Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

T-minus: 84 days

Crypto moves fast.

The pace at which narratives evolve, explode and fade away is reflected in the conference circuit.

So, as we’re now less than 90 days away from the third iteration of Blockworks’ flagship Permissionless event, let’s look back at the first one to see how the conversation has morphed.

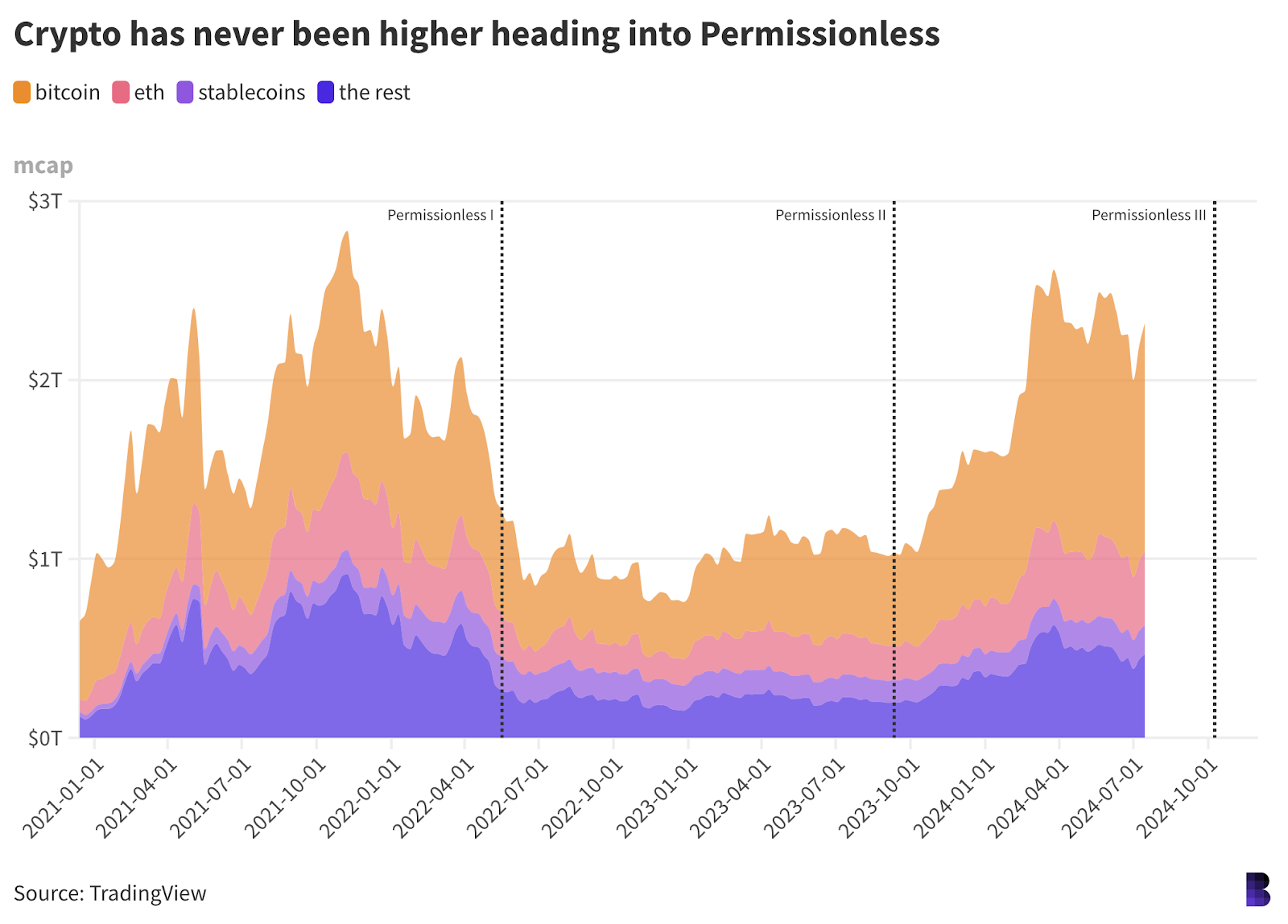

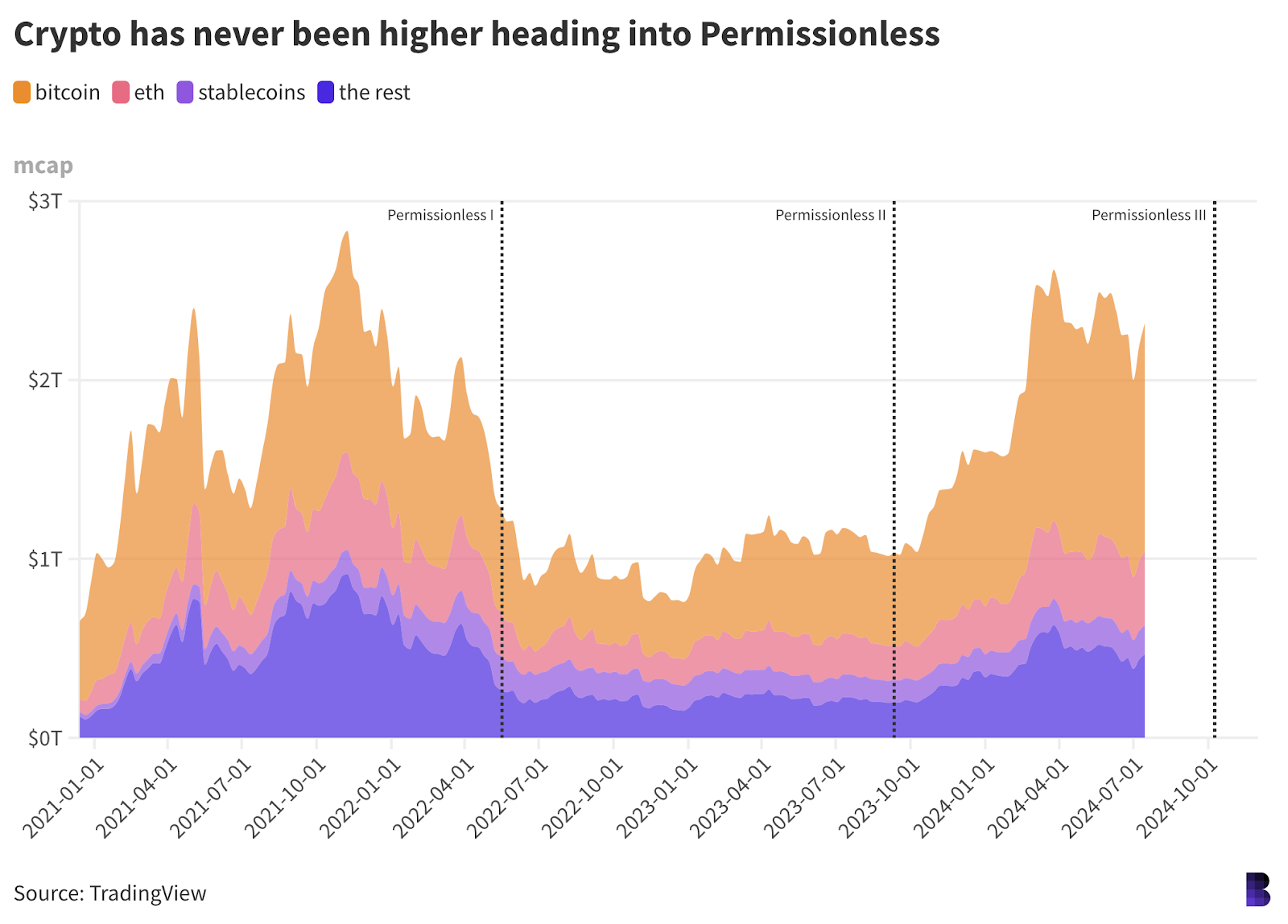

The first Permissionless ran in May 2022 — either the extreme end of the monstrous “DeFi summer” bull market or the early innings of the longest bear market on record, depending on how you look at it.

