A closely followed crypto analyst says one Bitcoin (BTC) metric that previously predicted a bullish reversal is once again flashing green.

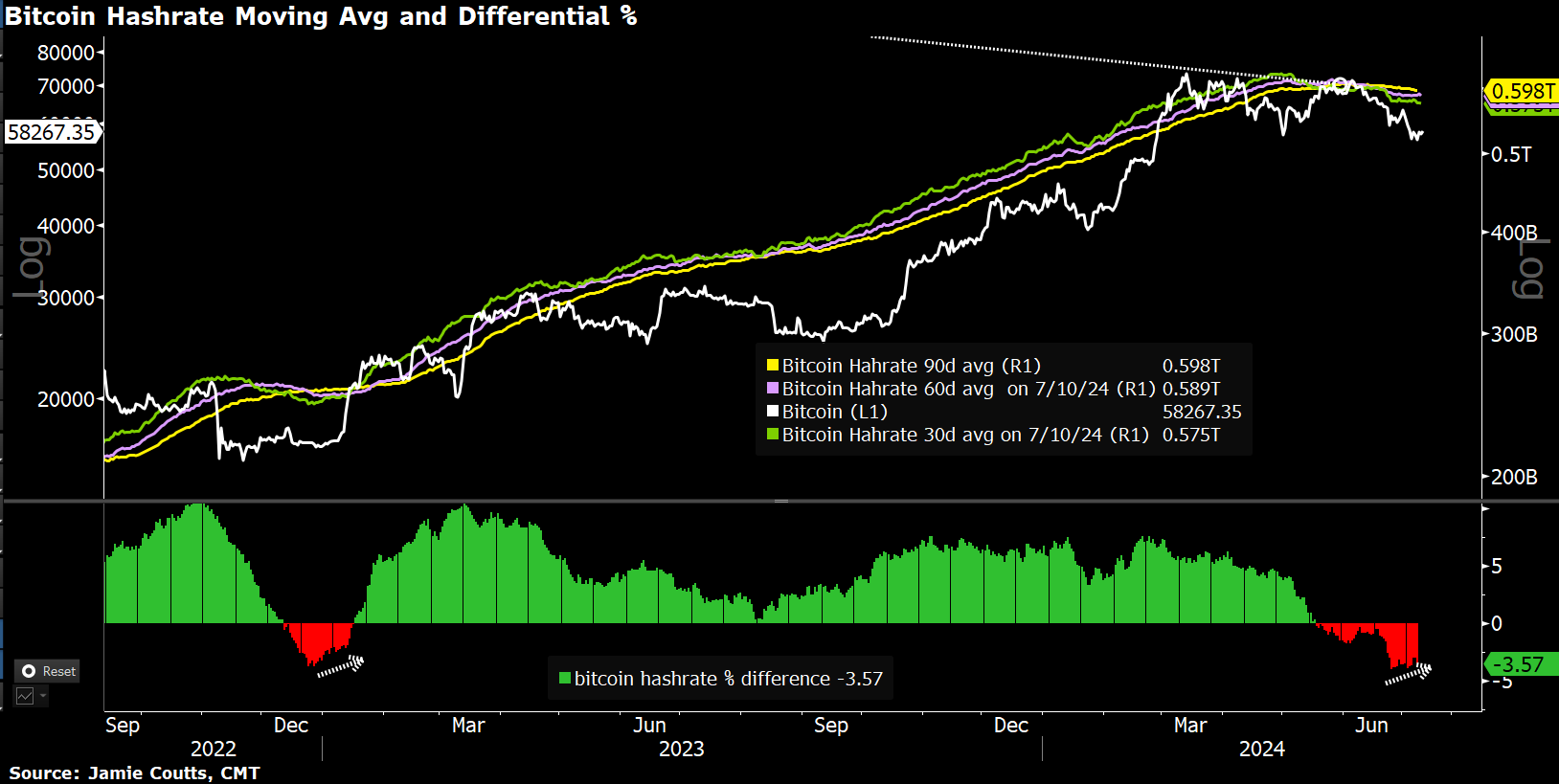

Jamie Coutts, the chief crypto analyst at Real Vision, says that Bitcoin’s hashrate decline is slowing, a signal that has typically preceded momentum reversal for the crypto king.

However, he notes that the prediction hinges on the stabilization of the rate of decline of BTC’s hashrate.

“Observing that Bitcoin’s hashrate decline is slowing, which typically precedes a bottom and reversal of the bearish cross post-May halving. However, this is predicated on a stabilization in the downtrend. The market is still digesting the supply overhang.

Notably, the percentage difference between the 30 and 90-day moving averages aligns with previous hashrate contractions and isn’t as severe as post-2020 halving.”

Coutts says that while the sale of Bitcoin from Mt. Gox – a prominent BTC exchange that went bankrupt after getting hacked in 2014 – may be bad for the price of Bitcoin in the short term, it will help grow the network over time.

“While painful in the short term, the distributions of the Mt.Gox reserve and government sales remove the annoying supply overhang, helping distribute coins to a wider array of holders, thereby growing the network and leaving Bitcoin even better off than before.”

Earlier this month, macroeconomist Alex Krüger and analysts at market intelligence platform CoinShares both shared the opinion that sell pressure from Mt. Gox wouldn’t be that bad for Bitcoin.

Bitcoin is trading for $57,635 at time of writing, a fractional decrease during the last 24 hours.

