The Near Protocol (NEAR) token displayed a wild recovery of over 35% this week and crossed key moving averages.

Via a double bottom pattern, NEAR rebounded sharply from the $4 mark, and retained the bullish trajectory. Notably, the token has settled the gains above the $6 mark. It is primed for the next bullish leg toward the $8 mark.

Fueled by the market recovery, NEAR was the frontrunner and surged the most within the past few trading sessions. Price action reflects fresh buyer accumulation.

At press time, the NEAR was worth $6.33 with an intraday surge of 4.01%, reflecting neutrality on the charts. It has a monthly return ratio of 27.20% and 312.20% yearly, reflecting a long-term uptrend.

The pair of NEAR/BTC is at 0.0000951 BTC, and the market cap is $3.85 Billion. Analysts are bullish and suggest that NEAR might stretch the upmove and expand further, leading a bullish leg toward the $8 mark ahead.

NEAR Bullish Trend Just Got Better

Its price action delivered a rise in the volume of buying activity. This gave a firm conviction that buyers were preparing to spread their next bullish leg toward the $8 mark.

The RSI curve stayed in the overbought zone and noted a positive crossover, implying a bullish outlook.

This week, the bullish momentum went down as the token waits another wave. Once a daily candlestick close above $6.60 was established, the token could stretch the up move toward the $7 mark soon.

Near On-Chain Data Gives Positive Outlook

Fueled by the price recovery, the weighted sentiment improved slightly and retained the midline zone, which noted at 0.127. It directs the positive inflows in the token.

Similarly, the development activity data reflected the ecosystem’s significant growth and consistent developments. This favored the price rise. Notably, the value lifted over 33% to 44 mark.

Meanwhile, the open interest data soared over 1.21% to $211.23 Million, signifying a long addition activity in the last 24 hours.

A tweet by @damskotrades highlighted that NEAR has established its foot near the support zones and is primed for a surge ahead.

$NEAR | USD

It’s at a great spot on the higher time frames. We got a macro range low reclaim set up, and the price action (higher time frames range high) matches being in stage 4 in the cycle.

You could simply slowly accumulate in the yellow, ideally on dips. If you want to be… pic.twitter.com/qMmrNnCovN