Back then, major talking points included MEV, stablecoins and DeFi. Flashbots Auction, one of the earliest primary cogs in the MEV machine, had been running for about 18 months leading up to the first Permissionless.

The cumulative payout across the entire MEV had gone from $90 million to $633 million in that time.

And since the Permissionless MEV panel “Why you can’t afford to ignore MEV,” featuring Flashbots gurus Hasu and Stephane Gosselin, an additional $1.87 billion in ETH has been paid out to proposers, valued at current prices.

Another panel asked whether Wall Street was coming for DeFi. It turns out it was — six months later, JPMorgan executed a live tokenized foreign exchange trade on Polygon PoS alongside DBS and SBI Digital Asset.

The trade took place through a forked and modified version of Aave Arc, so that participating banks could set their own transaction parameters and still settle on a permissionless blockchain.

Permissionless III, which happens 29 months after the first event, will host conversations more up to the minute.

Modularity and interoperability, the intersection of AI and crypto, the potential cascading risk of restaking. Fully onchain games. Layer-2s (including for Bitcoin) and shared sequencing.

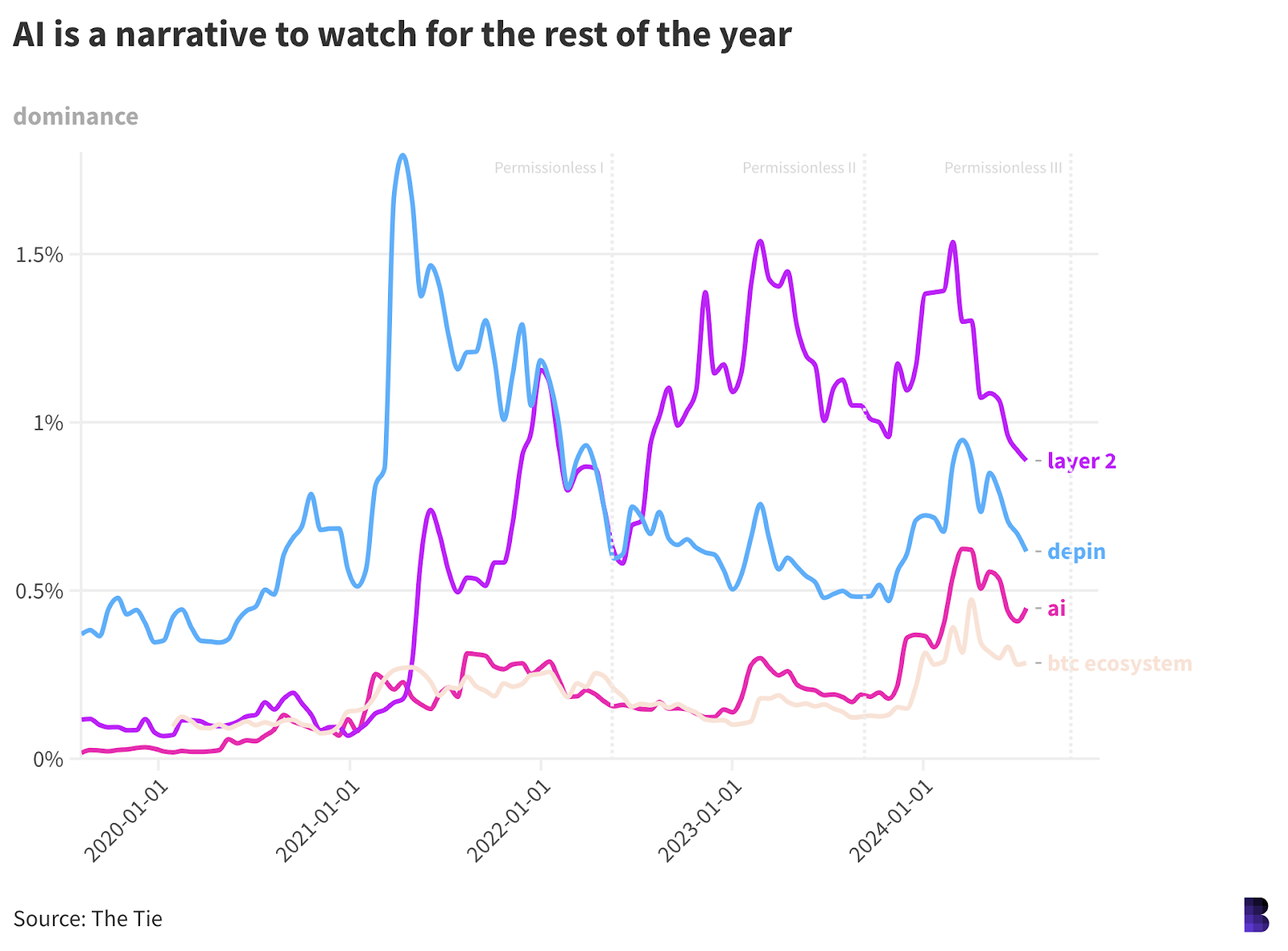

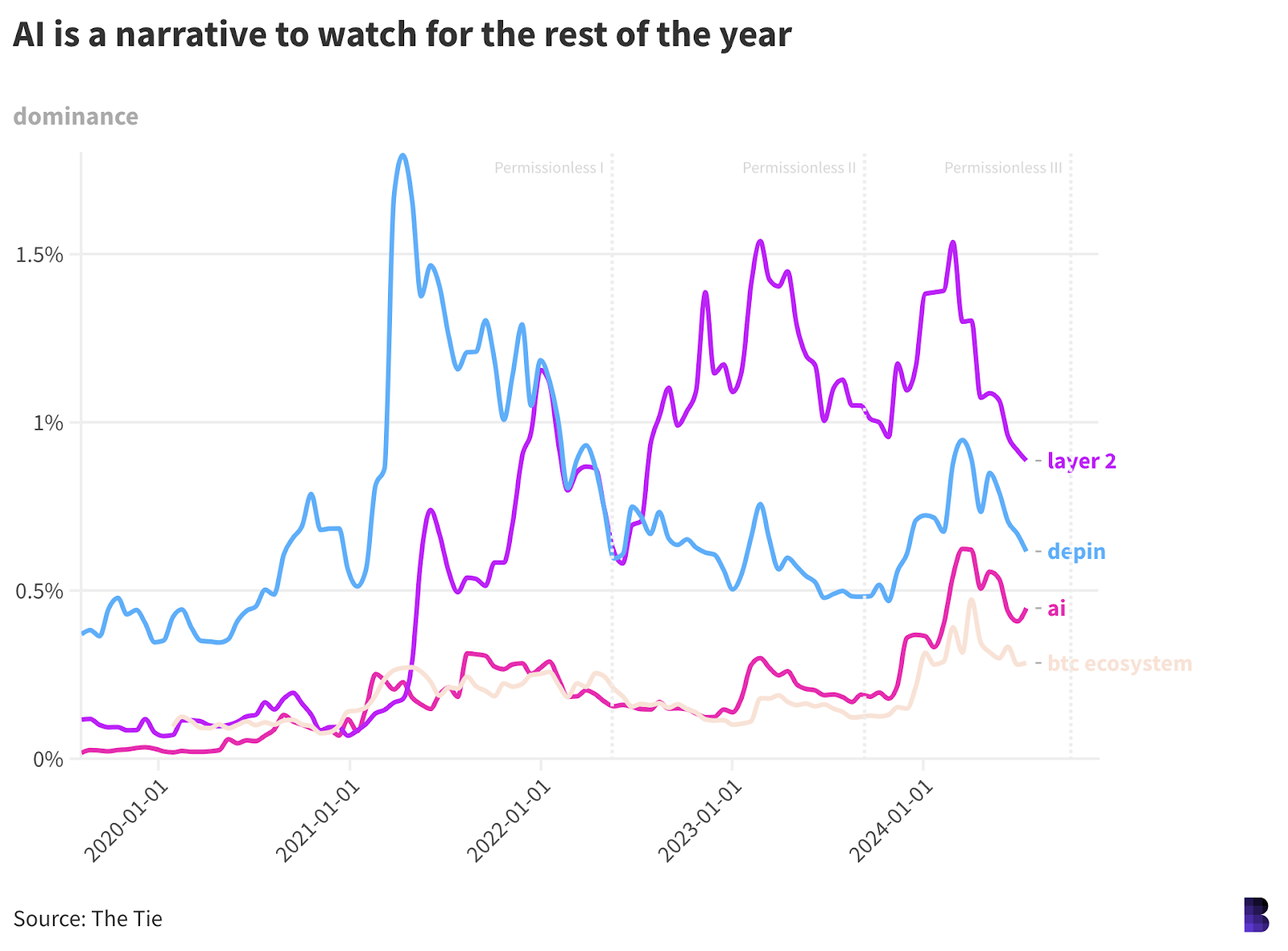

For what it’s worth, the market is already voting on what narratives solidify into full-blown phenomenon.

The market dominance of layer-2s — a metric for gauging how much of the crypto market is made up of layer-2 tokens — peaked at 1.54% in both February 2023 and 2024. It has since retraced to 0.89%, according to The Tie data. Still way up from the 0.12% market dominance recorded five years ago.

