The market capitalization of AI-related projects is showing a resurgence in October. While meme coins remain popular, data suggests that AI tokens could attract significant investment in the final months of the year.

It’s not just individual investors but also investment funds showing interest in early-stage AI projects.

Investors Turn Attention to AI Tokens Right After Meme Coins

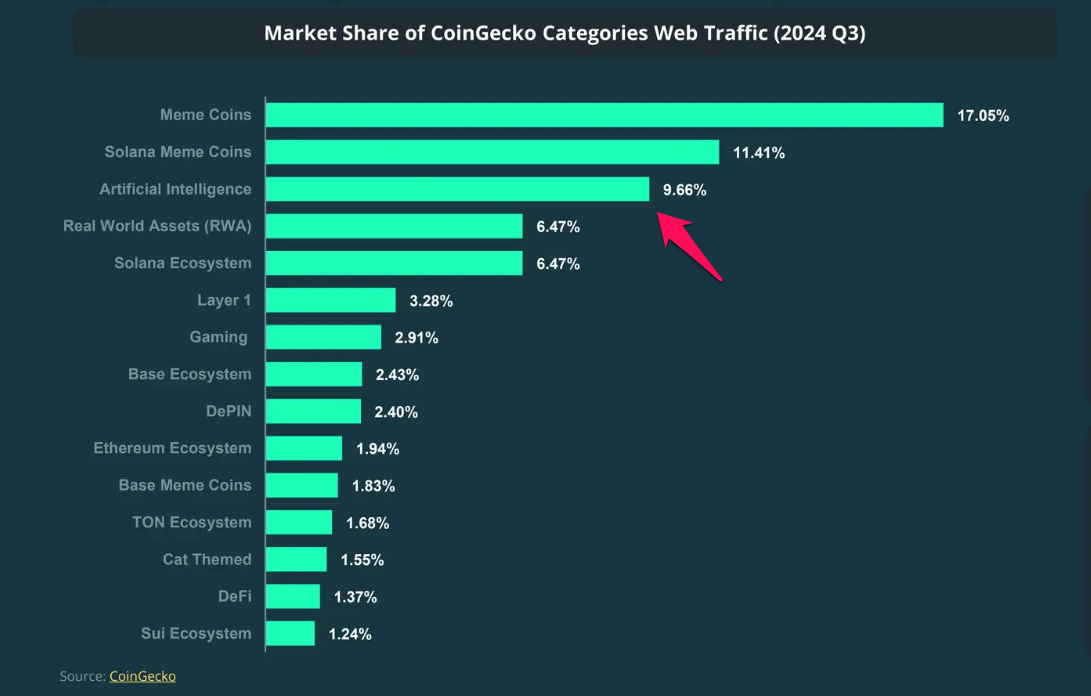

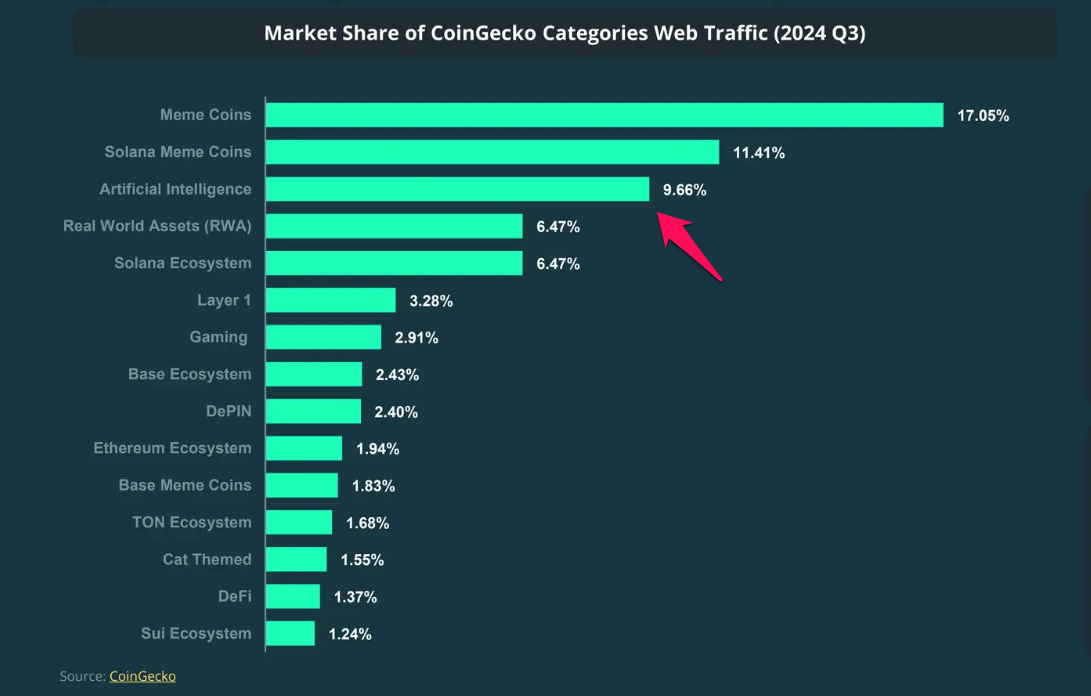

