ARB, the native token of the leading Layer 2 (L2) network Arbitrum, has dropped significantly in the past few weeks. On July 5, the altcoin traded at an all-time low of $0.57.

Although ARB’s price has since climbed 22%, the decrease in user demand for the L2 network threatens to erase these gains.

Arbitrum Witnesses User Exodus

On-chain data has shown a decline in user demand for Arbitrum since June 21. Since that day, the daily count of active addresses involved in at least one transaction on the L2 has plummeted by over 46%.

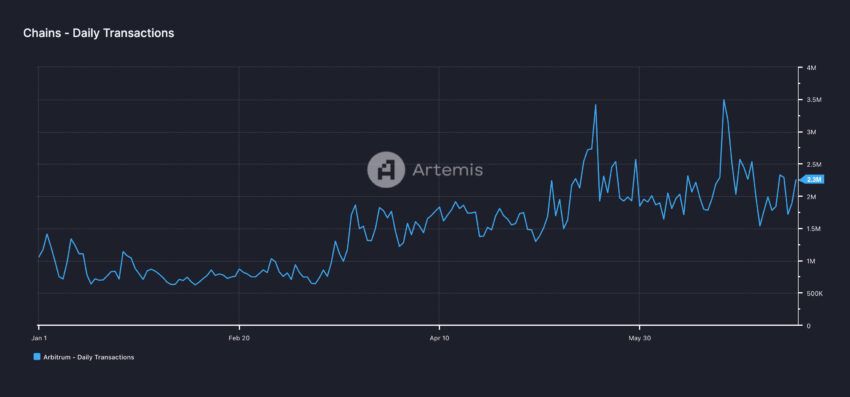

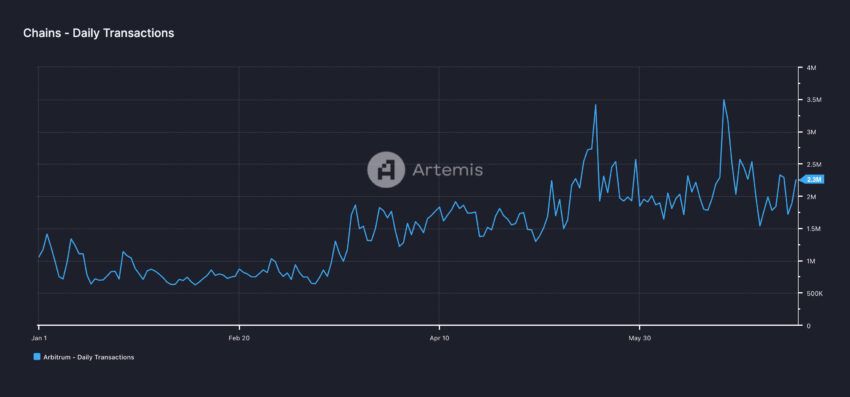

Due to the fall in the count of unique addresses active on the network, the number of transactions completed daily on Arbitrum has also dwindled.

After climbing to a year-to-date peak of 3.5 million, the daily transactions count on the L2 initiated a downtrend. It has since decreased by 34%.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