DePIN, meanwhile, really hit an all-time high for dominance in April 2021 (almost peak bull market), but it has since given up two-thirds of that ground.

(It should be said that the token price performance relative to the market has little to do with the growth of their underlying projects or protocols. Onchain DePIN activity, for instance, is generally growing, despite the dominance trend, although rising prices definitely seem to help.)

Going by market makeup, AI and the Bitcoin ecosystem — projects building in Bitcoin’s orbit, but not bitcoin itself — are set to be the hottest leading into Permissionless III.

They both make up less than half a percent of the crypto market right now, according to The Tie, but the trajectory looks destined to change that.

— David Canellis

Grab your ticket to Permissionless III in Salt Lake City here. Prices are subject to increase.

Data Center

- Ethereum’s validator count is at a new all-time high: 1,034,051, up 65% since this time last year.

- That has driven the ETH stakingAPR down to 3.22%, up slightly from last week but still down from 4.59% year on year.

- Tron persists as the biggest layer-1 for fee spend, making up 50% of fees generated among the top 20 last week, per Token Terminal.

- Most of that is due to the popularity of stablecoin tether on the network, which is burning 96% of all TRX fees right now.

- BTC and ETH are working to extend their recoveries, both up less than 2% over the past day (BTC: $64,700; ETH: $3,450).

Vibe check

This week is the first time this summer that there’s been a noticeable shift in sentiment. The air feels cleaner in crypto, the birds are singing and the machines whirring. It feels good.

