- Ethereum is attempting recovery after the Fed reduced rates by 50 basis points.

- ETH holders are displaying mixed actions following its weak performance against Bitcoin.

- Ethereum could break above the $2,395 resistance level.

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve’s (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Ethereum attempts to stage recovery following Fed rate cut

Ethereum and the general crypto market are seeing buying momentum after the Fed reduced interest rates by 50-basis-points to 4.75% – 5% on Wednesday. The move marks the first rate cut since March 2020, when the agency slashed interest rates to 0%.

ETH may see a recovery in the coming weeks as expectations are that investors may begin to step into the market again with heightened buying momentum following the rate cut. Additionally, Q4 has historically been the best-performing season for the crypto market. Hence, the coming months could prove crucial for Ethereum.

Breaking: Fed cuts interest rate by 50 bps to 4.75%-5%

Read More!➡️ https://t.co/xG9MSy6qau#Fed #Forex pic.twitter.com/yskwQ2mLFj

— FXStreet News (@FXStreetNews) September 18, 2024

Meanwhile, following the ETH/BTC plunge to a low last seen in April 2021, Ethereum holder’s activity has remained fairly quiet, with a slightly diverging strategy among the different cohorts, per CryptoQuant’s data.

Large holders with supply above 100K have been largely inactive, holding onto their tokens — potentially across staking and DeFi yield-bearing protocols. Mid-tier holders (10K – 100K) are slightly bullish, accumulating at a slow pace. However, small holders (100 – 1K) have been shedding their holdings steadily since the beginning of the year, with August and September experiencing steeper selling pressure than in previous months.

ETH Accumulation

On the other hand, US spot Ethereum ETFs posted net outflows of $15.1 million on September 17, with Grayscale’s ETHE shedding $17.9 million and its Ethereum Mini Trust seeing just $2.8 million worth of inflows.

Ethereum could rally to $2,817 if it closes above key resistance

Ethereum is trading around $2,330 on Wednesday after seeing a rejection near $2,395 on Tuesday. In the past 24 hours, ETH has seen over $22 million in liquidations, with long and short liquidations accounting for $17.69 million and $5.19 million, respectively.

Ethereum is trading within a key rectangle channel with resistance and support levels at $2,395 and $2,207, respectively. A descending trendline extending from May 27 and the 50-day and 200-day Simple Moving Averages (SMAs) also stand as potential resistance.

ETH/USDT 4-hour chart

ETH’s next move could be determined by the Fed’s decision to cut rates by 50 basis points. The move could see ETH break the $2,395 resistance and rally toward $2,817. If ETH fails to see a rejection around $2,817, the next target is $3,237.

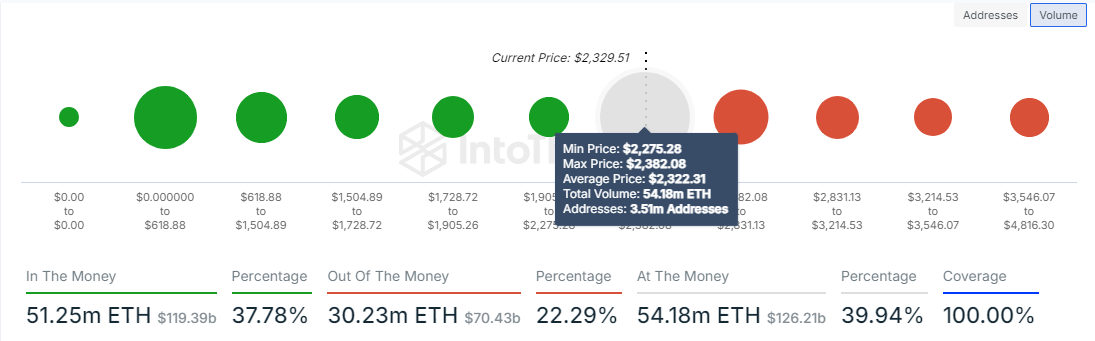

On the downside, ETH could bounce around the $2,207 support level. This level has established itself as critical support, considering it is closest to ETH’s highest demand zone, where investors purchased 54.18 million ETH tokens. Hence, buyers may step in to defend their coins from falling into losses.

ETH Global In/Out of the Money

If the support doesn’t hold, ETH could decline toward $2,111. A daily candlestick close below this level will invalidate the thesis and trigger significant losses.