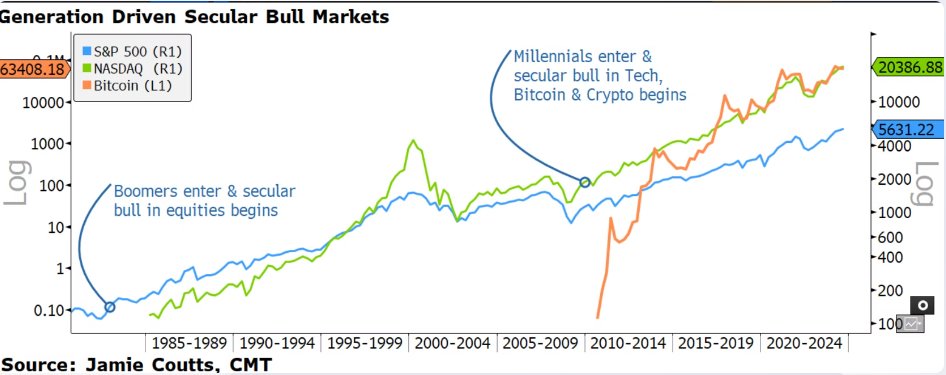

A closely followed crypto analyst believes that Bitcoin (BTC) and other digital assets are still in just the early stages of a secular bull market.

Jamie Coutts, the chief crypto analyst at Real Vision, predicts that adoption will continue to increase for Bitcoin over decades, similar to the lifecycle of the NASDAQ.

He notes similarities between the launch of Bitcoin in 2009 and the NASDAQ’s launch in the 1970s, and says that “2009 is to Millennials what 1982 was to Boomers.”

“The NASDAQ launched in the 1970s but wasn’t considered a serious investment venue until the mid-1980s or early 1990s. Since then, it has outperformed all other markets. Bitcoin launched in 2009 and, for its first decade, was met with ambivalence or derision. As Bitcoin enters its mainstream moment, the wider asset class will also see adoption and investment inflows.

Investing in Bitcoin is a low-risk way to hedge against accelerating debasement, while blockchain assets represent a bet on the secular trend of technological adoption. Bitcoin and crypto are two very different assets with distinct risk profiles. So size accordingly, but also zoom out. There is still a long way to go in this secular bull market.”

Coutts is also closely watching the 30-day and 90-day moving average of Bitcoin’s hashrate, which has nearly completed a bullish crossover and has often coincided with positive price reversals.

“Bitcoin’s post-halving hashrate contraction is on the verge of reversing… Security is growing [which] equals healthy network and positive for price.”

Bitcoin is trading for $66,323 at time of writing.

Generated Image: Midjourney

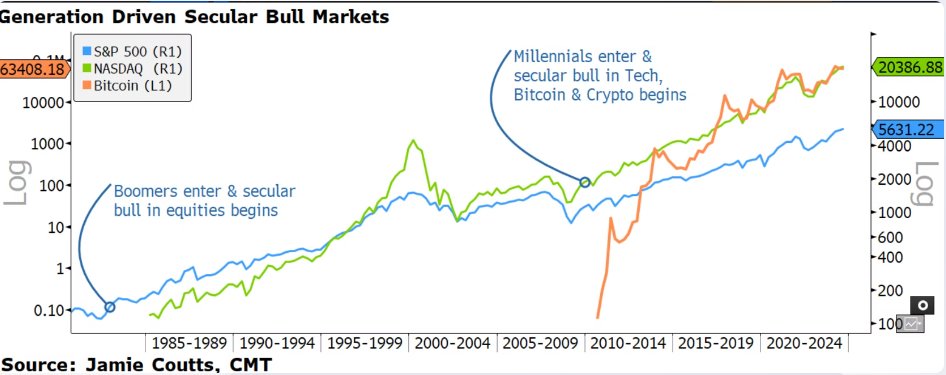

A closely followed crypto analyst believes that Bitcoin (BTC) and other digital assets are still in just the early stages of a secular bull market.

Jamie Coutts, the chief crypto analyst at Real Vision, predicts that adoption will continue to increase for Bitcoin over decades, similar to the lifecycle of the NASDAQ.

He notes similarities between the launch of Bitcoin in 2009 and the NASDAQ’s launch in the 1970s, and says that “2009 is to Millennials what 1982 was to Boomers.”

“The NASDAQ launched in the 1970s but wasn’t considered a serious investment venue until the mid-1980s or early 1990s. Since then, it has outperformed all other markets. Bitcoin launched in 2009 and, for its first decade, was met with ambivalence or derision. As Bitcoin enters its mainstream moment, the wider asset class will also see adoption and investment inflows.

Investing in Bitcoin is a low-risk way to hedge against accelerating debasement, while blockchain assets represent a bet on the secular trend of technological adoption. Bitcoin and crypto are two very different assets with distinct risk profiles. So size accordingly, but also zoom out. There is still a long way to go in this secular bull market.”

Coutts is also closely watching the 30-day and 90-day moving average of Bitcoin’s hashrate, which has nearly completed a bullish crossover and has often coincided with positive price reversals.

“Bitcoin’s post-halving hashrate contraction is on the verge of reversing… Security is growing [which] equals healthy network and positive for price.”

Bitcoin is trading for $66,323 at time of writing.

Generated Image: Midjourney