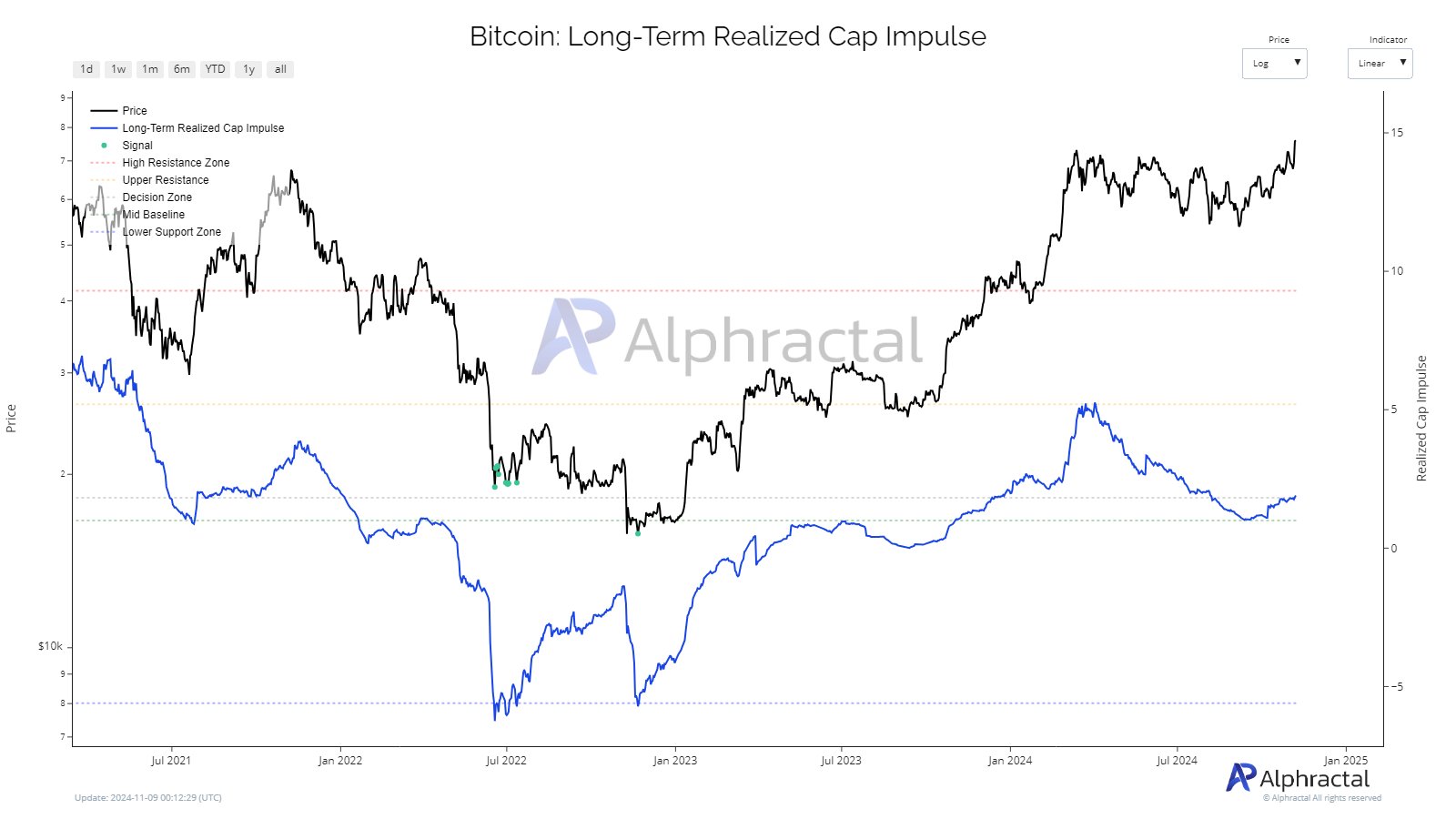

Cryptocurrency analytics firm Alphractal reported that Bitcoin has entered a critical juncture, previously described as a “key decision zone,” as it approaches historic levels that signal major shifts in the market trend.

This assessment is based on Alphractal’s Long-Term Realized Cap Impulse metric, a tool that measures long-term changes in Bitcoin’s realized market value and captures broader supply and demand dynamics that shorter time frames may miss.

The Long-Term Realized Cap Impulse metric identifies key historical moments with dotted lines marking market extremes. Alphractal notes that these lines have reliably shown market bottoms in the past, while upper cap lines often act as local resistances or the basis for trend reversals.

Currently, Bitcoin’s position within this decision zone is notable, as this level previously served as resistance during the market slowdown in 2019 and acted as a trigger for a new bull cycle in 2021.

Alphractal emphasized that it is important to monitor this metric closely as it can provide insight into on-chain demand and market sentiment. Large movements in long-held Bitcoin assets can have significant impacts on this indicator, potentially signaling shifts in investor sentiment and supply dynamics.

*This is not investment advice.