According to a recent report from CoinGecko, traffic to AI projects on the platform accounts for 9.66% of the total. With over 20 million monthly visits, this translates to roughly 2 million views for AI projects each month.

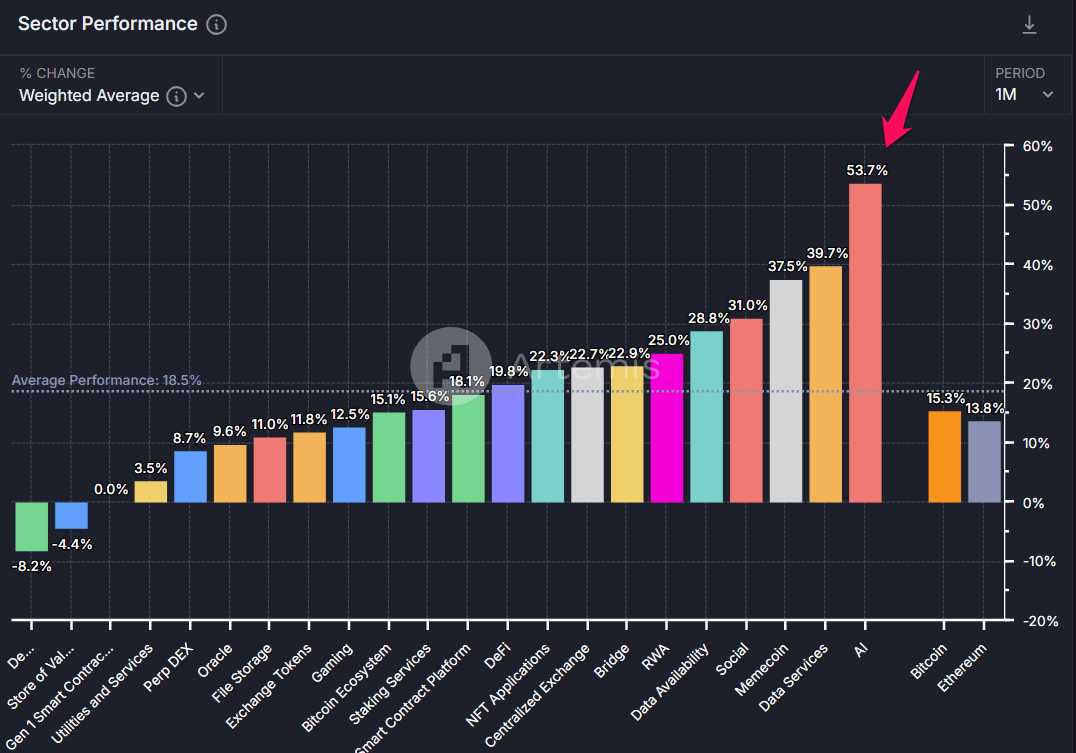

Despite this, interest in AI tokens still trails behind meme coins and Solana meme coins. However, October data from Artemis indicates that AI tokens have delivered superior price performance over the past 30 days.

