The German government has finally emptied its Bitcoin (BTC) wallet. On-chain data reveals that a series of transactions on July 12 concluded the government’s sell-offs.

This decision has sparked discussion within the crypto community, highlighting speculation about the future impact on the market.

German Government Bitcoin Sale Concludes, Market Awaits Long-Term Impact

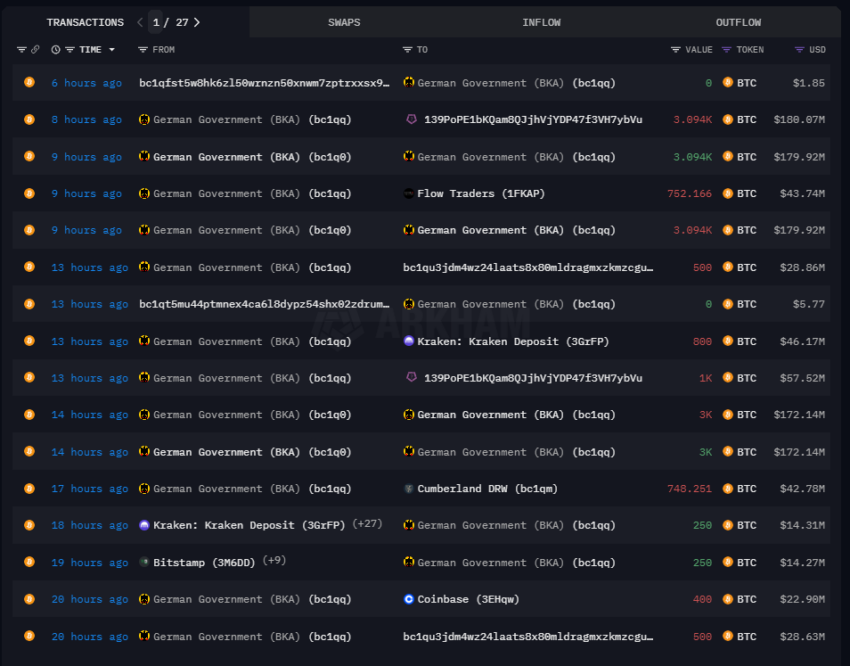

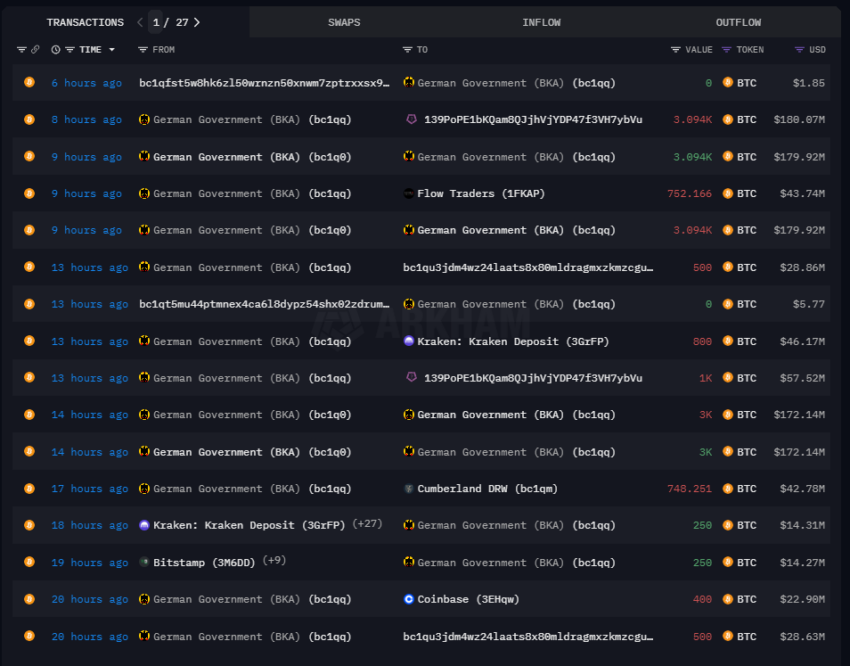

Arkham Intelligence data indicates that the German government began its sales spree yesterday by sending 2,700 BTC to major exchanges such as Kraken, Bitstamp, and Coinbase. Additionally, it utilized other institutional deposit services for these transactions.