There are a few reasons for this. No doubt getting alerts that bitcoin keeps climbing, carving out highs we haven’t seen in — *checks notes* — a month makes it feel like that bearish narrative that was creeping in is quickly being swatted away.

There’s also the Republican presidential ticket. The combination of a candidate who seems to be leaning pro-crypto and an undoubtedly pro-crypto vice presidential candidate has many in the space abuzz with possibilities.

2 Punks Capital general partner Jacob Martin told me he’s “pretty bullish going into the fall” given the circumstances.

“I think we’re about to find out over the next six months if the general market is actually ready to put real capital into crypto funds. And we’ll find that out the hard way…You know, good, bad or ugly,” Martin said.

One thing that stands out to me is not just the general vibes shift, but how that could impact the next few months, given that we might see bounceback a little earlier than previously expected. Or maybe this is all just a blip on the radar given that Mt Gox is still an overhang to account for right now.

We’ve previously chatted with folks like Ledn’s CIO John Glover, who told us that we should expect positive price action in the fall. But more immediately, bitcoin has climbed steadily since this past weekend.

Some of this makes sense if you pay attention to prediction markets like Polymarket, which now has a Trump victory at 70% with Biden at 18% odds of winning.

“I think you’re going to see a lot of red dollars and a lot of middle dollars that weren’t sure” come into the space, Martin tells me. “I think there’s a whole new base of capital that’s going to show up not just towards the ETFs, but towards private allocation as well.”

