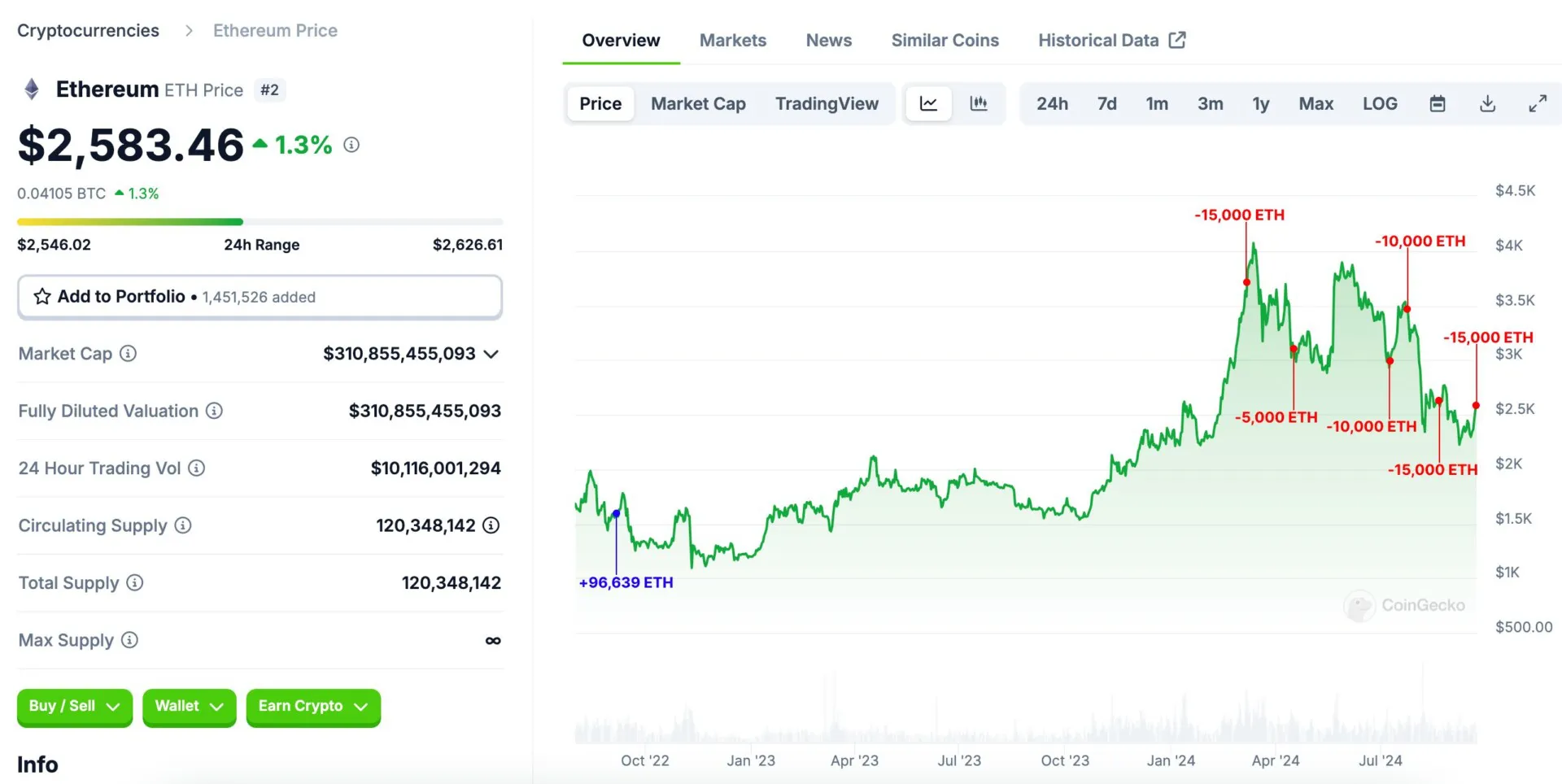

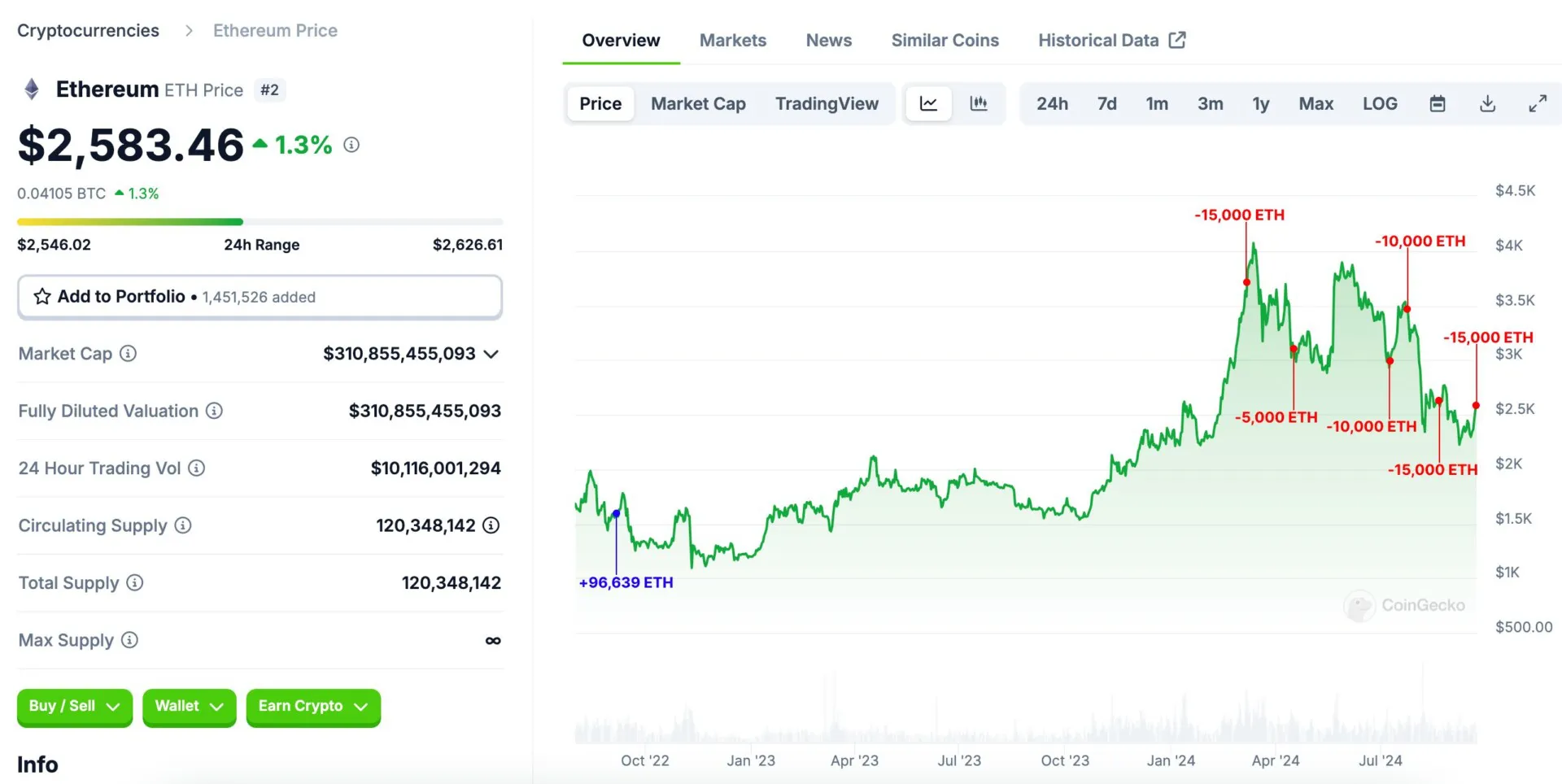

According to blockchain tracking firm Lookonchain, a long-term Ethereum investor, recently realized a profit of $131.72 million after holding his Ether for two years. The individual purchased Ether during the 2022 bear market and has since held onto it through the market uncertainty.

The investor acquired 96,639 ETH from Coinbase between September 3 and 4, 2022, when Ether was trading at approximately $1,567. This investment totaled around $151.43 million.