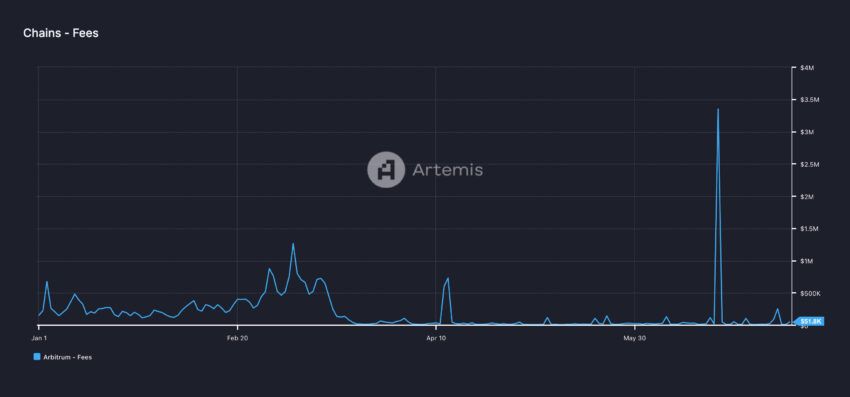

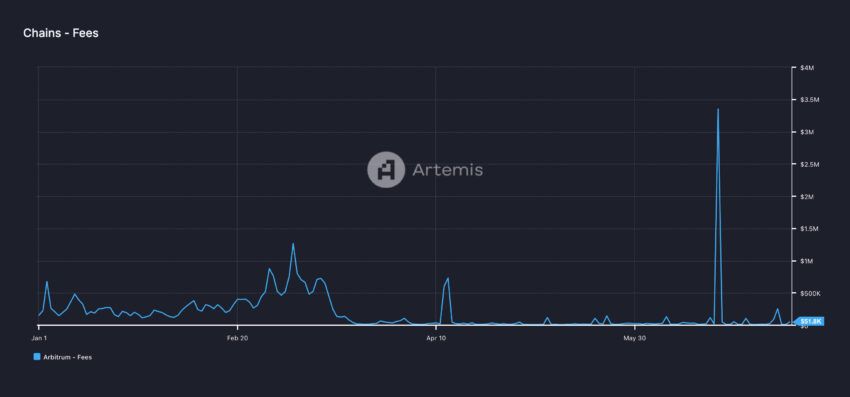

With fewer transactions completed on the L2, Arbitrum’s network fees and revenue derived from them are at multi-month lows. Arbitrum’s total network fees spiked to an all-time high of $3.4 million on June 20 because the L2 was used as the main coordination chain for the LayerZero airdrop.

However, following the conclusion of the controversial airdrop, users flocked out of Arbitrum, pushing its network fees down by 98% the following day.

The network’s revenue witnessed a 99% decline during the 24-hour period.

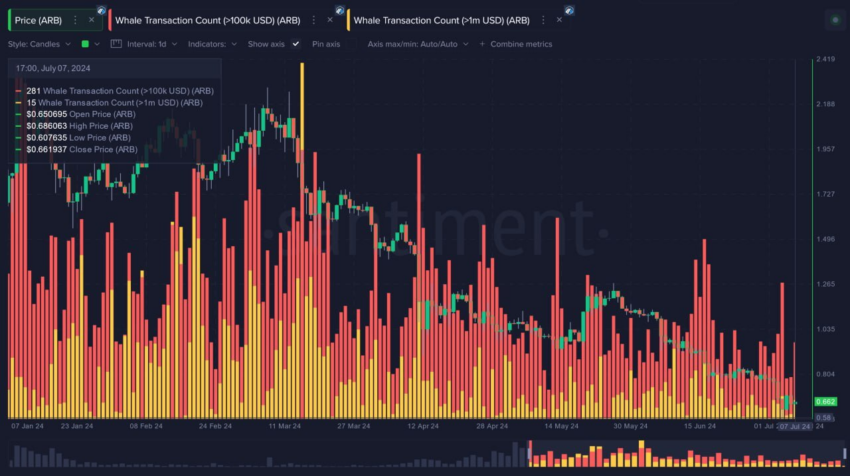

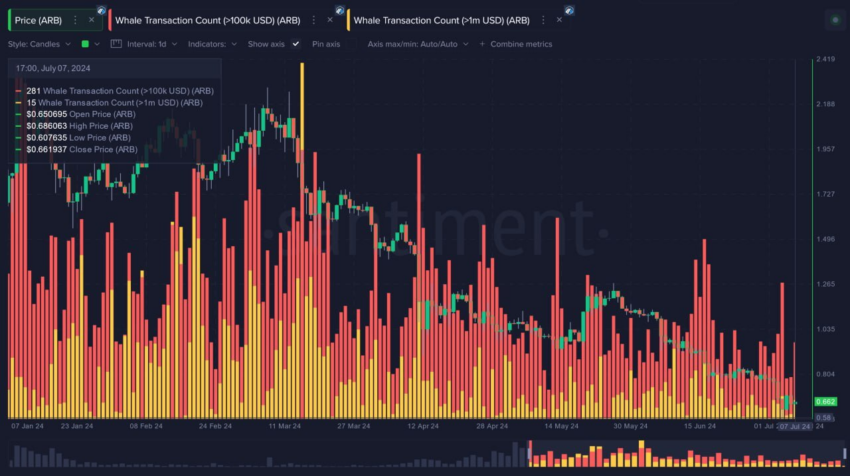

Lead Analyst at Santiment, Brian Quinliven, added to the bearish sentiment, insisting that whales could be holding out for bullish momentum before shifting funds around:

“The lack of whale activity looks quite similar to what we have been seeing for Optimism. A gradual decline in big moves isn’t necessarily a bad thing. It simply means they may be waiting for a bit more volatility to really capitalize on before making their moves.” Quinlivan stated.