Generated Image: Midjourney

A closely followed crypto analyst says one Bitcoin (BTC) metric that previously predicted a bullish reversal is once again flashing green.

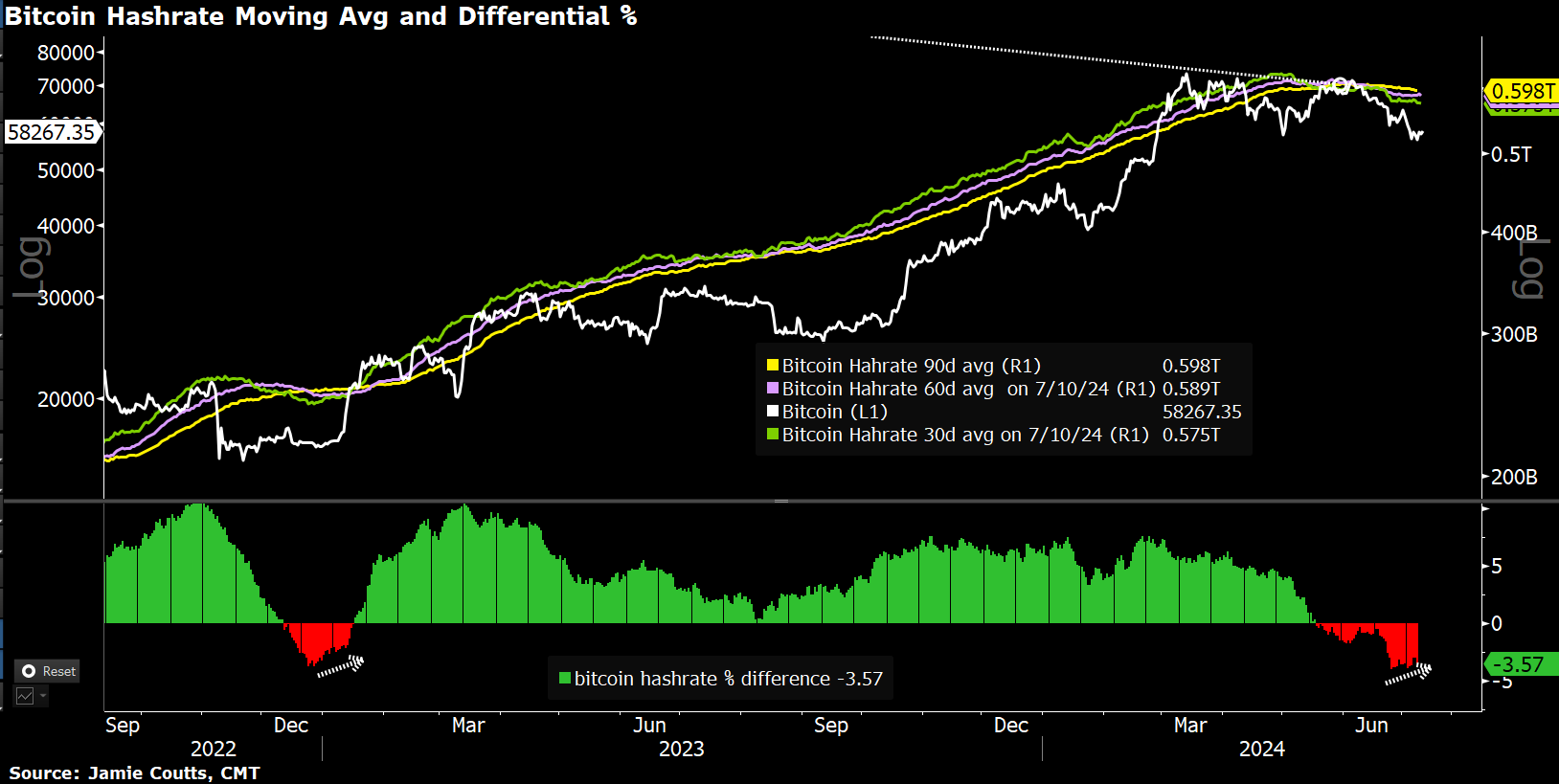

Jamie Coutts, the chief crypto analyst at Real Vision, says that Bitcoin’s hashrate decline is slowing, a signal that has typically preceded momentum reversal for the crypto king.

However, he notes that the prediction hinges on the stabilization of the rate of decline of BTC’s hashrate.

“Observing that Bitcoin’s hashrate decline is slowing, which typically precedes a bottom and reversal of the bearish cross post-May halving. However, this is predicated on a stabilization in the downtrend. The market is still digesting the supply overhang.

Notably, the percentage difference between the 30 and 90-day moving averages aligns with previous hashrate contractions and isn’t as severe as post-2020 halving.”

Coutts says that while the sale of Bitcoin from Mt. Gox – a prominent BTC exchange that went bankrupt after getting hacked in 2014 – may be bad for the price of Bitcoin in the short term, it will help grow the network over time.

“While painful in the short term, the distributions of the Mt.Gox reserve and government sales remove the annoying supply overhang, helping distribute coins to a wider array of holders, thereby growing the network and leaving Bitcoin even better off than before.”

Earlier this month, macroeconomist Alex Krüger and analysts at market intelligence platform CoinShares both shared the opinion that sell pressure from Mt. Gox wouldn’t be that bad for Bitcoin.

Bitcoin is trading for $57,635 at time of writing, a fractional decrease during the last 24 hours.

Generated Image: Midjourney