The crypto market drop that has impacted assets such as Bitcoin, Shiba Inu and XRP is attributable to four main factors.

The cryptocurrency market has been hit hard recently, with Bitcoin (BTC) and other major digital assets experiencing significant declines. With BTC down 1.65% this morning, the leading cryptocurrency has collapsed 6.11% from the $68K high on July 22.

Altcoins have suffered similar declines. XRP is on the verge of retracing the 3.46% gain yesterday, down by more than 1.5% today. XRP’s saving grace has been the support at $0.60. Meanwhile, Shiba Inu (SHIB) is down 10% from the $0.00001832 peak of July 22 and 2.74% this morning due to its greater volatility.

Notably, four key factors have contributed to this downturn, causing concern among investors and market analysts. Here’s a closer look at what’s happening.

Bitstamp and Kraken Distributing Bitcoin to Mt. Gox Creditors

The defunct Mt. Gox exchange, which collapsed in 2014 after losing 850,000 bitcoins to a major security breach, has finally started repaying its creditors.

This long-awaited repayment involves distributing 142,000 BTC and 143,000 BCH. Mt. Gox is to distribute the tokens to creditors using centralized exchanges. Exchanges Bitstamp and Kraken are already facilitating the distribution, with Bitstamp having a 60-day window and Kraken up to 90 days to complete the payouts.

Bitstamp has committed to expediting the distribution, aiming to complete it well before the 60-day deadline. Similarly, Kraken is also beginning to release funds. The large volume of Bitcoin entering the market has led to increased selling pressure, contributing to the current market downturn.

Kraken started distributing Gox coins pic.twitter.com/cOxXQaC5p0

— punch (@Punch0x1) July 23, 2024

Concerns have emerged that many creditors may opt to liquidate their holdings immediately. However, data shows most Kraken users have held onto their tokens, but this has not mitigated the concerns.

US Stock Market Crash

Another event contributing to the market drop is the performance of U.S. equities. Recently, the US stock market experienced a significant crash, wiping out more than $1.1 trillion in value.

This loss has impacted traditional financial markets, further spilling over into the crypto scene. Historically, there has been a notable correlation between the performance of traditional markets and cryptocurrencies.

When the stock market suffers, risk assets like Bitcoin often follow suit as investors liquidate their holdings to cover losses or seek safer investments. The spillover has also contributed to XRP’s and Shiba Inu’s declines.

Decline in S&P 500 and NASDAQ

Amid the stock market crash, both the S&P 500 and NASDAQ indices have experienced their worst performance in the past two years. Market data confirms that the S&P 500 collapsed 2.3% yesterday.

This decline has further exacerbated the negative sentiment in the market. As major benchmarks of economic health, the performances of the S&P 500 and NASDAQ indices often lead to a broader pullback in various asset classes, including cryptocurrencies.

