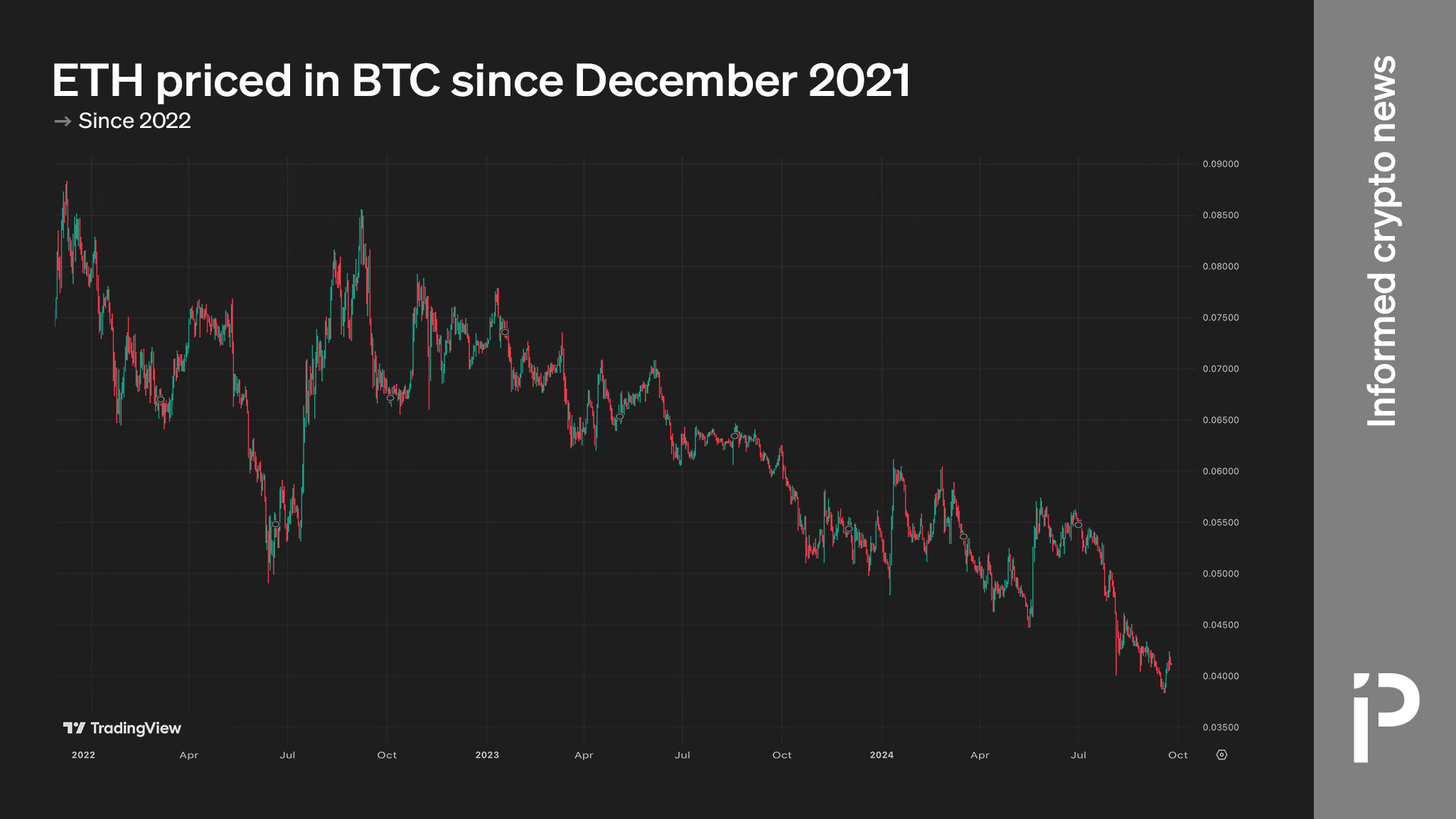

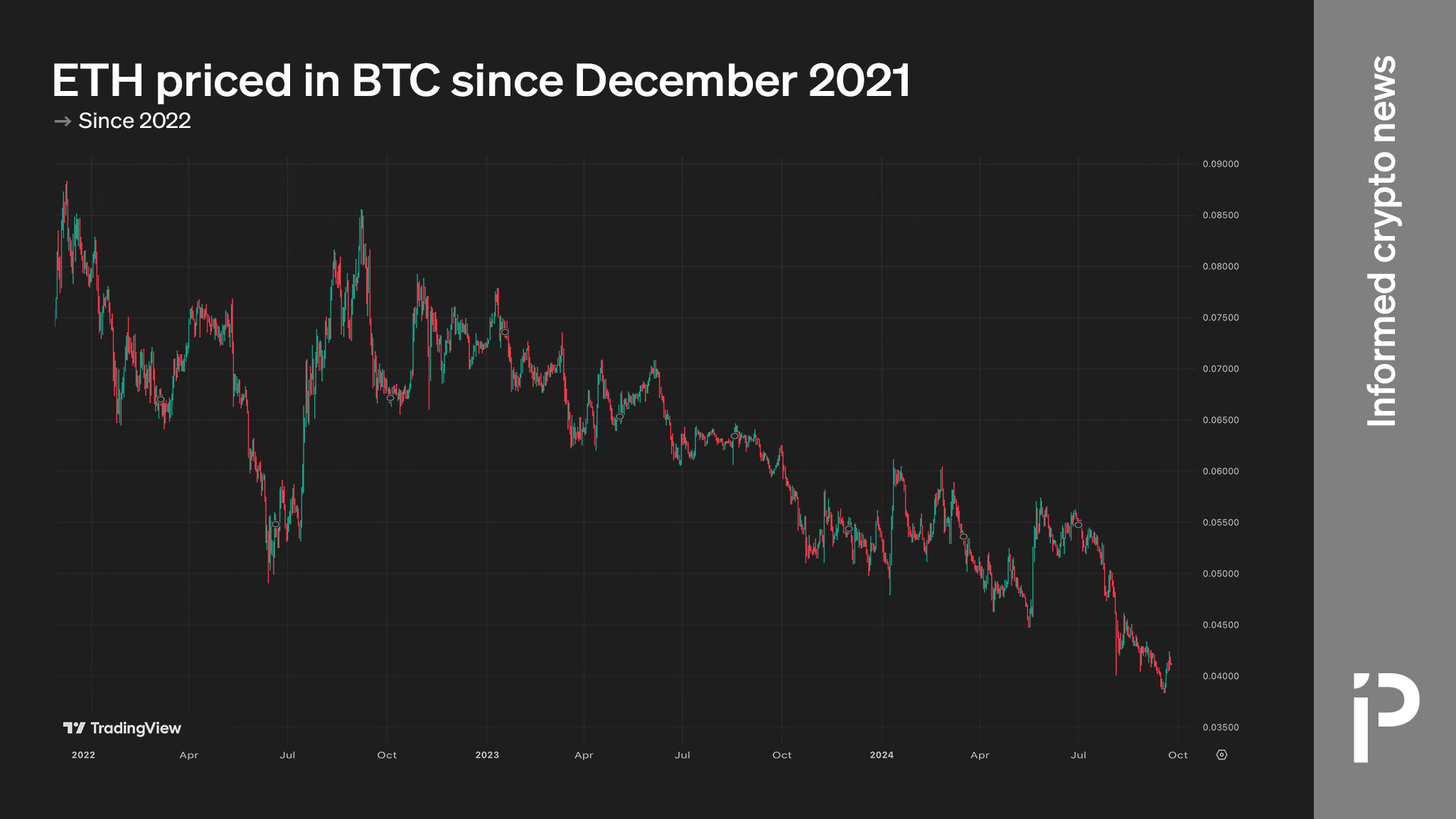

Ether’s (ETH) market cap has shed approximately one-third of its value in bitcoin (BTC) terms in just 12 months. Even worse, it’s been an embarrassing seven years since ETH last rallied to a new high against the world’s leading crypto.

During the early months of Ethereum’s initial coin offering (ICO) in 2017, ETH rallied to an all-time high of approximately 0.15 per bitcoin. It hasn’t surpassed that level since.

Even in 2021, amid several positive catalysts for ETH investors, it only hit 0.088 per BTC. That was a commendable comeback from its September 2019 low of 0.016 but still 42% below its 2017 high.

Understanding Ethereum’s failure to re-make a new high in BTC terms in 2021 is instructive for understanding its current, 32-month-and-counting decline.

Ethereum’s failure to make a new high against bitcoin in 2021

Back in 2021, investors were excitedly listening to announcements about Ethereum’s switch to wealth-based block validation dubbed ‘The Merge,’ predictions of ETH’s deflationary supply schedule called ‘ultrasound money,’ and most importantly, a network-wide transition to passive yield payouts of over 7% APR.