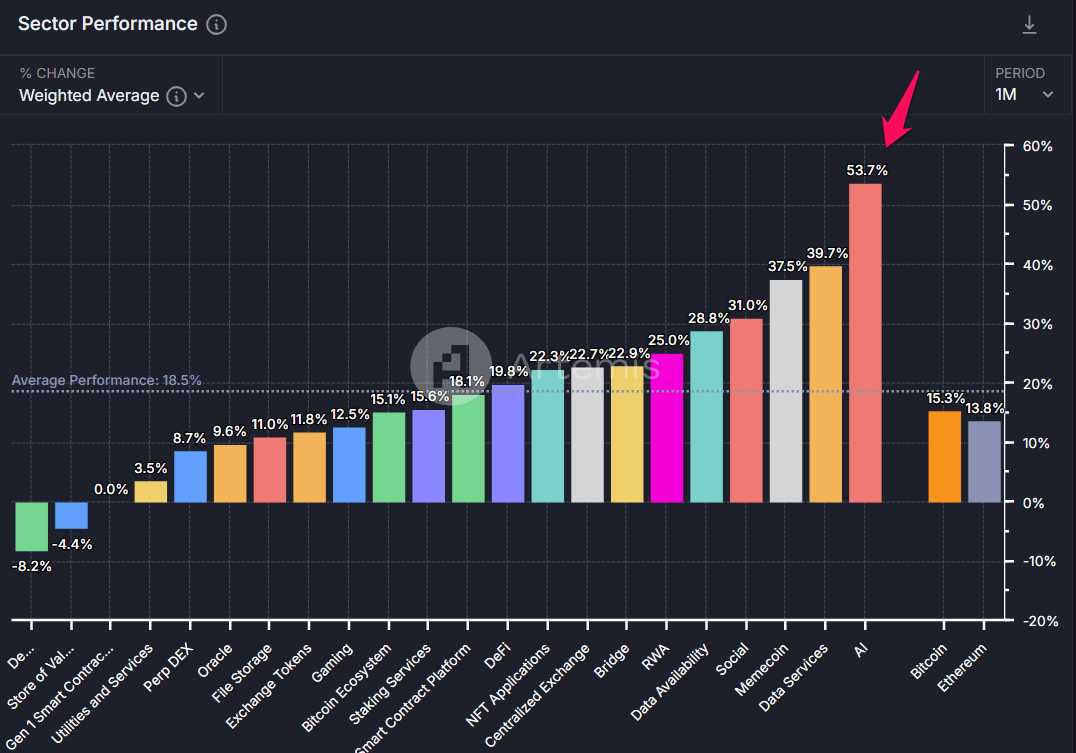

The AI coins portfolio tracked by Artemis has surged by 53.7%, three times the average increase across other sectors.

CoinMarketCap data shows AI coins’ market capitalization has more than doubled, rising from $18 billion in August to over $37 billion in October.

Additionally, daily trading volumes for AI coins have consistently remained above $2 billion throughout October, double the average of the previous two months. These figures reflect a growing demand among investors for AI tokens.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

