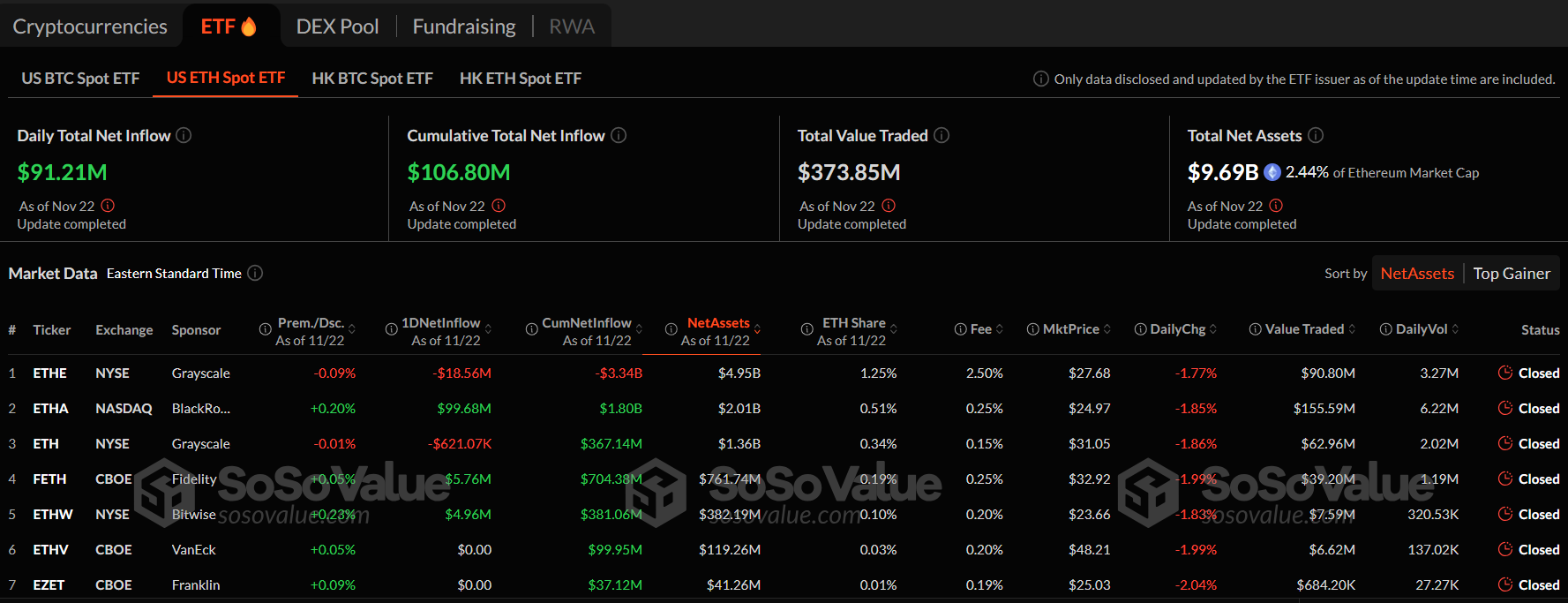

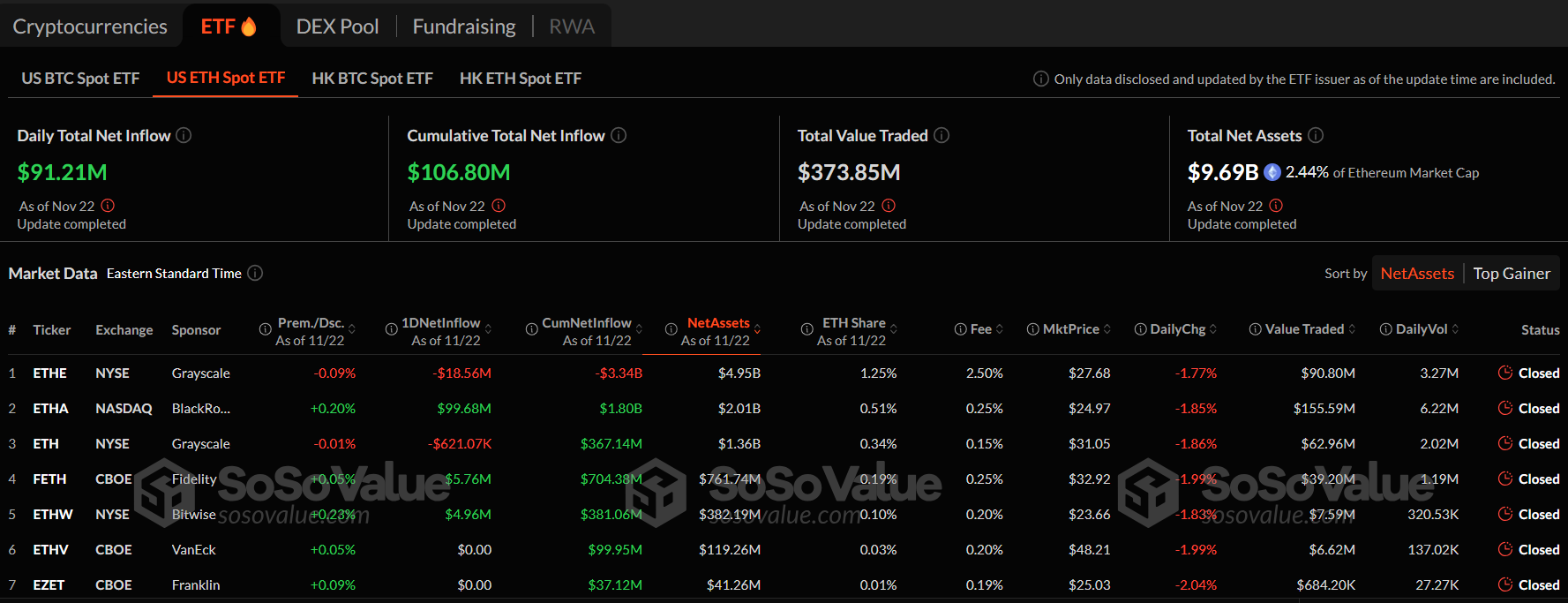

Ethereum Spot ETF inflows surged to $91.2 million, reversing six consecutive days of outflows. BlackRock’s Ethereum ETF (ETHA) significantly contributed to this trend. The exchange-traded fund saw a notable single-day inflow of $99.67 million, reinforcing Ethereum’s position in institutional portfolios.

This inflow pushed its total historical net inflow to $1.80 billion. Following was Fidelity’s FETH, which saw a net inflow of $5.76 million, bringing its total historical net inflow to $704 million.

Grayscale Ethereum Trust ETF ETHE had a net outflow of $18.5621 million yesterday, and its historical net outflow is currently $3.338 billion. Grayscale Ethereum Mini Trust ETF had a net outflow of $620,000 yesterday, and its historical total net inflow is $367 million.

Ethereum spot ETF inflows surge, signaling increased institutional confidence

On November 22nd, Ethereum Spot ETF inflowsrebounded substantially following six days of outflows. This return to positive inflows reflects increased investor interest in Ethereum as a digital asset.

The renewed inflows demonstrate Ethereum’s growing popularity as a mainstream investment product. Such institutional support, for example, shows the growing desire for regulated investment choices related to blockchain assets. Sosovalue believes that this bodes well for Ethereum-based ETFs in the future.

As of the time of publication, the total net asset value of Ethereum spot ETFs is $9.687 billion, with an ETF net asset ratio (market value relative to the overall market value of Ethereum) of 2.44% and a historical cumulative net inflow of $107 million.

BTC Spot ETF inflows continue to dominate the market

Bitcoin Spot ETF inflows were robust, totaling $490M on November 22, marking five consecutive days of net inflows.

According to data from SoSoValue, spot Bitcoin ETFs in the US now have around $107.488 billion in total assets, far surpassing other crypto ETFs. Their assets now account for around 6% of the flagship cryptocurrency’s market capitalization.

BlackRock’s IBIT ETF contributed an astonishing single-day $513 million to demonstrate Bitcoin’s increasing status as the go-to investment.

The price of Bitcoin has moved up more than 167% over the past year to now trade at $98,598, a milestone achieved after the launch of these spot Bitcoin ETFs and after Republican candidate Donald Trump won the US presidential elections.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap

Ethereum Spot ETF inflows surged to $91.2 million, reversing six consecutive days of outflows. BlackRock’s Ethereum ETF (ETHA) significantly contributed to this trend. The exchange-traded fund saw a notable single-day inflow of $99.67 million, reinforcing Ethereum’s position in institutional portfolios.

This inflow pushed its total historical net inflow to $1.80 billion. Following was Fidelity’s FETH, which saw a net inflow of $5.76 million, bringing its total historical net inflow to $704 million.

Grayscale Ethereum Trust ETF ETHE had a net outflow of $18.5621 million yesterday, and its historical net outflow is currently $3.338 billion. Grayscale Ethereum Mini Trust ETF had a net outflow of $620,000 yesterday, and its historical total net inflow is $367 million.

Ethereum spot ETF inflows surge, signaling increased institutional confidence

On November 22nd, Ethereum Spot ETF inflowsrebounded substantially following six days of outflows. This return to positive inflows reflects increased investor interest in Ethereum as a digital asset.

The renewed inflows demonstrate Ethereum’s growing popularity as a mainstream investment product. Such institutional support, for example, shows the growing desire for regulated investment choices related to blockchain assets. Sosovalue believes that this bodes well for Ethereum-based ETFs in the future.

As of the time of publication, the total net asset value of Ethereum spot ETFs is $9.687 billion, with an ETF net asset ratio (market value relative to the overall market value of Ethereum) of 2.44% and a historical cumulative net inflow of $107 million.

BTC Spot ETF inflows continue to dominate the market

Bitcoin Spot ETF inflows were robust, totaling $490M on November 22, marking five consecutive days of net inflows.

According to data from SoSoValue, spot Bitcoin ETFs in the US now have around $107.488 billion in total assets, far surpassing other crypto ETFs. Their assets now account for around 6% of the flagship cryptocurrency’s market capitalization.

BlackRock’s IBIT ETF contributed an astonishing single-day $513 million to demonstrate Bitcoin’s increasing status as the go-to investment.

The price of Bitcoin has moved up more than 167% over the past year to now trade at $98,598, a milestone achieved after the launch of these spot Bitcoin ETFs and after Republican candidate Donald Trump won the US presidential elections.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap