Whales have accumulated 8.46 million Chainlink (LINK) worth $118.44 million over the last three weeks.

Chainlink (LINK) has been a focal point in recent market trends, with significant activity from large investors.

Ali Martinez, an analyst on X, highlighted that in the last three weeks, whales have accumulated 8.46 million LINK, valued at approximately $118.44 million. This accumulation, paired with price fluctuations, provides insights into market sentiment and future price movements.

Whales are on a buying spree for #Chainlink! In the last three weeks, they’ve accumulated 8.46 million $LINK, valued at approximately $118.44 million. pic.twitter.com/PEtt2Vb39n

— Ali (@ali_charts) July 22, 2024

Whales on the Move

The provided data from Santiment showcases a detailed chart from April 21, 2024, to July 21, 2024, illustrating the price of LINK and the accumulation patterns of large holders.

Notably, there was a sharp drop in the LINK price in late April, followed by a gradual recovery through May and June, with fluctuations continuing into July.

The yellow area on the chart reflects the accumulation of LINK by large holders, specifically those owning between 100,000 to 1,000,000 LINK coins. From late June to mid-July, there is a noticeable surge in accumulation, indicating increased buying activity by whales.

This trend peaks on July 21, 2024, suggesting heightened interest and confidence among large investors in Chainlink’s future performance.

