Demand for Bitcoin in the U.S. has heightened as BTC price surged past $75,000 following Donald Trump’s election victory, driven by expectations of pro-crypto policies.

On Wednesday, Bitcoin climbed to an all-time high of $75,400. The cryptocurrency’s historic rally was fueled by a surge in investor confidence, sparked by Trump’s pledge to make the U.S. a “bitcoin superpower,” particularly after his victory in the presidential race.

This latest surge surpassed Bitcoin’s previous record of $73,803, set in March, as traders capitalized on the momentum from key election victories in swing states such as Pennsylvania, North Carolina, and Georgia.

Trump’s pro-crypto stance, including promises to dismantle regulatory barriers, has attracted support from influential figures such as Andreessen Horowitz and the Winklevoss twins.

Heightened Activities in Derivatives Market

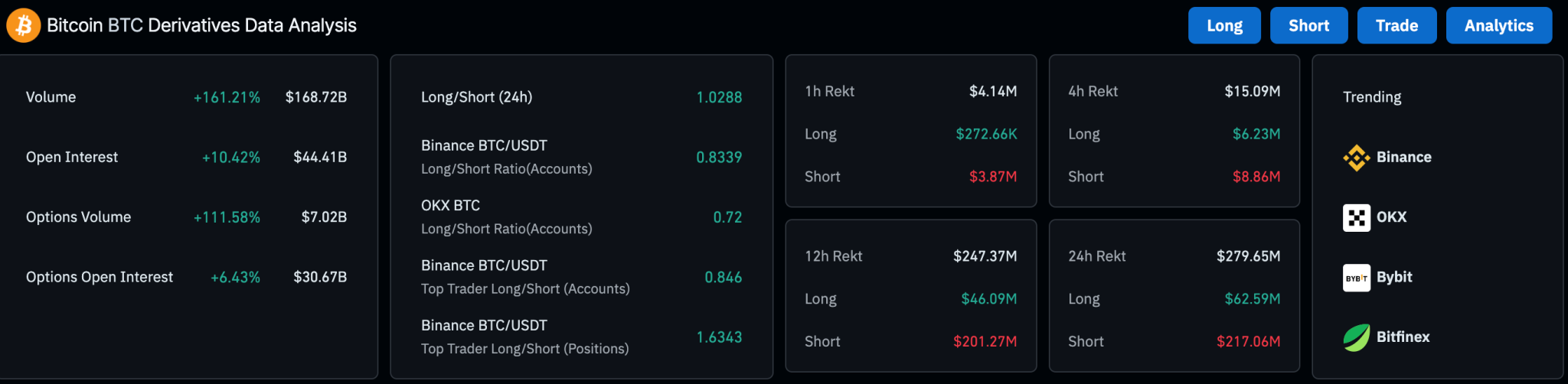

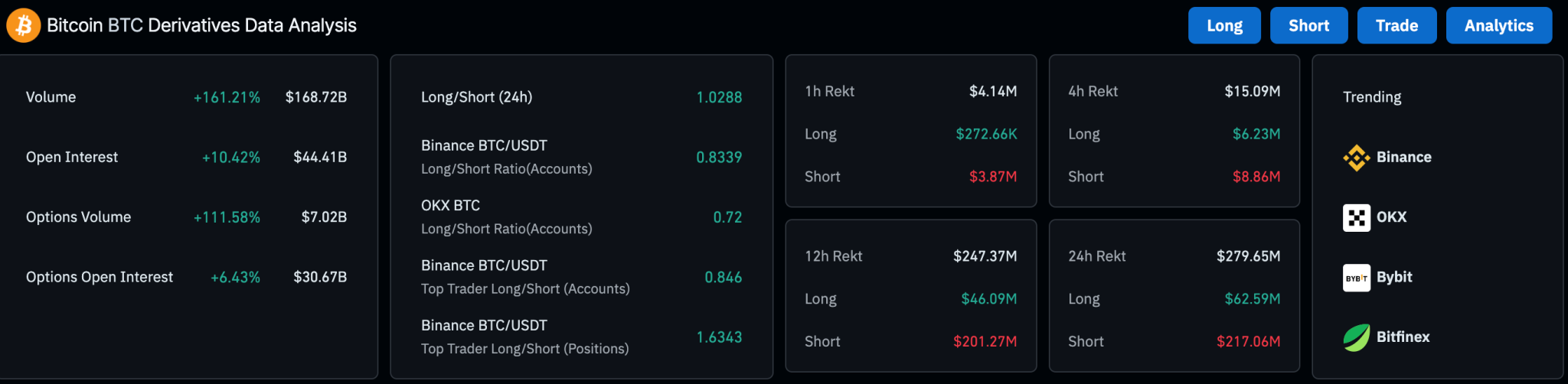

The spot market price rally was accompanied by a sharp increase in Bitcoin derivatives activity. Trading volumes surged by 161% to $168.17 billion, marking a significant uptick in participation.

