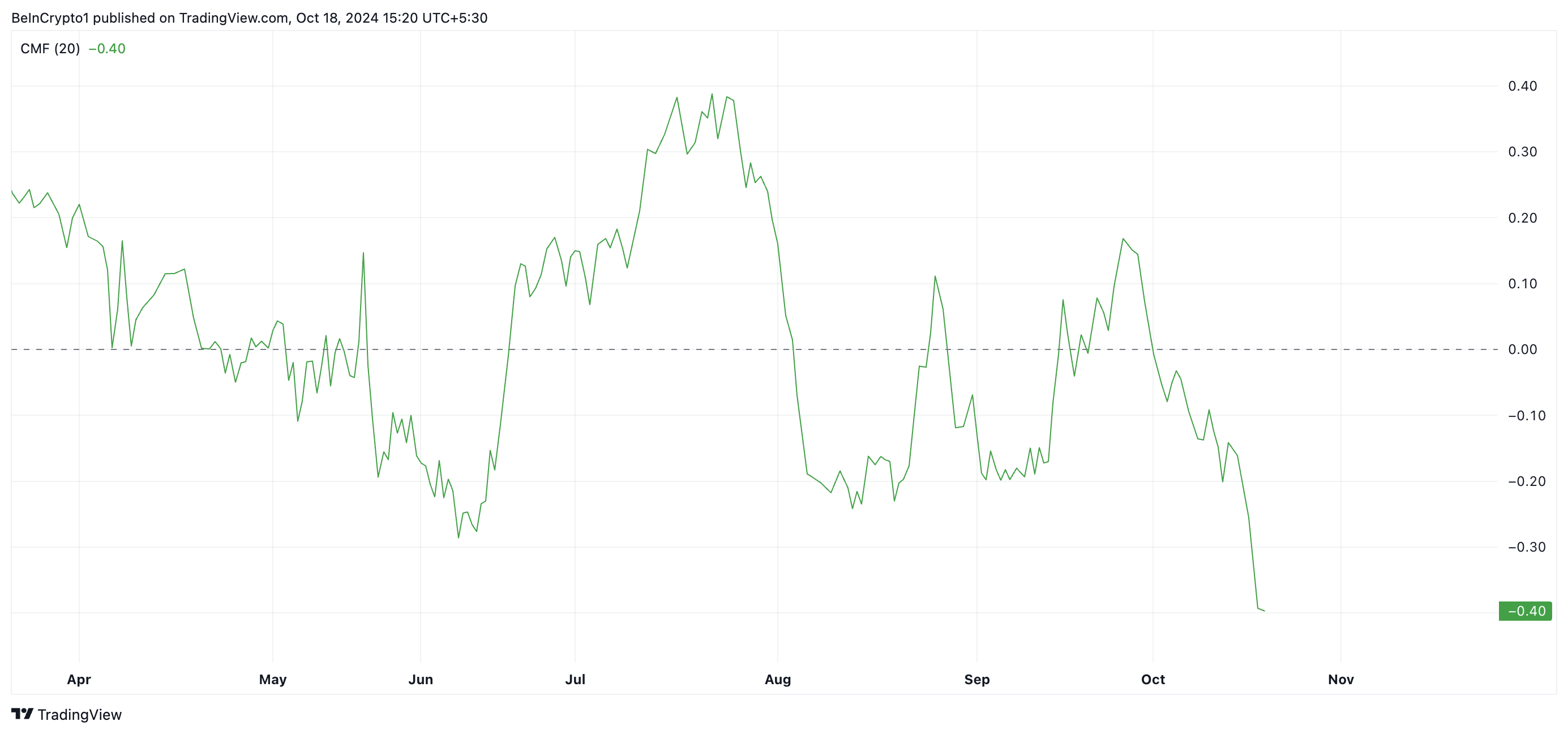

However, such new demand has been lacking in the MKR market for several weeks, as evidenced by its plummeting Chaikin Money Flow (CMF). This indicator, which measures how money flows into and out of an asset, is at -0.40, MKR’s lowest since August 2022.

When an asset’s CMF drops along with its price, it indicates weakening buying pressure and growing selling momentum. This alignment between price decline and a falling CMF reinforces the bearish outlook in the market. It signals that capital is flowing out of the asset, making a recovery less likely without a shift in market sentiment.

MKR Price Prediction: Sentiment Has To Shift

As of this writing, MKR is trading at $1,206. Based on readings from the altcoin’s Fibonacci Retracement tool, with the increasing selling pressure, MKR’s price could fall toward $511, marking its lowest level since May 2023.

Read More: Maker (MKR) Price Prediction 2023/2025/2030

However, this downward projection could be invalidated if market sentiment shifts from bearish to bullish. In that case, MKR’s price may attempt to break through the resistance levels formed by its Ichimoku Cloud at $1,954 and $2,632. A successful breakout could set the stage for a potential rally toward a six-month high of $4,118.

MKR, the governance token of the leading stablecoin lender MakerDAO, has experienced a sharp decline in recent weeks. It currently trades at $1,206, noting an 11% price drop over the past week.

The altcoin now trades at its lowest price since September 2023. If the downward trend continues, MKR’s price could fall below $1,000 for the first time since 2023. This analysis explains why.

Maker Holders May Be in Trouble

Since August, MKR has traded below its Ichimoku Cloud. This indicator tracks the momentum of its market trends and identifies potential support/resistance levels.

Read More: What Are Tokenized Real-World Assets (RWA)?

When an asset’s price falls below it, it signals a shift from a bullish to a bearish trend. If the price consistently stays beneath this cloud, it strengthens the downtrend. It suggests that a recovery above the cloud may be challenging unless driven by a significant increase in new demand.

However, such new demand has been lacking in the MKR market for several weeks, as evidenced by its plummeting Chaikin Money Flow (CMF). This indicator, which measures how money flows into and out of an asset, is at -0.40, MKR’s lowest since August 2022.

When an asset’s CMF drops along with its price, it indicates weakening buying pressure and growing selling momentum. This alignment between price decline and a falling CMF reinforces the bearish outlook in the market. It signals that capital is flowing out of the asset, making a recovery less likely without a shift in market sentiment.

MKR Price Prediction: Sentiment Has To Shift

As of this writing, MKR is trading at $1,206. Based on readings from the altcoin’s Fibonacci Retracement tool, with the increasing selling pressure, MKR’s price could fall toward $511, marking its lowest level since May 2023.

Read More: Maker (MKR) Price Prediction 2023/2025/2030

However, this downward projection could be invalidated if market sentiment shifts from bearish to bullish. In that case, MKR’s price may attempt to break through the resistance levels formed by its Ichimoku Cloud at $1,954 and $2,632. A successful breakout could set the stage for a potential rally toward a six-month high of $4,118.