The Ethena (ENA) market cap has surged 5.57% along with its intraday price. The ENA token last traded at $0.4737 with a market cap of $810.32 million. That helped it secure the 87th spot in the top 100 global cryptos on CoinMarketCap at press time.

The tokenomics highlighted that out of 15.0 Billion ENA, only 1.710 Billion ENA tokens floated in people’s hands.

Moreover, the liquidity seemed excellent at 11.0%, per the 24-hour volume-to-market cap ratio. This crypto asset has plenty of liquidity, facilitating investors and traders to buy and sell on an exchange closer to its price value.

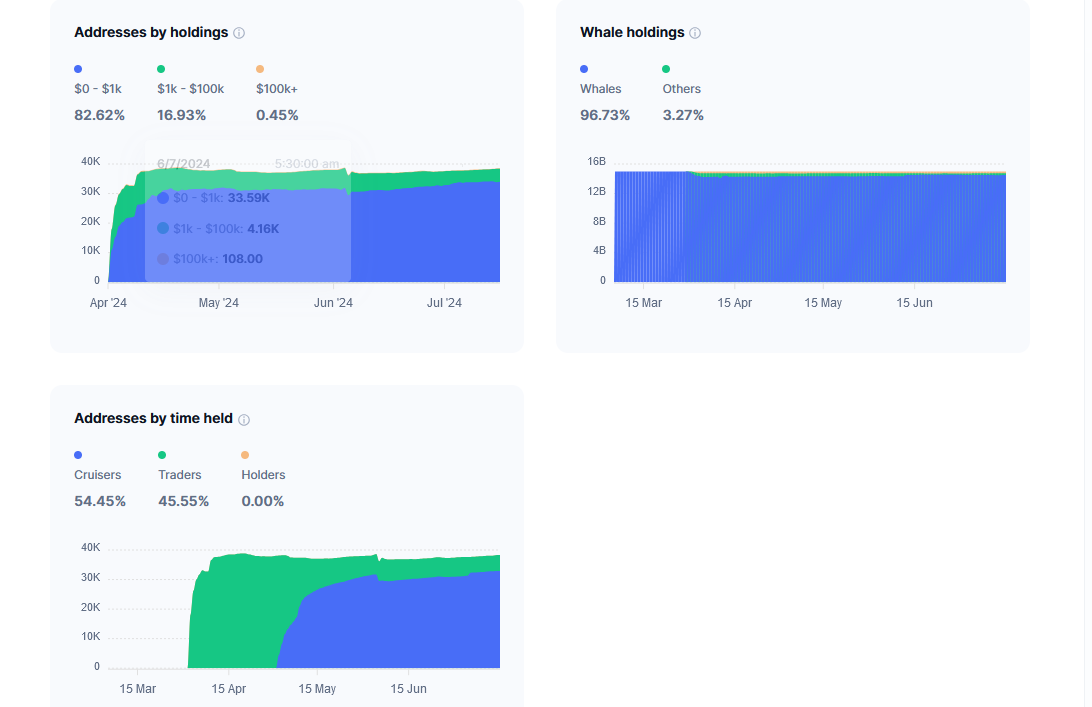

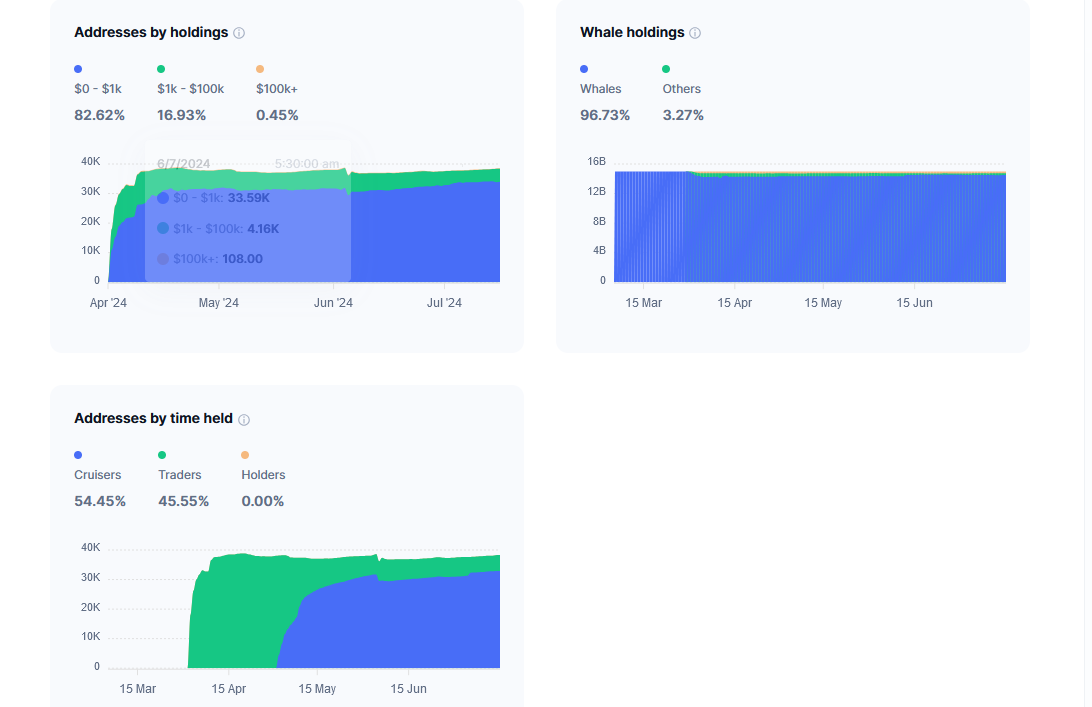

As per Ethena token’sholder’s pattern, the wallet addresses by the held amount in between $0 – $1K were 82.62%, $1k – $100K were 16.93%, and holders holding amounts above $100K were only 0.45%.

Meanwhile, the addresses by time held illustrated that most were cruisers at 54.45% and traders at 45.55%.

The whale holding pattern showed that whale wallet addresses holding over 1% of the circulating supply show a percentage of 96.73%, while others have a mere 3.27%.

What Do On-chain Metrics Highlight About Ethena (ENA)?

The ENA highlighted healthy developer activity in a cumulative chart as the developer’s commit count changes over time. The developer’s activity and commit count have presented sustained growth over Ethena crypto for the last six months, according to DefiLlama.

The weekly commits in ENA were 19; monthly commits were 25. Meanwhile, the weekly developers registered were 4, and the monthly developers were 7. The last commit that DefiLlama tracked was on July 13th, 2024.

Similarly, the social volume was rising as 98 tweets were registered. The advancement in the tweet volume indicated the rising crypto awareness among users and signified that it is among the bruited topics.

Moreover, the total value locked (TVL) has reached $3.395 Billion. An increase in ENA’s TVL over time reflects the surge in demand for the asset’s project and the changing dynamics of its market participation. That reflected that the higher TVL made the Ethena (ENA) asset more reliable and less risky.

The Fees and Revenue of Ethena (ENA) also increased, as Fees reached $101.1 Million and Revenue reached $65.82 Million.

