A recent report from Bybit and Block Scholes reveals shifting investor sentiment in the crypto derivatives market, favoring ethereum over bitcoin. This insight, derived from analysis of market trends across various trading formats, highlights an optimistic outlook for ether, especially with the impending launch of spot ether exchange-traded funds (ETFs) in the United States.

Shift in Crypto Derivatives: Ethereum Gains Edge Over Bitcoin

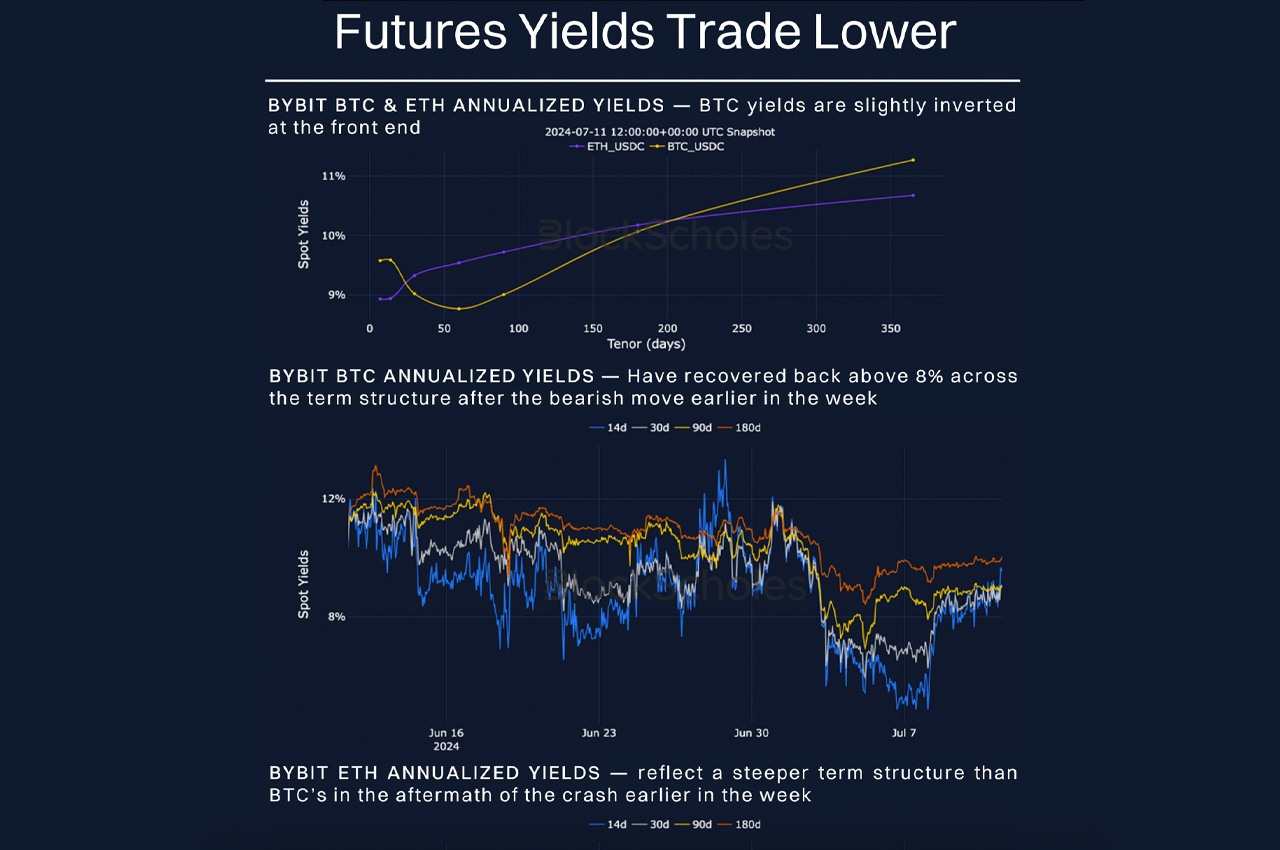

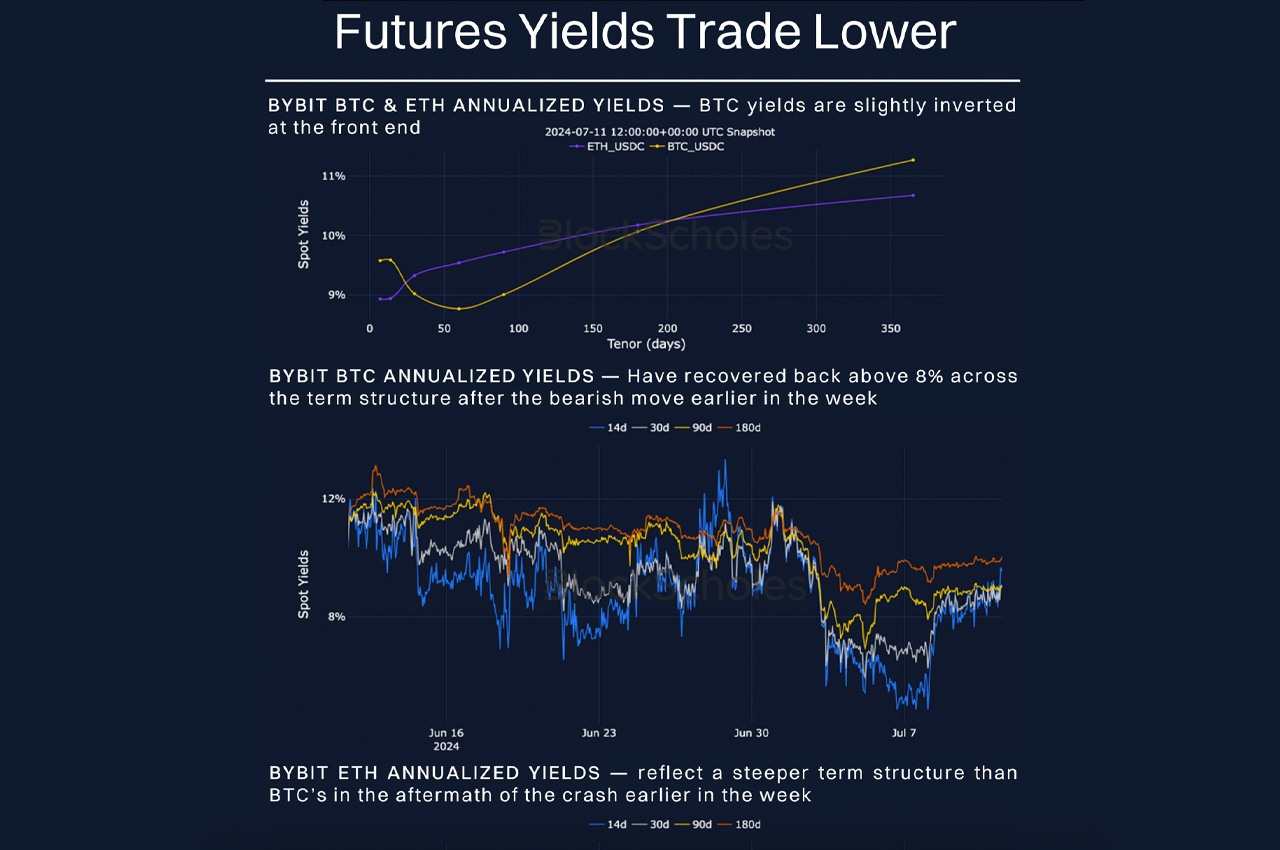

The joint report by Bybit and analytics firm Block Scholes details the evolving landscape in spot trading volumes, futures, options, and perpetual contracts. The analysis points to a sustained volatility premium for ethereum (ETH) over bitcoin (BTC), driven by heightened market activity and bullish sentiment toward ethereum’s market prospects.