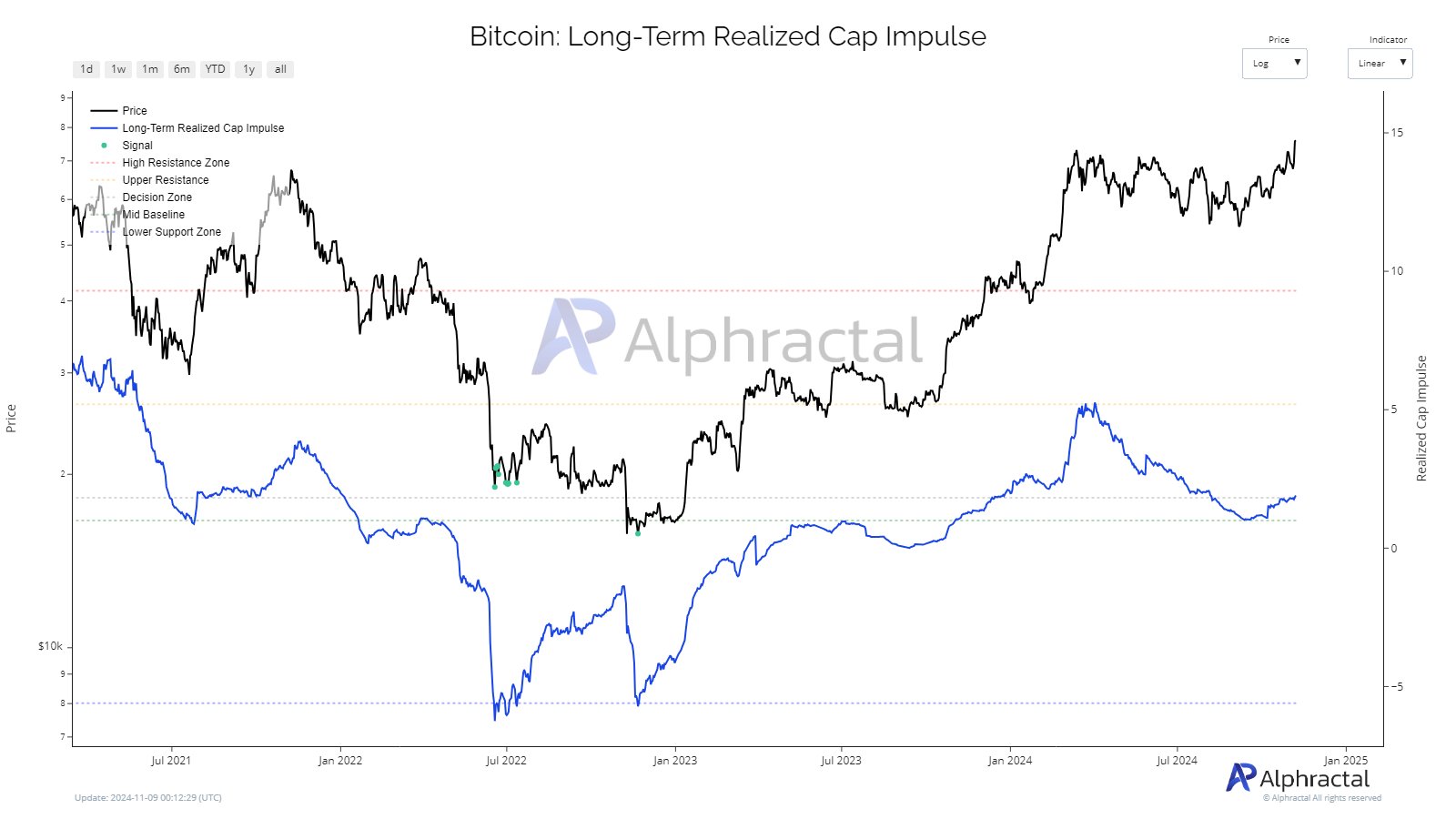

Cryptocurrency analytics firm Alphractal reported that Bitcoin has entered a critical juncture, previously described as a “key decision zone,” as it approaches historic levels that signal major shifts in the market trend.

This assessment is based on Alphractal’s Long-Term Realized Cap Impulse metric, a tool that measures long-term changes in Bitcoin’s realized market value and captures broader supply and demand dynamics that shorter time frames may miss.

The Long-Term Realized Cap Impulse metric identifies key historical moments with dotted lines marking market extremes. Alphractal notes that these lines have reliably shown market bottoms in the past, while upper cap lines often act as local resistances or the basis for trend reversals.

Currently, Bitcoin’s position within this decision zone is notable, as this level previously served as resistance during the market slowdown in 2019 and acted as a trigger for a new bull cycle in 2021.

Alphractal emphasized that it is important to monitor this metric closely as it can provide insight into on-chain demand and market sentiment. Large movements in long-held Bitcoin assets can have significant impacts on this indicator, potentially signaling shifts in investor sentiment and supply dynamics.

*This is not investment advice.