Read more: Who Owns the Most Bitcoin in 2024?

Following this, they received back 4,169 BTC, suggesting initial attempts to manage the sell-off’s impact. However, additional transactions included 748.25 BTC to Cumberland and another 2,300 BTC to Kraken and other services.

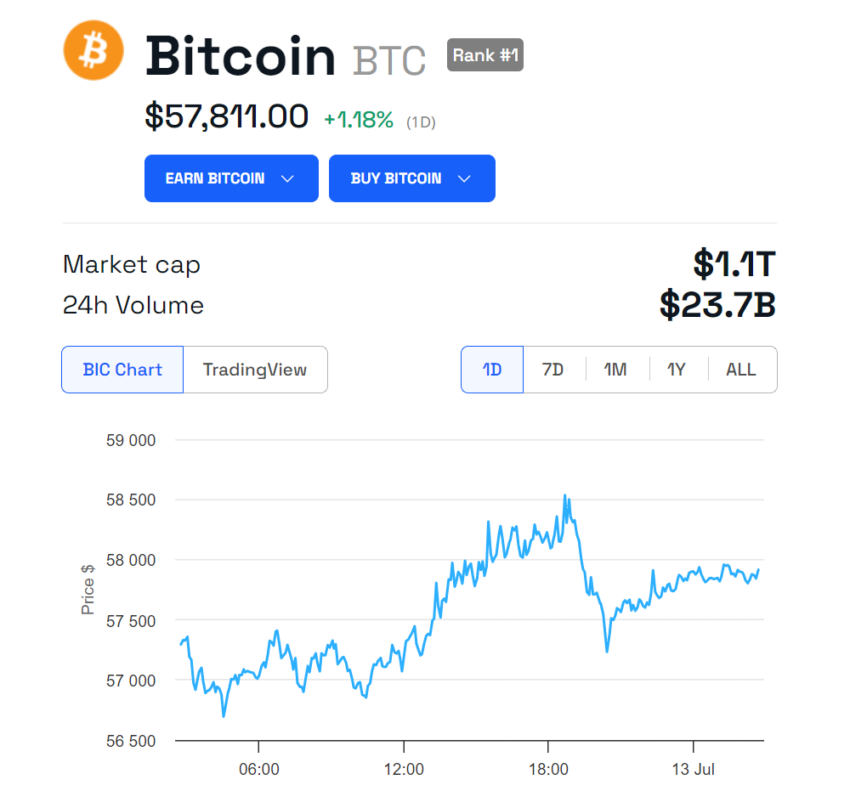

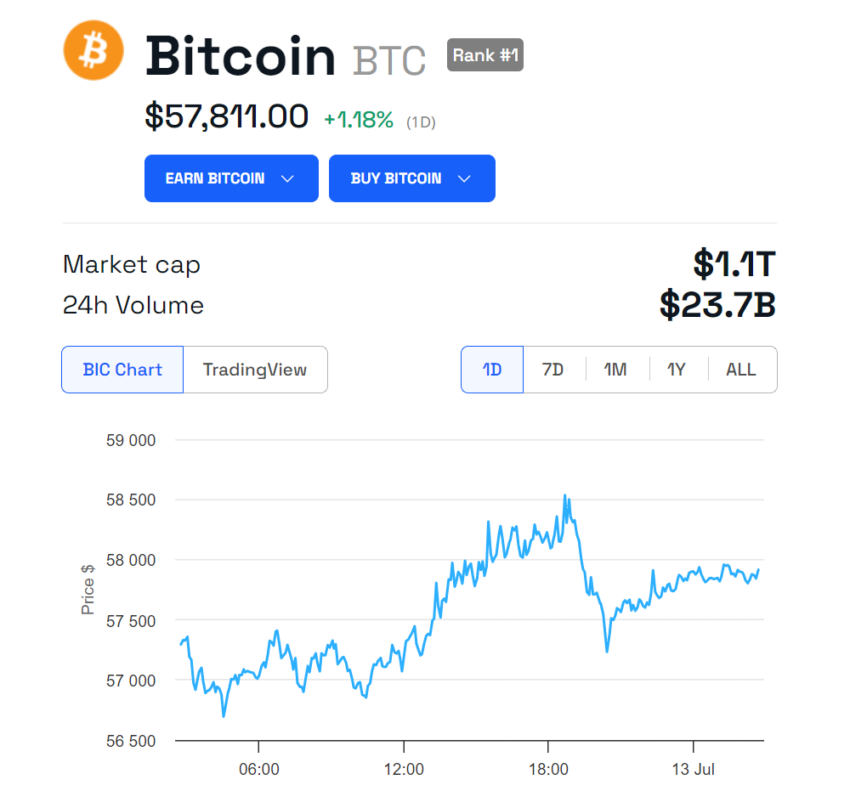

The final transactions involved sending 3,049 BTC to an institutional deposit service and 752.17 BTC to Flow Traders. The German government’s complete divestment slightly increased Bitcoin’s price from $57,232 to $57,896. At the time of writing, Bitcoin is trading at $57,811.

The crypto community expressed relief at this development, while some members predicted that the government might “deeply regret” its decision. BeInCrypto reported that the German government’s sales spree began on June 19, with significant daily sales impacting the market. Initially, Bitcoin was trading around $65,000, but it has remained below $60,000 since the intensified sales.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Despite the short-term liquidity shock, experts believe long-term bullish factors will eventually drive significant growth once the market absorbs these selling sprees. Renowned crypto trader Michaël van de Poppe noted that the market had absorbed approximately $3.5 billion in sell pressure over the past weeks.

“Bitcoin is still at $58,000. The rotation is around the corner,” he wrote.

The German government has finally emptied its Bitcoin (BTC) wallet. On-chain data reveals that a series of transactions on July 12 concluded the government’s sell-offs.

This decision has sparked discussion within the crypto community, highlighting speculation about the future impact on the market.