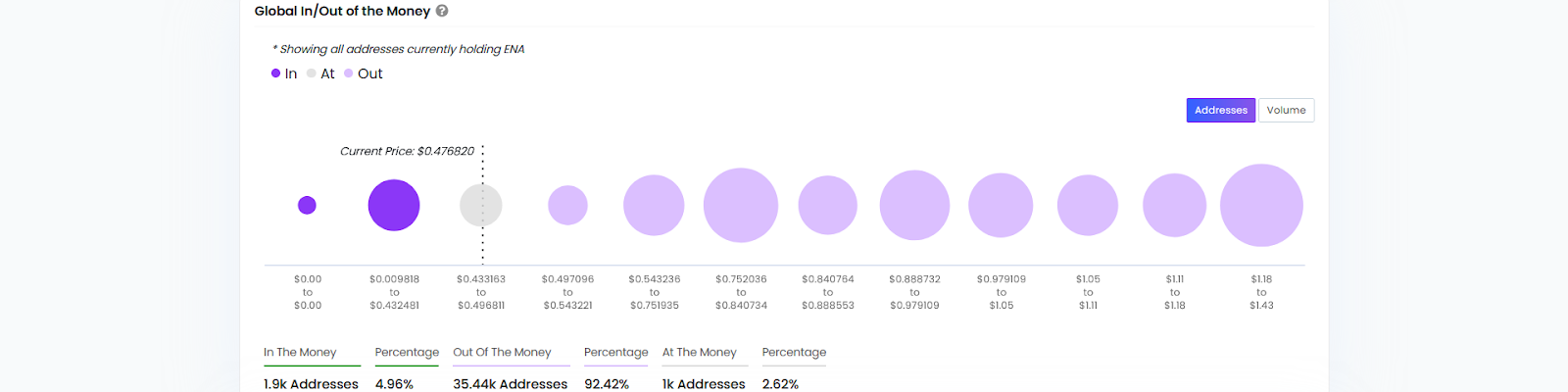

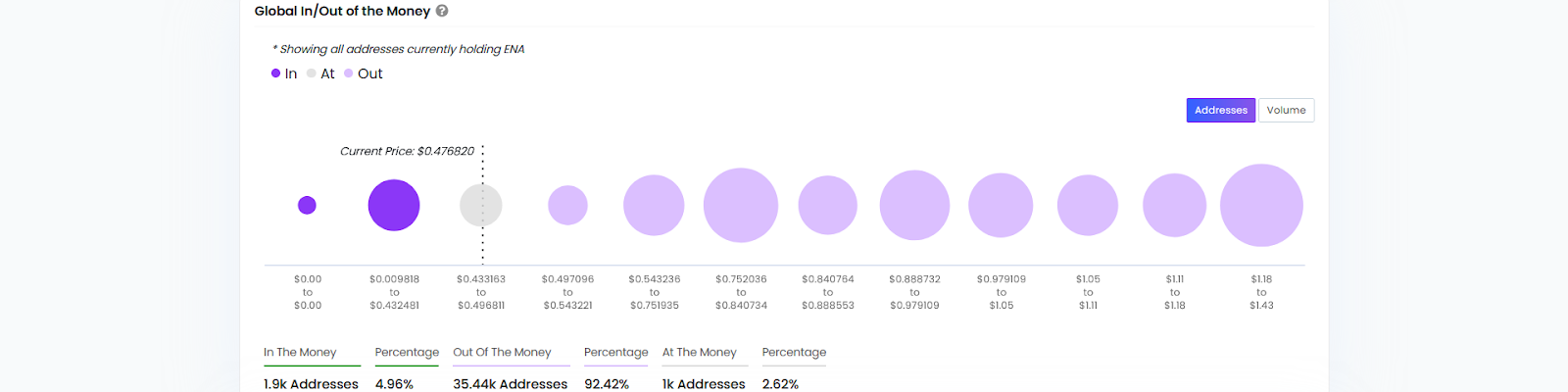

Additionally, the total addresses with a balance of a 30-day average have registered growth, with 38.04K addresses in total. Likewise, the addresses in profit based on their current price were low at 4.96% with 1.9K addresses. Additionally, there were 1K addresses at breakeven, making 2.62% of the total.

At the same time, the addresses that were sitting in loss due to massive deterioration in price are 35.44K addresses, which made 92.42% in total.

Ethena (ENA) Price Technical Analysis On Daily Chart!

The Ethena (ENA) price had an all-time high at $1.51 on April 11th, 2024, and then started plummeting by resonating with BTC, as ENA has a BTC correlation score of 0.83 at the time of writing. The price structure developed a falling channel, and for the last three months, the price has traded inside this pattern.

Recently, in correlation to BTC, the price showed a bullish presence from July 5th onwards. Besides, nearly 36% of the gains were from the support of $0.3523 and the lower border of the wedge. The price seems to be approaching the 50-day EMA band on the daily chart.

Meanwhile, other technical tools like MACD showed a histogram surge of 0.0195, with a bullish cross below the zero line. The RSI flashes at 48.05. It seems like a recovery on the way from oversold to overbought.

At press time, it has traded at $0.4817, where its price seemed to be heading toward the upper border of the wedge, where it could meet a hurdle at $0.6562. Once past that hurdle, further interruptions could lie around $0.8068 and $1.0098, respectively.

However, slipping its recent gains could retract toward the support of $0.3253 and lower the border of the wedge.

I heard every penny $ENA goes up, an angel gets their wings pic.twitter.com/dSXkqVNnhL

— nick (@ExitLiqCapital) July 15, 2024

Additionally, an Analyst @ExitLiqCapital shared an optimistic tweet and an image where he expects bullishness. He further said that every penny ENA surges gets closer to rallying.

Is ENA Price Attempting a Breakout?

Ethena’s market cap and price surged with healthy developer activity and rising social volume. After recent gains, the ENA price was trying to break out of a falling wedge pattern.