Indeed, just two months into 2022, predictions reached a feverish 9-12% from even Coinbase Institutional analysts. Today, ETH’s actual yield is 3.5%.

In 2021, in addition to The Merge, buzzy new uses for ETH around artwork speculation and supposedly passive income were also attracting mainstream attention.

Despite Ethereum-based NFTs gaining prominence, a resurgence of ultra-high DeFi yields like Olympus’ nose-bleeding 7,300% APY, and a cornucopia of other Ethereum DeFi protocols, investors were only willing to bid 58% as much BTC per ETH as they were four years prior.

All of those use cases weren’t enough. Investors have bid less and less BTC for ETH ever since.

Read more: All of Michael Saylor’s Ethereum predictions were wrong

Layer 2s, SEC approvals, and benchmark-setting performance

Nowadays, Ethereum’s most exciting and prominent use case seems to be layer 2s — chains of transaction data blocks that are periodically broadcast onto Ethereum’s blockchain. Yes, more blockchains seems to be Ethereum’s latest idea for how to make a comeback.

For 32 months, it hasn’t worked. ETH has been declining in BTC terms since December 2021.

This is in spite of many additional, substantial victories by Etherians.

- The famously skeptical Securities and Exchange Commission (SEC) has finally admitted publicly, “The Commission has not concluded that ETH is a security.”

- The SEC also approved the listing of several spot ETH ETFs on US securities markets.

- Ethereum has not suffered any major network outage in years, unique wallets are at highs, nodes still number in the thousands, validators exceed 1 million, and most metrics of network health are stable.

Nevertheless, the crypto market appears to remain — as it has since inception — a ‘winner take most’ market.