Large Holder Confidence in Chainlink

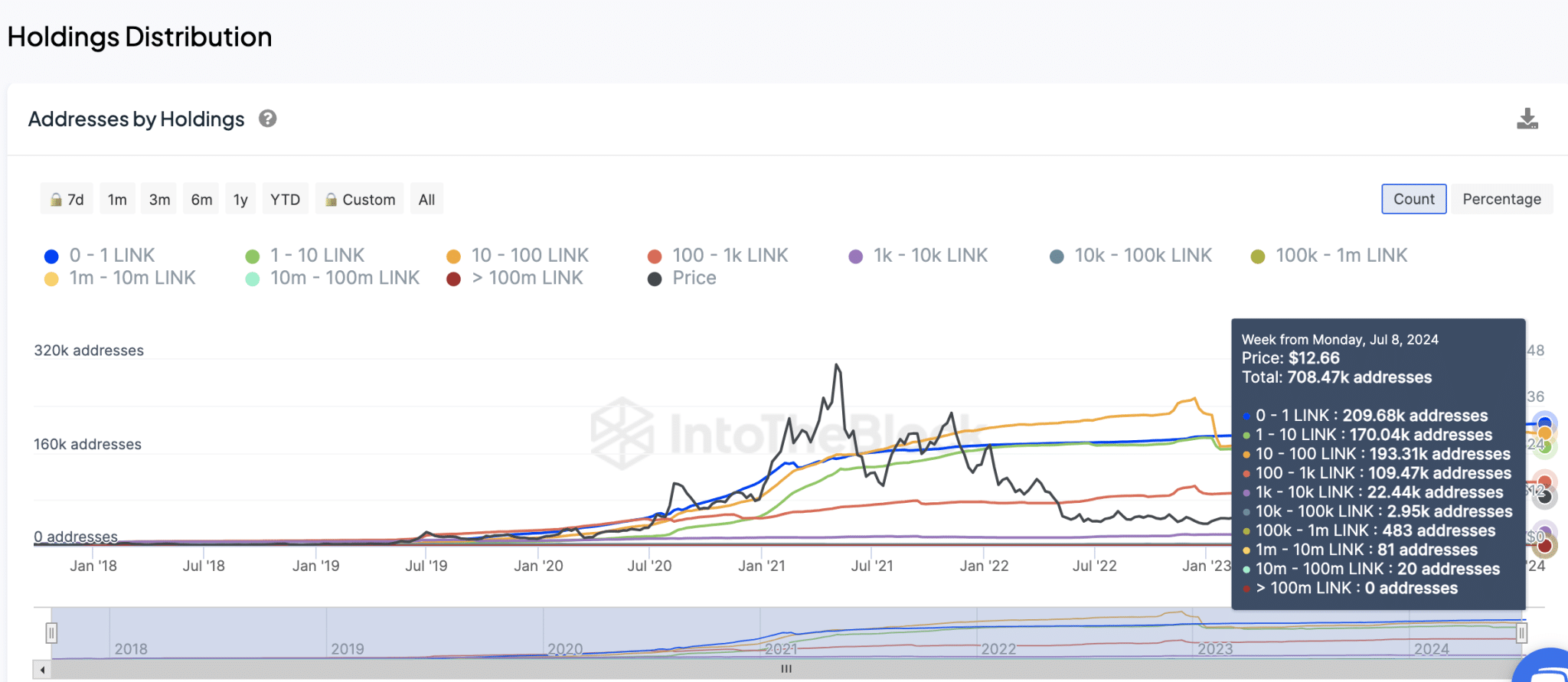

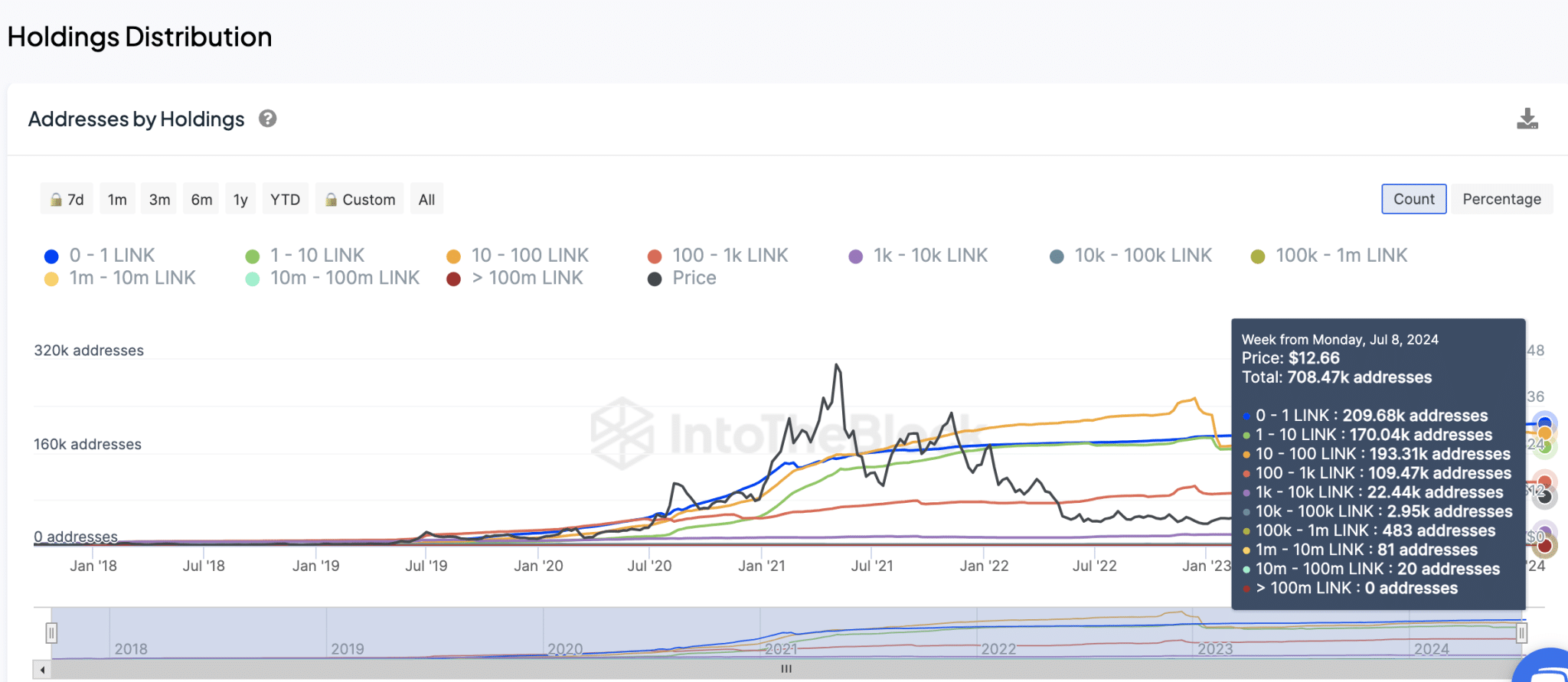

Further analysis from IntoTheBlock provides a holdings distribution chart for LINK addresses from January 2018 to July 2024. As of July 8, 2024, LINK’s price was $12.66, with a total of 708.47k addresses holding varying amounts of LINK.

The distribution shows a high number of addresses holding small amounts of LINK (0 – 10 LINK), indicating widespread participation from retail investors.

