The US presidential election is entering its final stretch, with just over 20 days left until the vote. The outcome will have a significant and long-lasting impact on the crypto industry.

Several industry experts have made predictions about altcoins as the election countdown continues.

Altcoins Could Surge if Regulatory Barriers are Lifted

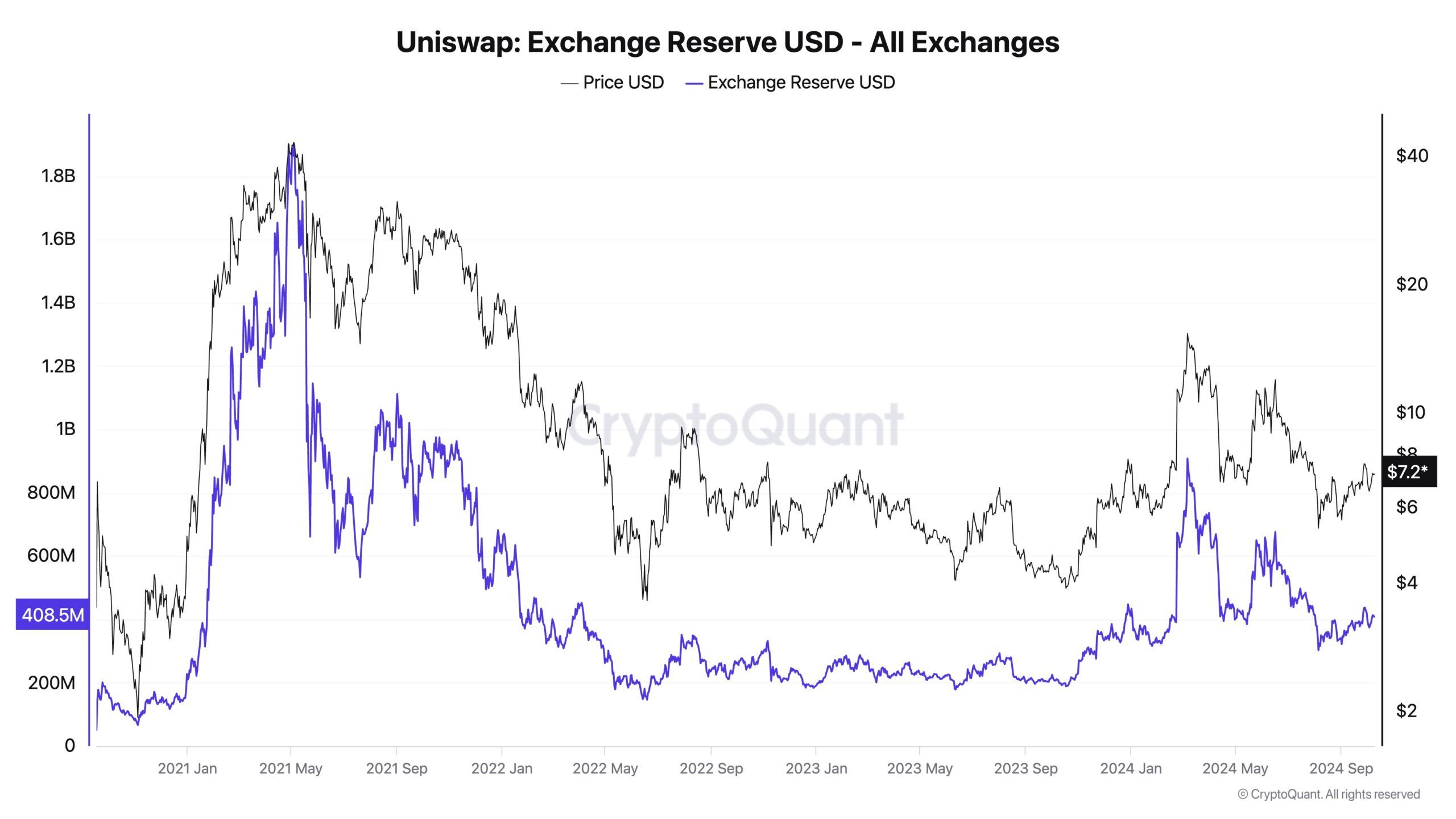

Ki Young Ju, CEO of CryptoQuant, believes that certain altcoins have not appreciated due to regulatory hurdles. He cited the case of Uniswap (UNI) to support his argument.

Since 2022, Uniswap has proposed a fee switch mechanism, which would redistribute protocol fees to UNI token holders. However, Uniswap expressed concerns that this feature might expose the project to legal risks, and UNI could be classified as a security. In April 2024, the SEC issued Well Notes to Uniswap, prompting the project to delay its proposal.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

Ki Young Ju suggests that if the fee switch were activated, investors could use the redistributed funds to drive up UNI’s price.

“For example, if Uniswap’s fee switch had been activated, its treasury could hold $314 million. Currently, there are $408 million worth of UNI on centralized exchanges. If the treasury were used for buybacks, prices could have surged by 10x-100x, depending on order book depth. (Not financial advice; I don’t hold UNI.),” Ki Young Ju explained.

He also predicts that if Donald Trump wins the election, new regulations might allow the fee switch to be implemented, boosting UNI’s price.

Altcoins Poised for Surges Based on Historical Models

Other analysts are focusing on past market patterns to forecast a year-end altcoin season.

CRG’s analysis suggests that Bitcoin’s current phase resembles the late 2020 cycle. He observed that more than 100 weeks after Bitcoin’s bottom, its price typically climbs to a new peak, followed by an altcoin rally a week later.

“Compared to previous cycles, we appear to be right on track for an explosive 3rd year. If we are to repeat the last cycle, time wise, BTC is 4 weeks away from price discovery + BTC dominance is 5 weeks away from a multi month top” CRG predicted.

Read more: Bitcoin Dominance Chart: What Is It and Why Is It Important?

At the time of writing, Bitcoin’s dominance remains at 58%, with no signs of correction. A decline in Bitcoin dominance might suggest that the other crypto assets are gaining more market share, indicating altcoin season.

Moreover, Michaël van de Poppe believes that the altcoin season will kickstart in the next 15 days, citing the altcoin market capitalization (TOTAL3).

“The Altcoin market capitalization looks ready for a breakout. The next 1-2 weeks are likely going to provide that breakout.” Michaël van de Poppe predicted.

According to these timelines, altcoins could witness a strong rally after the election on November 5. Polymarket currently gives Trump a 54% chance of winning. Moreover, another observation shows that during the last four presidential terms, Bitcoin experienced its best growth during Trump’s presidency.