ETF Foundation president Nate Geraci has predicted that asset manager Vanguard Group will soon allow access to spot Bitcoin and Ethereum exchange-traded funds on its brokerage platform. In a post on X, Geraci said he expects Vanguard to reverse its refusal to allow these ETFs.

The comment follows the recent performance of the spot Bitcoin ETFs, which have attracted little mainstream attention due to massive daily inflows into the products after Donald Trump’s victory. If the current trend persists, Geraci believes Vanguard will allow its customers access to the ETFs by 2025.

Geraci said:

“Think Salim forward-thinking enough. It’s one thing not to offer spot crypto ETFs. It’s another to block them from your clients. Just an all-around bad look IMO.”

However, he noted that if Bitcoin saw a massive drop of almost 90% before that time, he expected Vanguard to be very pleased with its decision not to allow clients exposure to crypto investment products. Senior ETF analyst at Bloomberg James Seyffart also agreed with this view, noting that he believes this is what the firm should do.

Vanguard maintains its stance on Crypto ETFs

Vanguard, known for its cautious approach to crypto-related investment products, remains one of the few major asset managers that has excluded Bitcoin and Ethereum ETFs from its offerings. The firm, which manages $7 trillion in assets and serves nearly 50 million clients, has avoided issuing crypto ETFs and blocked clients from purchasing them.

This stance has drawn criticism from the crypto community. Many argue that Vanguard is lagging behind competitors like BlackRock, Fidelity, and Charles Schwab, which have embraced crypto ETFs. Bloomberg analyst Eric Balchunas described Vanguard’s position as “unnecessary,” especially given the growing success of Bitcoin ETFs.

Vanguard CEO Salim Ramji has defended the firm’s approach. Speaking in August 2024, Ramji reiterated that Vanguard prioritizes protecting clients from volatile asset classes. He emphasized that crypto, despite being classified as a commodity, remains speculative and lacks inherent economic value. Vanguard’s Head of ETFs, Janel Jackson echoed these concerns, stating that crypto’s immaturity as an asset class poses significant risks.

He said:

“While crypto has been classified as a commodity, it’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.”