German Government Bitcoin Sale Concludes, Market Awaits Long-Term Impact

Arkham Intelligence data indicates that the German government began its sales spree yesterday by sending 2,700 BTC to major exchanges such as Kraken, Bitstamp, and Coinbase. Additionally, it utilized other institutional deposit services for these transactions.

Read more: Who Owns the Most Bitcoin in 2024?

Following this, they received back 4,169 BTC, suggesting initial attempts to manage the sell-off’s impact. However, additional transactions included 748.25 BTC to Cumberland and another 2,300 BTC to Kraken and other services.

The final transactions involved sending 3,049 BTC to an institutional deposit service and 752.17 BTC to Flow Traders. The German government’s complete divestment slightly increased Bitcoin’s price from $57,232 to $57,896. At the time of writing, Bitcoin is trading at $57,811.

The crypto community expressed relief at this development, while some members predicted that the government might “deeply regret” its decision. BeInCrypto reported that the German government’s sales spree began on June 19, with significant daily sales impacting the market. Initially, Bitcoin was trading around $65,000, but it has remained below $60,000 since the intensified sales.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Despite the short-term liquidity shock, experts believe long-term bullish factors will eventually drive significant growth once the market absorbs these selling sprees. Renowned crypto trader Michaël van de Poppe noted that the market had absorbed approximately $3.5 billion in sell pressure over the past weeks.

“Bitcoin is still at $58,000. The rotation is around the corner,” he wrote.