The value of one Bitcoin has now surpassed one kilogram (kg) of gold after the flagship digital asset surpassed $85,000. A kg of gold is trading at around $84,000 as the precious metal now trails Bitcoin.

Over the last 24 hours, BTC has increased by more than 10% and has now cemented its position over $89,000. This represents one of its biggest daily gains over the past seven days, leading to speculations that it could hit $100,000 before the month ends.

Bitcoin’s positive performance highlights the unrelenting upward movement of the crypto industry and financial marketers in general since Donald Trump was elected president. Over the last seven days, Bitcoin has increased by 30%, enough to cause the flagship asset to double in value year-to-date.

The flagship asset’s market cap has now reached $1.77 trillion, overtaking silver as the eighth biggest asset and poised to surpass Saudi Aramco, ranked seventh with $1.807 trillion. Many believe it will eventually overtake gold in market cap as well.

Bitcoin could see more growth in 2025

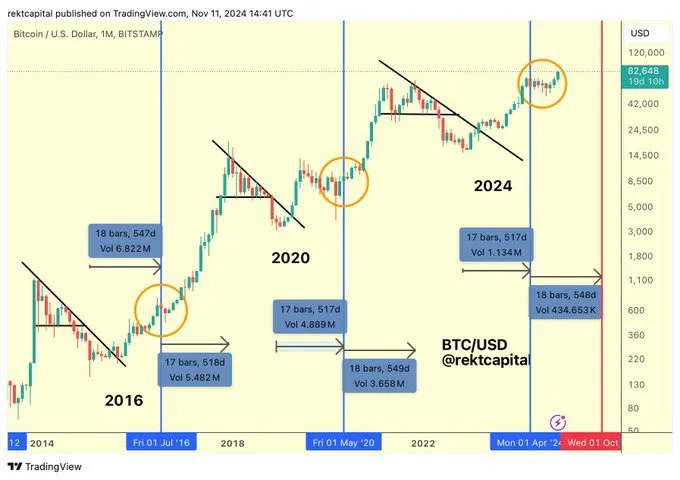

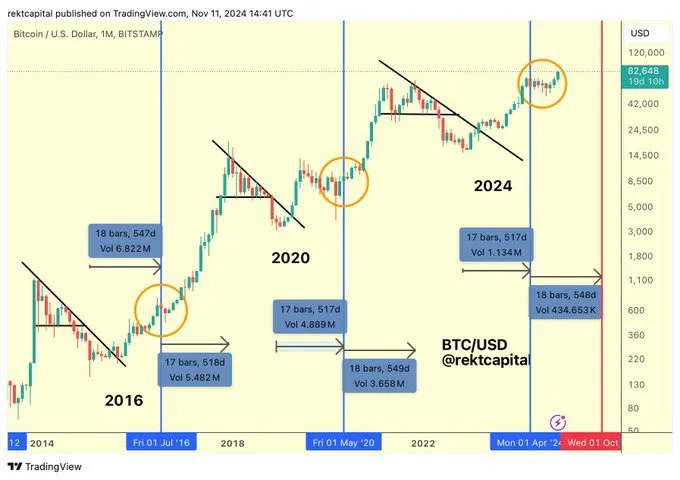

Market experts believe the recent rally is only the tip of the iceberg in terms of future Bitcoin price growth. According to crypto analyst Rekt Capital, the current bull market for Bitcoin might not peak until October 2025.

This prediction is based on a historical analysis of Bitcoin’s halving and the asset’s performance. In 2016, Bitcoin bottomed 547 days before the halving and reached its bull market top 518 days after. The same happened during the 2020 halving when Bitcoin bottomed 517 days before the event and topped 549 days after.

History now looks set to repeat itself, given that Bitcoin reached its lowest price 517 days before the 2024 halving.

Rekt Capital noted:

“Halving acts like a mirror. Bitcoin Bear Market Bottoms occur a similar amount of days prior to the Halving compared to the amount of days its takes for Bitcoin to form Bull Market Tops after the Halving.”