If successful, resistance could be at the $0.66, $0.81, and $1.01. However, failing to hold gains could see a drop back to the support level at $0.33.

The Ethena (ENA) market cap has surged 5.57% along with its intraday price. The ENA token last traded at $0.4737 with a market cap of $810.32 million. That helped it secure the 87th spot in the top 100 global cryptos on CoinMarketCap at press time.

The tokenomics highlighted that out of 15.0 Billion ENA, only 1.710 Billion ENA tokens floated in people’s hands.

Moreover, the liquidity seemed excellent at 11.0%, per the 24-hour volume-to-market cap ratio. This crypto asset has plenty of liquidity, facilitating investors and traders to buy and sell on an exchange closer to its price value.

As per Ethena token’sholder’s pattern, the wallet addresses by the held amount in between $0 – $1K were 82.62%, $1k – $100K were 16.93%, and holders holding amounts above $100K were only 0.45%.

Meanwhile, the addresses by time held illustrated that most were cruisers at 54.45% and traders at 45.55%.

The whale holding pattern showed that whale wallet addresses holding over 1% of the circulating supply show a percentage of 96.73%, while others have a mere 3.27%.

What Do On-chain Metrics Highlight About Ethena (ENA)?

The ENA highlighted healthy developer activity in a cumulative chart as the developer’s commit count changes over time. The developer’s activity and commit count have presented sustained growth over Ethena crypto for the last six months, according to DefiLlama.

The weekly commits in ENA were 19; monthly commits were 25. Meanwhile, the weekly developers registered were 4, and the monthly developers were 7. The last commit that DefiLlama tracked was on July 13th, 2024.

Similarly, the social volume was rising as 98 tweets were registered. The advancement in the tweet volume indicated the rising crypto awareness among users and signified that it is among the bruited topics.

Moreover, the total value locked (TVL) has reached $3.395 Billion. An increase in ENA’s TVL over time reflects the surge in demand for the asset’s project and the changing dynamics of its market participation. That reflected that the higher TVL made the Ethena (ENA) asset more reliable and less risky.

The Fees and Revenue of Ethena (ENA) also increased, as Fees reached $101.1 Million and Revenue reached $65.82 Million.

Additionally, the total addresses with a balance of a 30-day average have registered growth, with 38.04K addresses in total. Likewise, the addresses in profit based on their current price were low at 4.96% with 1.9K addresses. Additionally, there were 1K addresses at breakeven, making 2.62% of the total.

At the same time, the addresses that were sitting in loss due to massive deterioration in price are 35.44K addresses, which made 92.42% in total.

Ethena (ENA) Price Technical Analysis On Daily Chart!

The Ethena (ENA) price had an all-time high at $1.51 on April 11th, 2024, and then started plummeting by resonating with BTC, as ENA has a BTC correlation score of 0.83 at the time of writing. The price structure developed a falling channel, and for the last three months, the price has traded inside this pattern.

Recently, in correlation to BTC, the price showed a bullish presence from July 5th onwards. Besides, nearly 36% of the gains were from the support of $0.3523 and the lower border of the wedge. The price seems to be approaching the 50-day EMA band on the daily chart.

Meanwhile, other technical tools like MACD showed a histogram surge of 0.0195, with a bullish cross below the zero line. The RSI flashes at 48.05. It seems like a recovery on the way from oversold to overbought.

At press time, it has traded at $0.4817, where its price seemed to be heading toward the upper border of the wedge, where it could meet a hurdle at $0.6562. Once past that hurdle, further interruptions could lie around $0.8068 and $1.0098, respectively.

However, slipping its recent gains could retract toward the support of $0.3253 and lower the border of the wedge.

I heard every penny $ENA goes up, an angel gets their wings pic.twitter.com/dSXkqVNnhL

— nick (@ExitLiqCapital) July 15, 2024

Additionally, an Analyst @ExitLiqCapital shared an optimistic tweet and an image where he expects bullishness. He further said that every penny ENA surges gets closer to rallying.

Is ENA Price Attempting a Breakout?

Ethena’s market cap and price surged with healthy developer activity and rising social volume. After recent gains, the ENA price was trying to break out of a falling wedge pattern.

If successful, resistance could be at the $0.66, $0.81, and $1.01. However, failing to hold gains could see a drop back to the support level at $0.33.