Microstrategy’s stock, MSTR, has soared 1,620% since the company adopted a bitcoin-centered strategy, far outpacing bitcoin itself, the S&P 500, and tech giants such as Nvidia. The company’s bitcoin holdings now exceed 252,000 BTC. Microstrategy’s executive chairman, Michael Saylor, remains bullish about bitcoin’s price as his company plans to further boost its BTC investments.

Microstrategy’s Bitcoin Plan Delivers Massive Stock Gains

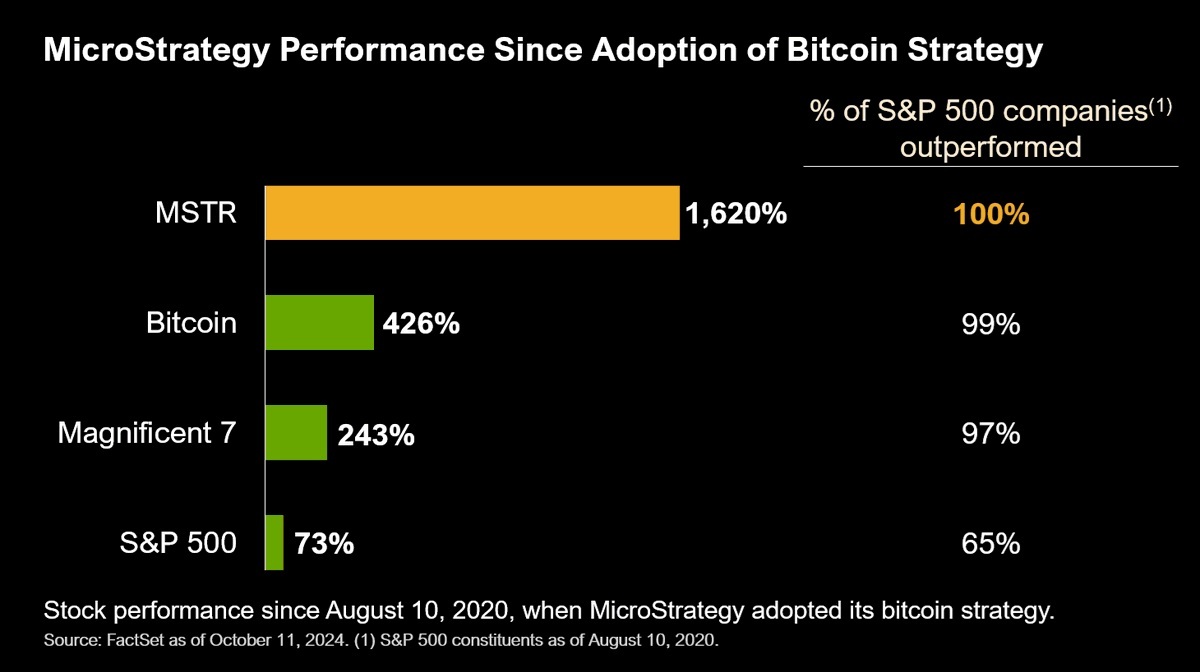

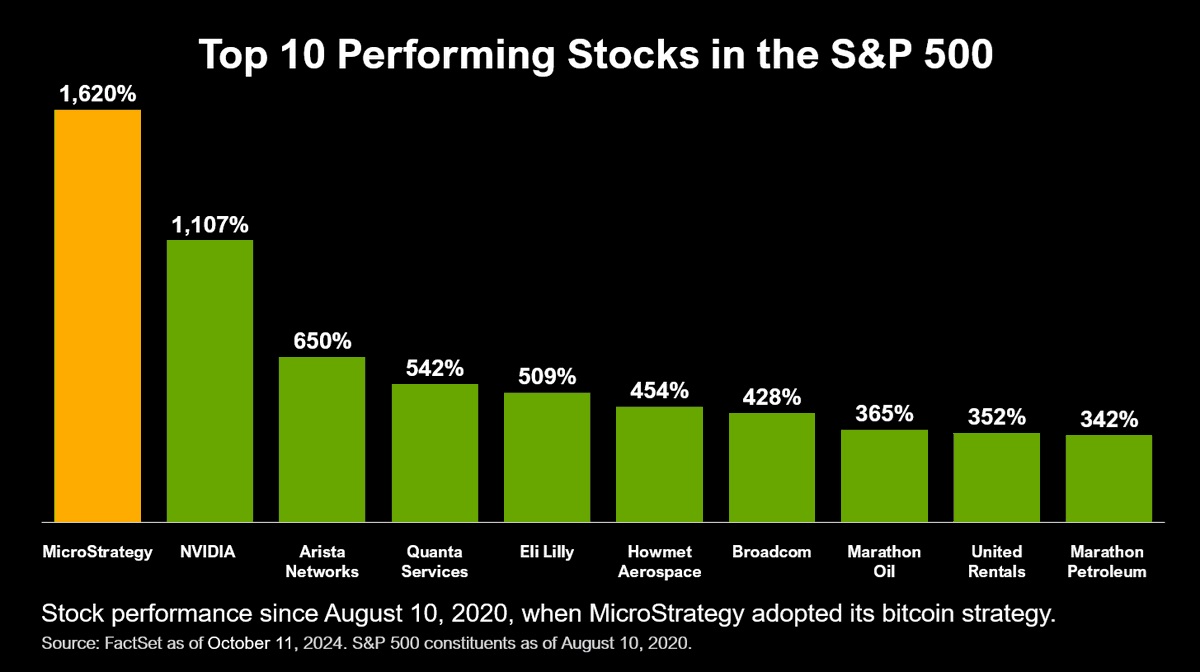

Microstrategy’s stock (Nasdaq: MSTR) has surged 1,620% since the company adopted its bitcoin-focused strategy, eclipsing the gains of BTC, the S&P 500, and major tech stocks. Over the weekend, executive chairman Michael Saylor highlighted this performance on social media platform X, comparing Microstrategy’s growth to bitcoin, the “Magnificent 7” tech giants, and the broader market over the past three years.

Since August 2020, Microstrategy has significantly outperformed, with MSTR up 1,620% compared to bitcoin’s 426%, the Magnificent 7’s 243%, and the S&P 500’s 73%. Reaffirming his bullish stance on BTC, Saylor wrote:

The only thing better than bitcoin is more bitcoin … If you want to win, you need a bitcoin strategy.

The Magnificent 7 refers to Alphabet (GOOGL; GOOG), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA), which have driven much of the recent market rally. Despite their success, MSTR’s gains have far outpaced these tech leaders. Saylor’s second chart shows MSTR’s gains significantly outpacing Nvidia’s 1,107% increase and Arista Networks’ 650% rise.

As of September, Microstrategy holds 252,220 bitcoins. On Sept. 20, the company acquired 7,420 BTC for $458.2 million at an average price of $61,750 per coin. This purchase, funded through a convertible note offering, solidified the software intelligence firm’s position as the largest corporate holder of bitcoin.

What do you think about Microstrategy’s bold bitcoin strategy and its stock performance? Let us know in the comments section below.