AI is Among the Top 5 Sectors of Interest for VCs

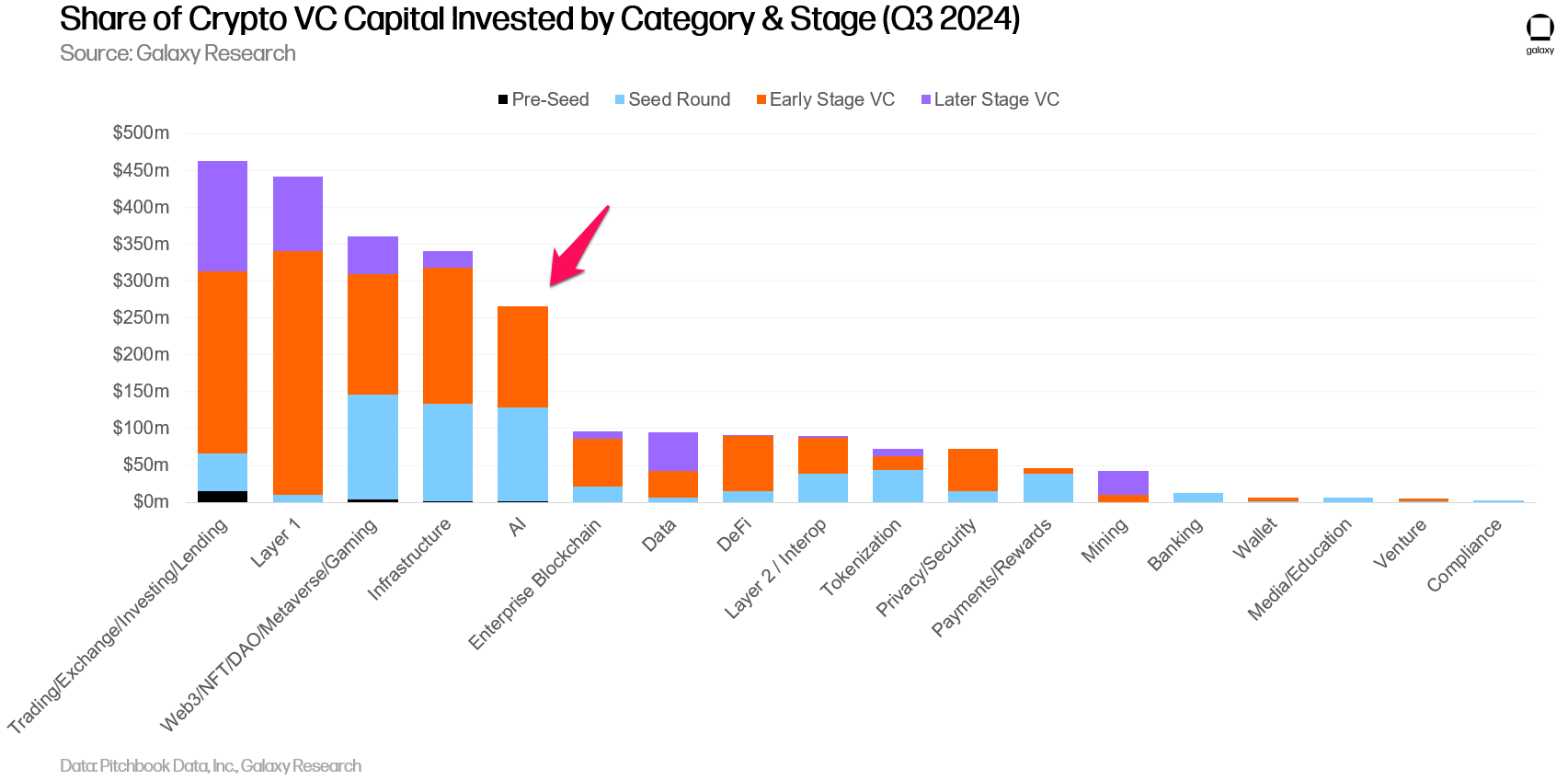

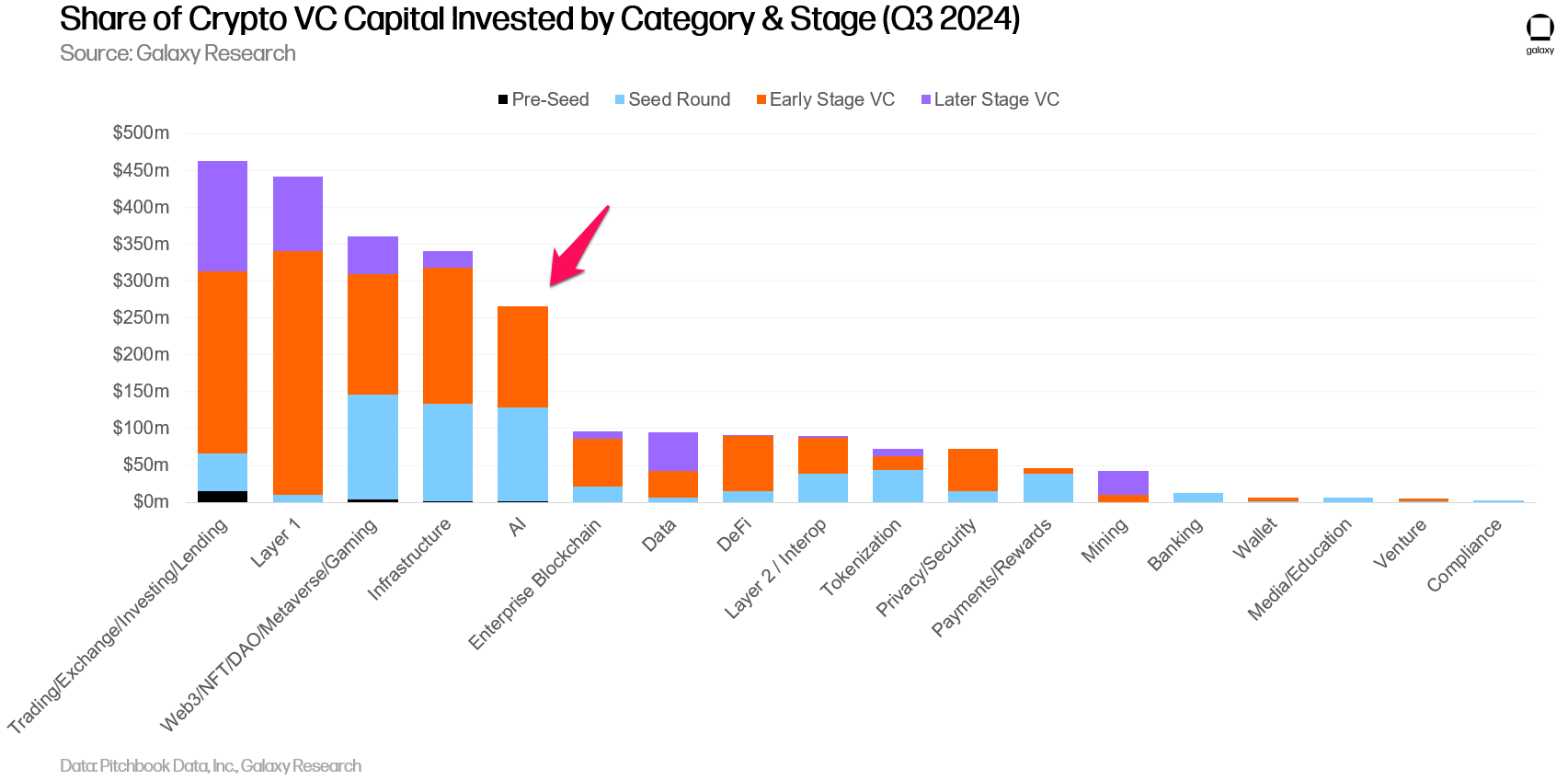

One key difference between AI coins and Meme coins is the level of interest from venture capital (VC) firms. According to a recent report from Galaxy, VCs are skeptical about the long-term value of meme coins, instead opting for sectors they believe hold greater potential.

The data shows AI as one of the top five sectors VCs focused on over the last quarter. Most investments in AI projects are at the Seed Round and Early Stage, signaling confidence in the sector’s long-term prospects.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Recently, VanEck, a New York-based investment management firm, launched VanEck Ventures, which focuses on cryptocurrencies and AI.

“Three inflection points core to our investment thesis are starting to reshape the foundation of the internet: stablecoins emerging as an open-source banking layer, the commoditization of blockspace, and AI breakthroughs.” Wyatt Lonergan, General Partner at VanEck Ventures, said.

The market capitalization of AI-related projects is showing a resurgence in October. While meme coins remain popular, data suggests that AI tokens could attract significant investment in the final months of the year.

It’s not just individual investors but also investment funds showing interest in early-stage AI projects.

Investors Turn Attention to AI Tokens Right After Meme Coins

According to a recent report from CoinGecko, traffic to AI projects on the platform accounts for 9.66% of the total. With over 20 million monthly visits, this translates to roughly 2 million views for AI projects each month.

