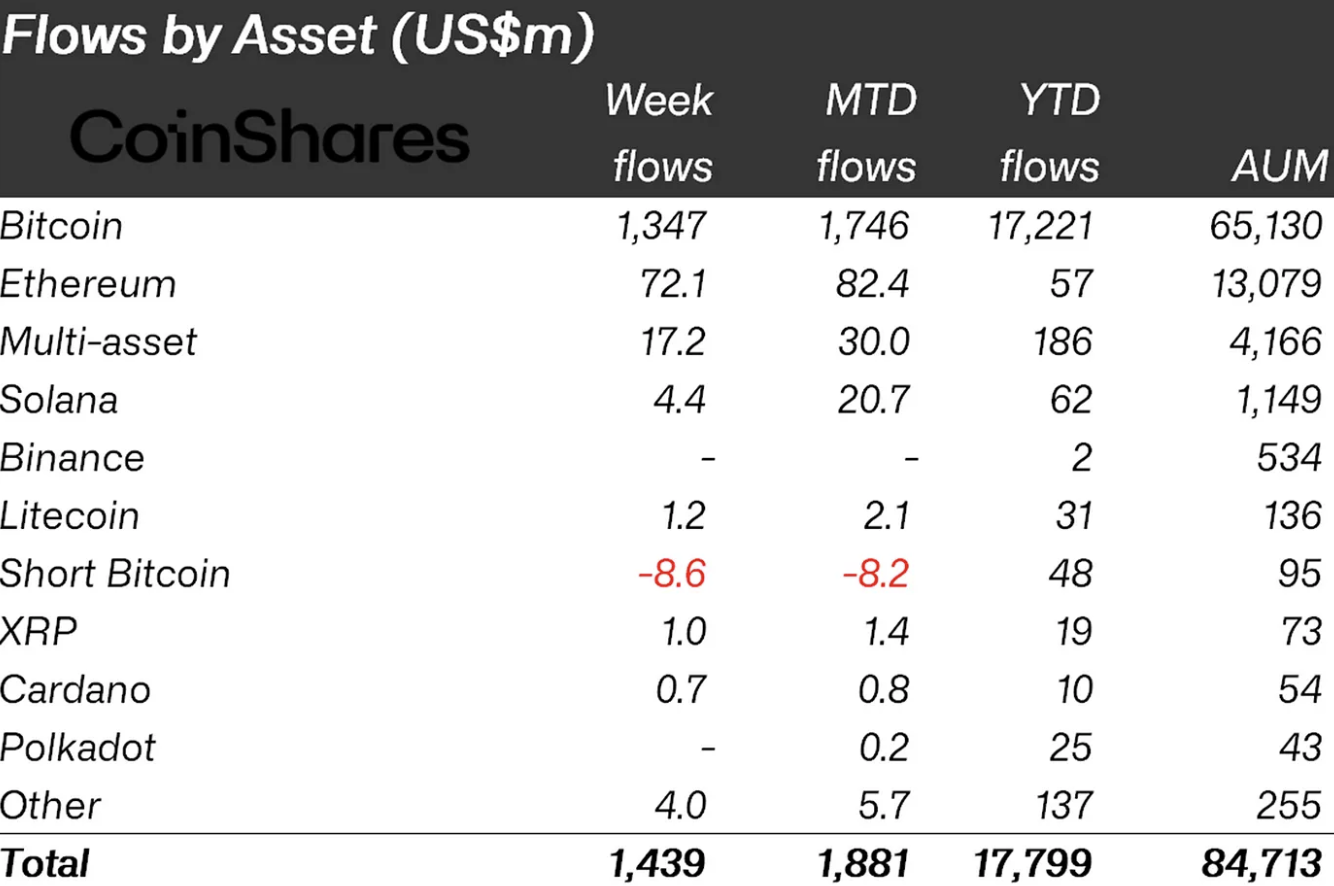

According to the latest report from CoinShares, inflows into XRP-focused investment products surged by $500,000 in the past week. While this is a significant decrease from the previous week’s inflow of over $1 million, it still represents half a million dollars of inflows.

This latest surge brings the total net flows into XRP exchange-traded products (ETPs) to more than $19 million since the start of the year.

The rise is likely connected to heightened expectations surrounding the SEC’s case against Ripple. The legal battle, which is approaching a pivotal moment, has led traders and enthusiasts to speculate about a potential settlement or resolution on July 25.

Ripple v. SEC

As reported by U.Today, the SEC rescheduled a key closed meeting by a week, further fueling speculation about the case’s outcome. Currently, the SEC is demanding billions in compensation, while Ripple is seeking a much lower amount of $10 million.

The anticipation of this ruling has also impacted XRP’s market performance, with the popular cryptocurrency experiencing a price increase of nearly 50% last week. This uptick coincides with the approaching one-year anniversary of the landmark decision, when XRP was officially recognized as a nonsecurity.

Thursday, July 25, is now a focal point, as the closed meeting could potentially finalize the lawsuit and discuss a settlement between Ripple and the SEC. With the ongoing inflows into XRP ETPs, it seems that investor optimism remains high, unless an unexpected development occurs.