— CryptoAmsterdam (@damskotrades) July 20, 2024

A tweet by @damskotrades | Source: X

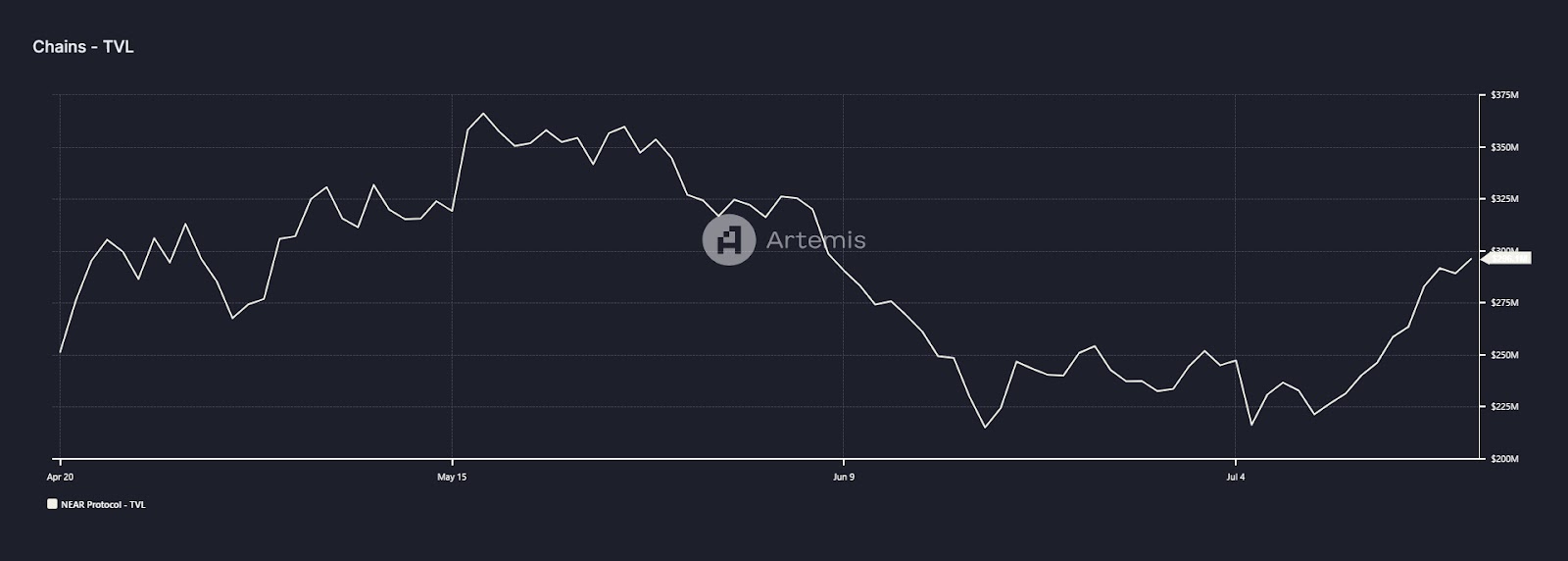

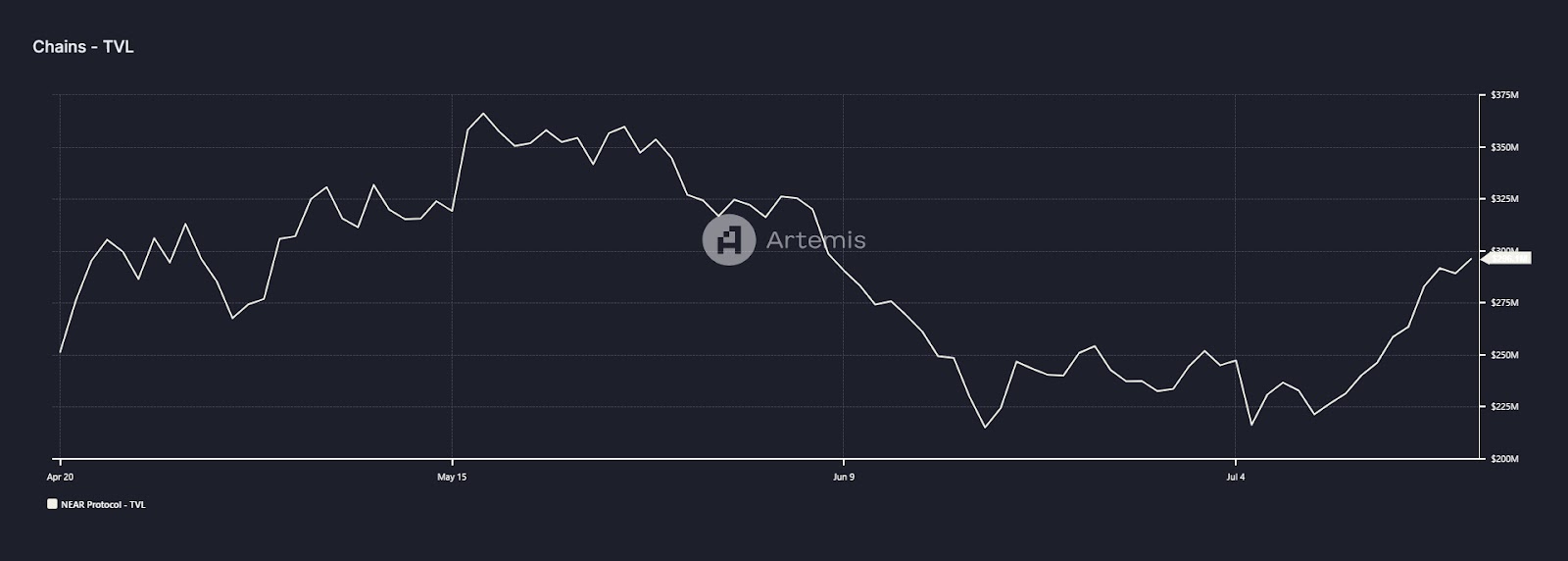

Total Value Locked (TVL) on the Rise

After the wild price recovery, the positive shift in the TVL of the token gave a strong conviction about the internal growth of the token.