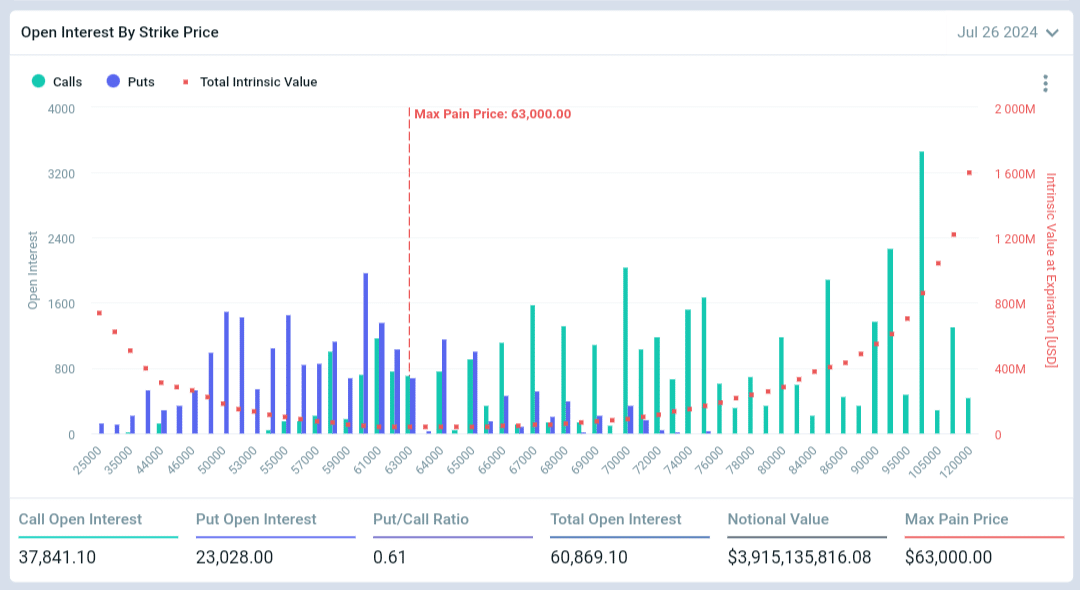

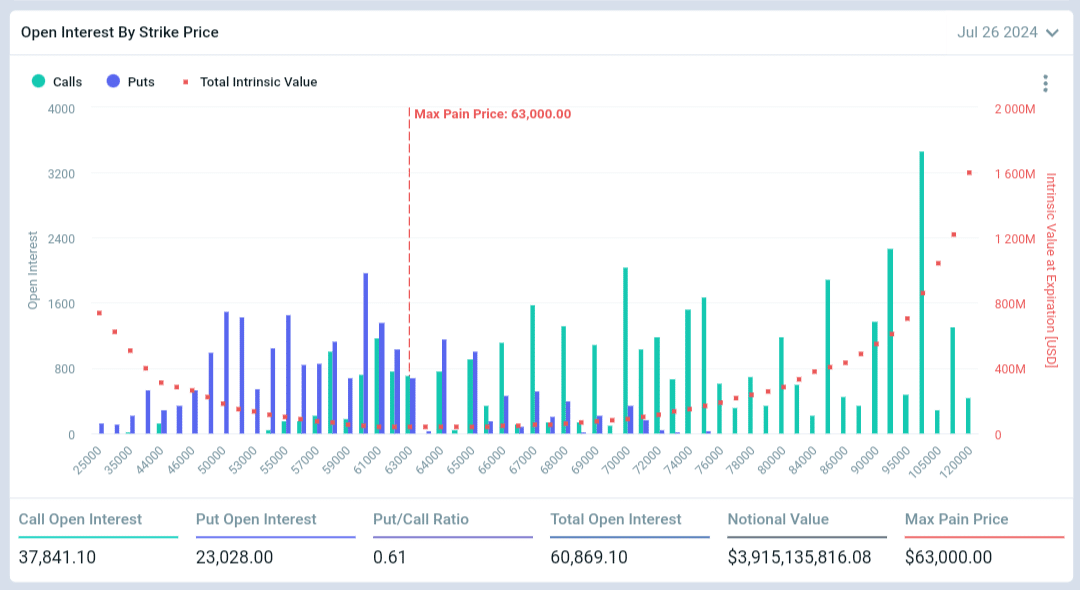

$4 Billion Bitcoin Options Expiry

Another major factor affecting the crypto market is the imminent expiration of Bitcoin options worth nearly $4 billion. Data from Deribit confirms that Bitcoin has a total open interest of 60,869 options with a national value of $3.9 billion about tomorrow, July 26. The max pain for these options is $63,000.

The potential expiry of this significant volume of options contracts has contributed to the market’s instability, as traders will be forced to either sell their positions or roll them over in accordance with the expiry.

The crypto market drop that has impacted assets such as Bitcoin, Shiba Inu and XRP is attributable to four main factors.

The cryptocurrency market has been hit hard recently, with Bitcoin (BTC) and other major digital assets experiencing significant declines. With BTC down 1.65% this morning, the leading cryptocurrency has collapsed 6.11% from the $68K high on July 22.

Altcoins have suffered similar declines. XRP is on the verge of retracing the 3.46% gain yesterday, down by more than 1.5% today. XRP’s saving grace has been the support at $0.60. Meanwhile, Shiba Inu (SHIB) is down 10% from the $0.00001832 peak of July 22 and 2.74% this morning due to its greater volatility.

Notably, four key factors have contributed to this downturn, causing concern among investors and market analysts. Here’s a closer look at what’s happening.

Bitstamp and Kraken Distributing Bitcoin to Mt. Gox Creditors

The defunct Mt. Gox exchange, which collapsed in 2014 after losing 850,000 bitcoins to a major security breach, has finally started repaying its creditors.

This long-awaited repayment involves distributing 142,000 BTC and 143,000 BCH. Mt. Gox is to distribute the tokens to creditors using centralized exchanges. Exchanges Bitstamp and Kraken are already facilitating the distribution, with Bitstamp having a 60-day window and Kraken up to 90 days to complete the payouts.

Bitstamp has committed to expediting the distribution, aiming to complete it well before the 60-day deadline. Similarly, Kraken is also beginning to release funds. The large volume of Bitcoin entering the market has led to increased selling pressure, contributing to the current market downturn.

Kraken started distributing Gox coins pic.twitter.com/cOxXQaC5p0

— punch (@Punch0x1) July 23, 2024

Concerns have emerged that many creditors may opt to liquidate their holdings immediately. However, data shows most Kraken users have held onto their tokens, but this has not mitigated the concerns.

US Stock Market Crash

Another event contributing to the market drop is the performance of U.S. equities. Recently, the US stock market experienced a significant crash, wiping out more than $1.1 trillion in value.

This loss has impacted traditional financial markets, further spilling over into the crypto scene. Historically, there has been a notable correlation between the performance of traditional markets and cryptocurrencies.

When the stock market suffers, risk assets like Bitcoin often follow suit as investors liquidate their holdings to cover losses or seek safer investments. The spillover has also contributed to XRP’s and Shiba Inu’s declines.

Decline in S&P 500 and NASDAQ

Amid the stock market crash, both the S&P 500 and NASDAQ indices have experienced their worst performance in the past two years. Market data confirms that the S&P 500 collapsed 2.3% yesterday.

This decline has further exacerbated the negative sentiment in the market. As major benchmarks of economic health, the performances of the S&P 500 and NASDAQ indices often lead to a broader pullback in various asset classes, including cryptocurrencies.

$4 Billion Bitcoin Options Expiry

Another major factor affecting the crypto market is the imminent expiration of Bitcoin options worth nearly $4 billion. Data from Deribit confirms that Bitcoin has a total open interest of 60,869 options with a national value of $3.9 billion about tomorrow, July 26. The max pain for these options is $63,000.

The potential expiry of this significant volume of options contracts has contributed to the market’s instability, as traders will be forced to either sell their positions or roll them over in accordance with the expiry.