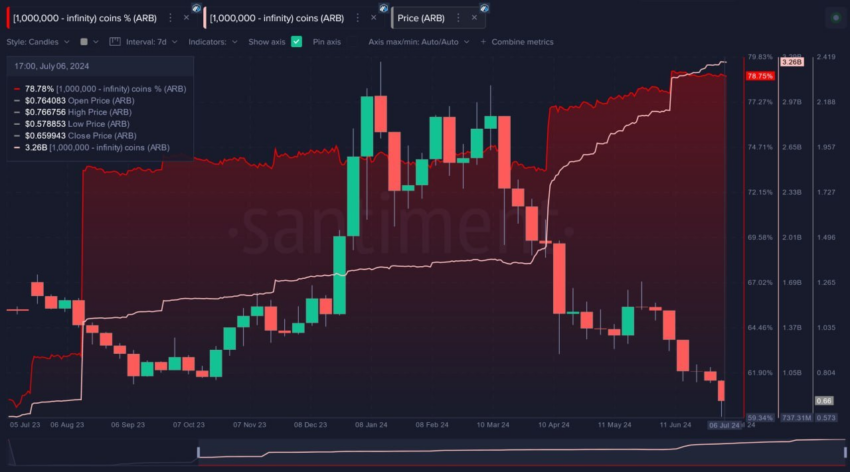

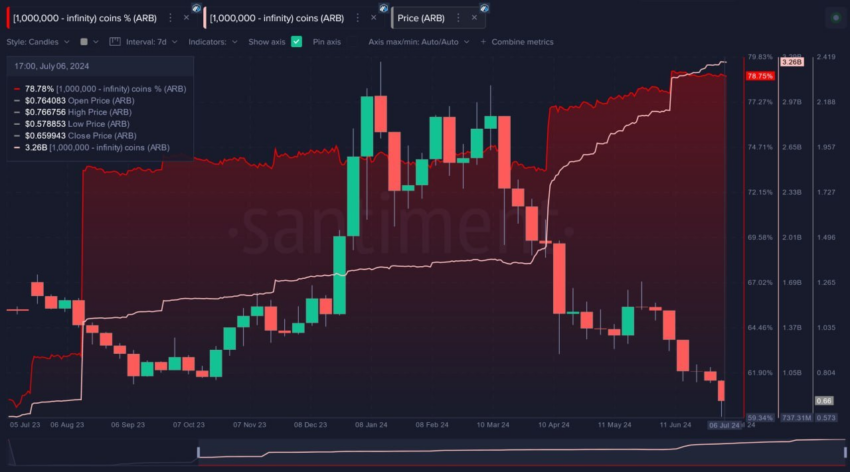

Quinlivan also added that wallets holding at least one million ARB hold a very high level of Arbitrum’s supply despite the large price decline in 2024.

“These key stakeholders clearly feel comfortable hanging on to their coins for the long haul despite its market value dropping a bit over -70% in 6 months.” Quinlivan added.

ARB Price Prediction: Ready for a Rebound?

While ARB’s price has trended downward in the past week, its Chaikin Money Flow (CMF) is in an uptrend. This indicator measures how money flows into and out of an asset.

When an asset’s price falls while its CMF rises, a bullish divergence is formed. This divergence signals a potential price reversal. It suggests that the selling pressure may be weakening, and the asset might be poised for a price rebound.

If this happens, ARB’s price could increase to $0.72.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, if the current decline continues, the token’s price will plummet to $0.66.

ARB, the native token of the leading Layer 2 (L2) network Arbitrum, has dropped significantly in the past few weeks. On July 5, the altcoin traded at an all-time low of $0.57.

Although ARB’s price has since climbed 22%, the decrease in user demand for the L2 network threatens to erase these gains.

Arbitrum Witnesses User Exodus

On-chain data has shown a decline in user demand for Arbitrum since June 21. Since that day, the daily count of active addresses involved in at least one transaction on the L2 has plummeted by over 46%.

Due to the fall in the count of unique addresses active on the network, the number of transactions completed daily on Arbitrum has also dwindled.

After climbing to a year-to-date peak of 3.5 million, the daily transactions count on the L2 initiated a downtrend. It has since decreased by 34%.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

With fewer transactions completed on the L2, Arbitrum’s network fees and revenue derived from them are at multi-month lows. Arbitrum’s total network fees spiked to an all-time high of $3.4 million on June 20 because the L2 was used as the main coordination chain for the LayerZero airdrop.

However, following the conclusion of the controversial airdrop, users flocked out of Arbitrum, pushing its network fees down by 98% the following day.

The network’s revenue witnessed a 99% decline during the 24-hour period.

Lead Analyst at Santiment, Brian Quinliven, added to the bearish sentiment, insisting that whales could be holding out for bullish momentum before shifting funds around:

“The lack of whale activity looks quite similar to what we have been seeing for Optimism. A gradual decline in big moves isn’t necessarily a bad thing. It simply means they may be waiting for a bit more volatility to really capitalize on before making their moves.” Quinlivan stated.

Quinlivan also added that wallets holding at least one million ARB hold a very high level of Arbitrum’s supply despite the large price decline in 2024.

“These key stakeholders clearly feel comfortable hanging on to their coins for the long haul despite its market value dropping a bit over -70% in 6 months.” Quinlivan added.

ARB Price Prediction: Ready for a Rebound?

While ARB’s price has trended downward in the past week, its Chaikin Money Flow (CMF) is in an uptrend. This indicator measures how money flows into and out of an asset.

When an asset’s price falls while its CMF rises, a bullish divergence is formed. This divergence signals a potential price reversal. It suggests that the selling pressure may be weakening, and the asset might be poised for a price rebound.

If this happens, ARB’s price could increase to $0.72.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, if the current decline continues, the token’s price will plummet to $0.66.