Framework Ventures’ Michael Anderson — who I spoke to before Vance was announced as Trump’s VP choice — said that one big question mark over crypto remains “how does the US receive a lot of this industry from a regulatory perspective or a legislative perspective?”

“And it’s been back and forth. It’s been partisan. It’s been nonpartisan, bipartisan. It’s been up for vote. It’s been blocked or vetoed. Like there’s just been so much back and forth, it’s hard to know exactly how that’ll play out, and that’s a huge edge factor for innovation and growth in the US, which is where a lot of the people are, I would say, in the crypto industry,” Anderson added.

Vance, per a Politico report last month, could be looking to clear up the regulatory hurdle. And we know he’s not a huge fan of SEC Chair Gary Gensler, going by a clip from Consensys’ Bill Hughes.

From a VC vantage point, it’s looking really bullish this fall, Martin said.

“Basically, if there is a crypto fund that you can think of their name, they will raise this fall, or they’re already raising right now. And so I think we will actually see very clearly, if this thesis is correct, over the next six months,” he added.

And he’s not feeling bullish for just VCs, either. Martin believes “you’ll have a hard time probably finding a more bullish six months to raise, whether it’s for a fund or a startup,” because of the possibility of a clearer regulatory environment. Though it’s not yet clear whether the regulatory uncertainty will clear up anytime soon.

Looking to Bitcoin 2024 and Permissionless III — both fall events — we might also see that upbeat attitude reflected on the ground. Maybe the crypto industry won’t seem so burnt out…

One thing’s for sure: It’s all about the vibes.

— Katherine Ross

The Works

- Marc Andreessen and Ben Horowitz plan to donate to Donald Trump’s campaign, Bloomberg reported.

- Deribit announced that it’s launching bitcoin and ether options that will expire in early November.

- Hong Kong’s Monetary Authority is plotting a licensing regime for stablecoin companies.

- According to a statement, Cypherpunk upped its Solana holdings.

- Craig Wright faces a potential perjury investigation over his claims that he created bitcoin, Wired reported.

The Riff

Q: Does the Craig Wright debacle have a silver lining?

The correspondence between Satoshi and Martii Malmi.

Don’t get me wrong, I think it’s unfortunate that the back and forth between the two had to be used against Wright’s claims, but I think they offered a very unique and important look into Satoshi.

When they first dropped, the other Blockworks editors and I spent hours thumbing through each email just analyzing everything Satoshi said back in the day. We learned a lot.

He didn’t want to call bitcoin an investment, for example.

Wright can no longer claim to be Satoshi as ruled by a UK judge, and his site now says, “Dr. Craig Steven Wright is not Satoshi Nakamoto.”

After years of Wright’s claims — and so many legal battles — we can finally put this one to rest. Unless he’s formally charged, of course.

— Katherine Ross

They say nature healed during the pandemic.

Dolphins frolicking through Venice canals. Mountain lions curiously explored urban outskirts, where they’re usually turned off by the buzz of pesky humans.

The boffins might debate whether all that actually happened, or even if it did, whether the covid “anthropause” was a net positive for nature.

But the same thing can now happen to Bitcoin and blockchain development. Craig Wright was a key antagonist in the Block Size War, which ultimately diluted Bitcoin discourse, resulting in two satellite ecosystems of builders.

The work of those builders, particularly in Bitcoin SV world, was forever overshadowed by whatever controversy Wright was wrapped up in at any given time.

Bitcoin is different now than before the hard forks. There’s more freedom to build, even non-money use cases like Ordinals.

Maybe a prodigal developer out there could be the one to make a breakthrough layer-2. Who knows. At least there’s one less distraction.

— David Canellis

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

T-minus: 84 days

Crypto moves fast.

The pace at which narratives evolve, explode and fade away is reflected in the conference circuit.

So, as we’re now less than 90 days away from the third iteration of Blockworks’ flagship Permissionless event, let’s look back at the first one to see how the conversation has morphed.