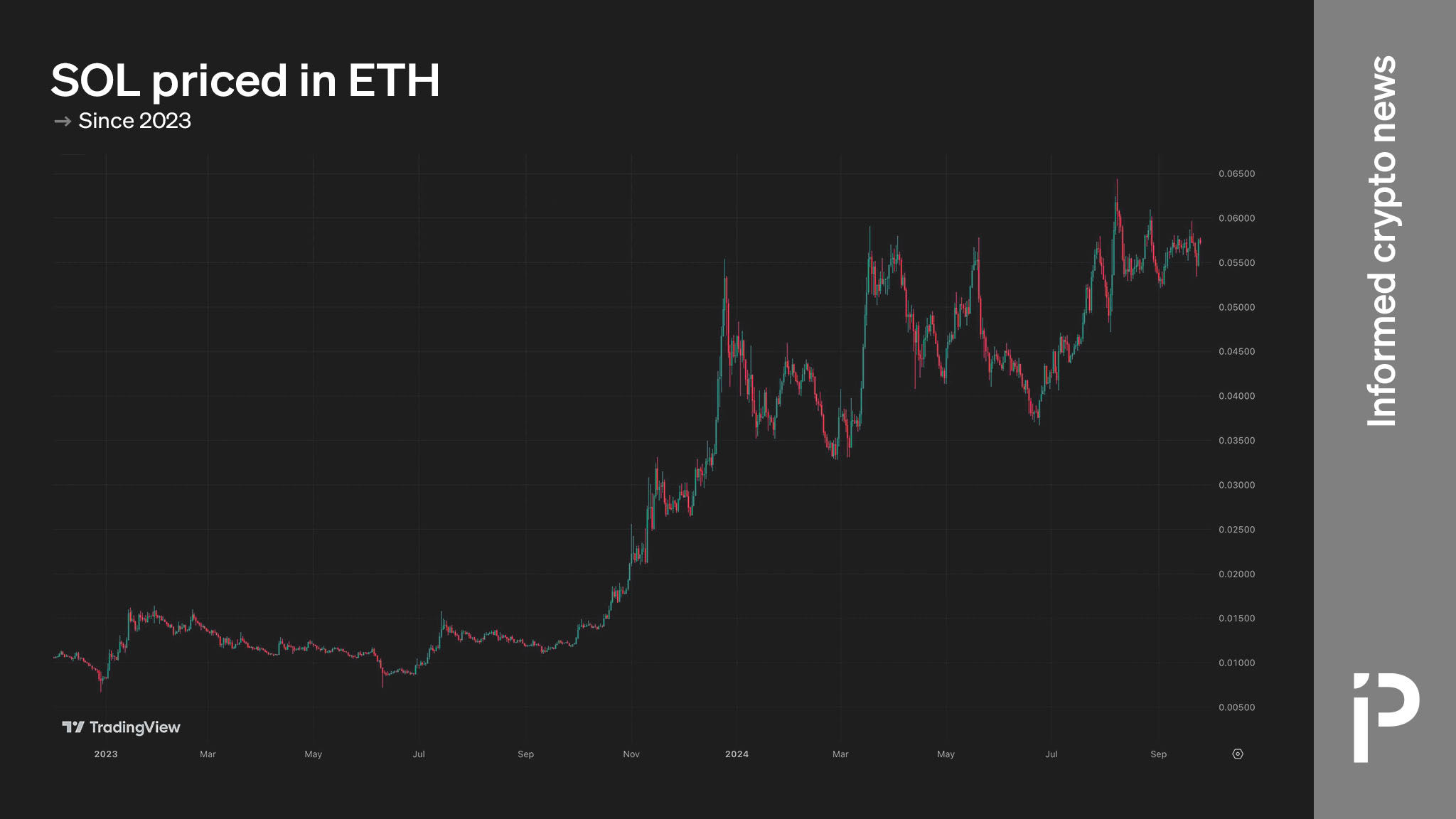

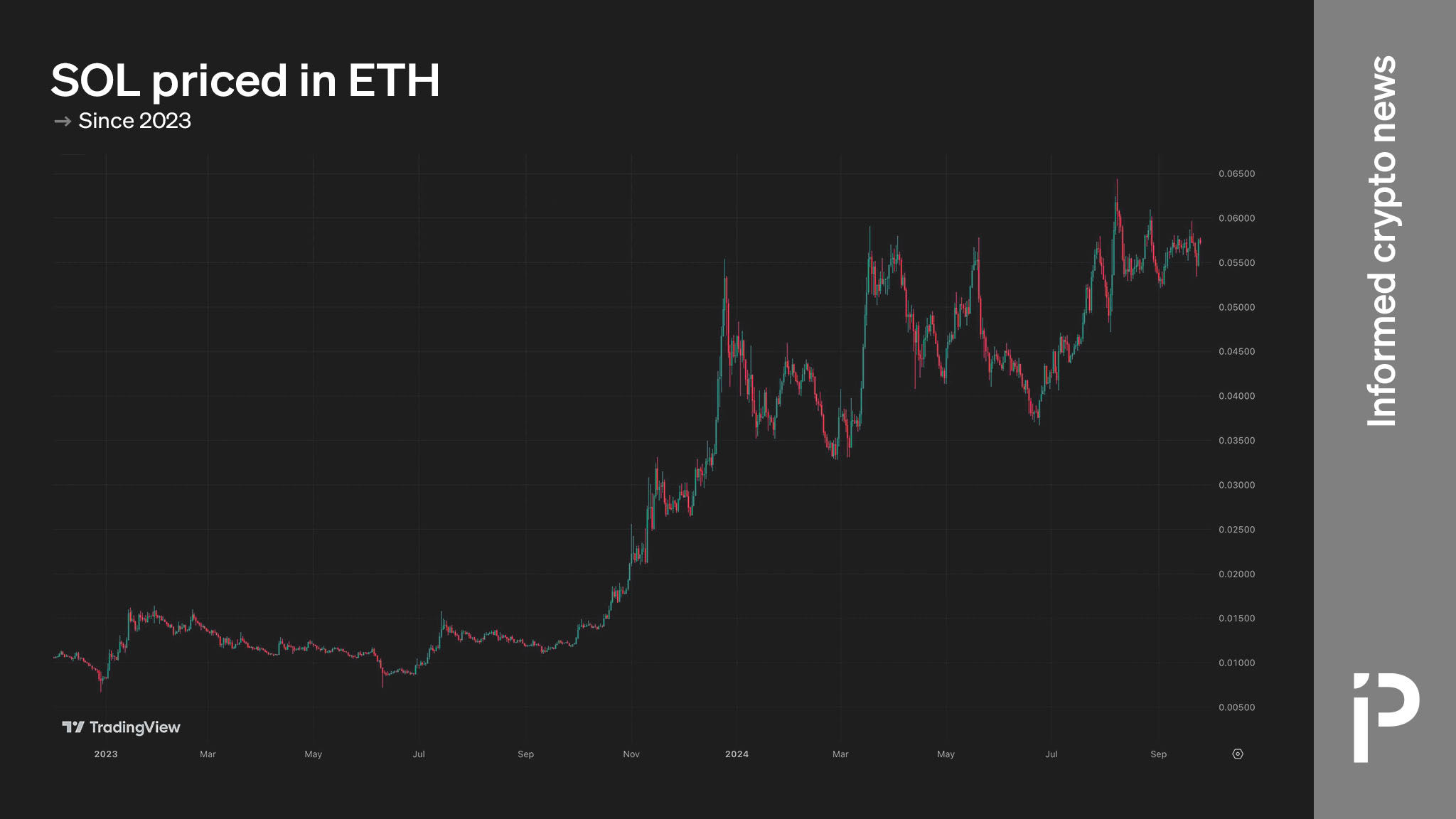

Although there are millions of altcoins, ETH’s contention in second place has not been enough to convince investors to displace their confidence in BTC as the most compelling investment in the sector. Indeed, Ethereum competitor Solana has septupled against ETH since January 2023. Other altcoins are gaining prominence as well, such as Telegram, Binance, and Tron.

As it has for most years since 2009, BTC alone has a larger market capitalization than the combined tally of all altcoins. Its 53% dominance dwarfs Ethereum’s 15% and it has gained ground for more than two years.

Ether’s (ETH) market cap has shed approximately one-third of its value in bitcoin (BTC) terms in just 12 months. Even worse, it’s been an embarrassing seven years since ETH last rallied to a new high against the world’s leading crypto.

During the early months of Ethereum’s initial coin offering (ICO) in 2017, ETH rallied to an all-time high of approximately 0.15 per bitcoin. It hasn’t surpassed that level since.

Even in 2021, amid several positive catalysts for ETH investors, it only hit 0.088 per BTC. That was a commendable comeback from its September 2019 low of 0.016 but still 42% below its 2017 high.

Understanding Ethereum’s failure to re-make a new high in BTC terms in 2021 is instructive for understanding its current, 32-month-and-counting decline.

Ethereum’s failure to make a new high against bitcoin in 2021

Back in 2021, investors were excitedly listening to announcements about Ethereum’s switch to wealth-based block validation dubbed ‘The Merge,’ predictions of ETH’s deflationary supply schedule called ‘ultrasound money,’ and most importantly, a network-wide transition to passive yield payouts of over 7% APR.

Indeed, just two months into 2022, predictions reached a feverish 9-12% from even Coinbase Institutional analysts. Today, ETH’s actual yield is 3.5%.

In 2021, in addition to The Merge, buzzy new uses for ETH around artwork speculation and supposedly passive income were also attracting mainstream attention.