The rising TVL meant that the market participants were confident and continued to make positions in the token for healthy long-term gains.

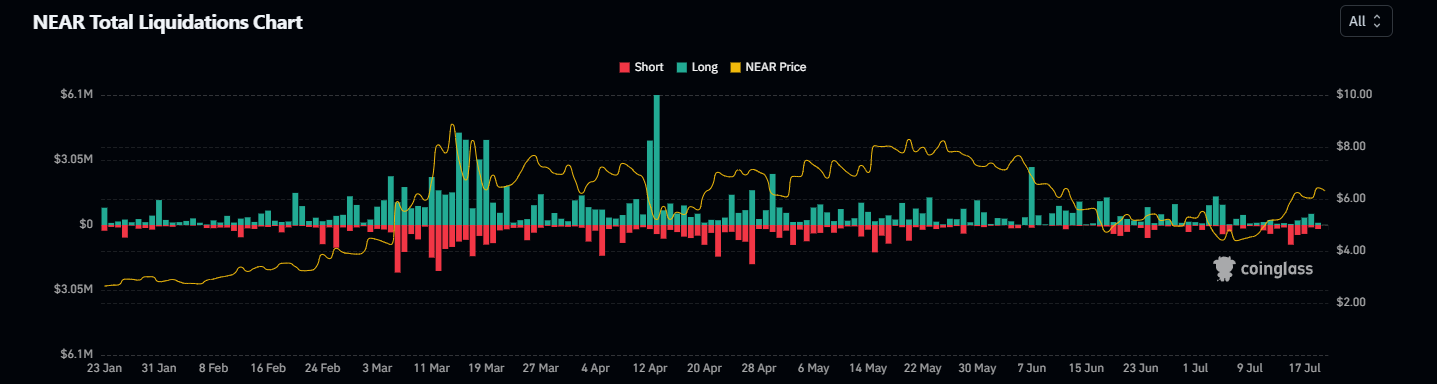

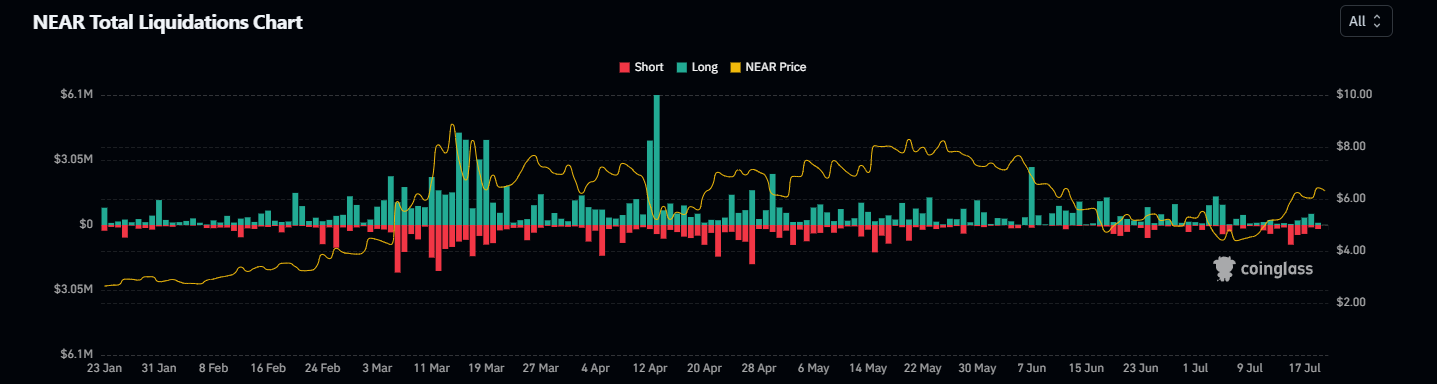

Total Liquidations Chart Show Confirms On-chain Data

Amidst the recent growth in the token price, the battle became more exciting, and bulls and bears were keen to gain dominance, but none of them have gained the upper hand, as reflected by the liquidations data.