The first Permissionless ran in May 2022 — either the extreme end of the monstrous “DeFi summer” bull market or the early innings of the longest bear market on record, depending on how you look at it.

Back then, major talking points included MEV, stablecoins and DeFi. Flashbots Auction, one of the earliest primary cogs in the MEV machine, had been running for about 18 months leading up to the first Permissionless.

The cumulative payout across the entire MEV had gone from $90 million to $633 million in that time.

And since the Permissionless MEV panel “Why you can’t afford to ignore MEV,” featuring Flashbots gurus Hasu and Stephane Gosselin, an additional $1.87 billion in ETH has been paid out to proposers, valued at current prices.

Another panel asked whether Wall Street was coming for DeFi. It turns out it was — six months later, JPMorgan executed a live tokenized foreign exchange trade on Polygon PoS alongside DBS and SBI Digital Asset.

The trade took place through a forked and modified version of Aave Arc, so that participating banks could set their own transaction parameters and still settle on a permissionless blockchain.

Permissionless III, which happens 29 months after the first event, will host conversations more up to the minute.

Modularity and interoperability, the intersection of AI and crypto, the potential cascading risk of restaking. Fully onchain games. Layer-2s (including for Bitcoin) and shared sequencing.

For what it’s worth, the market is already voting on what narratives solidify into full-blown phenomenon.

The market dominance of layer-2s — a metric for gauging how much of the crypto market is made up of layer-2 tokens — peaked at 1.54% in both February 2023 and 2024. It has since retraced to 0.89%, according to The Tie data. Still way up from the 0.12% market dominance recorded five years ago.

DePIN, meanwhile, really hit an all-time high for dominance in April 2021 (almost peak bull market), but it has since given up two-thirds of that ground.

(It should be said that the token price performance relative to the market has little to do with the growth of their underlying projects or protocols. Onchain DePIN activity, for instance, is generally growing, despite the dominance trend, although rising prices definitely seem to help.)

Going by market makeup, AI and the Bitcoin ecosystem — projects building in Bitcoin’s orbit, but not bitcoin itself — are set to be the hottest leading into Permissionless III.

They both make up less than half a percent of the crypto market right now, according to The Tie, but the trajectory looks destined to change that.

— David Canellis

Grab your ticket to Permissionless III in Salt Lake City here. Prices are subject to increase.

Data Center

- Ethereum’s validator count is at a new all-time high: 1,034,051, up 65% since this time last year.

- That has driven the ETH stakingAPR down to 3.22%, up slightly from last week but still down from 4.59% year on year.

- Tron persists as the biggest layer-1 for fee spend, making up 50% of fees generated among the top 20 last week, per Token Terminal.

- Most of that is due to the popularity of stablecoin tether on the network, which is burning 96% of all TRX fees right now.

- BTC and ETH are working to extend their recoveries, both up less than 2% over the past day (BTC: $64,700; ETH: $3,450).

Vibe check

This week is the first time this summer that there’s been a noticeable shift in sentiment. The air feels cleaner in crypto, the birds are singing and the machines whirring. It feels good.

There are a few reasons for this. No doubt getting alerts that bitcoin keeps climbing, carving out highs we haven’t seen in — *checks notes* — a month makes it feel like that bearish narrative that was creeping in is quickly being swatted away.

There’s also the Republican presidential ticket. The combination of a candidate who seems to be leaning pro-crypto and an undoubtedly pro-crypto vice presidential candidate has many in the space abuzz with possibilities.

2 Punks Capital general partner Jacob Martin told me he’s “pretty bullish going into the fall” given the circumstances.

“I think we’re about to find out over the next six months if the general market is actually ready to put real capital into crypto funds. And we’ll find that out the hard way…You know, good, bad or ugly,” Martin said.

One thing that stands out to me is not just the general vibes shift, but how that could impact the next few months, given that we might see bounceback a little earlier than previously expected. Or maybe this is all just a blip on the radar given that Mt Gox is still an overhang to account for right now.

We’ve previously chatted with folks like Ledn’s CIO John Glover, who told us that we should expect positive price action in the fall. But more immediately, bitcoin has climbed steadily since this past weekend.