Despite Ethereum-based NFTs gaining prominence, a resurgence of ultra-high DeFi yields like Olympus’ nose-bleeding 7,300% APY, and a cornucopia of other Ethereum DeFi protocols, investors were only willing to bid 58% as much BTC per ETH as they were four years prior.

All of those use cases weren’t enough. Investors have bid less and less BTC for ETH ever since.

Read more: All of Michael Saylor’s Ethereum predictions were wrong

Layer 2s, SEC approvals, and benchmark-setting performance

Nowadays, Ethereum’s most exciting and prominent use case seems to be layer 2s — chains of transaction data blocks that are periodically broadcast onto Ethereum’s blockchain. Yes, more blockchains seems to be Ethereum’s latest idea for how to make a comeback.

For 32 months, it hasn’t worked. ETH has been declining in BTC terms since December 2021.

This is in spite of many additional, substantial victories by Etherians.

- The famously skeptical Securities and Exchange Commission (SEC) has finally admitted publicly, “The Commission has not concluded that ETH is a security.”

- The SEC also approved the listing of several spot ETH ETFs on US securities markets.

- Ethereum has not suffered any major network outage in years, unique wallets are at highs, nodes still number in the thousands, validators exceed 1 million, and most metrics of network health are stable.

Nevertheless, the crypto market appears to remain — as it has since inception — a ‘winner take most’ market.

Although there are millions of altcoins, ETH’s contention in second place has not been enough to convince investors to displace their confidence in BTC as the most compelling investment in the sector. Indeed, Ethereum competitor Solana has septupled against ETH since January 2023. Other altcoins are gaining prominence as well, such as Telegram, Binance, and Tron.

As it has for most years since 2009, BTC alone has a larger market capitalization than the combined tally of all altcoins. Its 53% dominance dwarfs Ethereum’s 15% and it has gained ground for more than two years.