Despite this, interest in AI tokens still trails behind meme coins and Solana meme coins. However, October data from Artemis indicates that AI tokens have delivered superior price performance over the past 30 days.

The AI coins portfolio tracked by Artemis has surged by 53.7%, three times the average increase across other sectors.

CoinMarketCap data shows AI coins’ market capitalization has more than doubled, rising from $18 billion in August to over $37 billion in October.

Additionally, daily trading volumes for AI coins have consistently remained above $2 billion throughout October, double the average of the previous two months. These figures reflect a growing demand among investors for AI tokens.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

AI is Among the Top 5 Sectors of Interest for VCs

One key difference between AI coins and Meme coins is the level of interest from venture capital (VC) firms. According to a recent report from Galaxy, VCs are skeptical about the long-term value of meme coins, instead opting for sectors they believe hold greater potential.

The data shows AI as one of the top five sectors VCs focused on over the last quarter. Most investments in AI projects are at the Seed Round and Early Stage, signaling confidence in the sector’s long-term prospects.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Recently, VanEck, a New York-based investment management firm, launched VanEck Ventures, which focuses on cryptocurrencies and AI.

“Three inflection points core to our investment thesis are starting to reshape the foundation of the internet: stablecoins emerging as an open-source banking layer, the commoditization of blockspace, and AI breakthroughs.” Wyatt Lonergan, General Partner at VanEck Ventures, said.