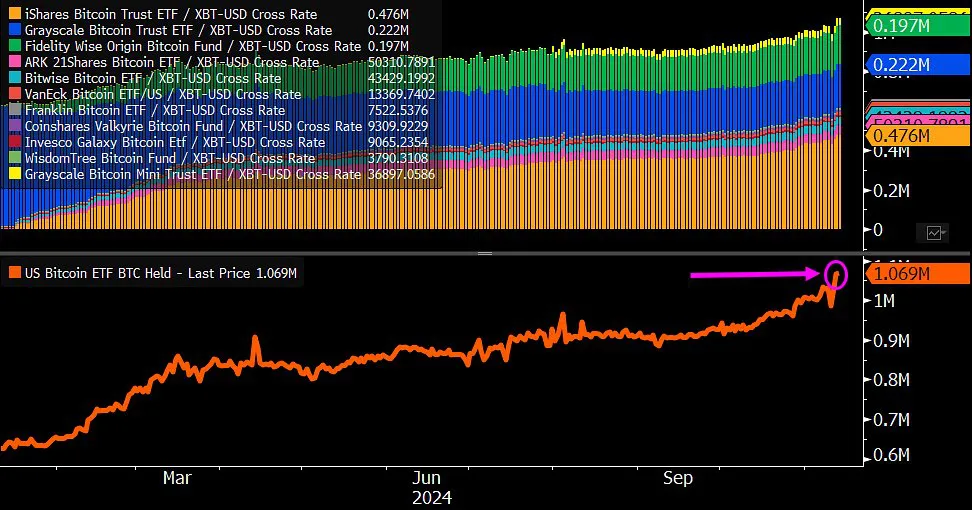

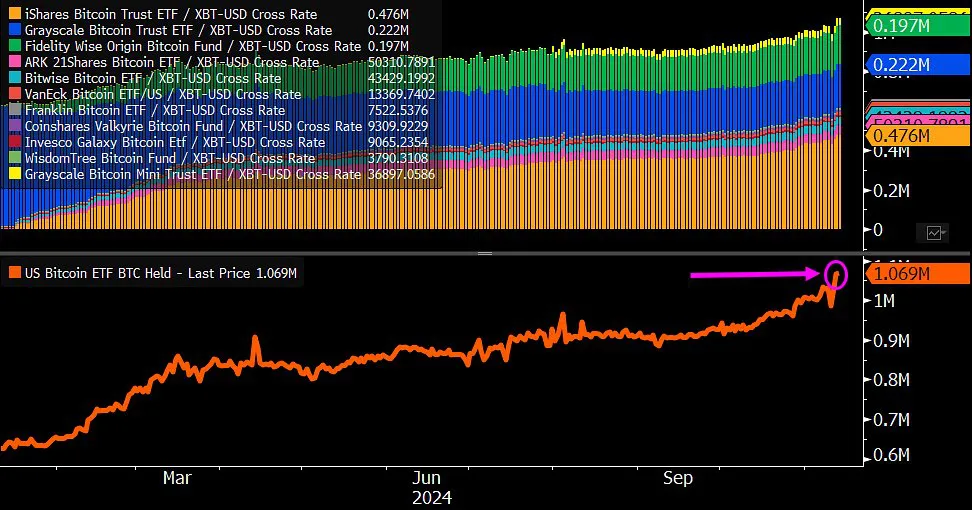

US spot Bitcoin ETFs now own 1.07 million ETFs

Meanwhile, the amount of Bitcoin held by the ten issuers has reached 1.07 million BTC after the massive inflows into the product since Trump was announced as the winner of the US elections. Between November 11 and November 13, the Bitcoin ETFs saw a net inflow of $2.44 billion but recorded outflows of over $400 million yesterday.

Seyfarrt, who shared the information, noted that the US spot Bitcoin ETFs could soon hold more Bitcoin than the estimated 1.1 million that Satoshi is holding. BlackRock IBIT remains the biggest Bitcoin ETF and recently reached $40 billion in assets within two weeks of hitting $30 billion.

The product achieved this milestone in a record 211 days and is now a top 1% ETF by assets within just 10 months of launch, bigger than all the 2,800 ETFs launched in the last 10 years.

ETF Foundation president Nate Geraci has predicted that asset manager Vanguard Group will soon allow access to spot Bitcoin and Ethereum exchange-traded funds on its brokerage platform. In a post on X, Geraci said he expects Vanguard to reverse its refusal to allow these ETFs.

The comment follows the recent performance of the spot Bitcoin ETFs, which have attracted little mainstream attention due to massive daily inflows into the products after Donald Trump’s victory. If the current trend persists, Geraci believes Vanguard will allow its customers access to the ETFs by 2025.

Geraci said:

“Think Salim forward-thinking enough. It’s one thing not to offer spot crypto ETFs. It’s another to block them from your clients. Just an all-around bad look IMO.”

However, he noted that if Bitcoin saw a massive drop of almost 90% before that time, he expected Vanguard to be very pleased with its decision not to allow clients exposure to crypto investment products. Senior ETF analyst at Bloomberg James Seyffart also agreed with this view, noting that he believes this is what the firm should do.

Vanguard maintains its stance on Crypto ETFs

Vanguard, known for its cautious approach to crypto-related investment products, remains one of the few major asset managers that has excluded Bitcoin and Ethereum ETFs from its offerings. The firm, which manages $7 trillion in assets and serves nearly 50 million clients, has avoided issuing crypto ETFs and blocked clients from purchasing them.

This stance has drawn criticism from the crypto community. Many argue that Vanguard is lagging behind competitors like BlackRock, Fidelity, and Charles Schwab, which have embraced crypto ETFs. Bloomberg analyst Eric Balchunas described Vanguard’s position as “unnecessary,” especially given the growing success of Bitcoin ETFs.

Vanguard CEO Salim Ramji has defended the firm’s approach. Speaking in August 2024, Ramji reiterated that Vanguard prioritizes protecting clients from volatile asset classes. He emphasized that crypto, despite being classified as a commodity, remains speculative and lacks inherent economic value. Vanguard’s Head of ETFs, Janel Jackson echoed these concerns, stating that crypto’s immaturity as an asset class poses significant risks.

He said:

“While crypto has been classified as a commodity, it’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.”

US spot Bitcoin ETFs now own 1.07 million ETFs

Meanwhile, the amount of Bitcoin held by the ten issuers has reached 1.07 million BTC after the massive inflows into the product since Trump was announced as the winner of the US elections. Between November 11 and November 13, the Bitcoin ETFs saw a net inflow of $2.44 billion but recorded outflows of over $400 million yesterday.

Seyfarrt, who shared the information, noted that the US spot Bitcoin ETFs could soon hold more Bitcoin than the estimated 1.1 million that Satoshi is holding. BlackRock IBIT remains the biggest Bitcoin ETF and recently reached $40 billion in assets within two weeks of hitting $30 billion.

The product achieved this milestone in a record 211 days and is now a top 1% ETF by assets within just 10 months of launch, bigger than all the 2,800 ETFs launched in the last 10 years.