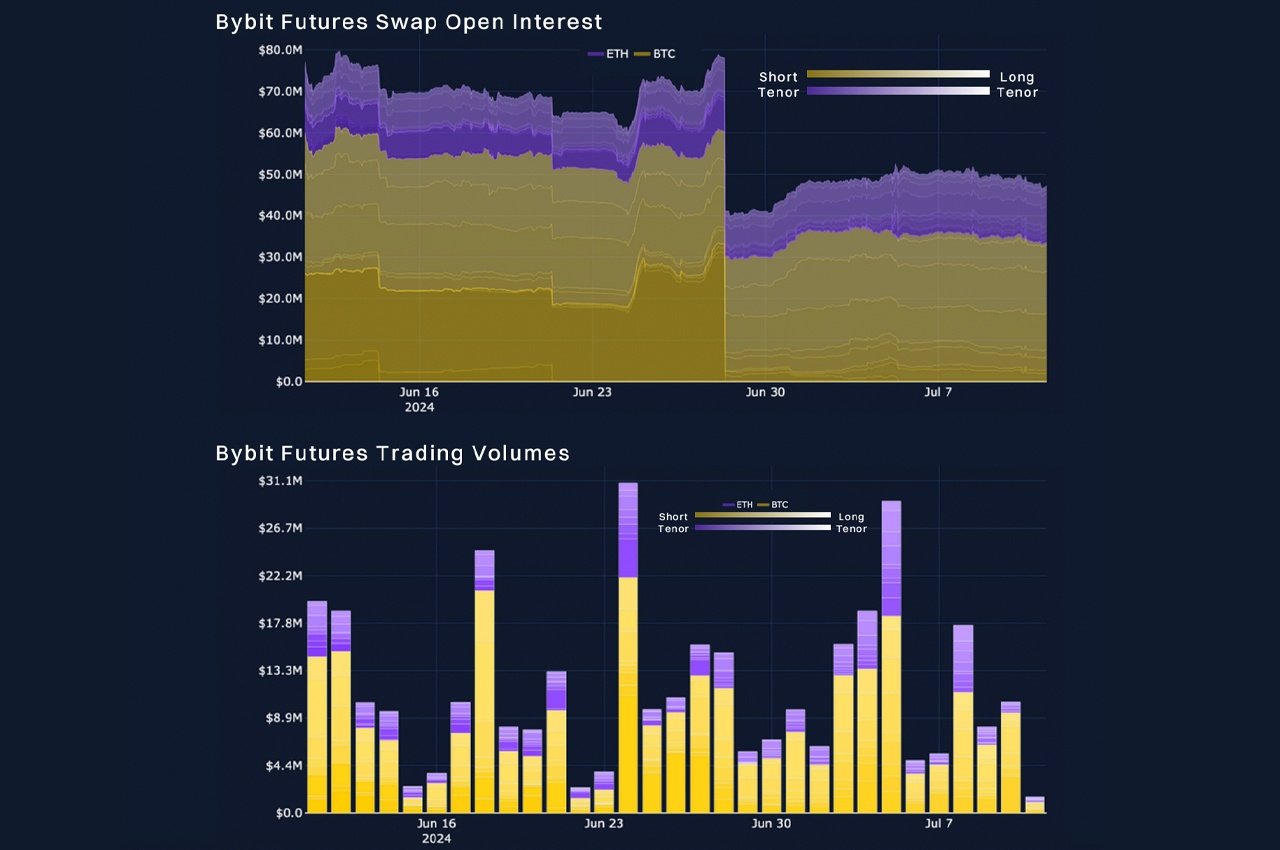

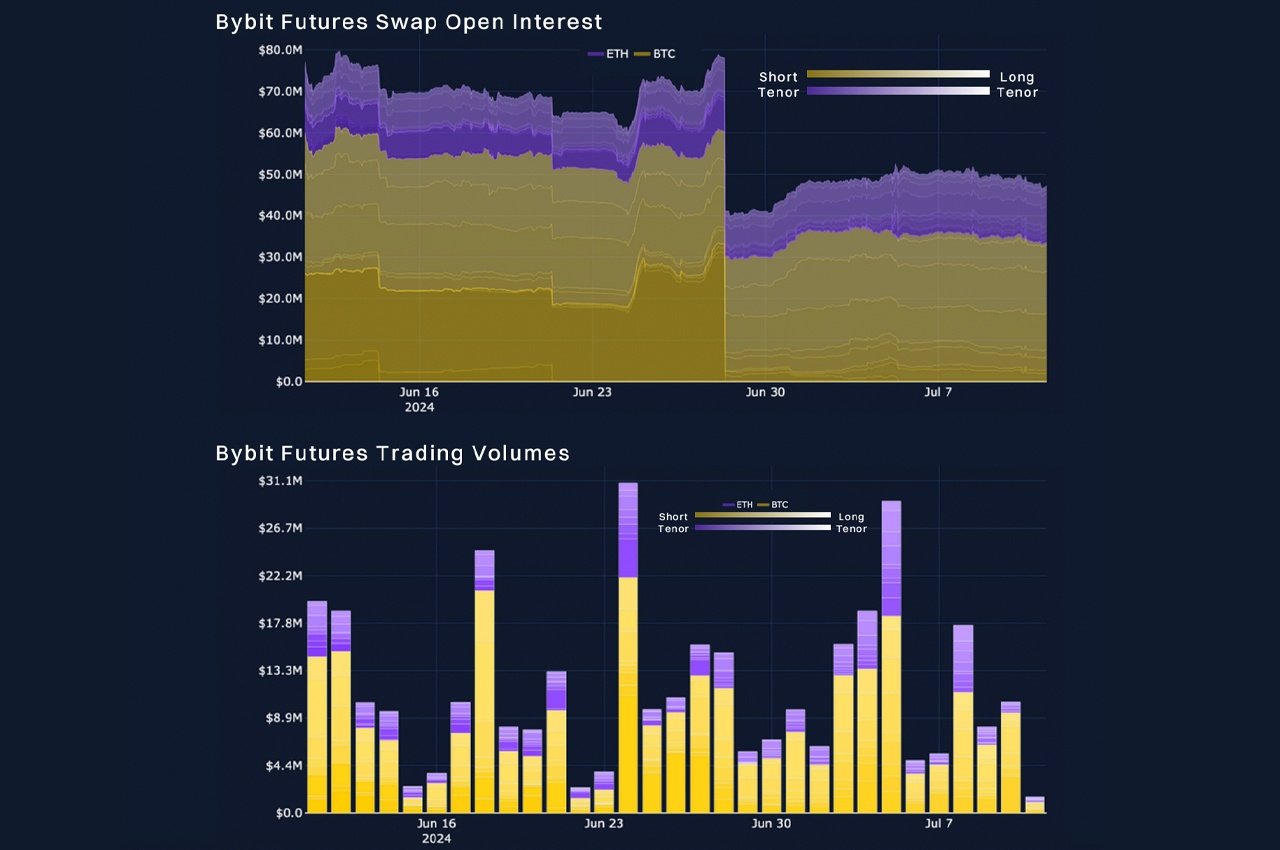

Despite recent market volatility, ethereum futures have shown a quicker recovery in open interest compared to bitcoin. This trend underscores a strong market confidence in ethereum, particularly in light of the anticipated ETF introductions in the United States.

Moreover, the report notes that ethereum’s options market has maintained elevated volatility, especially in response to ETF approval expectations, contrasting with bitcoin’s more defensive market stance.

Ethereum’s perpetual contracts have witnessed substantial trading volumes, indicating strong long positions. This activity suggests strategic positioning by investors in anticipation of significant market developments.

This sentiment is expected to influence market dynamics significantly, particularly as ethereum continues to demonstrate a volatility premium and resilience in trading activities compared to bitcoin.

What do you think about the Bybit and Block Scholes report? Share your thoughts and opinions about this subject in the comments section below.

A recent report from Bybit and Block Scholes reveals shifting investor sentiment in the crypto derivatives market, favoring ethereum over bitcoin. This insight, derived from analysis of market trends across various trading formats, highlights an optimistic outlook for ether, especially with the impending launch of spot ether exchange-traded funds (ETFs) in the United States.

Shift in Crypto Derivatives: Ethereum Gains Edge Over Bitcoin

The joint report by Bybit and analytics firm Block Scholes details the evolving landscape in spot trading volumes, futures, options, and perpetual contracts. The analysis points to a sustained volatility premium for ethereum (ETH) over bitcoin (BTC), driven by heightened market activity and bullish sentiment toward ethereum’s market prospects.

Despite recent market volatility, ethereum futures have shown a quicker recovery in open interest compared to bitcoin. This trend underscores a strong market confidence in ethereum, particularly in light of the anticipated ETF introductions in the United States.

Moreover, the report notes that ethereum’s options market has maintained elevated volatility, especially in response to ETF approval expectations, contrasting with bitcoin’s more defensive market stance.

Ethereum’s perpetual contracts have witnessed substantial trading volumes, indicating strong long positions. This activity suggests strategic positioning by investors in anticipation of significant market developments.

This sentiment is expected to influence market dynamics significantly, particularly as ethereum continues to demonstrate a volatility premium and resilience in trading activities compared to bitcoin.

What do you think about the Bybit and Block Scholes report? Share your thoughts and opinions about this subject in the comments section below.