Some of this makes sense if you pay attention to prediction markets like Polymarket, which now has a Trump victory at 70% with Biden at 18% odds of winning.

“I think you’re going to see a lot of red dollars and a lot of middle dollars that weren’t sure” come into the space, Martin tells me. “I think there’s a whole new base of capital that’s going to show up not just towards the ETFs, but towards private allocation as well.”

Framework Ventures’ Michael Anderson — who I spoke to before Vance was announced as Trump’s VP choice — said that one big question mark over crypto remains “how does the US receive a lot of this industry from a regulatory perspective or a legislative perspective?”

“And it’s been back and forth. It’s been partisan. It’s been nonpartisan, bipartisan. It’s been up for vote. It’s been blocked or vetoed. Like there’s just been so much back and forth, it’s hard to know exactly how that’ll play out, and that’s a huge edge factor for innovation and growth in the US, which is where a lot of the people are, I would say, in the crypto industry,” Anderson added.

Vance, per a Politico report last month, could be looking to clear up the regulatory hurdle. And we know he’s not a huge fan of SEC Chair Gary Gensler, going by a clip from Consensys’ Bill Hughes.

From a VC vantage point, it’s looking really bullish this fall, Martin said.

“Basically, if there is a crypto fund that you can think of their name, they will raise this fall, or they’re already raising right now. And so I think we will actually see very clearly, if this thesis is correct, over the next six months,” he added.

And he’s not feeling bullish for just VCs, either. Martin believes “you’ll have a hard time probably finding a more bullish six months to raise, whether it’s for a fund or a startup,” because of the possibility of a clearer regulatory environment. Though it’s not yet clear whether the regulatory uncertainty will clear up anytime soon.

Looking to Bitcoin 2024 and Permissionless III — both fall events — we might also see that upbeat attitude reflected on the ground. Maybe the crypto industry won’t seem so burnt out…

One thing’s for sure: It’s all about the vibes.

— Katherine Ross

The Works

- Marc Andreessen and Ben Horowitz plan to donate to Donald Trump’s campaign, Bloomberg reported.

- Deribit announced that it’s launching bitcoin and ether options that will expire in early November.

- Hong Kong’s Monetary Authority is plotting a licensing regime for stablecoin companies.

- According to a statement, Cypherpunk upped its Solana holdings.

- Craig Wright faces a potential perjury investigation over his claims that he created bitcoin, Wired reported.

The Riff

Q: Does the Craig Wright debacle have a silver lining?

The correspondence between Satoshi and Martii Malmi.

Don’t get me wrong, I think it’s unfortunate that the back and forth between the two had to be used against Wright’s claims, but I think they offered a very unique and important look into Satoshi.

When they first dropped, the other Blockworks editors and I spent hours thumbing through each email just analyzing everything Satoshi said back in the day. We learned a lot.

He didn’t want to call bitcoin an investment, for example.

Wright can no longer claim to be Satoshi as ruled by a UK judge, and his site now says, “Dr. Craig Steven Wright is not Satoshi Nakamoto.”

After years of Wright’s claims — and so many legal battles — we can finally put this one to rest. Unless he’s formally charged, of course.

— Katherine Ross

They say nature healed during the pandemic.

Dolphins frolicking through Venice canals. Mountain lions curiously explored urban outskirts, where they’re usually turned off by the buzz of pesky humans.

The boffins might debate whether all that actually happened, or even if it did, whether the covid “anthropause” was a net positive for nature.

But the same thing can now happen to Bitcoin and blockchain development. Craig Wright was a key antagonist in the Block Size War, which ultimately diluted Bitcoin discourse, resulting in two satellite ecosystems of builders.

The work of those builders, particularly in Bitcoin SV world, was forever overshadowed by whatever controversy Wright was wrapped up in at any given time.

Bitcoin is different now than before the hard forks. There’s more freedom to build, even non-money use cases like Ordinals.

Maybe a prodigal developer out there could be the one to make a breakthrough layer-2. Who knows. At least there’s one less distraction.

— David Canellis