After experiencing a strong downturn in late August and early September, Bitcoin (BTC) has, in recent weeks, entered a rally that only grew in intensity shortly after the Federal Reserve lowered interest rates by 50 basis points on September 18 for the first time since 2020.

The rally has sent BTC well above $60,000 and, at one point in the early hours on Friday, above $64,000.

Bitcoin has, however, quickly entered a slight correction, but one prominent cryptocurrency expert, Ali Martinez, warned on X that investors would be wise to ‘book some profits’ by selling the cryptocurrency.

According to Martinez, a technical analysis (TA) tool known as TD Sequential has issued a sell signal for the flagship digital asset, indicating an imminent correction for the world’s most famous coin.

Judging by the coin’s recent performance, it is possible Bitcoin has already had its ‘trigger’ in the latest interest rate decision. Alternatively, it is safe to assume that the November Presidential Election will also serve as a catalyst for the cryptocurrency.

Still, it is worth noting that the results of the elections could determine whether BTC enters a rally or a downfall upon their conclusion.

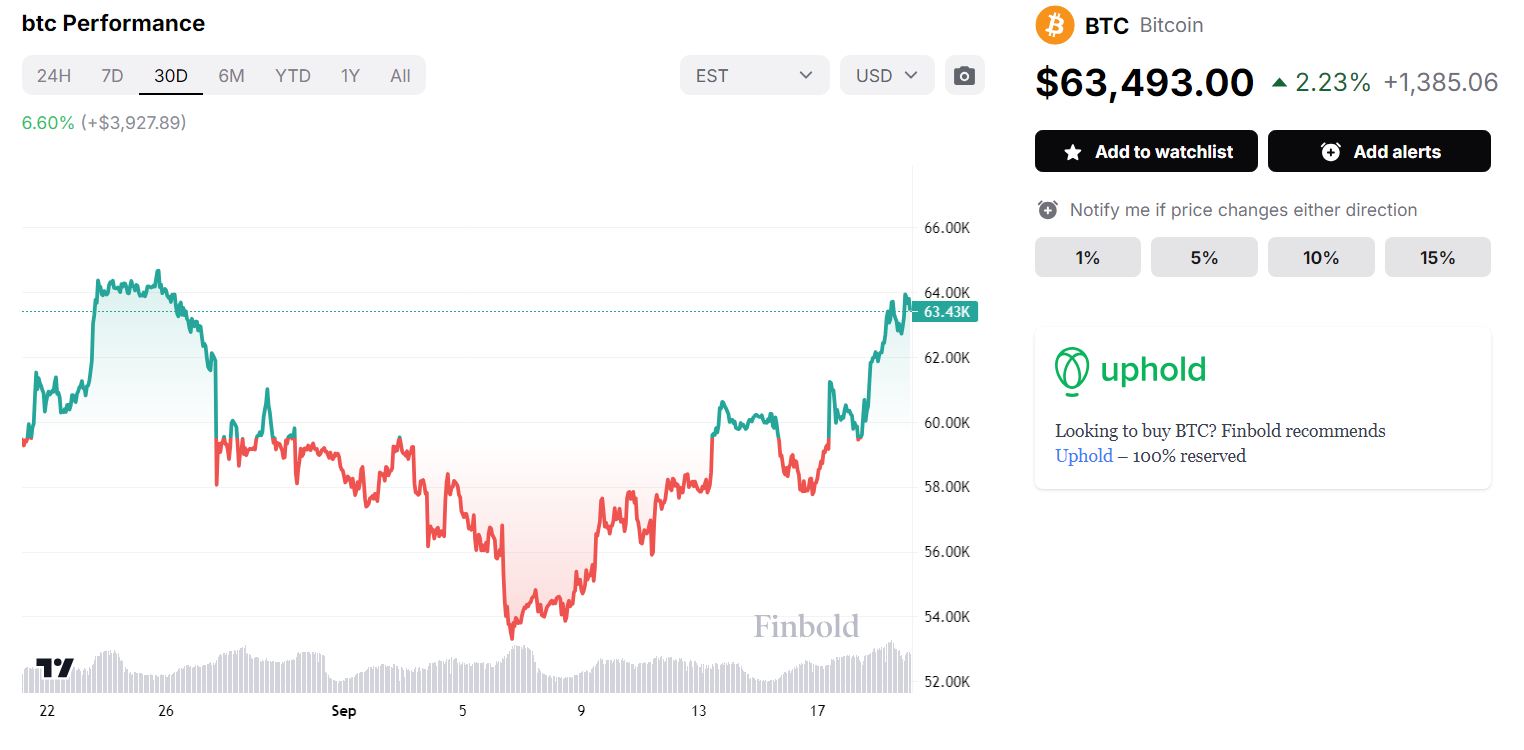

BTC price chart

No matter what the future holds, it is safe to say that Bitcoin has entered a period of strong performance after September 7. The world’s largest cryptocurrency is 6.60% in the green in the 30-day chart and Bitcoin price today stands at $63,493.

Additionally, despite the turbulence prevalent in the crypto market in recent months, 2024 remains a strong year for the coin as it is up an impressive 49.10% up in the year-to-date (YTD) chart.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.