At the beginning of the year, the investor transferred over 72% of their initial investment (70,000 ETH) to the Kraken exchange through several transactions. Ether’s market price had risen to $3,062 at the time of writing, making the transfer worth approximately $214.34 million.

In addition to the recent transfers from Kraken, this investor holds 26,639 ETH in their wallet from the original purchase, valued at approximately $68.81 million.

Diamond hands generated massive profits in the crypto market

Over the years, a buy-the-dip mentality has allowed crypto investors to achieve significant long-term gains. A notable example is a Shiba Inu (SHIB) investor with diamond hands who recently realized a $1.1 million profit from a $2,625 investment after a three-year wait. Lookonchain reported:

After being dormant for 3.5 years, the super diamond trader finally sold $SHIB at a profit. They purchased 48.09 billion $SHIB for 2 ETH ($2,625) on February 1, 2021, and sold it for 278.7 ETH ($1.1 million), resulting in a gain of 419x!

~Lookonchain

This trade occurred just two weeks after another savvy trader transformed a $3,000 investment in the Pepe (PEPE) memecoin into $46 million during the resurgence of the GameStop saga, which propelled certain memecoins to new heights.

James Fickel incurred a $43 million loss in a failed Bitcoin bet

Crypto millionaire James Fickel and the founder of longevity research firm Amaranth Foundation, lost over 18,000 ETH, valued at $43.7 million by essentially betting on Ether’s price against Bitcoin. This hit increases his total debt to $132 million.

According to a September 14 post by Lookonchain, millionaire James Fickel anticipated that Ether’s price would rise against Bitcoin when he first borrowed $172 million worth of Wrapped Bitcoin (WBTC) on January 10, 2024.

However, Ether has underperformed compared to Bitcoin since the beginning of the year. According to Binance data, Ether’s price relative to Bitcoin has dropped by more than 24% year-to-date (YTD) and over 9% in the past month.

According to blockchain tracking firm Lookonchain, a long-term Ethereum investor, recently realized a profit of $131.72 million after holding his Ether for two years. The individual purchased Ether during the 2022 bear market and has since held onto it through the market uncertainty.

The investor acquired 96,639 ETH from Coinbase between September 3 and 4, 2022, when Ether was trading at approximately $1,567. This investment totaled around $151.43 million.

At the beginning of the year, the investor transferred over 72% of their initial investment (70,000 ETH) to the Kraken exchange through several transactions. Ether’s market price had risen to $3,062 at the time of writing, making the transfer worth approximately $214.34 million.

In addition to the recent transfers from Kraken, this investor holds 26,639 ETH in their wallet from the original purchase, valued at approximately $68.81 million.

Diamond hands generated massive profits in the crypto market

Over the years, a buy-the-dip mentality has allowed crypto investors to achieve significant long-term gains. A notable example is a Shiba Inu (SHIB) investor with diamond hands who recently realized a $1.1 million profit from a $2,625 investment after a three-year wait. Lookonchain reported:

After being dormant for 3.5 years, the super diamond trader finally sold $SHIB at a profit. They purchased 48.09 billion $SHIB for 2 ETH ($2,625) on February 1, 2021, and sold it for 278.7 ETH ($1.1 million), resulting in a gain of 419x!

~Lookonchain

This trade occurred just two weeks after another savvy trader transformed a $3,000 investment in the Pepe (PEPE) memecoin into $46 million during the resurgence of the GameStop saga, which propelled certain memecoins to new heights.

James Fickel incurred a $43 million loss in a failed Bitcoin bet

Crypto millionaire James Fickel and the founder of longevity research firm Amaranth Foundation, lost over 18,000 ETH, valued at $43.7 million by essentially betting on Ether’s price against Bitcoin. This hit increases his total debt to $132 million.

According to a September 14 post by Lookonchain, millionaire James Fickel anticipated that Ether’s price would rise against Bitcoin when he first borrowed $172 million worth of Wrapped Bitcoin (WBTC) on January 10, 2024.

However, Ether has underperformed compared to Bitcoin since the beginning of the year. According to Binance data, Ether’s price relative to Bitcoin has dropped by more than 24% year-to-date (YTD) and over 9% in the past month.