Meanwhile, many believe it is now a buyers’ market for Bitcoin, and more people will keep buying, which will continue driving up prices.

Bitcoin analyst Vijay Boyapati noted that the asset spent 6 months absorbing sell-offs from holders such as Mt Gox, the German government, and other bankruptcy liquidations, and now, there are no major sellers left.

He said:

“There are no major sellers left, only buyers. Liquidity on the upside will likely only show up at much higher prices. It may take some time, but once 100k is breached the “frenzy” stage of the bull market will begin as the media finally.”

Boyapati added that the FTX refund could boost Bitcoin prices as the distribution is in dollars, and most creditors will seek exposure to BTC after missing two years of upside.

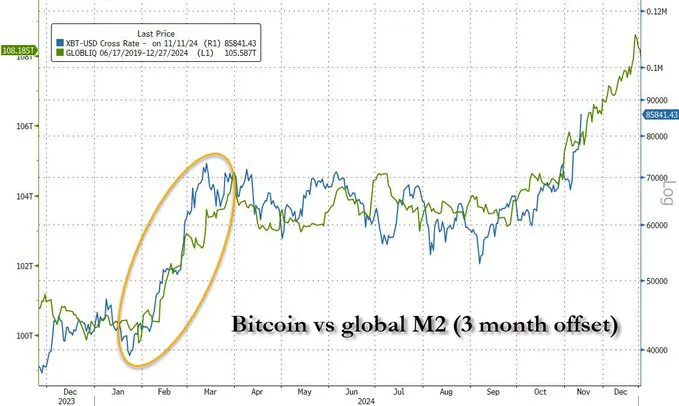

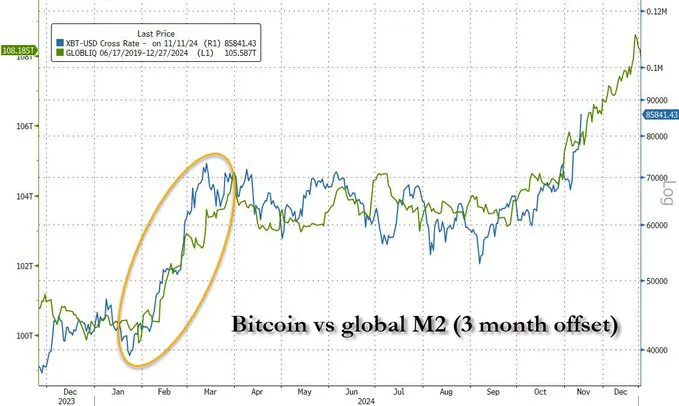

Additionally, analysts such as Vivek Sun have established a correlation between Bitcoin prices and global liquidity, noting that a return to monetary expansionist policies always brings higher prices for Bitcoin. With several central banks embracing the quantitative easing trend, ZeroHedge on X noted that the correlation has held true.

Meanwhile, there are also increasingly positive signs that the US could create a Strategic Bitcoin Reserve. Bitcoin Magazine CEO David Bailey noted that this is the most important crypto industry policy for the Trump administration. Senator Cynthia Lummis, who proposed the Bitcoin National Reserve Act, also agreed. She noted that the bill could get bipartisan support within the first 100 days as long as the people support it.