Similarly, open interest in Bitcoin futures contracts rose by 10.2%, reaching $44.34 billion. This increase suggests stronger trader confidence in capitalizing on Bitcoin’s bullish momentum.

Options trading mirrored this growth, with volumes climbing by 108.91% to $7.01 billion. Options open interest also increased by 6.69%, reaching $30.73 billion.

However, market sentiment showed some divergence across platforms. Binance’s BTC/USDT ratio of 1.028 leaned slightly toward long positions, while OKX data revealed a bearish tilt, with a ratio of 0.8369 favoring shorts.

As volatility spiked, liquidations surged across the market. Over the past 24 hours, total liquidations reached $279.58 million, with short positions taking the hardest hit at $217.07 million. Long liquidations came in lower at $62.51 million.

U.S. Demand Drives Market Sentiment Higher

The Coinbase Premium Index offered further insight into Bitcoin’s record-breaking rally, revealing a strong correlation between U.S. demand and price performance.

The index recently turned positive, indicating that Bitcoin was trading at a premium on Coinbase compared to other global exchanges. Historically, such positive premiums have often been associated with significant price increases, reflecting heightened buying pressure from U.S. investors.

Market Sentiment Flips to “Greed”

This surge in demand aligns with broader market sentiment. The Fear and Greed Index, a widely watched measure of investor sentiment, registered a score of 70, indicating “Greed.” While this is slightly lower than last week’s Extreme Greed reading of 77, it remains notably higher than last month’s Neutral score of 50.

This shift highlights sustained investor enthusiasm as Bitcoin reaches new record highs, with the market responding to evolving geopolitical and economic dynamics.

Demand for Bitcoin in the U.S. has heightened as BTC price surged past $75,000 following Donald Trump’s election victory, driven by expectations of pro-crypto policies.

On Wednesday, Bitcoin climbed to an all-time high of $75,400. The cryptocurrency’s historic rally was fueled by a surge in investor confidence, sparked by Trump’s pledge to make the U.S. a “bitcoin superpower,” particularly after his victory in the presidential race.

This latest surge surpassed Bitcoin’s previous record of $73,803, set in March, as traders capitalized on the momentum from key election victories in swing states such as Pennsylvania, North Carolina, and Georgia.

Trump’s pro-crypto stance, including promises to dismantle regulatory barriers, has attracted support from influential figures such as Andreessen Horowitz and the Winklevoss twins.

Heightened Activities in Derivatives Market

The spot market price rally was accompanied by a sharp increase in Bitcoin derivatives activity. Trading volumes surged by 161% to $168.17 billion, marking a significant uptick in participation.

Similarly, open interest in Bitcoin futures contracts rose by 10.2%, reaching $44.34 billion. This increase suggests stronger trader confidence in capitalizing on Bitcoin’s bullish momentum.

Options trading mirrored this growth, with volumes climbing by 108.91% to $7.01 billion. Options open interest also increased by 6.69%, reaching $30.73 billion.

However, market sentiment showed some divergence across platforms. Binance’s BTC/USDT ratio of 1.028 leaned slightly toward long positions, while OKX data revealed a bearish tilt, with a ratio of 0.8369 favoring shorts.

As volatility spiked, liquidations surged across the market. Over the past 24 hours, total liquidations reached $279.58 million, with short positions taking the hardest hit at $217.07 million. Long liquidations came in lower at $62.51 million.

U.S. Demand Drives Market Sentiment Higher

The Coinbase Premium Index offered further insight into Bitcoin’s record-breaking rally, revealing a strong correlation between U.S. demand and price performance.

The index recently turned positive, indicating that Bitcoin was trading at a premium on Coinbase compared to other global exchanges. Historically, such positive premiums have often been associated with significant price increases, reflecting heightened buying pressure from U.S. investors.

Market Sentiment Flips to “Greed”

This surge in demand aligns with broader market sentiment. The Fear and Greed Index, a widely watched measure of investor sentiment, registered a score of 70, indicating “Greed.” While this is slightly lower than last week’s Extreme Greed reading of 77, it remains notably higher than last month’s Neutral score of 50.

This shift highlights sustained investor enthusiasm as Bitcoin reaches new record highs, with the market responding to evolving geopolitical and economic dynamics.