Larger holdings (100k – 1M LINK and 1M – 10M LINK) are fewer in number but significant in volume. There are 483 addresses holding between 100K – 1M LINK and 81 addresses holding balances from 1M to 10M LINK.

The slight increase in addresses holding 1M – 10M LINK suggests some accumulation by large holders over time, reflecting confidence among whales and institutional investors.

Market Bottom Indicators

Previous reports indicate critical resistance and support levels for LINK’s price. The key support level lies between $12.52 and $12.87, where 9.1K addresses hold 38.32 million LINK. This range represents strong support, indicating a substantial number of investors are in profit at this price level.

On the resistance side, the price range of $12.92 to $13.26 is crucial, with 10.93K addresses holding 44.04 million LINK. This volume suggests a strong resistance level that must be overcome for further upward movement.

Further resistance is identified at the $14.04 to $14.44 range, with 18.14k addresses holding 35.84 million LINK. Breaking this resistance could propel LINK towards $15.50, according to Ali Martinez and data from IntoTheBlock.

Recent data from Santiment also indicates that Chainlink may be approaching a market bottom. This conclusion is based on significant investor behavior, including its biggest capitulation spike this year and substantial realized losses.

On July 8, realized losses amounted to $60 million, reflecting high levels of fear, uncertainty, and doubt among traders. This capitulation event is an indication of a market bottom.

Whales have accumulated 8.46 million Chainlink (LINK) worth $118.44 million over the last three weeks.

Chainlink (LINK) has been a focal point in recent market trends, with significant activity from large investors.

Ali Martinez, an analyst on X, highlighted that in the last three weeks, whales have accumulated 8.46 million LINK, valued at approximately $118.44 million. This accumulation, paired with price fluctuations, provides insights into market sentiment and future price movements.

Whales are on a buying spree for #Chainlink! In the last three weeks, they’ve accumulated 8.46 million $LINK, valued at approximately $118.44 million. pic.twitter.com/PEtt2Vb39n

— Ali (@ali_charts) July 22, 2024

Whales on the Move

The provided data from Santiment showcases a detailed chart from April 21, 2024, to July 21, 2024, illustrating the price of LINK and the accumulation patterns of large holders.

Notably, there was a sharp drop in the LINK price in late April, followed by a gradual recovery through May and June, with fluctuations continuing into July.

The yellow area on the chart reflects the accumulation of LINK by large holders, specifically those owning between 100,000 to 1,000,000 LINK coins. From late June to mid-July, there is a noticeable surge in accumulation, indicating increased buying activity by whales.

This trend peaks on July 21, 2024, suggesting heightened interest and confidence among large investors in Chainlink’s future performance.

Large Holder Confidence in Chainlink

Further analysis from IntoTheBlock provides a holdings distribution chart for LINK addresses from January 2018 to July 2024. As of July 8, 2024, LINK’s price was $12.66, with a total of 708.47k addresses holding varying amounts of LINK.

The distribution shows a high number of addresses holding small amounts of LINK (0 – 10 LINK), indicating widespread participation from retail investors.

Larger holdings (100k – 1M LINK and 1M – 10M LINK) are fewer in number but significant in volume. There are 483 addresses holding between 100K – 1M LINK and 81 addresses holding balances from 1M to 10M LINK.

The slight increase in addresses holding 1M – 10M LINK suggests some accumulation by large holders over time, reflecting confidence among whales and institutional investors.

Market Bottom Indicators

Previous reports indicate critical resistance and support levels for LINK’s price. The key support level lies between $12.52 and $12.87, where 9.1K addresses hold 38.32 million LINK. This range represents strong support, indicating a substantial number of investors are in profit at this price level.

On the resistance side, the price range of $12.92 to $13.26 is crucial, with 10.93K addresses holding 44.04 million LINK. This volume suggests a strong resistance level that must be overcome for further upward movement.

Further resistance is identified at the $14.04 to $14.44 range, with 18.14k addresses holding 35.84 million LINK. Breaking this resistance could propel LINK towards $15.50, according to Ali Martinez and data from IntoTheBlock.

Recent data from Santiment also indicates that Chainlink may be approaching a market bottom. This conclusion is based on significant investor behavior, including its biggest capitulation spike this year and substantial realized losses.

On July 8, realized losses amounted to $60 million, reflecting high levels of fear, uncertainty, and doubt among traders. This capitulation event is an indication of a market bottom.