The short liquidations data noted at $176k, whereas the long liquidations were at $102k. This data implies an equal-weighted presence, and the token remains in the midst.

The immediate support levels for NEAR are $6.00 and $5.80, whereas the key upside hurdle is around $7.20, followed by $7.40

NEAR climbed above the key moving averages and is preparing to unfold a sharp spike. Its price action favored the rise, and the token could resume the outperformance ahead. Bulls must break its primary hurdle of $7 to establish strength, which would lead to a major upside move toward the $8 mark ahead.

The Near Protocol (NEAR) token displayed a wild recovery of over 35% this week and crossed key moving averages.

Via a double bottom pattern, NEAR rebounded sharply from the $4 mark, and retained the bullish trajectory. Notably, the token has settled the gains above the $6 mark. It is primed for the next bullish leg toward the $8 mark.

Fueled by the market recovery, NEAR was the frontrunner and surged the most within the past few trading sessions. Price action reflects fresh buyer accumulation.

At press time, the NEAR was worth $6.33 with an intraday surge of 4.01%, reflecting neutrality on the charts. It has a monthly return ratio of 27.20% and 312.20% yearly, reflecting a long-term uptrend.

The pair of NEAR/BTC is at 0.0000951 BTC, and the market cap is $3.85 Billion. Analysts are bullish and suggest that NEAR might stretch the upmove and expand further, leading a bullish leg toward the $8 mark ahead.

NEAR Bullish Trend Just Got Better

Its price action delivered a rise in the volume of buying activity. This gave a firm conviction that buyers were preparing to spread their next bullish leg toward the $8 mark.

The RSI curve stayed in the overbought zone and noted a positive crossover, implying a bullish outlook.

This week, the bullish momentum went down as the token waits another wave. Once a daily candlestick close above $6.60 was established, the token could stretch the up move toward the $7 mark soon.

Near On-Chain Data Gives Positive Outlook

Fueled by the price recovery, the weighted sentiment improved slightly and retained the midline zone, which noted at 0.127. It directs the positive inflows in the token.

Similarly, the development activity data reflected the ecosystem’s significant growth and consistent developments. This favored the price rise. Notably, the value lifted over 33% to 44 mark.

Meanwhile, the open interest data soared over 1.21% to $211.23 Million, signifying a long addition activity in the last 24 hours.

A tweet by @damskotrades highlighted that NEAR has established its foot near the support zones and is primed for a surge ahead.

$NEAR | USD

It’s at a great spot on the higher time frames. We got a macro range low reclaim set up, and the price action (higher time frames range high) matches being in stage 4 in the cycle.

You could simply slowly accumulate in the yellow, ideally on dips. If you want to be… pic.twitter.com/qMmrNnCovN

— CryptoAmsterdam (@damskotrades) July 20, 2024

A tweet by @damskotrades | Source: X

Total Value Locked (TVL) on the Rise

After the wild price recovery, the positive shift in the TVL of the token gave a strong conviction about the internal growth of the token.

The rising TVL meant that the market participants were confident and continued to make positions in the token for healthy long-term gains.

Total Liquidations Chart Show Confirms On-chain Data

Amidst the recent growth in the token price, the battle became more exciting, and bulls and bears were keen to gain dominance, but none of them have gained the upper hand, as reflected by the liquidations data.

The short liquidations data noted at $176k, whereas the long liquidations were at $102k. This data implies an equal-weighted presence, and the token remains in the midst.

The immediate support levels for NEAR are $6.00 and $5.80, whereas the key upside hurdle is around $7.20, followed by $7.40

NEAR climbed above the key moving averages and is preparing to unfold a sharp spike. Its price action favored the rise, and the token could resume the outperformance ahead. Bulls must break its primary hurdle of $7 to establish strength, which would lead to a major upside move toward the $8 mark ahead.