Bitcoin-related products see a massive uptick in trading volume

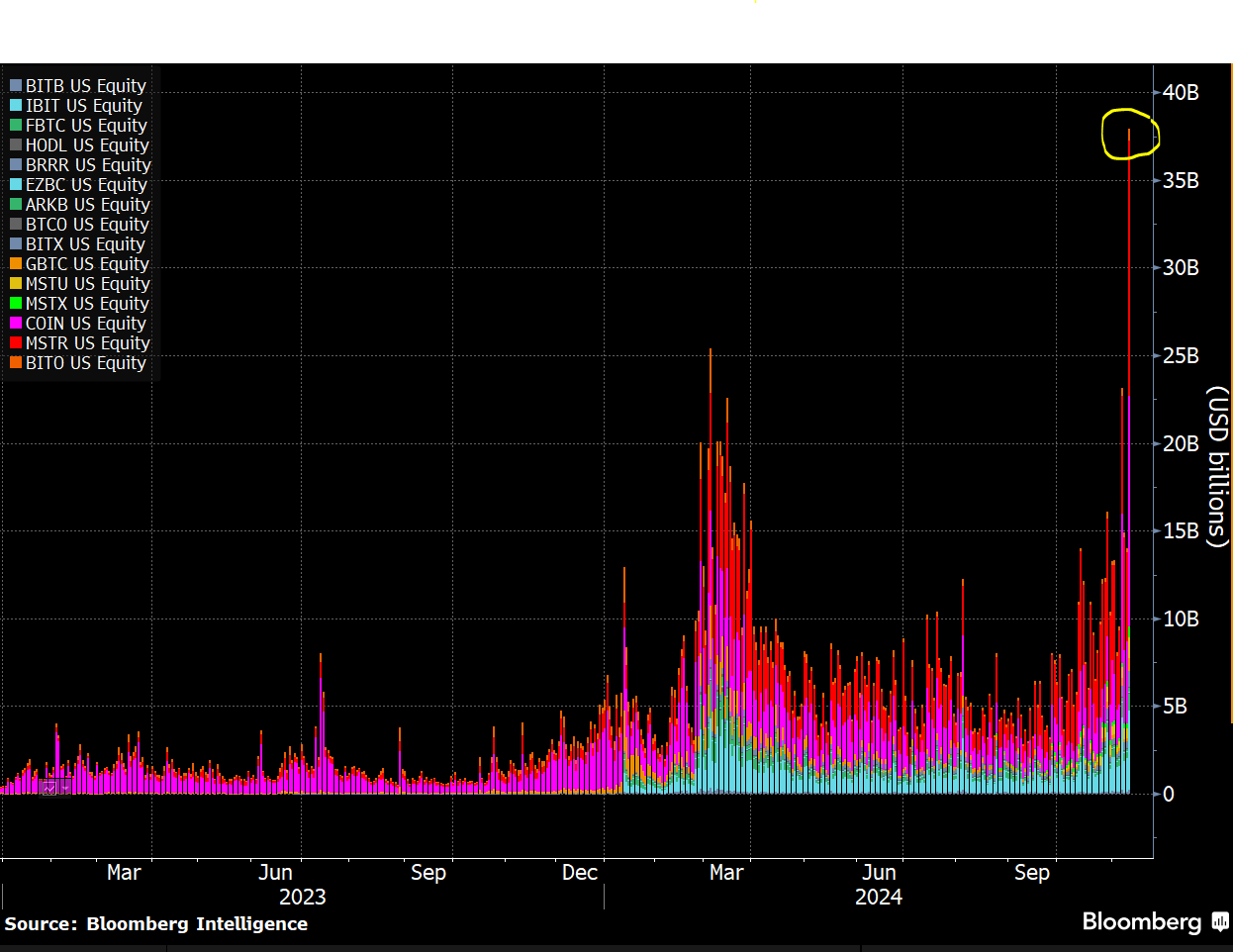

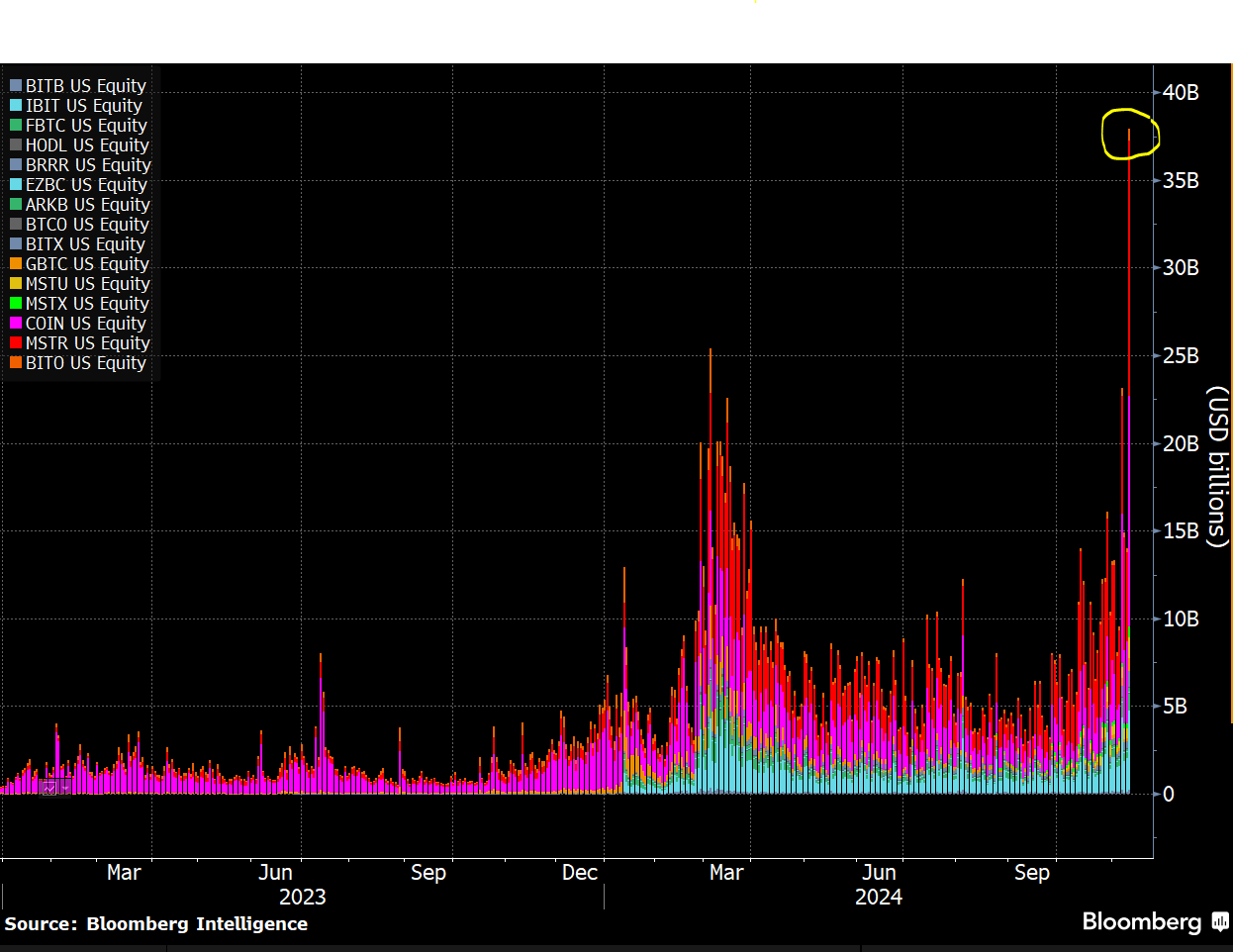

The positive performance of BTC has impacted other crypto-related assets and products. Bloomberg analyst Eric Balchunas observed that the Bitcoin Industrial Complex, which includes the exchange-traded funds (ETFs), MicroStrategy MSTR, and Coinbase COIN, saw a combined trading volume of $38 billion on November 11.

Bitcoin ETFs and equities see $38 billion in volume – Eric BalchunasBalchunas noted that this volume is record-breaking for the asset class, with BlackRock IBIT ETF alone seeing $4.5 billion, while Fidelity FBTC recorded over $1 billion. Bitcoin ETFs saw $7.2 billion in trading volume that day, the highest daily volume since March 14, highlighting the robust week of inflows for the products.

Meanwhile, MicroStrategy, which recently announced a $2 billion acquisition of BTC, also saw $13 billion in trading volume for MSTR, the biggest daily volume ever. Coinbase has also benefited from the renewed interest in BTC, with the platform now ranked 33 in the list of top apps on the Apple App Store. This is its highest rank since February 2022.

The value of one Bitcoin has now surpassed one kilogram (kg) of gold after the flagship digital asset surpassed $85,000. A kg of gold is trading at around $84,000 as the precious metal now trails Bitcoin.

Over the last 24 hours, BTC has increased by more than 10% and has now cemented its position over $89,000. This represents one of its biggest daily gains over the past seven days, leading to speculations that it could hit $100,000 before the month ends.

Bitcoin’s positive performance highlights the unrelenting upward movement of the crypto industry and financial marketers in general since Donald Trump was elected president. Over the last seven days, Bitcoin has increased by 30%, enough to cause the flagship asset to double in value year-to-date.

The flagship asset’s market cap has now reached $1.77 trillion, overtaking silver as the eighth biggest asset and poised to surpass Saudi Aramco, ranked seventh with $1.807 trillion. Many believe it will eventually overtake gold in market cap as well.

Bitcoin could see more growth in 2025

Market experts believe the recent rally is only the tip of the iceberg in terms of future Bitcoin price growth. According to crypto analyst Rekt Capital, the current bull market for Bitcoin might not peak until October 2025.

This prediction is based on a historical analysis of Bitcoin’s halving and the asset’s performance. In 2016, Bitcoin bottomed 547 days before the halving and reached its bull market top 518 days after. The same happened during the 2020 halving when Bitcoin bottomed 517 days before the event and topped 549 days after.

History now looks set to repeat itself, given that Bitcoin reached its lowest price 517 days before the 2024 halving.

Rekt Capital noted:

“Halving acts like a mirror. Bitcoin Bear Market Bottoms occur a similar amount of days prior to the Halving compared to the amount of days its takes for Bitcoin to form Bull Market Tops after the Halving.”

Meanwhile, many believe it is now a buyers’ market for Bitcoin, and more people will keep buying, which will continue driving up prices.

Bitcoin analyst Vijay Boyapati noted that the asset spent 6 months absorbing sell-offs from holders such as Mt Gox, the German government, and other bankruptcy liquidations, and now, there are no major sellers left.

He said:

“There are no major sellers left, only buyers. Liquidity on the upside will likely only show up at much higher prices. It may take some time, but once 100k is breached the “frenzy” stage of the bull market will begin as the media finally.”

Boyapati added that the FTX refund could boost Bitcoin prices as the distribution is in dollars, and most creditors will seek exposure to BTC after missing two years of upside.

Additionally, analysts such as Vivek Sun have established a correlation between Bitcoin prices and global liquidity, noting that a return to monetary expansionist policies always brings higher prices for Bitcoin. With several central banks embracing the quantitative easing trend, ZeroHedge on X noted that the correlation has held true.

Meanwhile, there are also increasingly positive signs that the US could create a Strategic Bitcoin Reserve. Bitcoin Magazine CEO David Bailey noted that this is the most important crypto industry policy for the Trump administration. Senator Cynthia Lummis, who proposed the Bitcoin National Reserve Act, also agreed. She noted that the bill could get bipartisan support within the first 100 days as long as the people support it.

Bitcoin-related products see a massive uptick in trading volume

The positive performance of BTC has impacted other crypto-related assets and products. Bloomberg analyst Eric Balchunas observed that the Bitcoin Industrial Complex, which includes the exchange-traded funds (ETFs), MicroStrategy MSTR, and Coinbase COIN, saw a combined trading volume of $38 billion on November 11.

Bitcoin ETFs and equities see $38 billion in volume – Eric BalchunasBalchunas noted that this volume is record-breaking for the asset class, with BlackRock IBIT ETF alone seeing $4.5 billion, while Fidelity FBTC recorded over $1 billion. Bitcoin ETFs saw $7.2 billion in trading volume that day, the highest daily volume since March 14, highlighting the robust week of inflows for the products.

Meanwhile, MicroStrategy, which recently announced a $2 billion acquisition of BTC, also saw $13 billion in trading volume for MSTR, the biggest daily volume ever. Coinbase has also benefited from the renewed interest in BTC, with the platform now ranked 33 in the list of top apps on the Apple App Store. This is its highest rank since February 2022.